The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

Axial is excited to release our 2022 Lower Middle Market Investment Banking League Tables.

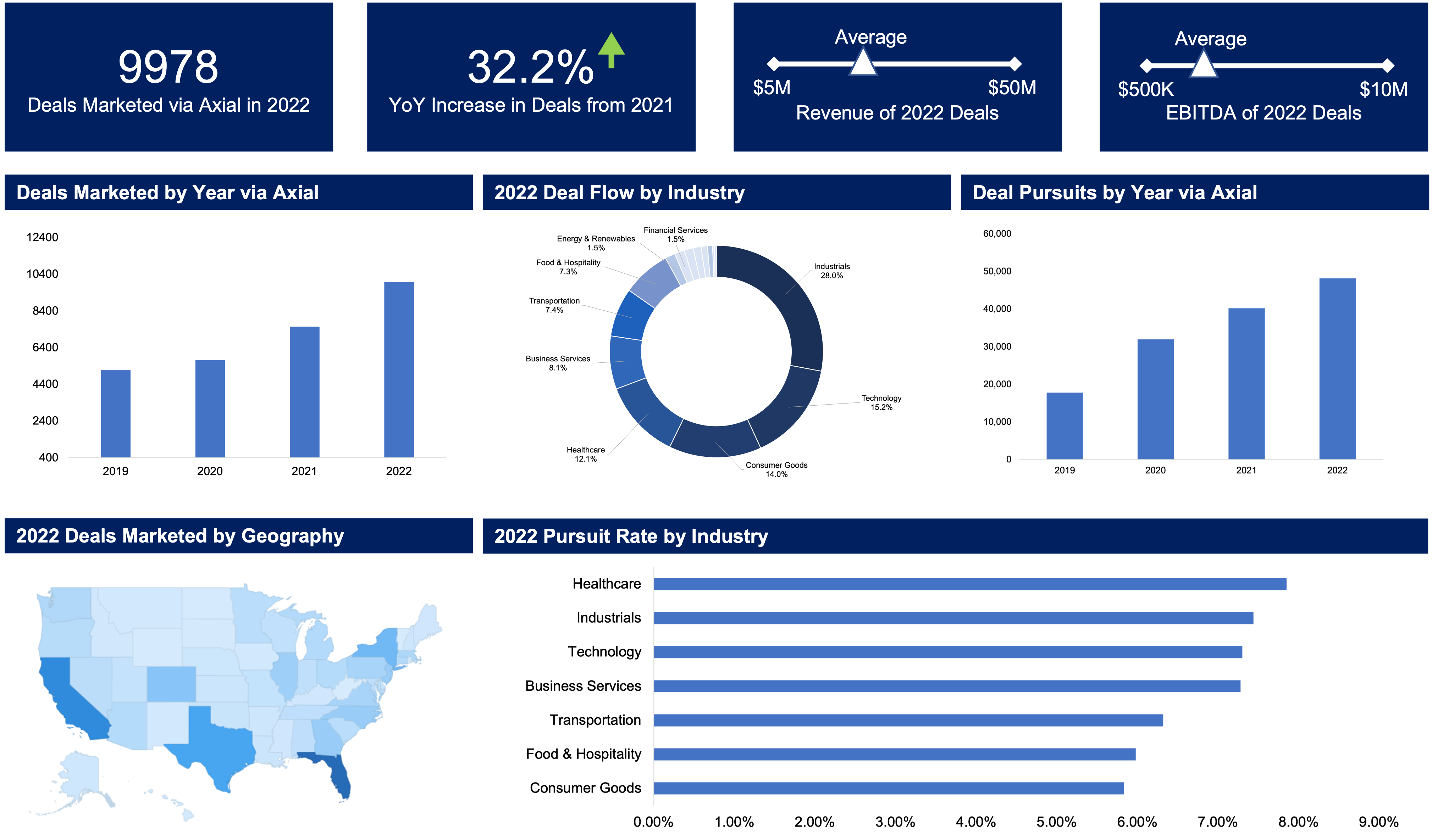

These league tables are assembled based on the 2022 dealmaking activities of 768 sell-side investment banks and M&A advisors who used Axial’s deal marketing platform to collectively contribute to 9,978 deals in the calendar 2022 year. Four factors disproportionately drive league table ranking:

For detailed methodology, see the end of this feature.

Overall deal activity occurred against a backdrop of significant change and headwinds for worldwide M&A, private equity, and capital markets. Rising borrowing costs, inflation, commodity price swings, war, and elevated recession risk weighed on M&A activity and transaction multiples. Surprisingly, top-of-funnel deal activity on the Axial platform grew in 2022, rising by 32.2% year on year.

The lower middle market investment banks profiled in these league tables found a way to navigate those changes and challenges on behalf of their clients. Congratulations to each of these investment banks and M&A advisory firms for their dealmaking achievements in 2022.

| Rank | Firm | HQ |

|---|---|---|

| 1 | Peakstone | IL |

| 2 | FOCUS Investment Banking | VA |

| 3 | eMerge M&A | NY |

| 4 | Woodbridge International | CT |

| 5 | Align Business Advisory Services | FL |

| 6 | Auctus Capital Partners | IL |

| 7 | New Direction Partners | PA |

| 8 | Plethora Businesses | CA |

| 9 | Cornerstone Business Services, Inc. | WI |

| 10 | Embarc Advisors | CA |

| 11 | Bridgepoint Investment Banking | NE |

| 12 | Salt Creek Partners | TX |

| 13 | FirePower Capital | CAN |

| 14 | SDR Ventures | CO |

| 15 | Business Acquisition and Merger Associates | NC |

| 16 | Vista Business Group | KS |

| 17 | Northern Edge Advisors | NY |

| 18 | Janas Associates | CA |

| 19 | Meritage Partners, Inc | CA |

| 20 | WhiteHorse Partners | TN |

| 21 | Gleason Advisors | PA |

| 22 | Clayton Capital Partners | MO |

| 23 | Sun Mergers & Acquisitions | NJ |

| 24 | Vertess Healthcare Advisors, LLC | TX |

| 25 | Transact Capital Partners | VA |

| Firm | HQ |

|---|---|

| American HealthCare Capital | CA |

| 41 North LLC | CA |

| ACT Capital Advisors | WA |

| Liberty Ridge Advisors | WA |

| Crystal Capital Consulting | FL |

| Firm | HQ |

|---|---|

| Market Street Capital, Inc. | TX |

| Miller Advisory Corp. | FL |

| A. Buchholtz & Company, LLC | NY |

| Roadmap Advisors | VA |

| Waypoint Private Capital, Inc. | WI |

| Firm | HQ |

|---|---|

| Business Capital Exchange | MA |

| Madison Street Capital | IL |

| GT Securities | CA |

| Exit Partners, LLC | TX |

| Berkery Noyes Investment Bankers | NY |

| Firm | HQ |

|---|---|

| Two Roads Advisors | NY |

| Corum Group | WA |

| STS Worldwide | GA |

| EBB Group | TX |

| Kaulkin Ginsberg | MD |

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Industries: Business Services, Consumer Goods, Financial Services, Food & Beverage, Health & Wellness, Healthcare, Industrials Manufacturing, Real- Estate, Retail, Tech Software/SaaS

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 37 senior bankers is supported by more than a dozen analysts, senior advisors and support staff. Each FOCUS banker maintains a core practice in one of the 13 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

Industries: Technology, Industrials, Manufacturing, Consumer Goods, Business Services, Distribution, Health Care, Telecommunications, Financial Services, Retail

“Originally founded in 1989, our mission is to provide a level of expertise, knowledge, and execution not typically available to owners of privately-held middle market companies.

With offices in New York, Pennsylvania, Florida, Texas, and California, eMerge M&A is perhaps the most experienced and data rich M&A firm serving this market segment. No one has more experience with privately-held companies.”

Industries: Aerospace & Defense, Business Services, Construction, Consumer, Distribution, Energy, Health Care, Manufacturing, Media & Advertising, Technology, Transportation & Logistics

“Woodbridge International markets your company to more buyers globally than any other Sell-Side M&A firm. We create a competitive auction for your company by contacting 50 times more buyers than other investment bankers do.

We’re also the only firm that brings sellers to market in print, video and social media. Our videos pique buyers’ interest, allowing them to meet our clients on-screen and spotlight the company’s unique competitive advantages. You don’t have to take our word for it — watch our video testimonials after we’ve closed a deal.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Materials, Technology, Energy & Utilities, Retail, Business Services, Distribution, Health Care, Consumer Services, Media, Life Sciences, Telecommunications, Real Estate, Financial Services

“Align Business Advisory Services (“Align”) is a nationwide mergers & acquisitions advisory firm focused on the lower middle market. Their team of industry professionals align buyers and sellers in successful transactions, providing advice and guidance before, during, and after the transaction.

Align’s mission is to provide lower-middle-market businesses with enterprise expertise and innovative and personalized service. We provide concierge service to ensure that the right buyers and sellers are aligned for success and enterprise value creation. To date, our firm has facilitated over $1B in M&A transaction volume across a variety of industries.”

Industries: Manufacturing, Technology, Retail, Business Services, Consumer Goods, Distribution, Health Care, Media, Consumer Services, Industrials, Life Sciences, Telecommunications, Financial Services

“Auctus Capital Partners is a leading financial services and investment banking firm focused exclusively on creating value for the lower middle market. We specialize in merger & acquisition advisory, institutional private placements of debt and equity, financial restructuring, valuation, and strategic consulting. Our senior bankers have deep domain expertise across a range of industries, with the necessary foresight to navigate highly-complex transactions to maximize value and achieve optimal outcomes for clients.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Energy & Utilities, Retail, Business Services, Materials, Distribution, Health Care, Consumer Services, Media, Life Sciences, Telecommunications, Real Estate, Financial Services

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

Industries: Manufacturing, Business Services, Industrials, Media

“Plethora Businesses is a leading M&A Advisor for the lower middle market. We were formed in 1999 with the objective of creating a market place for buyers and sellers of privately held businesses. Throughout the years we have pursued this objective with constant vigor and dedication. We’re proud of our history, the relationships we’ve built and the hundreds of completed transactions and projects.

Whether an acquisition or merger, we believe these transactions are a significant milestone for every client. Each transaction helps to transform an individual’s life, create opportunities, transfer wealth and build upon prior success. We have fun doing what we do, enjoy the challenges, and find satisfaction navigating and completing complex transactions”

Industries: Consumer Goods, Industrials, Materials, Retail, Business Services, Consumer Services, Media

“Cornerstone Business Services is a boutique investment bank serving the lower middle market, domestically and internationally for more than 20 years. We create value through acquisition, valuation and exit strategies, with a focus on businesses typically with annual revenue from $5 million to $150 million. Being one of the largest M&A firms in the Midwest focused exclusively on the lower middle market, we bring a team of specialist, our proprietary Assurance 360 process and the full benefits of being a founding member of the Cornerstone International Alliance to clients to achieve extraordinary results.”

Industries: Industrials, Manufacturing, Technology, Distribution, Financial Services, Health Care, Business Services, Consumer Goods, Life Sciences, Materials, Telecommunications, Energy & Utilities, Consumer Services, Media, Retail

“Former Goldman Sachs and McKinsey consultants providing Finance-as-a-Service to support startup and middle market companies with their M&A activities. We also work with Private Equity / Venture Capital firms in their deal underwriting and due diligence.”

Industries: Business Services, Consumer Goods, Consumer Services, Manufacturing

“Bridgepoint Investment Banking is a market-leading boutique investment bank that serves clients over their corporate lifecycles by providing capital raising and M&A advisory solutions. We serve clients globally across a range of focus sectors.

Together, Bridgepoint principals have more than 313 years of investment banking experience, allowing us to provide our clients with Wall Street-quality experience and deep national and international funding and buyer connectivity. We have successfully moved more than $333 billion of capital across 357 completed debt, equity and merger and acquisition transactions.”

Industries: Consumer Goods, Manufacturing, Industrials, Technology, Financial Services, Materials, Business Services, Distribution, Health Care, Consumer Services, Life Sciences, Energy & Utilities, Retail

“Salt Creek Partners (“SCP”) is a boutique M&A advisory firm operating in the Southwest, Southeast, New England and Gulf Coast regions.

SCP serves business leaders in the emerging growth and middle markets, specifically on clients looking to be acquired and companies wanting to make an acquisition. We provide strategic consulting to reposition and optimize companies wanting to sell in order to ultimately increase valuation.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Technology, Retail, Business Services, Health Care, Consumer Services, Life Sciences

“Our M&A professionals have directly executed on more than 80 deals since 2013. We advise private, owner-operated Canadian companies on their major transactional activity: mergers & acquisitions (sell- and buy-side) and growth. Our work spans most industries except for resource extraction, pharmaceuticals, and life sciences.

In each assignment, we analyze all aspects of the business in order to provide the most informed representation possible. We then tailor the appropriate transaction strategy, be it a targeted process or broad auction. We work closely with our client to select the appropriate buyer and negotiate the full list of transaction parameters. Our efforts complement those of our clients’ lawyers, accountants or other advisors in the preparation of the definitive agreements. We believe that when advancing a transaction, it is all in the story-telling and negotiating, and we pride ourselves on our ability to effectively navigate these challenges.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Business Services, Retail, Materials, Distribution, Health Care, Life Sciences, Consumer Services, Telecommunications

“SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies with values up to $300 million. The SDR Ventures approach of thinking like owners helps businesses maximize their value. Whether owners are looking to sell a business, buy a business or raise debt or equity, SDR is committed to helping them succeed.”

Industries: Manufacturing, Consumer Goods, Industrials, Business Services, Technology, Distribution, Health Care, Energy & Utilities, Financial Services, Materials, Consumer Services, Life Sciences, Media, Real Estate

“Founded on the principle of adding value and professional skill to business transfers, BAMA helps clients acquire or sell companies. Our “buyer” clients are both financial and strategic buyers, management teams, private equity groups, and mezz lenders who are looking to invest in good companies. “Seller” clients include business owners who desire recapitalizations for founder-family business transfer, growth capital, corporate divestitures and those seeking business transfer due to retirement, health, family or personal reasons.

Three key principles drive BAMA’s work. They can be summed up in one sentence. Execute a confidential process with people we enjoy who value and desire the unique skill set and services offered by BAMA.”

Industries: Distribution, Industrials, Health Care, Business Services, Consumer Goods, Consumer Services, Life Sciences, Manufacturing, Technology

“Vista Business Group is a mergers and acquisitions company, confidentially bringing business buyers and sellers together. Centrally located in Kansas our organization operates nationally. Our group’s strong banking background and in depth understanding of financing, is very beneficial to both sides of the transaction.”

Industries: Consumer Goods, Financial Services, Industrials, Materials, Energy & Utilities, Retail, Technology, Business Services, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

“Northern Edge is a boutique investment bank with a core focus on sell-side financial advisory services for privately owned North American businesses. We dedicate a senior team to lead and advise, support, and guide to deliver the best possible outcome for each of our clients.

What sets us apart: decades of experience have earned us a preeminent track record for completing successful transactions across virtually every industry and an enviable reputation for always being on our client’s side, every step of the way. A sale is a significant point in a business owner’s journey, and the right path forward can be uncertain if you don’t know the way. By navigating it alongside our clients, we become their decisive advantage. Their Edge.”

Industries: Consumer Goods, Materials, Energy & Utilities, Retail, Health Care, Consumer Services, Media, Life Sciences

“Trusted M&A advisors with more than 20 years experience helping Middle Market business owners navigate and negotiate the constantly changing M&A markets across all industries. Janas has developed a customized, dynamic approach to the sale and acquisition of companies. Our focus allows us to regularly achieve above-market results.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Distribution, Media, Retail, Technology, Business Services, Financial Services, Consumer Services, Energy & Utilities, Health Care, Real Estate, Life Sciences

“Meritage Partners is a multi-disciplined mergers and acquisitions advisory firm serving the lower middle market. Our advisors are made up of accomplished and experienced entrepreneurs with over 130 years of collective experience. Our team has advised on over $2 billion of successful transactions with private equity firms, high net-worth individuals, and public companies. Our clients are privately-held businesses in a variety of industries throughout North America.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Business Services, Distribution, Energy & Utilities, Materials, Health Care, Financial Services, Life Sciences, Telecommunications

Visit Meritage Partners’ Profile

“WhiteHorse Partners offers M&A services to the middle market, specializing in sell-side engagements for owners of privately held companies. We work with only a select number of clients at any given time, which allows us to concentrate all of our creativity and talent on a small number of clients to whom we bring great value. We personally research, negotiate, and manage all aspects of every engagement, and pride ourselves on building long-term, mutually rewarding relationships.”

Industries: Aerospace & Defense, Business Services, Distribution, Transportation, Energy, Health Care, Technology, Industrials, Manufacturing, Tech Software/SaaS

“When closely held, private companies have a need for financial advice – in seeking a liquidity event or when capital needs to be raised, for example – Gleason Advisors acts as a trusted partner to business owners and management. We provide valuable financial and strategic advice throughout the business life cycle.

Our service offering at Gleason Advisors allows us to work with businesses facing a wide range of issues and financial challenges. These situations often call on us to leverage our symbiotic relationship with the services of Gleason Experts, where we have deep expertise in forensic accounting, litigation support, and bankruptcy proceedings. Combined, these groups allow us to serve our clients as a more complete financial advisor. Providing value beyond dispute.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Technology, Retail, Business Services, Distribution, Health Care

“Clayton Capital Partners (CCP) is one of the nation’s top independent investment banking firms for the middle market, as reported by Thomson Financial, Mergerstat and Investment Dealers Digest. The reasons for our success are simple: We understand our client’s expectations and believe in exceeding them.

Our clients are located from coast to coast and our specialists have closed more than 200 M&A transactions. With diverse backgrounds ranging from investment banking to law, accounting, finance, and entrepreneurship, our team is uniquely suited to close the most successful transaction possible.”

Industries: Business Services, Consumer Goods, Energy & Utilities, Industrials, Manufacturing

“Sun Mergers & Acquisitions is a full-service professional business intermediary firm specializing in all aspects of the confidential sale, merger, acquisition and valuation of privately held mid-market companies with a primary focus in handling the sale of entrepreneurial and family held companies. Sun M&A brings extensive, broad based expertise, yielding the greatest probability of a successful sale with a maximum net after-tax yield.”

Industries: Industrials, Business Services, Distribution, Financial Services

“VERTESS is a healthcare-focused Mergers + Acquisitions (M+A) advisory firm that helps owners increase their company’s financial value and negotiate the best price when they decide to sell their own company or grow through acquisition. Our expertise spans diverse healthcare and human service verticals, ranging from behavioral health and intellectual/developmental disabilities to DME, pharmacies, home care/hospice, urgent care, dental practices, life sciences, and other specialized services and products. Each VERTESS Managing Director has had executive experience in either launching or managing and ultimately successfully exiting a healthcare company.”

Industries: Heath Care, Life Sciences

“Transact Capital and subsidiary, Transact Capital Securities, represent business owners in the confidential sales of their business. Founded in 2001, our firm’s 17 experienced professionals specialize in selling privately-owned, mid-tier businesses throughout the U.S with enterprise values of up to $150MM.

We have cultivated a reputation for providing our clients with a team of extremely smart, truthful, deal-savvy, close-oriented professionals with a bias for action and an overwhelming concern for our client’s well-being.”

Industries: Consumer Goods, Business Services, Industrials, Distribution, Manufacturing, Health Care, Technology, Financial Services, Media, Life Sciences, Materials, Telecommunications, Real Estate, Retail, Consumer Services

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email kaitlinn.thatcher@axial.net to learn more.