The Top 50 Lower Middle Market Healthcare Investors & M&A Advisors [2025]

Healthcare deal activity is on the rise. As reported in the most recent issue of The SMB M&A Pipeline, healthcare…

Axial is excited to release our Q1 2025 Lower Middle Market Investment Banking League Tables.

To assemble this list, we reviewed the deal-making activities of 400+ investment banks and advisory firms that met the qualifications to be considered for league tables last quarter.

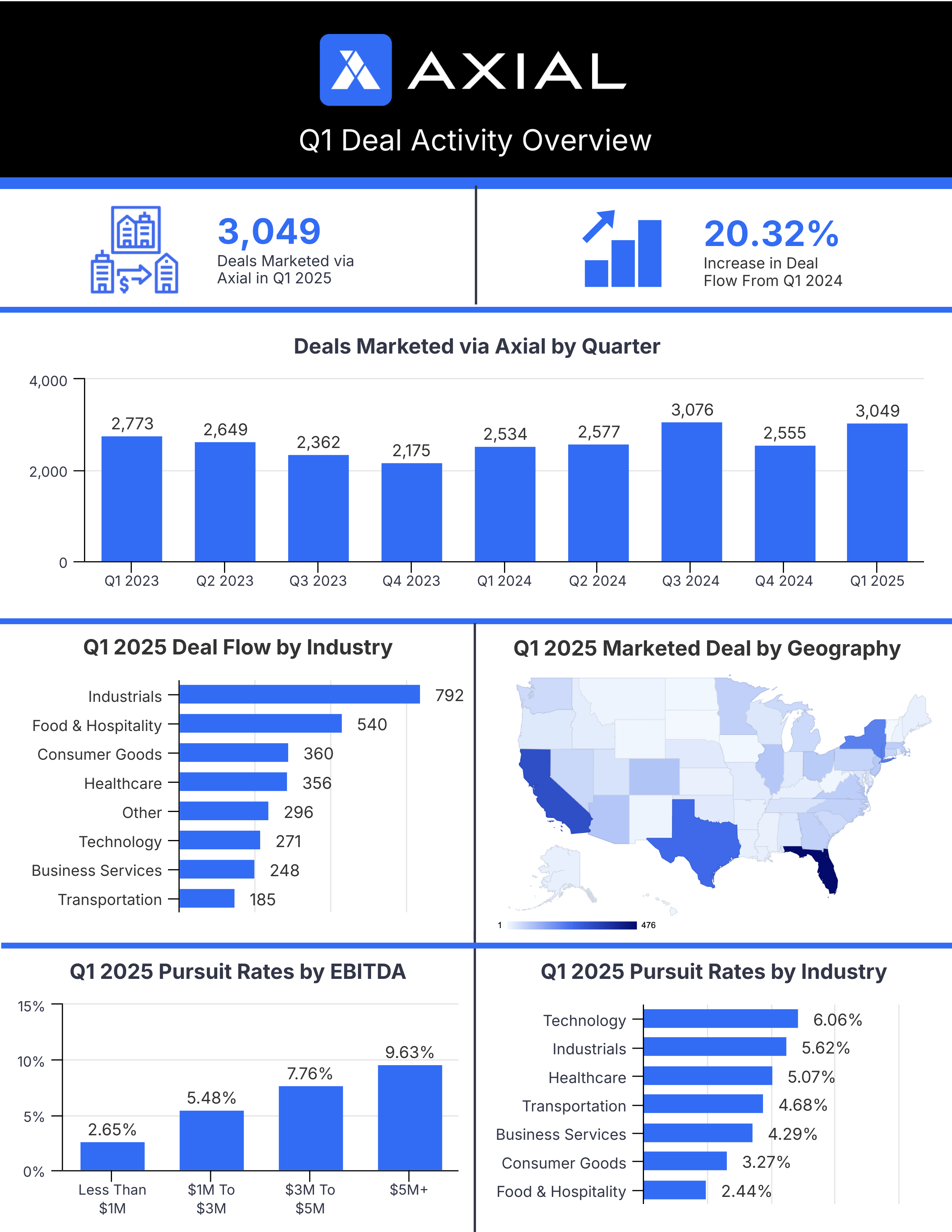

Axial members hit the ground running in 2025, marketing 3,049 deals via the platform in Q1—a 20.32% increase in deal flow compared to Q1 of last year and the second-highest quarterly total in Axial history. Buyer interest remained highest in deals with $5M+ in EBITDA, which drew a pursuit rate of 9.63%, and in Technology and Industrials opportunities, which posted pursuit rates of 6.06% and 5.62%, respectively.

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is primarily driven by four factors:

Congratulations to these investment banks and M&A advisory firms for their dealmaking achievements!

| Rank | Firm | HQ |

|---|---|---|

| 1 | Ad Astra Equity Advisors | Kansas City, MO |

| 2 | FOCUS Investment Banking | Vienna, VA |

| 3 | The Advisory | Beverly Hills, CA |

| 4 | ASA Ventures Group | Englewood, CO |

| 5 | Vesticor Advisors | Lansing, MI |

| 6 | The Bloom Organization | Miami, FL |

| 7 | Solganick & Co. | El Segundo, CA |

| 8 | Peakstone Group | Chicago, IL |

| 9 | Madison Street Capital | Austin, TX |

| 10 | Corum Group | Bothell, WA |

| 11 | Gleason Advisors | Pittsburgh, PA |

| 12 | TREP Advisors | Sarasota, FL |

| 13 | Exit Partners | Plano, TX |

| 14 | ACT Capital Advisors | Mercer Island, WA |

| 15 | Vertess Healthcare Advisors | Fort Worth, TX |

| 16 | NorthStar Mergers & Acquisitions | Southlake, TX |

| 17 | A Neumann Associates | Atlantic Highlands, NJ |

| 18 | Good Hope Advisors | New York, NY |

| 19 | Decosimo Corporate Finance | Chattanooga, TN |

| 20 | Founder M&A | Burleson, TX |

| 23 | Mor-Liquidity M&A | Kanata, ON |

| 22 | Olympic M&A | Louisville, KY |

| 23 | Embarc Advisors | West Hollywood, CA |

| 24 | NextGen Capital | Atlanta, GA |

| 25 | McDonald Dalton Capital Partners | Houston, TX |

“AAE is a boutique merger and acquisition advisory firm located in the Kansas City area. We offer M&A advisory services as sell-side advisors. We guide business owners through strategic planning, marketing, and closing of a deal to transition their company. Ad Astra has successfully closed a combined transaction value of $500 million.

Our team works with owners across the nation, of varying sizes, across several industries, with each owner having unique goals. We are well equipped to understand a business owner’s wants and needs… converting those goals into our unique deal process, which becomes our roadmap to their ideal outcome.”

Visit Ad Astra Equity’s Profile

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 35+ senior bankers is supported by more than a dozen analysts, senior advisors, and support staff. Each FOCUS banker maintains a core practice in one of the 12 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

![]() Visit FOCUS Investment Banking’s Profile

Visit FOCUS Investment Banking’s Profile

“We are an investment bank representing business owners and operators navigating the process of selling their company. We primarily advise middle market “add-on” businesses during the sale process to one of the 4,500+ private equity companies who own “platforms”. We specialize in helping businesses in Skilled Trade, Consumer Services, and Medical Services connect directly with top private equity buyers, not just local brokers. Our team creates competitive bidding environments by leveraging deep relationships with leading private equity platforms to maximize your company’s value.”

“ASA Ventures Group supports business owners by reducing their ongoing equity risk and their burden of business ownership. We will take the burden off your shoulders by providing you with a dedicated and knowledgeable growth investment partner so that you may not have to worry about your business growth. Whether you wish to further grow your business or exit your existing business, you can count on our team.”

![]() Visit ASA Venture Group’s Profile

Visit ASA Venture Group’s Profile

![]()

“Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. We support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital. After founding, building and exiting our own businesses, the partners at Vesticor came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy and financial independence.”

“A leading investment bank specializing in healthcare mergers and acquisitions. With closed transactions representing more than $10 Billion in market capitalization, our leadership team of professionals has developed unmatched relationships with healthcare providers and industry professionals. We understand that healthcare, more than any other industry, requires a deep understanding of the strategic value of both buyer and seller.”

![]() Visit The Bloom Organization’s Profile

Visit The Bloom Organization’s Profile

“Founded in 2009, Solganick & Co. is a data-driven investment bank and M&A advisory firm focused exclusively on software, healthcare IT, and tech-enabled services companies. Offices are located in Austin, Dallas, Los Angeles, and San Francisco. Our deal team has completed over $20 billion in M&A transactions to date.”

![]()

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

![]() Visit Peakstone Group’s Profile

Visit Peakstone Group’s Profile

“Madison Street Capital is an international investment banking firm dedicated to the highest standards of integrity and professionalism. We provide corporate financial advisory services, mergers and acquisitions expertise, valuation services, and financial opinions to publicly and privately held businesses through our offices in North America, Asia, and Africa.

Our professionals draw on specialized expertise in partnering with middle-market firms in all industry verticals and niche markets to achieve an optimal outcome through a variety of transactions. Madison Street Capital’s professionals precisely analyze each client’s needs to determine the best match between buyers and sellers, arrange cost-effective financing, and produce capitalization structures that maximize each client’s potential. Madison Street Capital is a trusted partner and industry-leading provider of financial advisory services, M&A assistance, and business valuations.”

![]() Visit Madison Street Capital’s Profile

Visit Madison Street Capital’s Profile

“Corum Group Ltd. is the global leader in merger and acquisition services, specializing in serving software and information technology companies worldwide.

For 37 years, Corum has created the standard for success. With offices across the globe, Corum has completed over 500 transactions with over $20 billion in wealth created. Corum is also the leading industry educator with its popular conferences and publishes the most widely distributed software M&A research.”

![]()

“Our service offering at Gleason Advisors allows us to work with businesses facing a wide range of issues and financial challenges. These situations often call on us to leverage our symbiotic relationship with the services of Gleason Experts, where we have deep expertise in forensic accounting, litigation support, and bankruptcy proceedings. Combined, these groups allow us to serve our clients as a more complete financial advisor. Providing value beyond dispute.”

![]() Visit Gleason Advisors’ Profile

Visit Gleason Advisors’ Profile

“TREP Advisors is an advisory firm focused on succession solutions for business owners. At TREP Advisors, we know you want to be an owner who understands the future options for your business. To do that, you need a succession plan that fulfills your desires and addresses all the issues of estate planning and taxes. The problem is that you are so busy running the company that it makes you feel confused about addressing the issues of a succession plan.

We believe every owner is truly unique and that your succession plan is the single most important business decision you will make to achieve the freedom you deserve. We understand the struggles and opportunities you face every day because we have walked in your shoes, which is why we have been able to help owners like yourself sustain control over their business while liquidating equity in their business for financial security.”

“Exit Partners is an independent M&A Investment Banking firm with extensive experience in sales to strategic buyers, private equity buyers, and buy-side advisory. We help you succeed by delivering uncommonly effective negotiation, strategic insight, and transaction guidance. Our principals have maximized over 100 transactions involving buyers and sellers from across the U.S. as well as 15 other countries, representing $11 billion in deal value.”

“ACT Capital Advisors has been helping owners sell their businesses since 1986. Through hundreds of transactions, we’ve developed a strategic process that’s highly effective in closing deals. Unlike other M&A companies that hand you off to various specialists throughout the stages of a sale, you’ll work with one team at ACT, a group of hand-selected individuals familiar with your industry. They’ll be with you from start to finish, working toward your goals and looking out for your best interests.”

Visit ACT Capital Advisors’ Profile

“VERTESS is a healthcare-focused Mergers + Acquisitions (M+A) advisory firm that helps owners increase their company’s financial value and negotiate the best price when they decide to sell their company or grow through acquisition. Our expertise spans diverse healthcare and human service verticals, ranging from behavioral health and intellectual/developmental disabilities to DME, pharmacies, home care/hospice, urgent care, dental practices, life sciences, and other specialized services and products. Each VERTESS Managing Director has had executive experience in either launching or managing and ultimately successfully exiting a healthcare company.”

![]() Visit Vertess Healthcare Advisors’ Profile

Visit Vertess Healthcare Advisors’ Profile

“When founding partners Tom Bronson, Jeremy Furtick, and John Gorbutt launched NorthStar Mergers & Acquisitions, their collective goal was simple, albeit lofty – create a unique M&A advisory service that did not currently exist in the marketplace, but was desperately needed. After months of brainstorming, researching, and planning, NorthStar was born and began working with the owners of privately held companies in the lower-middle market.

While the core function of NorthStar is not unique – assisting business owners with the sales of their companies – what is unique are the processes, methods, and motivations the founders utilized to create NorthStar’s proprietary offering.”

Visit NorthStar Mergers & Acquisitions’ Profile

“A Neumann & Associates, LLC is a professional mergers & acquisitions advisory firm headquartered in New Jersey that has assisted business owners and buyers in the business valuation and business transfer process nationwide through its affiliation for the past 30 years. With an A+ Better Business Bureau Rating for 18+ years in a row, and over 5,000 business valuations performed through its affiliations, the company maintains its corporate offices in Atlantic Highlands, NJ approximately 45 minutes south of New York City and has trusted professionals with a deep knowledge base in multiple field offices along the East Coast.”

![]() Visit A Neumann Associates’ Profile

Visit A Neumann Associates’ Profile

“Good Hope Advisors specializes in forging strategic partnerships, orchestrating recapitalizations, and crafting successful exit strategies for residential and commercial contractors. With deep expertise in mergers and acquisitions (M&A), the firm works closely with business owners, private and public buyers and sellers, financial institutions, and private equity groups to navigate the complexities of the transaction process.”

Visit Good Hope Advisors’ Profile

“DCF, LLC, a member of FINRA and SIPC, provides sell-side and buy-side advisory services, debt and equity capital sourcing, and fairness opinions. We provide these services to business owners from a wide range of industries across the nation. We strive to build client relationships based on trust, our years of experience, and our wealth of connections.”

Visit Decosimo Corporate Finance’s Profile

“At Founder M&A, we are a dynamic advisory firm specializing in sell-side transactions across diverse industry sectors, with decades of transactional expertise that has enabled our seasoned team to orchestrate numerous deals in the lower-middle and middle markets successfully.

Our approach is grounded in a proven formula for success, carefully tailored to guide business owners and leaders through the complexities of the transaction journey. With a focus on facilitating deals for businesses with annual revenues ranging from $5 million to $250 million, Founder M&A ensures smooth transitions and optimal outcomes for all parties involved.”

“Mor-Liquidity was founded in 2009 and brings a vast array of experience representing privately owned lower middle-market (5-50M Million $/Revenue) enterprises in both Canada and United States. Our business model was built with the processes, resources, and expertise to maximize the financial opportunity for the clients we represent. Our goal is to provide Ownership with peace of mind!

By minimizing the risks and maximizing the financial opportunity for the clients we represent, we professionally and confidentially assist small to mid-size private enterprises with Exit Planning, Value Enhancement consulting, Strategic Mergers & Acquisitions, Third Party Sales, Management Buy Outs, and Recapitalizations.”

![]() Visit Mor-Liquidity M&A’s Profile

Visit Mor-Liquidity M&A’s Profile

“Olympic M&A is a national merger and acquisition advisory firm selling behavioral health, medical aesthetics, ophthalmic, and physician-owned practices to private equity and strategic buyers.”

“Olympic M&A is a national merger and acquisition advisory firm selling behavioral health, medical aesthetics, ophthalmic, and physician-owned practices to private equity and strategic buyers.”

“We are a disruptive M&A Advisory firm founded by an ex-Goldman Sachs, ex-McKinsey M&A professional. The goal is to bring Goldman and McKinsey-level services to the middle market. We doubled in size in 2023, one of the worst M&A markets in the recent decade.

Leveraging our M&A expertise, we have been successful in a broad range of sectors, including business services, IT services, healthcare, industrial, software/hardware, consumer retail, etc. We have even been successful in situations where traditional investment banks were not able to close a transaction successfully.”

Visit Embarc Advisors’ Profile

“NextGen Capital is a privately held investment bank, multi-family office, and private capital investment firm headquartered in Atlanta, Georgia, and with regional offices in Boston, Massachusetts, and Orange County, California. We offer independent, unbiased financial counsel focused on the unique needs of entrepreneurs and majority shareholders, offering our clients a wide range of services and access to global investment opportunities, capital markets, tax, operating expertise, philanthropy, estate planning, and cash management.

We are a trusted financial advisor for a select group of clients for whom we carefully craft and implement tailor-made strategies for transactions, wealth accumulation, transfers, and preservation. Our goal is to foster equitable, long-term relationships with our clients, business partners, and members of our investment community.”

Visit NextGen Capital‘s Profile

“McDonald Dalton Capital Partners is a seasoned capital markets firm dedicated to completing successful transactions for clients, backed by over 70 years of partner experience in venture capital, public market compliance, mergers and acquisitions, and corporate growth financing. The firm is known for its commitment to excellence, with a strong track record in raising capital for companies at all stages, preserving client confidentiality, maximizing valuations across various deal structures, negotiating favorable terms, and providing expert guidance throughout the capitalization process to achieve critical business goals.”

Visit McDonald Dalton Capital Partners’ Profile

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial (all-time)

– 2 or more closed deals on Axial (all-time)

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down-funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those that work with the most in-demand clients, balance breadth, selectivity, and accuracy in the buyers they engage, and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.