The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

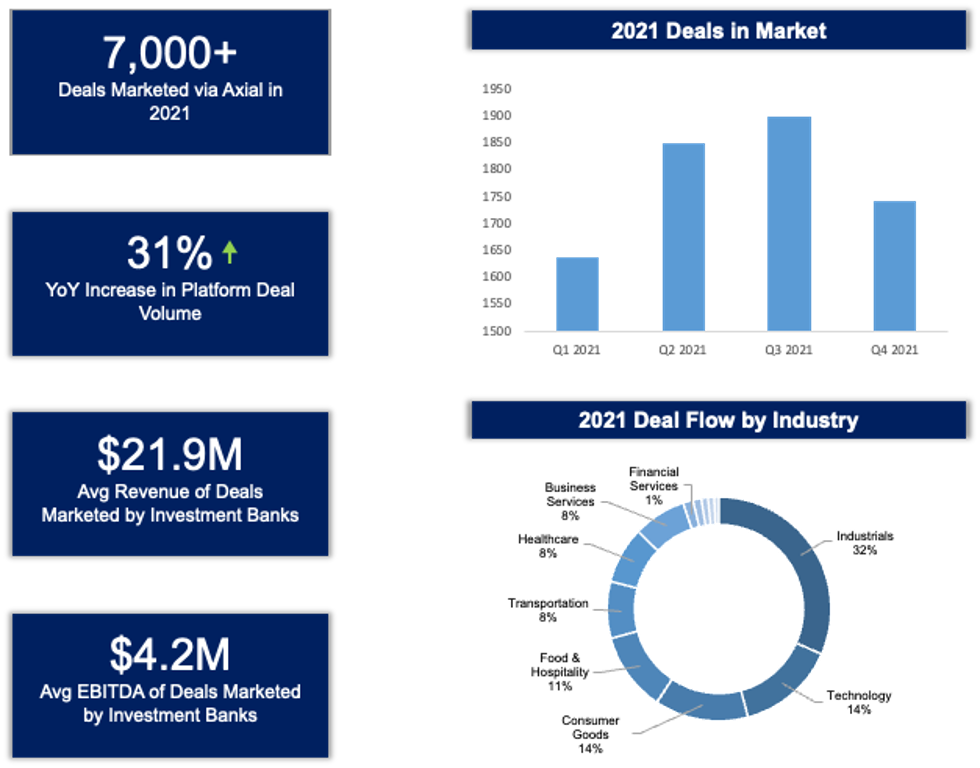

We are excited to release Axial’s Q4 2021 Lower Middle Market Investment Banking League Tables.

2021 was the strongest year on record for M&A, both on Axial’s lower middle market deal making platform, and in the broader M&A market. Recovering markets, a 2020 Covid-driven backlog of sellers, cheap financing, and heavily incentivized buyers combined to create extremely active small business M&A conditions.

M&A activity on Axial grew 31% overall in 2021:

Axial’s Lower Middle Market Investment Banking League Tables aggregate and rank Axial sell-side M&A advisors based on their quarterly deal activity. Three factors disproportionately drive league table ranking:

For detailed methodology, see the end of this feature.

Congratulations to Q4’s Top 20 lower middle market investment banks for their results in the final quarter of a record year for M&A.

| Rank | Firm | HQ | Score |

|---|---|---|---|

| 1 | FOCUS Investment Banking | VA | .99 |

| 2 | Woodbridge International | CT | .98 |

| 3 | Peak Technology Partners | CA | .98 |

| 4 | DelMorgan & Co | CA | .98 |

| 5 | Auctus Capital Partners | IL | .97 |

| 6 | Three Twenty-One Capital Partners | MD | .97 |

| 7 | Vertess Healthcare Advisors | TX | .96 |

| 8 | Skyway Capital Markets | FL | .96 |

| 9 | Baker Group M&A Consultants | KS | .95 |

| 10 | Sun Mergers & Acquisitions | NJ | .95 |

| 11 | Oberon Securities | NY | .95 |

| 12 | American HealthCare Capital | CA | .94 |

| 13 | SECTOR Advisors | GA | .94 |

| 14 | ACT Capital Advisors | WA | .93 |

| 15 | MAPP Advisors | NV | .93 |

| 16 | A Neumann Associates | NJ | .93 |

| 17 | ASA Ventures Group | CO | .93 |

| 18 | Trudeau & Trudeau Associates | MA | .92 |

| 19 | Clarke Advisors | AZ | .92 |

| 20 | Bridgepoint Investment Banking | NE | .91 |

| Firm | HQ |

|---|---|

| Blitzer, Clancy & Company | NY |

| Murphy McCormack Capital Advisors | PA |

| Albatross Group | CO |

| TEG Capital Advisors LLC | TX |

| Colliers International | UT |

| Firm | HQ |

|---|---|

| Vaupen Financial Advisors, LLC | FL |

| Mystic Capital Advisors Group | NY |

| Northbound Group | MN |

| Strategic Exit Advisors | PA |

| Business Acquisition and Merger Associates | NC |

| Firm | HQ |

|---|---|

| First Liberties Financial | TX |

| Everingham & Kerr, Inc. | NJ |

| Capital Research Partners & Co. | CT |

| Falcon Capital Advisers, LLC | PA |

| Corporate Finance Associates – Houston | TX |

| Firm | HQ |

|---|---|

| Large Practice Sales | FL |

| Allen Villere Partners | LA |

| Merritt Healthcare Advisors | CT |

| Stump & Company | NC |

| SF&P Advisors | FL |

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in middle market M&A advisory services worldwide. FOCUS works to understand each client’s strategic and financial objectives, craft the best plan to achieve these goals and deliver success. FOCUS is a partner driven firm and all 25+ bankers are seasoned C-level operating executives and most have participated in transactions as a principal. Our cadre of over 30 senior advisors are available to advise and assist bankers when deep industry domain knowledge is appropriate.”

Industries: Advanced Manufacturing, Automotive, Energy, Government, Aerospace & Defense, Health Care, Technology, Telecommunications

Visit FOCUS Investment Banking’s Profile

“Woodbridge is an M&A firm with 19 offices in North America, Europe, Asia, Latin America and the Middle East, providing clients with the local knowledge and global reach they demand. Our U.S. team is committed to providing sellers with a dynamic global marketplace of buyers in which to find the best possible value for their company. Our bankers have collectively closed over 500 transactions (5 since March) and know success can only be achieved when the deal process is not allowed to languish. That’s why our entire global team is focused on selling your company in 200 days from the time of engagement.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Materials, Technology, Energy & Utilities, Retail, Business Services, Distribution, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

Visit Woodbridge International’s Profile

Peak Technology Partners is a boutique investment bank specializing in M&A and capital raise transactions for high-growth technology companies. The PEAK team has been advising technology companies on critical financing and strategic transactions for over 50 years, completing over 175 financing and M&A transactions with a combined deal value of over $100 billion. The PEAK team has prior experience with both bulge and middle-market investment banks, including Goldman Sachs, Morgan Stanley, Lehman Brothers, Barclays Capital and Arbor Advisors.

Industries: Technology

Visit Peak Technology Partners’ Profile

“With over $300 billion in successfully completed transactions in over 75 countries, the professionals at DelMorgan & Co. provide world-class financial advice and assistance to companies, institutions, governments, and individuals around the world. DelMorgan’s unique approach to business has grown out of its dedication to its core principles and the experience of its professionals over the course of decades working on some of the most challenging, most rewarding and highest profile transactions around the globe. DelMorgan & Co. brings significant intellectual firepower to each client situation. DelMorgan & Co. treats each engagement as a new and exciting opportunity to be capitalized on, not following a “standard approach” but rather tailoring its approach to each situation. DelMorgan & Co. thinks outside the box, identifying and analyzing all options in conducting a strategic assessment and striving to be recognized as a thought leader in each of its assignments.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Business Services, Energy & Utilities, Retail, Consumer Services, Distribution, Media, Materials, Telecommunications, Health Care, Financial Services

Visit DelMorgan & Co’s Profile

“Auctus Capital Partners a multi-faceted financial group specializing in merger & acquisition advisory; institutional private placements of debt and equity; financial restructuring; valuation; and strategic consulting. In select situations, Auctus also provides debt/equity cash infusions to lower middle market companies through its affiliate Auctus Partners, L.P. Our experienced professionals have the foresight necessary to navigate through highly complicated transactions to maximize value for our clients.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Energy & Utilities, Retail, Business Services, Materials, Distribution, Health Care, Consumer Services, Media, Life Sciences, Telecommunications, Real Estate, Financial Services

Visit Auctus Capital Partners’ Profile

“Three Twenty-One Capital Partners is a leading Private Investment Bank and Advisory Firm providing premier service to the middle market. Our team of Wall Street veterans have advised sell-side and buy-side engagements with over $15 billion in value for entrepreneurs, family-run businesses and financial sponsors. We are a National Firm with a Global Reach, supporting clients throughout the United States with headquarters in Columbia, Maryland, and offices in Denver, Colorado and Los Angeles, California.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Technology, Retail, Business Services, Distribution, Health Care, Consumer Services

Visit Three Twenty-One Capital Partners’ Profile

“Vertess was formed by a visionary group of results-oriented professionals as an alternative to traditional M+A firms and investment banks. We focus primarily on your personal and professional goals and help facilitate transactions that make sense to you for the long term. We guarantee integrity, confidentiality and a commitment to the best outcome for you, your company and your family. Whether a start-up, a turnaround, the sale of your business or acquisition of another, we will provide outstanding, personal service.”

Industries: Health Care, Life Sciences

“Skyway is a full-service, industry agnostic, boutique investment bank focused on the lower middle market. The Company is headquartered in Tampa, FL, and specializes in M&A advisory as well as raising growth capital in the form of equity or debt. The Company also offers corporate finance, valuation, advisory and restructuring services.”

Industries: Manufacturing, Financial Services, Consumer Goods, Technology, Energy & Utilities, Retail, Business Services, Distribution, Health Care, Consumer Services, Life Sciences, Telecommunications

Visit Skyway Capital Markets’ Profile

“Baker Group M&A Consultants, Inc. is different in numerous ways. Jerry Baker, the President of the Baker Group has over 50 years experience as an entrepreneur, who started and developed many companies over his career. He can relate to a business of any size. His knowledge acquired over the years is extremely helpful in developing a relationship with clients. Since 1988, Jerry Baker’s companies have consulted with and successfully concluded over 200 transactions in numerous industries. Jerry’s experience in starting companies, building companies, taking companies public, selling companies, dealing with national accounting firms and major law firms in numerous negotiations and leading and mentoring employees to successful careers is priceless when it comes to selecting a deal maker. Baker Group M&A Consultants can discuss with clients different types of transactions and structures to consider.”

Industries: Health Care

Visit Baker Group M&A’s Profile

“Sun Mergers & Acquisitions is a full-service professional business intermediary firm specializing in all aspects of the confidential sale, merger, acquisition and valuation of privately held mid-market companies with a primary focus in handling the sale of entrepreneurial and family held companies. Sun M&A brings extensive, broad based expertise, yielding the greatest probability of a successful sale with a maximum net after-tax yield.”

Industries: Industrials, Manufacturing, Transportation

Visit Sun Mergers & Acquisitions’ Profile

“Oberon Securities is a New York based boutique investment bank that addresses the financial needs of emerging and mid-size businesses across a broad range of industries. Our company was founded in 2001 by senior professionals who have extensive Wall Street experience in investment banking, venture capital and research. Oberon provides customized financial solutions to emerging and middle market companies which are seeking assistance with their M&A and financing needs. Oberon’s professionals have an average of more than 15 years on Wall Street; that combined experience and our small and middle market focus allow us to bring a level of service and expertise normally available only to large companies.”

Industries: Consumer Goods, Industrials, Technology, Energy & Utilities, Manufacturing, Retail, Business Services, Materials, Health Care, Consumer Services, Media, Real Estate, Telecommunications

Visit Oberon Securities, LLC’s Profile

“American Healthcare Capital is a 27 year old, full service, nationwide mergers & acquisitions advisory firm. With over $1 Billion in active Sell-Side and Buy-Side engagements, we cover the entire spectrum of the healthcare industry including but not limited to Home Health, Hospice, Private Duty, Behavioral Health, IDD, DME, Medical Staffing, Long Term Care and all types of Pharmacy. With an emphasis on healthcare transactions, we understand the need for a unique approach to the healthcare services sector. Since we’re always in the market, we pride ourselves on our intimate, real time knowledge of the marketplace.”

Industries: Health Care, Life Sciences

Visit American HealthCare Capital’s Profile

“SECTOR Advisors helps companies successfully plan and execute merger & acquisition transactions. Our investment banking services are tailored to each client. We only serve the middle-market and exclusively serve three sectors: technology, healthcare, and consumer. Our core focus and industry coverage leads to deeper and more meaningful relationships with companies, buyers, and investors, and better outcomes for our clients.”

Industries: Consumer Goods, Technology, Health Care, Consumer Services

Visit SECTOR Advisors, LLC’s Profile

“ACT Capital Advisors has facilitated the mergers, acquisitions, and divestitures of hundreds of companies. Our principals have closed mergers and acquisitions totaling over $2 billion in total corporate transactional value. Our team consists of dedicated professionals who apply their extensive expertise and experience to achieve maximum value for their companies and clients. We work closely with our client’s financial and legal advisors. With multiple decades of experience, ACT’s principals have represented a diverse range of industries, including manufacturing, contracting, wholesale, distribution and service industries. Our track record of success has provided us with an understanding and appreciation of the unique challenges presented by each industry, and allows us to continue to best realize the goals of our clients.”

Industries: Consumer Goods, Industrials, Materials, Energy & Utilities, Financial Services, Retail, Technology, Business Services, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

Visit ACT Capital Partners’ Profile

“MAPP Advisors is a fintech advisory firm with a core focus on payments and integrated software vendors. Founded in 2015, our reputation is built on delivering accretive results to clients across the fintech ecosystem. Our domain expertise is a direct result of founding, operating, and advising fintech companies for over 30 years.”

Industries: Financial Services, Technology, Business Services

“A Neumann & Associates, LLC is a professional mergers & acquisitions and business broker firm in New Jersey assisting business owners and buyers in the business valuation and business transfer process. The company maintains its corporate offices in Atlantic Highlands, approximately 45 minutes south of New York City and has seven field offices across the New York, New Jersey and Pennsylvania region.”

Industries: Consumer Goods, Industrials, Materials, Energy & Utilities, Financial Services, Retail, Technology, Business Services, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

Visit A Neumann Associates, LLC’s Profile

“ASA Ventures Group (AVG) provides M & A representation to middle-market private companies. ASA has 25 years experience in Mergers, Acquisitions, and corporate exits.”

Industries: Business Services, Distribution, Health Care, Industrials, Manufacturing, Materials, Real Estate, Technology, Telecommunications

Visit ASA Ventures Group’s Profile

“The firm Trudeau & Trudeau Associates, Inc. (T&T) is a M&A advisory firm that provides merger and acquisition and strategic consulting services to client companies and private equity groups. Since their founding in 1982 by the Trudeau brothers, the firm’s philosophy has been to bring an organized and systematic approach to merger and acquisition transactions for their clients. After 28 years, the Trudeau brothers are still active partners providing their clients and colleagues with the experience of having successfully completed hundreds of transactions. Since inception, out-of-the-box thinking has been the cornerstone of the firm, with creative programs such as DEALMAKER™ . T&T has never been willing to follow the “typical” M&A thinking of the time. Most M&A firms today still subscribe to the typical auction “book-bid” process, whether their clients are buying or selling. Conversely, T&T’s buy side and sell side clients receive a program that utilizes an innovative highly targeted selection process which eliminates the damage and chaos caused by the conventional auction process.”

Industries :Industrials, Manufacturing, Health Care

Visit Trudeau & Trudeau Associates’ Profile

“Clarke Advisors LLC is a specialized Financial Advisory and Merchant Banking Firm, providing the highest quality Investment Banking services including institutional financing, merger, acquisition and divestiture for small to medium-sized private and public companies. Clarke’s Industry Focus is Transportation, Logistics and Technology. Members of Clarke are FINRA Licensed Series 7, 79 and 63 . Based in the Phoenix metropolitan area, Clarke’s services include: Sell-Side, Buy-Side and Capital Market placements including; venture capital, private equity and debt recapitalization’s Clarke’s Merchant Banking services include principal transactions in profitable lower middle market entities.”

Industries: Technology, Distribution, Energy & Utilities, Industrials

Visit Clarke Advisors’ Profile

“Bridgepoint Investment Banking is a market-leading boutique investment bank that serves clients over their corporate lifecycles by providing capital raising and M&A advisory solutions. We serve clients globally across a range of focus sectors.”

Industries: Consumer Goods, Manufacturing, Industrials, Technology, Financial Services, Materials, Business Services, Distribution, Health Care, Consumer Services, Life Sciences, Energy & Utilities, Retail

Visit Bridgepoint Investment Banking’s Profile

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal volume and deal dollar volume, Axial league tables surface data on investment banks that reveal their selectivity, the relative attractiveness of their client’s businesses, and their overall sell-side process efficacy.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 20 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email dani.forman@axial.net to learn more.