The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

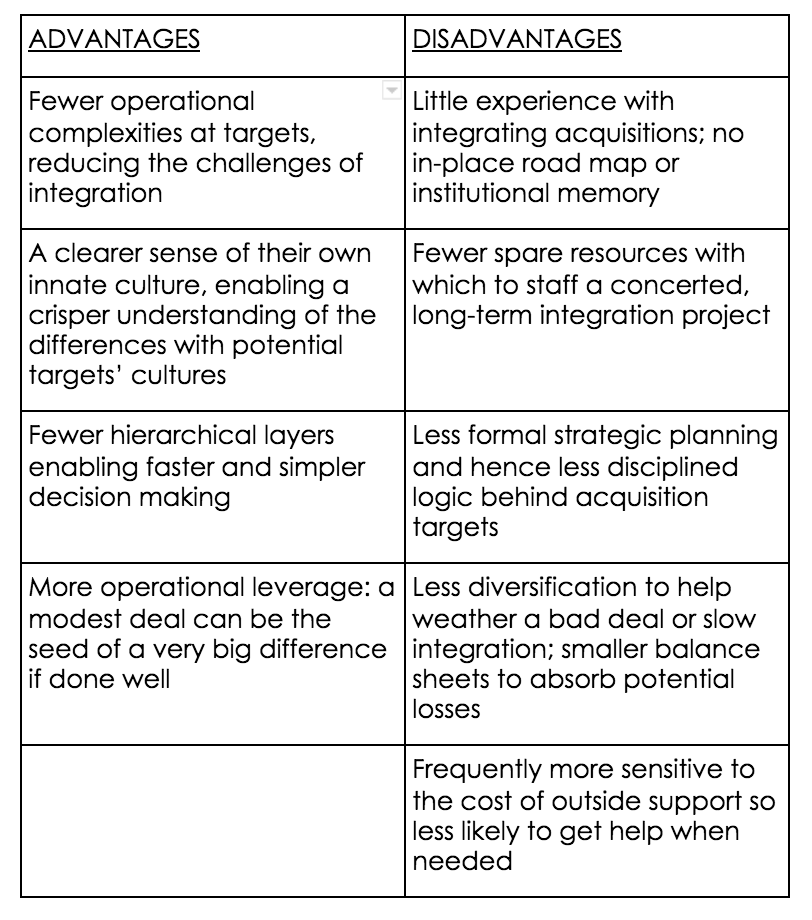

There’s good news and bad news for middle market companies looking to acquire a business for the first time.

The bad news is that the failure rates for less frequent acquirers tend to be high. This is usually the result of limited deal experience or too lax an approach to the challenges of integration.

The good news is that first-time acquirers and the targets they buy tend to be less complicated and therefore easier to integrate (though of course there are exceptions). So proper focus on the integration process can make a huge difference.

Advantages and Disadvantages for Infrequent Acquirers

For those looking to kick off an acquisition strategy, here are three quick keys to success.

1. Articulate your strategy.

Ask questions like: Why are we buying this company? What exact role does this specific target play in the fulfillment of our strategy? What will we need to get out of it in order to call the deal a success?

If at all possible, identify one overarching reason for the potential acquisition.

That is not to say that a deal shouldn’t have more than one potential source of value, but particularly for smaller, less experienced acquirers, simpler is better.

Make the deal’s strategic rational your company’s mantra. Make it the context for every action, priority, and decision.

2. Get help.

Remember that just because you’re fabulous at operating a software company or a food distribution company doesn’t mean that you’ll be equally fabulous at merging two software or food distribution companies. Why? Because integrating is not operating. Integrating is the temporary process of managing a little revolution.

Do not scrimp on the investment in the integration process… both in terms of time and money. The cost of a concerted, thorough integration process is the single most effective investment that a company makes in the process of successfully acquiring another company.

If you have no one in house with recent integration experience (and whose day job can be spared), seek outside help. In all likelihood it will be worth every penny you pay for it.

In total, middle market companies should expect to pay somewhere around eight to 12 percent of a deal’s price to ensure effective integration. Certain projects, e.g., those with major rebranding objectives or sweeping layoffs, can have large one-time costs that sharply increase that percentage. And larger, more complicated deals, for example, can see that cost rise toward 15 percent, a level that is something of a norm for bigger company acquisitions.

3. Get going.

Do not be misled by the widely-used term “post-merger integration.” The only thing “post” about integration is the timing of its impact. Waiting until your deal has closed to start thinking about integration is a surefire way to make the ugly failure odds even uglier.

So start early, in the strategy phase or — at the latest — due diligence. And make most decisions quickly, particularly those involving people. Uncertainty festers. Don’t let it.