Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Business Owners, Private Equity

A recent study by Harvard Business School found that up to half of venture capitalists rely more on gut instinct than financial metrics when making investment decisions.

Among other findings, the study reported:

In an article in PE Hub, Clint Korver of Ulu Ventures argues that these results suggest that VCs are an aberration in the finance world. “Most professionals in other areas of the financial world, from hedge funds to real estate investors, faithfully use financial metrics to calculate their risk-adjusted return… However, this type of rigor is not routine in venture capital.”

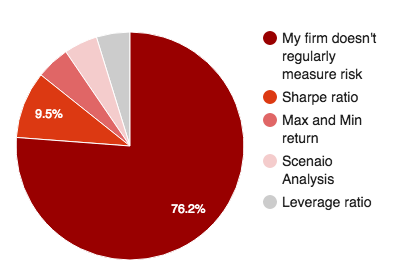

In fact, a survey conducted by Axial last year suggests that it’s not always routine in private equity, either. Seventy-six percent of PE investors reported that their firms do not regularly measure risk when evaluating opportunities.

“How does your firm measure risk?”

If not necessarily risk, we wondered:

“The #1 thing we consider when evaluating a potential investment is ‘How can we grow it?’. This encompasses many things — industry and trends, size of market, existence of qualified add-on candidates, etc., but most important in our assessment of our growth possibilities is the quality of the human capital. Backing solid and successful entrepreneurs and management teams who are hungry for growth and are partnering with us to achieve more than they can on their own is of utmost importance in investing.”

“The #1 thing we consider when evaluating a potential investment is ‘How can we grow it?’. This encompasses many things — industry and trends, size of market, existence of qualified add-on candidates, etc., but most important in our assessment of our growth possibilities is the quality of the human capital. Backing solid and successful entrepreneurs and management teams who are hungry for growth and are partnering with us to achieve more than they can on their own is of utmost importance in investing.”

-Gretchen Perkins, Huron Capital Partners

“Our first consideration is always the people involved. We want to understand their situation, motivations, and life philosophies, and how those things have impacted company culture. This helps us to evaluate if the deal is viable and how we can create the optimal transition plan.”

“Our first consideration is always the people involved. We want to understand their situation, motivations, and life philosophies, and how those things have impacted company culture. This helps us to evaluate if the deal is viable and how we can create the optimal transition plan.”

-Brent Beshore, adventur.es

“In some respects, all investing requires a degree of gut instinct, but it’s really important here to distinguish between VC and PE. I think of VC as capital that’s used for early-stage or growth investment — where the entire investment stays in the company and there is no liquidity for the shareholders. Since these early stage companies often do not have meaningful financial histories, the only thing the investor has to go on is his/her intuition.

“In some respects, all investing requires a degree of gut instinct, but it’s really important here to distinguish between VC and PE. I think of VC as capital that’s used for early-stage or growth investment — where the entire investment stays in the company and there is no liquidity for the shareholders. Since these early stage companies often do not have meaningful financial histories, the only thing the investor has to go on is his/her intuition.

“In contrast, we’re doing recapitalizations of more mature businesses with a reasonable history of financial performance. In addition, most of our capital ends up flowing out to the existing shareholders in the form of liquidity; therefore, we must be financially disciplined in how we underwrite an investment. In doing so, we certainly evaluate the financial health of the business, but we also assess the macro-market, the customer stability, the quality of management team, and a host of other key data points. That said, at the end of that day there’s no such thing in private investing as 100% certainty, so there’s also a healthy dose of gut feel.”

-Eric Mattson, Excellere Partners

“The #1 thing I consider when evaluating a business is the integrity and capability of the management team. You can do never a good deal with a bad person.”

“The #1 thing I consider when evaluating a business is the integrity and capability of the management team. You can do never a good deal with a bad person.”

-Jordan Bastable, LongWater Opportunities

“Sustainability is concern #1 for me. Technology, customers, management, competitive advantages, industry nuances, cash flow… how sustainable are all these things in this ever-changing world? The more sustainable they are, the better my gut feels about the deal. I tend to look at what’s probable (versus what’s possible) and that starts with sustainability.”

“Sustainability is concern #1 for me. Technology, customers, management, competitive advantages, industry nuances, cash flow… how sustainable are all these things in this ever-changing world? The more sustainable they are, the better my gut feels about the deal. I tend to look at what’s probable (versus what’s possible) and that starts with sustainability.”

-Brandon Hinkle, Chicago Capital Partners