Industry Report: Consumer Residential Services Q4 2025 [Bridgepoint IB]

Key Report Highlights Steady Market Growth Driven by Demographics and Outsourcing Trends The U.S. residential landscaping market is projected to…

Tags

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market via the platform over the past year. This strong showing reflects the sector’s vast subsector diversity—from specialty manufacturing and industrial services to logistics and distribution—and its ability to attract nearly all buyer types, including private equity firms, independent sponsors, and strategic acquirers. Industrials has maintained a top position in Axial’s quarterly SMB M&A Pipeline series, reinforcing its reputation as a cornerstone of lower middle market activity and a magnet for sustained investor interest.

For a glimpse into how industrials deals are getting structured in the lower middle market, the snapshot below from Axial’s Winning LOI Hub features a selection of executed LOIs from a variety of industrials deals, offering a look at key deal terms in the sector.

Deal Headline

Revenue

EBITDA

Multiple*

Cash

Earnout

Rollover Equity

Seller Note

Metal Fabrication & Manufacturing

$12,290,000

$3,350,000

5.97x

95.00%

--

--

5.00%

Machinery & Equipment Distribution

$17,500,000

$6,600,000

2.84x

90.67%

--

--

9.73%

HVAC & Plumbing Contractor

$2,693,000

$723,000

4.56x

100%

--

--

--

Appliance Repair Services

$5,896,000

$1,343,000

5.96x

66.25%

8.75%

--

25.00%

Landscaping Services

$17,500,000

$2,200,000

8.18x

85.42%

--

14.58%

--

Aerospace Manufacturing

$6,810,000

$1,418,000

3.67x

75.00%

--

--

25.00%

Fiberglass Tank Manufacturer

$8,000,000

$2,100,000

4.90x

70.87%

--

--

29.13%

Home Repair & Roofing Services

$1,800,000

$700,000

5.59x

60.36%

7.67%

--

31.97%

Wiring Device Manufacturing

$15,000,000

$3,500,000

4.71x

80.00%

--

--

20.00%

Commercial Construction

$30,795,592

$4,049,009

5.25x

85.00%

--

--

15.00%

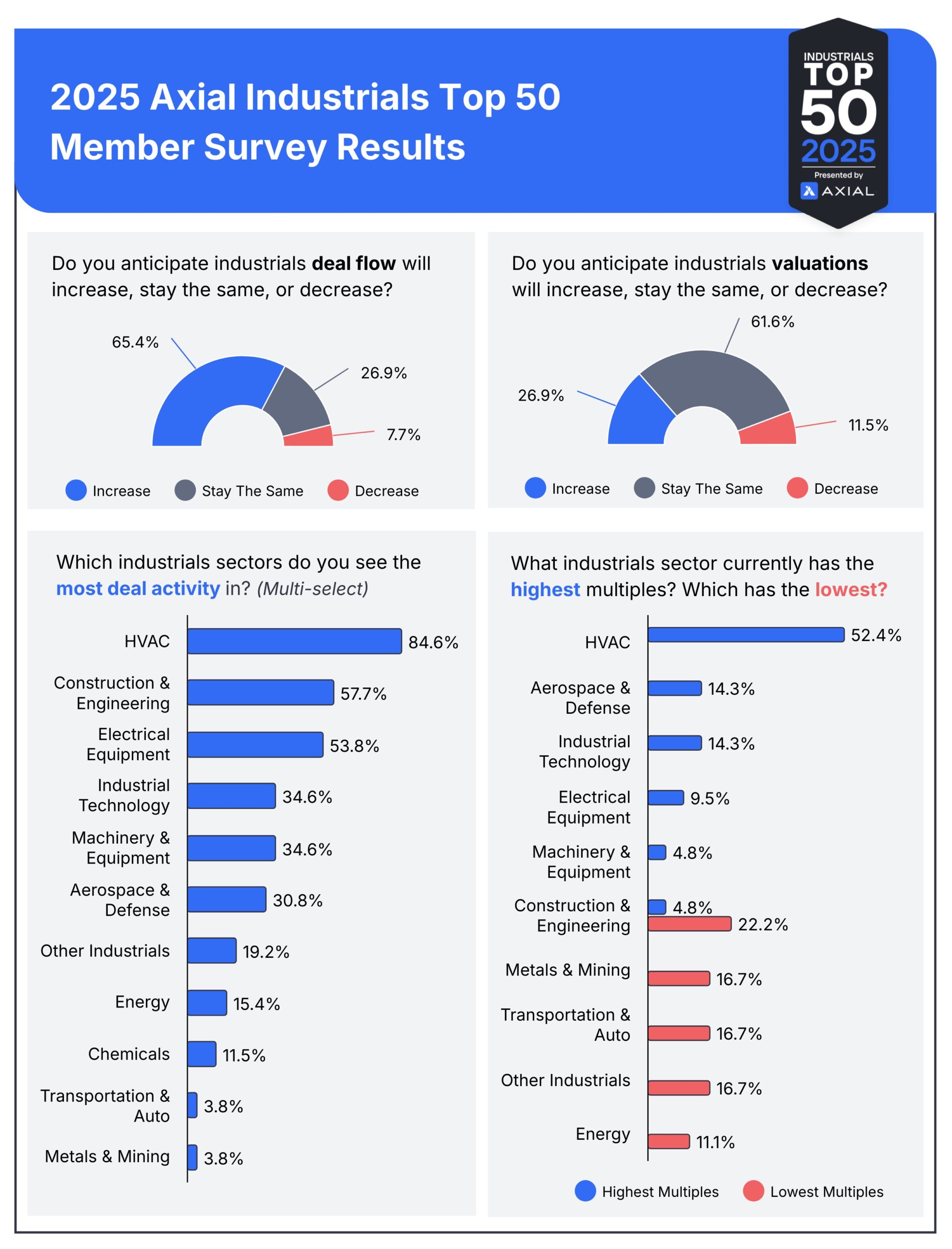

Today, Axial is excited to release its 2025 publication of the Top 50 Lower Middle Market Industrials Investors and M&A Advisors: a list that features Axial’s 50 most active and sought-after members who specialize in transactions across various industrials sectors over the past 12 months (see footnote for full methodology). In addition to celebrating these Top 50 members, this feature includes reflections and insight from our recent Top 50 Industrials M&A Outlook survey.

Congratulations to these members for their achievements!

We asked deal professionals whose firms are featured on this list to share insights on the general industry landscape, business owner mentality, and key sub-sectors, including:

Of the survey respondents — a combination of both the buy- and sell-side — 75% of them reported closing three or more deals in the industrials space in the past 12 months.

Drilling down a bit deeper, data centers, plumbing, and specialty contracting were the most frequently mentioned verticals when respondents were asked about the sub-sectors with the highest amount of deal activity. Runners-up included other industrial services, engineering, infrastructure, and niche manufacturing.

Highest Multiples

HVAC was the runaway when it came to the number of respondents who chose the sector as having the highest multiples, with more than 40% of participants choosing this as the lead sector in terms of valuation. The deal professionals with this response suggested they’re seeing valuations ranging from 6-12x, with an average multiple of 7x.

Bob Lewis of Business Acquisition & Merger Associates (M&A Advisory Firm) attributes the strong performance in the HVAC sector to continued consolidation, adding, “Strong brands of scale with a focus on break/fix services are still attracting double-digit multiples.”

Although they came up less often, respondents who chose Aerospace & Defense or Industrial Technology as the leaders in valuation suggested an average multiple of 9x for both sectors.

Mid-Range Multiples

Machinery & Equipment and Transportation & Auto both fell squarely in the middle of the pack, with respondents suggesting a 5x multiple for those sectors. Despite being middle-of-the-road, survey participants seemed to consider these multiples fairly low.

As it relates to machinery & equipment multiples, Kevin Salquist of Big 7 Ventures (Private Equity) says: “[These] businesses are highly capital intensive, requiring significant investments in factories, equipment, and infrastructure. These capital needs often lead to higher debt levels, which can constrain cash flow and increase financial risk. Buyers factor this risk into valuations, resulting in lower multiples compared to less capital-intensive sectors.”

Similarly, Clay Presley or SouthWorth Capital Management (Family Office) remarked: “The transportation industry has been challenged. There’s a lot of uncertainty about inventory, both related to imports as well as final retail needs, driven in part by tariffs and relative uncertainty. The high-profile bankruptcies and high capex requirements have made this a hard space to get financing comfortably, which is leading to lower successful deal volume and trade multiples.”

Lowest Multiples

Despite being one of the more active sectors in terms of deal activity, Construction & Engineering was most often selected in the lowest-multiple category, with survey participants estimating a multiple range of 2-4x.

According to Thomas Kerchner from BMI Mergers and Acquisitions (M&A Advisory Firm), “The construction sector continues to see reduced multiples compared to other industries such as manufacturing and technology. We attribute this to the more cyclical nature of the industry, but we also see more interest in the sector as fierce buyer competition in other industries is forcing investors to look closer at the construction industry.”

Surprisingly – or maybe not – more than 25% of our survey respondents seemed somewhat unfazed by tariffs heading into the second half of the year.

According to one investment banker who preferred to stay anonymous: “We have seen a greater impact from the general uncertainty created by the tariff discussions than a direct impact of applied tariffs.”

Jonathan Hadley of Founder M&A (M&A Advisory Firm) had a similar calming viewpoint: “Overall, tariffs were more of a blip than a major disruption in what we’ve seen. Some of the businesses we’ve worked with had exposure to Asia-Pacific markets, but many were diversified, sourcing from Mexico and other international regions. A number of them shifted more heavily toward Mexican manufacturing, which helped offset tariff impacts by reducing freight costs. Trucking materials up the interstate proved more cost-effective than relying on sea freight, coupled with upfront lower production in many cases.”

And when we asked about potential opportunities that the tariffs present for industrials businesses, half of our participants were (predictably) very bullish on U.S.-based manufacturing businesses, with many referencing steel and aluminum producers specifically.

However, the concerns that did arise surrounding tariffs were certainly not absent and were also extremely consistent:

| Current M&A Opportunities in the Industrials Space |

|---|

| Supply chain shifts and adoption of digital and automation technologies. Karin Neumann, A Neumann & Associates (M&A Advisory Firm) |

| Across the board, acquirers are looking for fundamentally sound opportunities that make sense. Acquirers (whether strategic or institutional capital) want real businesses that do real things. Arthur Petropoulos, Hill View Partners (M&A Advisory Firm) |

| Timing tariffs with inventory; if a company has high inventory levels, being able to sell at a higher market price & replacing down the road when/if tariffs are reduced. Drew Morgan, FOCUS Investment Banking (Investment Bank) |

| Automation, supply chain upgrades, and sustainable manufacturing could be big plays this year. Dealmakers need to remember that it costs a lot to win, even more to lose. Eric Seifert, Good Hope Advisors (M&A Advisory Firm) |

| The biggest opportunities are for machined parts & manufacturers. And tariffs are disruptive and create uncertainty, but they also create opportunities for those who are opportunistic. Robert Hild, ACT Capital Advisors (M&A Advisory Firm) |

| Automation Clayton Stiver, Ad Astra Equity Advisors (M&A Advisory Firm) |

| The biggest opportunities are for the services businesses. Confidential, Family Office |

| Automation. Rob Chepak, TREP Advisors (M&A Advisory Firm) |

| Businesses that have the opportunity to re-shore their supply chain will have major pricing power advantages. Confidential, Independent Sponsor |

| Investing in areas that are being hit the hardest by tariffs; tariffs will normalize as we approach the mid-term elections. Gary D. Rakan, Vesticor Advisors (Investment Bank) |

| Infrastructure, automation, and data centers. Jessica Ginsberg, LFM Capital (Private Equity Firm) |

| Specialization and margin enhancement. Keith Wegan, Flatirons Capital Advisors (M&A Advisory Firm) |

| Data center products & services and electrical/power grid services. Scott Mitchell, SDR Ventures (Investment Bank) |

| Buying cheap, low-multiple businesses and growing through relationships. JP Iaropoli, Hillandale Advisors (Independent Sponsor) |

Our Top 50 industrials list was generated based on a weighted formula leveraging four key metrics:

Our Top 50 industrials list was generated based on a weighted formula leveraging four key metrics:

The number of industrials deals brought to market via Axial (sell-side).

The level of interest those deals generated from Axial’s buyside member base.

The number of specific industrials-focused investment mandates created in the platform (buyside).

The number of industrials deals that progressed through the deal funnel, achieving a signed NDA, shared CIM, received IOI, received LOI, executed LOI, or successfully consummated transaction (buyside & sell-side).