Add-On Demand in the LMM: A Data-Driven Look at Buyer Activity

Most successful businesses adopt both organic and inorganic growth strategies. And add-on acquisitions remain one of the most widely used…

Buyers, Lenders, Private Equity

“The legal cannabis industry is among the fastest-growing markets in the United States,” says Harrison Phillips, vice president at Viridian Capital Advisors, a New York-based advisory firm specializing in the industry.

The market was worth $8 billion in 2017 and is expected to reach $10.8 billion in 2018 and approximately $24.1 billion by 2025, according to market analysis firm New Frontier Data.

With 30 states plus Washington, D.C., permitting medical cannabis and new states permitting recreational cannabis each year, opportunities for investors are growing.

We spoke to Phillips about his predictions for the industry in the next year.

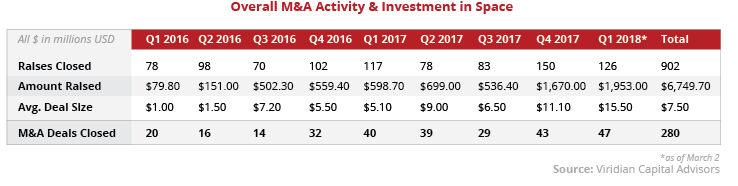

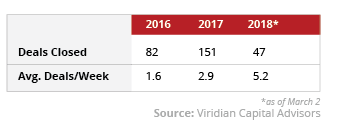

There have been 47 cannabis deals closed in Q1 2018 to date, higher than any previous quarter since 2016.

“M&A in the space has closely followed the pace of capital raising” as valuations in cannabis stocks have soared, says Phillips. “Not only do higher valuations allow issuers to raise more capital with less dilution, but they also incentivize the use of shares as currency in acquisitions. In 2018 to date, there were an average of 5.2 M&A deals closed per week, compared to 2.9 per week in 2017 and 1.6 in 2016.

Consolidation is driving M&A as providers look to develop economies of scale in existing and new markets and umbrella companies look to acquire successful local and regional brands. “International M&A and investment activity has also increased as companies look to develop strategic partnerships to drive growth,” says Phillips. He notes this is particularly true of companies in nationally regulated medical markets like Canada, Israel, Germany, Australia, and Colombia.

While we have yet to see the mass entry of big pharma, big agriculture, big tobacco, or big alcohol there were two significant moves into the cannabis space in late 2017 and early 2018 that may be a sign of more to come.

The first was Constellation Brands’ investment into Canopy Growth Corp., making it the first major play by a a big alcohol company into the cannabis industry. Constellation, which owns more than 100 brands including Corona, Modelo, and Svedka, acquired a 9.9 percent stake in the Canada-based producer of medical cannabis and received purchase warrants for an equal number of common shares at the same price for a potential future follow-on investment.

Phillips says the strategic investment seems to be a “defensive play to protect Constellation’s alcohol sales against substitution from the continually expanding cannabis market, as Constellation plans to create non-alcoholic, cannabis-infused beverages through this partnership.”

The second notable transaction in the space was by global tobacco wholesaler and distributor Alliance One International (AOI), which made investments into three cannabis-related companies. AOI’s subsidiary Pure-Ag NC, LLC acquired a 40 percent equity position in Criticality, LLC, a North Carolina-based grower of industrial hemp, while their subsidiary Canadian Cultivated Products, Ltd., acquired a 75 percent stake in Canadian medical cannabis seller Island Garden Inc. and an 80 percent stake in Goldleaf Pharm Inc., another Canadian company seeking a license to produce and sell medical cannabis.

While investment opportunities in the space are increasingly attractive, they are not without risk. This is especially true in the U.S. due to the shifting regulatory environment as well as the highly fragmented structure of the industry. “Each state market is unique in its regulations, leading to considerable nuances in properly understanding and navigating opportunities in the space,” says Phillips. “Cannabis remains illegal under U.S. federal law and in many U.S. states,” potentially putting those involved with it at risk of prosecution.

However, he adds that he expects the Trump administration to largely maintain the status quo. “A small percentage of investors in our network decided to hold off on entering the space due to the higher perceived political risk, but we have yet to see a significant shift in policy or enforcement.”

There may be increased intervention on cannabis companies acting out of compliance with state regulations from U.S. Attorney General Jeff Sessions.. “We expect Sessions to move most heavily against California,” where there are tens of thousands of non-compliant businesses, says Phillips. But Sessions said in March that federal prosecutors “haven’t been working small marijuana cases before” and “they are not going to be working them now.”

At the beginning of the year, Sessions abruptly rescinded prior guidance for financial institutions serving “marijuana-related businesses” — stirring up confusion among banks on how to legally do business with cannabis-related companies. According to Reuters, about 400 banks and credit unions — most “small institutions with operations limited to states where marijuana has been legalized” — do business with the U.S. marijuana industry.

Treasury Secretary Steve Mnuchin has announced plans for new marijuana banking guidance. Phillips says it’s still unclear “whether Mnuchin’s guidance will alleviate all the issues with banking the industry, but we expect cannabis businesses to have greater access to these services in the coming year.”