The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

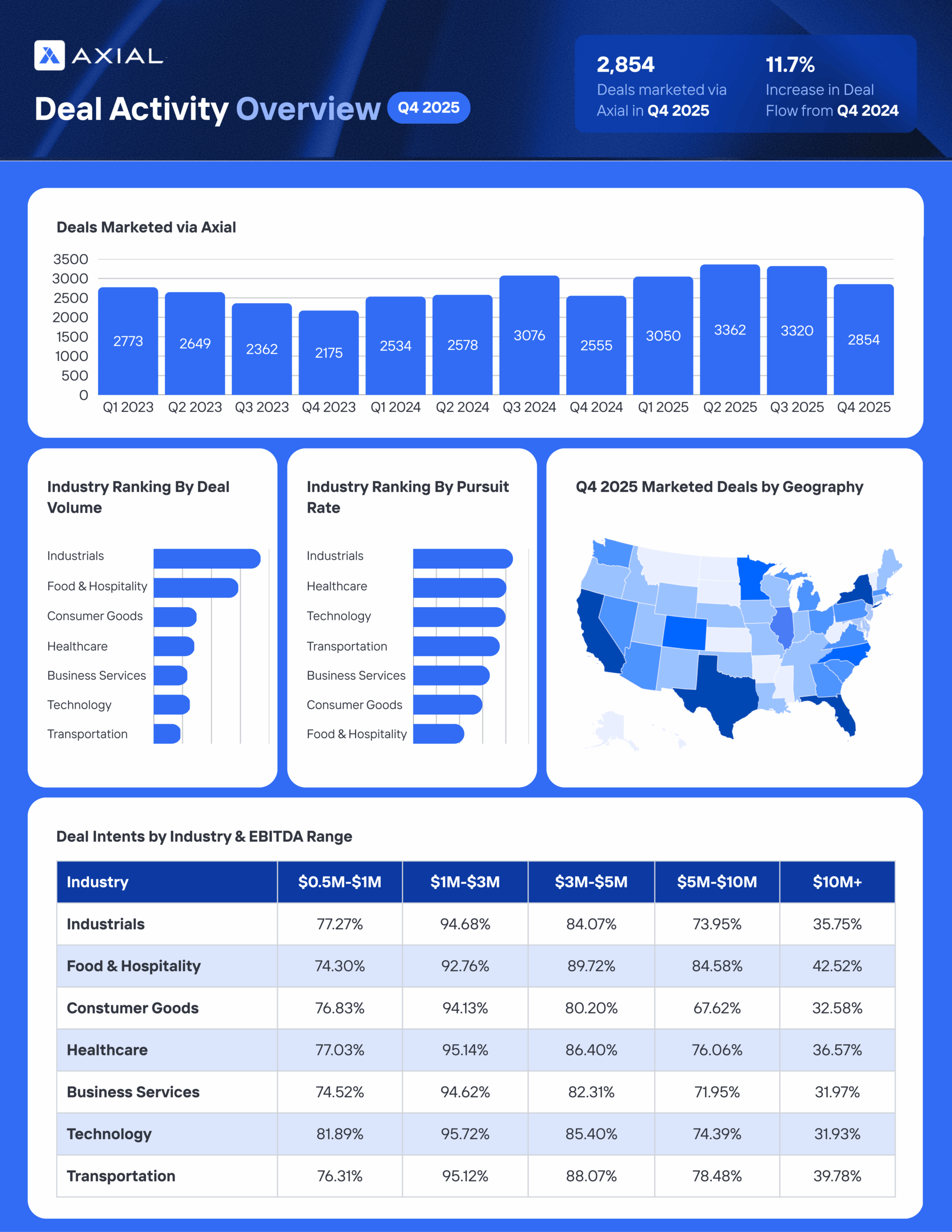

Welcome to the Q4 2025 issue of The SMB M&A Pipeline, the quarterly series that surfaces a top-of-the-funnel breakdown of the deal activity on Axial’s platform. The aggregated metrics include quarterly deal volumes, financial and geographic characteristics, and pursuit rates, sorted by industry category.

All deal data is fully anonymized to protect the confidentiality of these transactions.

“Pursuit rate” measures the rate at which Axial’s buyside members register interest in a deal that an Axial sell-side member has invited them to consider. If NDAs, IOIs, and LOIs reflect the deepening progression of interest among acquirers on a given deal, the pursuit rate is one step higher in the funnel than the signed NDA. It offers insight into the forward deal pipeline and the initial interest level of prospective Axial buyside members.

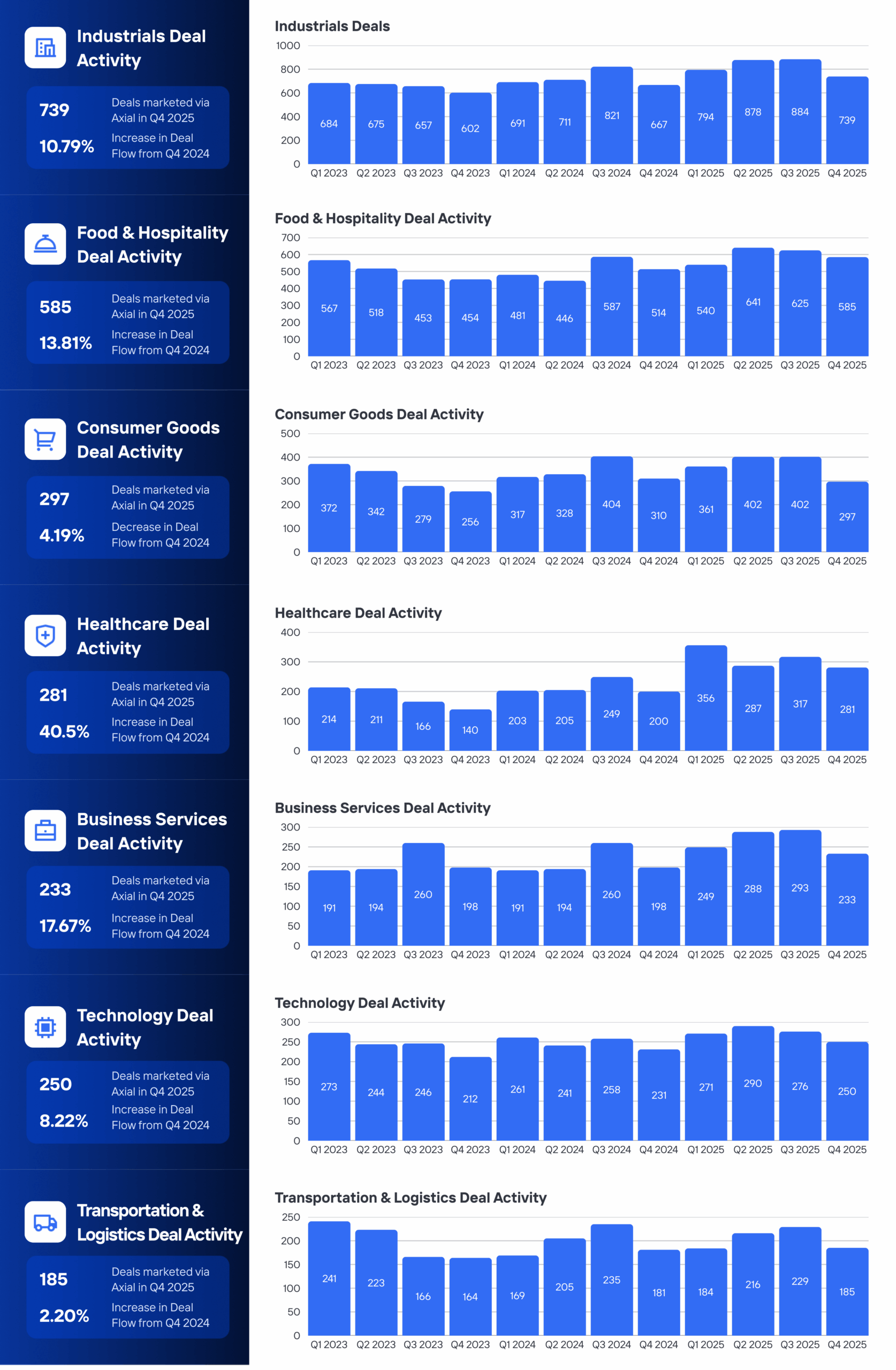

We saw 2,854 deals come to market in Q4, an 11.7% increase from the same time period last year. Six of the seven major industries reported year-over-year increases, with Healthcare posting the highest increase (+40.50%). This growth suggests a surge in owner readiness to transact, likely driven by continued consolidation, regulatory clarity in certain subsectors, and strong buyer demand for predictable, recession-resistant cash flows.

Industrials and Technology experienced more measured growth, up 10.8% and 8.2%, respectively, signaling steady but disciplined seller participation in sectors that continue to attract high buyer interest. Transportation saw only modest growth, while Consumer Goods was the lone sector to decline, down 4.2%, potentially reflecting lingering margin pressure, inventory challenges, or valuation disconnects.

| Industry | Increase / Decrease Compared to Q4 2024 |

| Healthcare | +40.50% |

| Business Services | +17.67% |

| Food & Hospitality | +13.81% |

| Industrials | +10.79% |

| Technology | +8.22% |

| Transportation | +2.20% |

| Consumer Goods | -4.19% |

Q4 capped off a record-breaking year for deal volume on Axial, with 12,856 deals coming to market in 2025—a 17.1% increase from 2024 and the highest annual total on record.

Industrials saw continued alignment between supply and buyer demand, ranking 1st in both deal volume and pursuit rate in Q4. This may be driven by the sector’s perceived durability, with many industrial businesses offering essential services, recurring demand, and tangible assets that help mitigate downside risk.

Inverse dynamics elsewhere highlight selectivity on the buyside. Food & Hospitality (#2 in deal volume but #7 in pursuit rate) and Consumer Goods (#3 in deal volume, #6 in pursuit rate) reflect elevated seller activity alongside comparatively weaker buyer interest. This imbalance suggests more owners are testing the market—potentially in response to margin pressure, labor costs, or demand uncertainty—while buyers remain cautious about underwriting risk in these sectors.

Technology shows the opposite pattern, ranking #5 in deal volume but #3 in pursuit rate. Fewer businesses are coming to market, but those that do attract disproportionately strong buyer interest. Overall, the data points to a market where sellers are active, but buyer enthusiasm is concentrated in sectors viewed as more durable and defensible.

| Industry | Ranking by Deal Volume | Ranking by Pursuit Rate |

| Industrials | 1 | 1 |

| Food & Hospitality | 2 | 7 |

| Consumer Goods | 3 | 6 |

| Healthcare | 4 | 2 |

| Technology | 5 | 3 |

| Business Services | 6 | 5 |

| Transportation | 7 | 4 |

Below is a breakdown of industry-specific and overall deal activity on Axial in Q4. Feel free to incorporate this data into your materials as you see fit.

Deal Intent Definition: A project created by a buyside member on Axial to signal the types of businesses they are actively looking to acquire or invest in, based on criteria like industry, size, and geography. Based on the specified range, deal intents can fall into multiple EBITDA buckets (e.g., $1M–$4M falls into both $1M–$3M and $3M–$5M).

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.