Top 25 Lower Middle Market Business Brokers | 2025

Axial launched its first business broker league table last year, recognizing the Top 25 brokerages delivering exceptional outcomes for business…

Axial is excited to release our Q2 2025 Lower Middle Market Investment Banking League Tables.

To compile this list, we reviewed the deal-making activities of 400+ investment banks and advisory firms that met the qualifications to be considered for league tables last quarter.

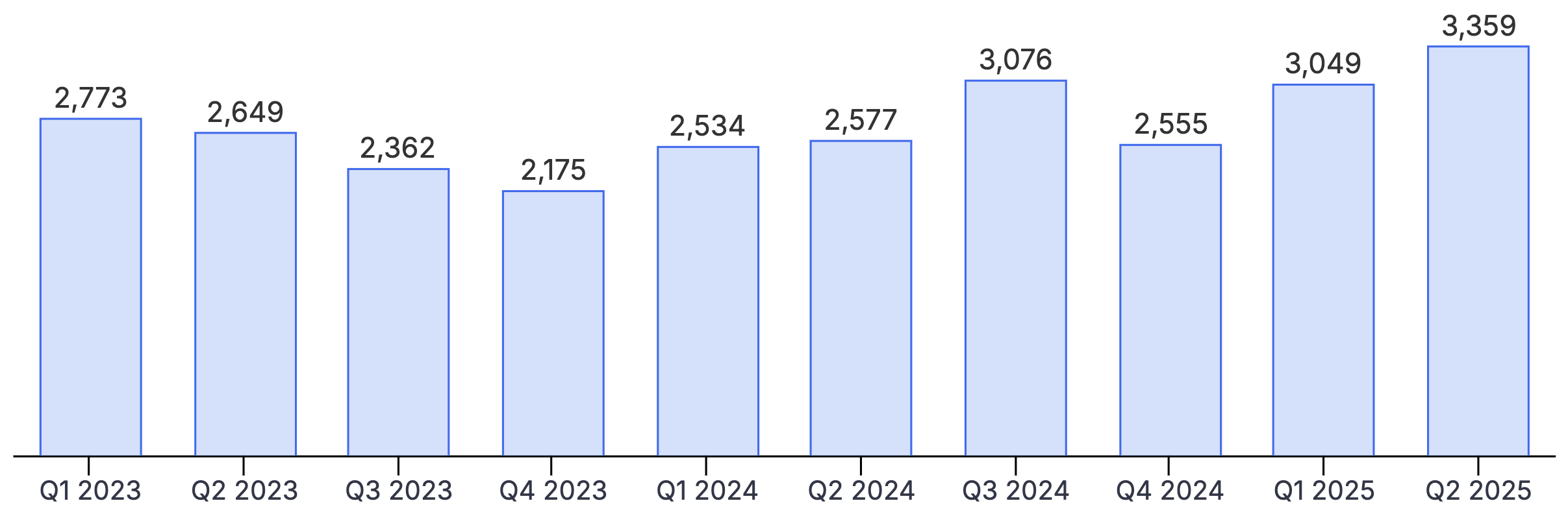

Axial members saw record-breaking deal activity last quarter, with 3,359 deals marketed via the platform — the highest quarterly deal flow in Axial history and a 30.34% increase from the same quarter last year.

Today’s 25 featured firms collectively marketed 108 deals via Axial last quarter. Those deals matched with 37,238 recommended buyers and received a total of 3,136 buyer pursuits, generating an average pursuit rate of 12.61% — a strong indicator of deal quality among these firms.

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is primarily driven by four factors:

Congratulations to these investment banks and M&A advisory firms for their dealmaking achievements!

| Firm | HQ | |

|---|---|---|

| 1 | Tower Partners | Columbia, MD |

| 2 | FOCUS Investment Banking | Vienna, VA |

| 3 | Peakstone Group | Chicago, IL |

| 4 | Venture North Group | Anchorage, AK |

| 5 | Madison Street Capital | Austin, TX |

| 6 | Business Acquisition and Merger Associates | Charlotte, NC |

| 7 | Alta Capital Partners | New York, NY |

| 8 | Cross Keys Capital | Miami, FL |

| 9 | Corum Group | Bothell, WA |

| 10 | FourBridges Capital Advisors | Chattanooga, TN |

| 11 | TREP Advisors | Sarasota, FL |

| 12 | The Advisory | Beverly Hills, CA |

| 13 | New Direction Partners | Valley Forge, PA |

| 14 | Baker Group M&A Consultants | Overland Park, KS |

| 15 | Ad Astra Equity Advisors | Kansas City, MO |

| 16 | Meritage Partners, Inc. | Newport Beach, CA |

| 17 | Exit Strategist, LLC | Massapequa, NY |

| 18 | HORNE Capital | Ridgeland, MS |

| 19 | SovDoc | Los Angeles, CA |

| 20 | Founder M&A | Burleson, TX |

| 23 | Axiom Acquisition | Lubbock, TX |

| 22 | Aurum Capital Connect | Denver, CO |

| 23 | Beacon Equity Advisors | Norwood, MA |

| 24 | ASA Ventures Group | Englewood, CO |

| 25 | Rowe Tomes Advisors | Houston, TX |

“Tower Partners is a leading Private Investment Bank and Advisory Firm providing premier service to the middle market. Our team of industry veterans have advised sell-side and buy-side engagements with over $15 billion in value for entrepreneurs, family-run businesses and financial sponsors. We are a national firm with a global reach, supporting clients throughout the United States with headquarters in Columbia, MD and offices in Baltimore, MD, Denver, CO, and New York, NY. Our entrepreneurial roots and years of experience have solidified our will to charge forward when others might quit.”

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 35+ senior bankers is supported by more than a dozen analysts, senior advisors, and support staff. Each FOCUS banker maintains a core practice in one of the 12 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

![]() Visit FOCUS Investment Banking’s Profile

Visit FOCUS Investment Banking’s Profile

![]()

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

![]() Visit Peakstone Group’s Profile

Visit Peakstone Group’s Profile

“Venture North is a firm based in Anchorage, Alaska that provides a full suite of services to our buy-side, sell-side, and capital finding clients. We have successfully managed and handled engagements in a wide variety of industries and are recognized as a leader in assisting in the sale or purchase of businesses. We do business throughout the US, but we have unmatched expertise in the Alaska market. Due to Alaska’s very low level of VC and PE activity, the returns tend to be higher and deal quality better than in other, more competitive markets.”

“Madison Street Capital is an international investment banking firm dedicated to the highest standards of integrity and professionalism. We provide corporate financial advisory services, mergers and acquisitions expertise, valuation services, and financial opinions to publicly and privately held businesses through our offices in North America, Asia, and Africa.

Our professionals draw on specialized expertise in partnering with middle-market firms in all industry verticals and niche markets to achieve an optimal outcome through a variety of transactions. Madison Street Capital’s professionals precisely analyze each client’s needs to determine the best match between buyers and sellers, arrange cost-effective financing, and produce capitalization structures that maximize each client’s potential. Madison Street Capital is a trusted partner and industry-leading provider of financial advisory services, M&A assistance, and business valuations.”

![]() Visit Madison Street Capital’s Profile

Visit Madison Street Capital’s Profile

“Business Acquisition and Merger Associates is a results-oriented, middle market intermediary firm located in Charlotte, NC. Founded on the principle of adding value and professional skill to business transfers, BAMA helps clients acquire or sell companies. Our “buyer” clients are both financial and strategic buyers, management teams, private equity groups, and mezz lenders who are looking to invest in good companies. “Seller” clients include business owners who desire recapitalizations for founder-family business transfer, growth capital, corporate divestitures, and those seeking business transfer due to retirement, health, family, or personal reasons.”

Visit Business Acquisition and Merger Associates’ Profile

“Alta Capital Partners is a leading boutique advisory firm providing best-in-class investment banking services to middle market clients around the world. Our principals bring the know-how and expertise of the world’s most successful investment banks to an independent, client-focused platform, offering first-tier experience and tailored solutions to mergers, acquisitions, and financings. Our strategic clients and longstanding relationships across the globe include early-stage entrepreneurs, family-owned businesses, established middle-market companies, and leading multinationals. We have an extensive network of domestic and international financial partners comprised of family offices, venture capital and private equity funds, as well as traditional and alternative debt providers.”

Visit Alta Capital Partners’ Profile

“Cross Keys Capital has offices in Fort Lauderdale, Florida, and Chicago, Illinois. With a team of more than 20 professionals, we provide our clients with a full suite of investment banking advisory services, including sell-side and buy-side M&A, recapitalizations, restructurings, and capital raising. At the onset, we perform comprehensive diligence and analyses on our clients to identify key deal factors, including the quality of the management team, the stability and track record of the business, the strength and testing of the company’s financial profile, and its competitive positioning.”

Visit Cross Keys Capital’s Profile

“Corum Group Ltd. is the global leader in merger and acquisition services, specializing in serving software and information technology companies worldwide.

For 37 years, Corum has created the standard for success. With offices across the globe, Corum has completed over 500 transactions with over $20 billion in wealth created. Corum is also the leading industry educator with its popular conferences and publishes the most widely distributed software M&A research.”

“FourBridges Capital is an investment banking firm that serves business owners across the Southeast. We act as the interface between our clients and the capital markets, helping them to identify potential investors or acquisition targets and successfully complete transactions. Our senior professionals draw on both expertise in investment banking and experience as C-level executives, having spent most of their careers serving the middle market. For information regarding our past deals, please visit: fourbridgescapital.com/transactions.”

Visit FourBridges Capital Advisors’ Profile

“TREP Advisors is an advisory firm focused on succession solutions for business owners. At TREP Advisors, we know you want to be an owner who understands the future options for your business. To do that, you need a succession plan that fulfills your desires and addresses all the issues of estate planning and taxes. The problem is that you are so busy running the company that it makes you feel confused about addressing the issues of a succession plan.

We believe every owner is truly unique and that your succession plan is the single most important business decision you will make to achieve the freedom you deserve. We understand the struggles and opportunities you face every day because we have walked in your shoes, which is why we have been able to help owners like yourself sustain control over their business while liquidating equity in their business for financial security.”

“We are an investment bank representing business owners and operators navigating the process of selling their company. We primarily advise middle market “add-on” businesses during the sale process to one of the 4,500+ private equity companies that own “platforms”. We specialize in helping businesses in Skilled Trade, Consumer Services, and Medical Services connect directly with top private equity buyers, not just local brokers. Our team creates competitive bidding environments by leveraging deep relationships with leading private equity platforms to maximize your company’s value.”

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

![]() Visit New Direction Partners’ Profile

Visit New Direction Partners’ Profile

“Baker Group M&A Consultants, Inc. is different in numerous ways. Jerry Baker, the President of the Baker Group has over 50 years experience as an entrepreneur, who started and developed many companies over his career. He can relate to a business of any size. His knowledge acquired over the years is extremely helpful in developing a relationship with clients.

Since 1988, Jerry Baker’s companies have consulted with and successfully concluded over 200 transactions in numerous industries. Jerry’s experience in starting companies, building companies, taking companies public, selling companies, dealing with national accounting firms and major law firms in numerous negotiations and leading and mentoring employees to successful careers is priceless when it comes to selecting a deal maker. Baker Group M&A Consultants can discuss with clients different types of transactions and structures to consider. BGMAC works closely with the attorney and accountants of its clients through the letter of intent, due diligence, purchase agreement and the closing.”

![]() Visit Baker Group M&A Consultants’ Profile

Visit Baker Group M&A Consultants’ Profile

“AAE is a boutique merger and acquisition advisory firm located in the Kansas City area. We offer M&A advisory services as sell-side advisors. We guide business owners through strategic planning, marketing, and closing of a deal to transition their company. Ad Astra has successfully closed a combined transaction value of $500 million.

Our team works with owners across the nation, of varying sizes, across several industries, with each owner having unique goals. We are well equipped to understand a business owner’s wants and needs… converting those goals into our unique deal process, which becomes our roadmap to their ideal outcome.”

Visit Ad Astra Equity’s Profile

“Meritage Partners (“Meritage”) is a multifaceted advisory firm specializing in mergers and acquisitions, capital advisory, and strategic exit planning, with a focus on the low to mid-markets. Our exceptional team boasts a wide range of expertise from entrepreneurs, investment banking, corporate finance, private equity, law, and accounting, collectively amassing over 130 years of experience. With deep-rooted backgrounds in private equity, encompassing roles as investors and trusted advisors, we have actively contributed to transactions exceeding $2 billion in enterprise value.”

![]() Visit Meritage Partners’ Profil

Visit Meritage Partners’ Profil

“The Exit Strategist team has been involved in 100 transactions throughout their careers. Specializing in demystifying the complexities of selling a business and minimizing the costly risks of mistakes, their comprehensive service offerings are designed to support business owners at every stage of a company’s life cycle. Whether planning for retirement, exploring an IPO, or considering acquisition by a larger company, Exit Strategist has business owners covered.”

Visit Exit Strategist’s Profile

“For more than 60 years, HORNE has provided tax, auditing, accounting and consulting expertise for hundreds of businesses throughout the southern U.S. and beyond. As we watched clients grow, mature and approach retirement, we became aware of their need for a qualified advisor they could trust to work in their best interests.

HORNE Capital was formed to provide M&A services that go beyond securing funding and executing a transaction. We work with sellers and buyers before, during and after the sale to help them successfully address the details that arise as they prepare, execute and transition from their sale or acquisition.”

“SovDoc is a growth and M&A advisory firm, focused specifically on private practices & healthcare companies. SovDoc takes a data-driven approach to M&A and growth advisory, helps helping entrepreneurs value their businesses, grow profitability, and prepare for future exits. SovDoc leverages deep financial expertise, industry insights, and a rigorous execution process. Whether you’re scaling your practice, preparing for a sale, or securing strategic capital, the SovDoc team ensures every step is optimized for maximum value.”

“At Founder M&A, we are a dynamic advisory firm specializing in sell-side transactions across diverse industry sectors, with decades of transactional expertise that has enabled our seasoned team to orchestrate numerous deals in the lower-middle and middle markets successfully.

Our approach is grounded in a proven formula for success, carefully tailored to guide business owners and leaders through the complexities of the transaction journey. With a focus on facilitating deals for businesses with annual revenues ranging from $5 million to $250 million, Founder M&A ensures smooth transitions and optimal outcomes for all parties involved.”

![]()

“Axiom Acquisition Group is a Texas-based, privately-owned company specializing in Mergers and Acquisitions for existing businesses of all types. With over 70 years of combined experience and $4 Billion in transaction volume, we have the experience and expertise across multiple markets and various industries to deliver results on all fronts.”

![]() Visit Axiom Acquisition’s Profile

Visit Axiom Acquisition’s Profile

“Aurum Capital Connect is a Denver- and Dallas-based investment bank and strategic advisory group that specializes in M&A and capital formation for middle market companies. We firmly believe active involvement with our client companies is key to success; we work closely with management teams to develop and execute strategy, open doors to capital, and create meaningful exits.”

Visit Aurum Capital Connect’s Profile

“Since 1985 Beacon Equity Advisors has worked with business owners seeking to grow or divest closely held businesses. Our team of advisors is made of up of entrepreneurs who understand business operations, business culture and business owner objectives. We strive help our sellers understand the value of the enterprise then put together transactions to meet their objectives.”

![]() Visit Beacon Equity Advisors’ Profile

Visit Beacon Equity Advisors’ Profile

“ASA Ventures Group supports business owners by reducing their ongoing equity risk and their burden of business ownership. We will take the burden off your shoulders by providing you with a dedicated and knowledgeable growth investment partner so that you may not have to worry about your business growth. Whether you wish to further grow your business or exit your existing business, you can count on our team.”

![]() Visit ASA Venture Group’s Profile

Visit ASA Venture Group’s Profile

“Led by passionate founders with decades of strategic advisory experience, R|T Advisors is a leading brand focused investment bank specializing in providing strategic advice, merger and acquisition expertise, and capital advisor for coveted brands and businesses in the U.S. and internationally. R|T partners closely with brand builders, entrepreneurs, founder-teams, and shareholders to drive optimal outcomes for stakeholders.”

![]() Visit Rowe Tomes Advisors’ Profile

Visit Rowe Tomes Advisors’ Profile

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial (all-time)

– 2 or more closed deals on Axial (all-time)

Unlike traditional league table structures that have remained unchanged for years, where firms are assessed based on deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down-funnel effectiveness for their clients.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those that work with the most in-demand clients, balance breadth, selectivity, and accuracy in the buyers they engage, and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.