Top 25 Lower Middle Market Investment Banks | Q1 2024

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Recently, a private equity investor reached out to us with a question: “How do other investors measure risk and return?”

We were intrigued, and decided to survey a few fellow Axial members for their thoughts. Here are the results:

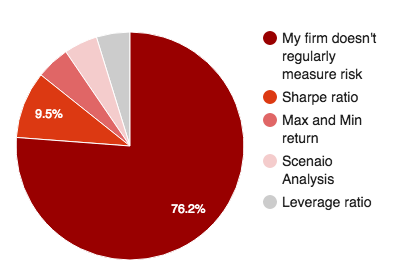

The majority of respondents (76%) said that they do not regularly measure risk. Of those that do, 9.5% use the Sharpe ratio, followed by max and min return, scenario analysis, and leverage ratio.

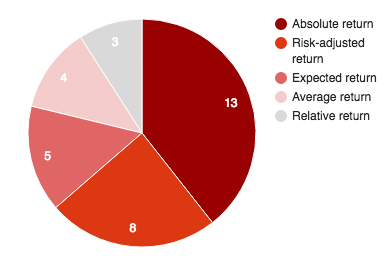

The most commonly selected measure was absolute return (13 selected) followed by risk-adjusted return (8 selected).

“When we assess an investment opportunity, we create three risk/return scenarios: expected, upside, and downside, which helps quantify the risk. We underwrite investments on the expected, but hope for the upside, and make sure the downside is manageable.”

– Istvan Nadas, IGH Holdings (subsidiary of Dunes Point Capital).

“We address the investment within the framework of a diversification thesis (i.e., will this investment exaggerate or offset negative performance in our other holdings?)”

– Brian Davidson, McKinney Capital

“We believe the main risks are market risk and operational risk. Market risk includes changes in interest rates, foreign exchange, political, regulatory, and macroeconomic factors such as commodity price changes. Operational risk includes: (1) Failures in internal due diligence procedures, (2) fundraising uncertainty, (3) execution by management teams, (4) potential weakness in portfolio company accounting or reporting systems, (5) management turnover at the firm or portfolio company level, (6) litigation, and (7) weakness in portfolio risk evaluation. Risk management can also be handled by a private equity fund manager across a portfolio of investments (for instance currency or commodity hedging across several companies).”

– Thomas Courtney, The Courtney Group