M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

When selling a business, knowing its value is top of mind for both seller and buyer. But differences in perspective can lead to significant gaps in value.

Value for a privately owned company is influenced not just by the condition of the business and the availability and cost of capital to fund the purchase but the objectives and personal motives of the parties involved. To add to the complexity, a sale transaction is often a result of negotiations involving cash, assumption of debt, future earnings, assets, and deal terms.

To help establish a perspective, a formal appraisal or valuation of the business is often performed. But keep in mind, there is a big distinction between value and a valuation. Value is based on perception while a valuation is based on a formal independent assessment.

A valuation is useful because it is a structured and disciplined process requiring experience, judgment, and skill. But it too relies on assumptions that involve as much (if not more) art as it does science. Fortunately, there are standards mandated by various authorities to establish consistency and quality. The final valuation opinion is usually presented as a range. The limits of the range are influenced by professional judgment and the rules for performing the necessary calculations. The credibility of the valuation depends on the experience and credentials of the appraiser.

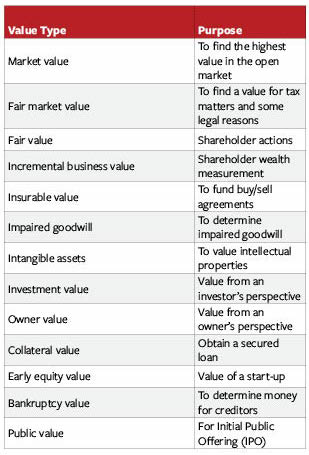

The kind of valuation most appropriate for an ownership transfer depends on its purpose. For example, you might not want to use the same approach to resolve a dispute (such as a divorce settlement) or file bankruptcy as to sell a business to a competitor. Rob Slee in his comprehensive treatise on “Private Capital Markets” outlines thirteen types of business values. All have a different purpose, function and rules for use.

Valuations are a Function of Need

In selling a business, a great deal depends on who the buyer is. Selling to the employees through an ESOP (Employee Stock Ownership Plan) requires a Fair Market Value assessment with all the rules and limitations of that process. Insurable value for a Buy/Sell agreement is a way to fund the acquisition of part of a private company due to the loss of an existing owner. Still others are interested in what they can garner from the open market. Here, market value is influenced by the state of the business and capital available for funding the purchase.

Many sellers don’t realize that every private company has at least three market values at the same time. Each of these represents the most likely selling price based on the most likely buyer type; Asset, Financial, or Strategic.

Asset Buyers

Asset buyers look at a company’s worth based on net value of the company’s assets. Here, beyond the possible write-up of the assets, the buyer is not buying the company’s earnings stream or giving credit to the company’s operations or goodwill (name, reputation, customer base etc.). This valuation approach is most useful if the business being sold is experiencing negative growth or some of the assets (e.g., real estate) do not contribute to the operations going forward.

Financial Buyers

A financial buyer is one that will pay for the business as a going concern, including goodwill. The valuation is based on the company’s historical financial statements and 3-5 year projections of the P&L and balance sheet. The company’s profit (Earnings Before Interest, Taxes, Depreciation and Amortization or EBITDA) projections are discounted back to the time of purchase to determine a net present value. The discount rate that is applied is a function of the company’s size, industry, dependence on economic conditions, debt leverage, and risk factors such as supplier or customer concentration, management strength, culture, business plan, etc.

Sellers can improve a buyer’s net present value for their company by minimizing these risks before entering into a sale process. Benchmarking the NPV against M&A supply/demand experience helps in framing “what the market will bear.” Competitive valuations are benchmarks that are formulated using multiples of EBITDA of like businesses purchased by like buyers. To achieve a conclusion, a valuation professional will likely apply some weighted average of the various calculations and determine a range of values for the subject business.

Strategic Buyers

A strategic buyer is one who already has some investment in a related business. By combining the existing business with the seller’s business, the buyer expects synergies that will generate improved sales and/or profits beyond what the businesses generate separately. Valuation professionals typically have little insight into what a strategic buyer will pay for a business because only the buyer knows what synergies might have an impact on an integrated concern. Typical synergies can result from the seller’s product, process or technology capabilities as well as customer relationships. Buyers who are consolidators look for economies of scale and lower cost structures as a result of the combination. Growth buyers expect to avoid the costs associated with business development for synergistic sales and operations. Either of these lead to the potential for a greater purchase price than what could be available from a financial buyer if the strategic is willing to share some of the profits from the combined businesses with the seller. On the downside, the value of a strategic buyer to the seller may not be as compelling if the net result of the combination has a negative impact on the seller’s employees, customers, or local community.

The Ultimate Valuation

Owners can secure a premium price for their company when capital for financing is attractive, they have minimized future growth risk in the business, and they find a strategic buyer who is both acceptable and willing to share the benefits of synergies. Fortunately, there are a number of financial advisors that can help make that happen. But it is important to keep in mind, at the end of the day, no matter what the purpose, a business is only worth what someone is willing to pay.