Advisor Industry Awards: The Top 10 Deals of 2025

Axial first introduced quarterly League Tables in 2019 to recognize the top Investment Banks and M&A Advisory Firms on Axial…

Tags

Healthcare deal activity is on the rise. As reported in the most recent issue of The SMB M&A Pipeline, healthcare deal flow on Axial grew 39% year-over-year in Q2 2025. This increase reflects a steady stream of healthcare businesses coming to market, even amid valuation and regulatory pressures.

For a glimpse into how healthcare deals are getting structured in the lower middle market, the snapshot below from Axial’s Winning LOI Hub features a selection of executed LOIs from a variety of healthcare deals, offering a look at key deal terms in the sector.

| Deal Headline | Revenue | EBITDA | Multiple* | Cash | Earnout | Rollover Equity | Seller Note |

|---|---|---|---|---|---|---|---|

| Dental Materials Manufacturing | $13,000,000 | $3,000,000 | 8.24 | 70.00% | 10.00% | 20.00% | -- |

| Medical Software | $9,603,224 | $3,502,491 | 9.49 | 70.00% | -- | -- | 30.00% |

| Medical Transportation | $7,890,000 | $2,800,000 | 6.19 | 80.78% | -- | 19.22% | -- |

| Emergency Center | $13,446,940 | $2,535,353 | 3.16 | 62.50% | 18.75% | -- | 18.75% |

| Eyeglasses Wholesaler | $19,000,000 | $4,100,000 | 7.32 | 68.33% | -- | 25.00% | 6.67% |

| Addiction Treatment Center | $12,000,000 | $4,800,000 | 4.17 | 75.00% | -- | 5.00% | 20% |

| Plastic Surgery Practice | $6,400,000 | $2,100,000 | 10.02 | 49.00% | -- | 30.00% | 21.00% |

| Disability Care Provider | $36,200,000 | $12,300,000 | 7.80 | 77.08% | 12.50% | 10.42% | -- |

Today, Axial is excited to release its 2025 publication of the Top 50 Lower Middle Market Healthcare Investors and M&A Advisors: a list that features Axial’s 50 most active and sought-after members who specialize in transactions across various healthcare sectors over the past 12 months (see footnote for full methodology). In addition to celebrating these Top 50 members, this feature includes reflections and insight from our recent Top 50 Healthcare M&A Outlook survey.

Congratulations to these members for their achievements!

–

We asked deal professionals whose firms are featured on this list to share insights on the current healthcare landscape. Of the survey respondents — a combination of both the buy- and sell-side — 77% of them reported closing two or more deals in the healthcare space in the past 12 months.

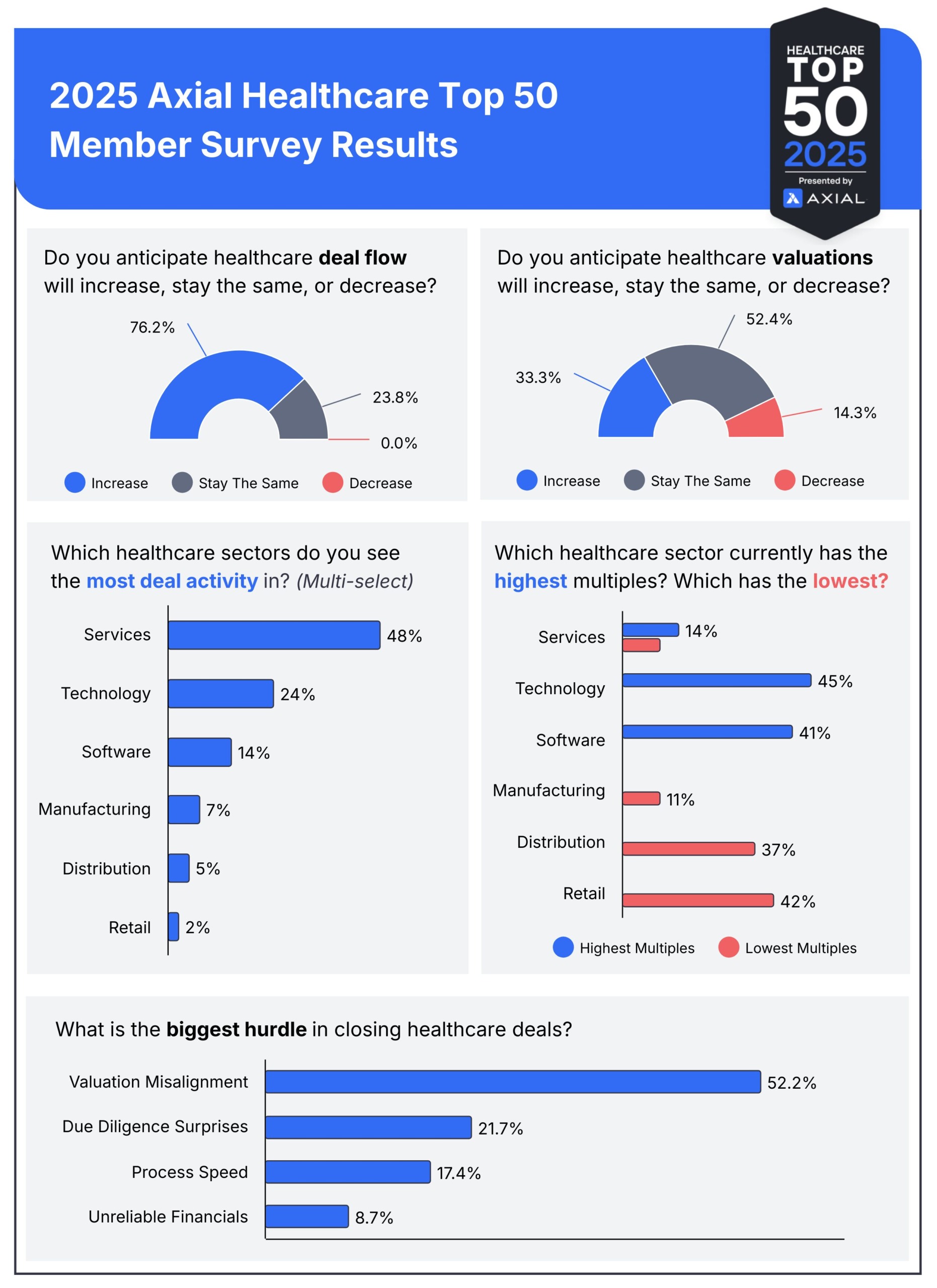

Survey results from the 2025 Axial Healthcare Top 50 show strong confidence in continued transaction activity, with more than three-quarters of respondents (76%) expecting deal flow to increase over the next 12 months and none anticipating a decline. Expectations around valuations are more tempered: just one-third expect them to rise, while over half anticipate valuations to remain steady, and 14% expect a decline.

When it comes to sector activity, services dominate as the most active area (48%), followed by technology and software. Respondents view technology and software as commanding the highest multiples, while retail, distribution, and manufacturing are seen at the lower end of the spectrum. Valuation misalignment emerged as the single biggest hurdle to closing deals, cited by more than half of respondents, with due diligence surprises and process speed also presenting notable challenges.

| Member + Firm | Quote |

|---|---|

| Bradley Smith, Vertess Healthcare | Reimbursement challenges and recruitment of skilled labor. |

| Farooq Tirmizi, SovDoc | The market has been battered by reimbursement cut over the past five years, and investors are shy about deploying more capital, even at lower multiples. |

| NOW Capital Partners | Wage inflation, employee turnover, and insurance reimbursement. |

| Anonymous Independent Sponsor | Uncertainty in the insurance landscape |

| TUSK Practice Sales | Payer reimbursement cuts (state and PPOs), regulatory risks and changes, and consumers saving more and spending less on elective procedures. |

| Kevin Taggart, Mertz Taggart | Regulatory environment for private equity and uncertainty around payer reimbursement. |

| Cody Clemens, ASA Ventures Group | One of the biggest challenges right now, in the post-COVID era, is workforce burnout and doctor attrition. These two factors lead to increased patient churn and overall company instability. Even five years removed from COVID, recruiting and retaining doctors remains challenging for many healthcare sectors. |

| Zak Eisenberg, Merritt Healthcare Advisors | Regulatory and compliance completion. |

| The Bloom Organization | Workforce shortages and burnout; rising costs and margin pressures; access to care and health equity; regulatory and reimbursement uncertainty. |

| Clayton Stiver, Ad Astra Equity | Government changes and insurance costs. |

Survey respondents identified reimbursement cuts, payer and insurance uncertainty, and regulatory pressures as the most pressing issues facing the healthcare industry. Workforce challenges were also emphasized, including shortages, burnout, turnover, and difficulties recruiting and retaining skilled labor. Rising costs, wage inflation, margin pressures, and shifting government policies were further cited as headwinds weighing on the sector today.

–

| Member + Firm | Quote |

|---|---|

| Jonathan Sadock, Paragon Ventures | Healthcare economics are evolving toward non-acute care delivery, including hospital-at-home, home healthcare, specialty services eg: pharmacy, outpatient services, and digital health |

| Anonymous Private Equity Fund | Underserved markets, consolidation of fragmented markets |

| Bradley Smith, Vertess Healthcare | Many businesses are antiquated, and adding technology will greatly improve efficiency and profitability. |

| Cody Clemens, ASA Ventures Group | The biggest opportunity in healthcare is the implementation of AI—at both the clinic level, with AI scribes and other tools to boost productivity, and in the advances it’s driving in genomics and drug discovery |

| John Bergano, TREP Advisors | The biggest opportunities are in manufacturing, distribution, technology, and infrastructure. |

| Farooq Tirmizi, SovDoc | Several physician practice management opportunities remain unconsolidated and ripe for a roll-up play, including ENT, neurology, and pain management. |

| Anonymous Private Equity Fund | Incorporating AI into workflows. |

| The Bloom Organization | Behavioral health and mental health; outpatient & home-based care; healthcare IT and tech-enabled services; specialty physician practices. |

Respondents highlighted technology adoption and AI as the most significant opportunities in healthcare, from improving efficiency in antiquated businesses to boosting productivity through AI-driven tools. Consolidation was another recurring theme, with physician practice management and fragmented markets seen as ripe for roll-up strategies. Other opportunities included evolving care delivery models—such as outpatient services and home healthcare—alongside growth in behavioral health, mental health, and specialty physician practices. Additional areas of potential were cited in manufacturing, distribution, infrastructure, and healthcare IT.

| Member + Firm | Quote |

|---|---|

| Cody Clemens, ASA Ventures Group | The general resiliance of the healthcare industry despite the uncertainty of 2025, will continue to create a favorable demand dynamic for healthcare companies in 2026 and beyond. |

| Anonymous Private Equity Fund | Interest rates; long-in-the-tooth assets needing to transact; expectation vs. actual multiple delta narrowing. |

| Farooq Tirmizi, SovDoc | Investors will see that the worst is over on reimbursement cuts, and the valuations will catch up, bringing more sellers to the market. |

| Anonymous M&A Advisor | Hopefully a reduced interest rate environment. |

| Kevin Taggart, Mertz Taggart | Any news regarding Medicare/Medicaid from Washington, DC. |

| Zak Eisenberg, Merritt Healthcare Advisors | Regulation and buyer acceptance of volatility. |

| NOW Capital Partners | Public healthcare multiples are at a historic low, and healthcare as a weighting in the S&P 500 is at an all-time low. This suggests a cyclical trough in valuations, and I think they’ll get bid in the coming months. |

| Anonymous Private Equity Fund | Ability to find models that can grow in the current environment |

Interest rates, regulatory shifts, and easing reimbursement pressures were highlighted as the key forces expected to shape healthcare valuations over the next 12 months. Some respondents pointed to the possibility of lower rates and clearer Medicare/Medicaid policy, while others emphasized buyer acceptance of volatility and the importance of finding growth-ready models. With public healthcare multiples and the sector’s S&P 500 weighting at historic lows, signs of a cyclical trough that could spark renewed investor demand.

| Member + Firm | Quote |

|---|---|

| John K. Hudson, Jr., Confluence Healthcare Partners | Lower middle market deals are typically less impacted by interest rate movements (up or down) so reimbursement will remain the key item. |

| The Bloom Organization | Overall, deal flow should pick up modestly as dry powder gets deployed, but structures like earnouts and rollovers will remain common to bridge valuation gaps. |

| Anonymous Independent Sponsor | More certainty will lead to increased volume |

| Clayton Stiver, Ad Astra Equity | I believe policy reform will cause changes that could impact valuations, mainly due to the unknown consequencess of the changes. Interest rates have impacted most deals - large and small. |

| Anonymous Private Equity Fund | Lower interest rates should fuel more M&A. Issuance of more policy guidance will provide certainty to conduct transactions. |

| Bradley Smith, Vertess Healthcare | Regulatory and policy reforms will hurt valuations but drive new opportunities; while market dynamics and interest rates will hopefully improve valuations. All things considered, these conditions will have a net neutral on valuations. |

| Farooq Tirmizi, SovDoc | Neither the states nor the federal government have the appetite to undertake serious healthcare reform, and so the tinkering on the edges isn't stopping anyone from doing deals. |

| Jonathan Sadock, Paragon Ventures | This is difficult to predict other than the constant in this area... change. With change comes both challenges and opportunities. Healthcare providers have historically been nimble and agile in dealing with the myriad of reimbursement and regulatory demands. |

Respondents anticipate a combination of regulatory shifts, interest rate fluctuations, and broader market dynamics will influence healthcare dealmaking in 2025. Some pointed to lower rates and clearer policy guidance as drivers of increased transaction volume, while others emphasized reimbursement as the key factor for deals. Policy reform was seen as a double-edged sword, creating both valuation pressures and new opportunities, while uncertainty around its outcomes remains a concern. Despite challenges, many noted that dry powder deployment, deal structures to bridge valuation gaps, and the sector’s ability to adapt suggest continued deal flow ahead.

The 2025 Healthcare Top 50 survey shows a sector facing both headwinds and opportunities. Respondents expect deal flow to rise, though valuations remain under pressure. Top challenges include reimbursement cuts, payer uncertainty, workforce shortages, and rising costs, while opportunities center on technology adoption, AI, consolidation, and new care delivery models. Looking forward, interest rates, regulation, and reimbursement dynamics are expected to drive valuations, with many seeing today’s historic lows as a potential turning point.

For a broader perspective, check out the 2025 Axial Industry Top 50 reports for Technology and Industrials to see how trends differ across markets.

Our Top 50 healthcare list was generated based on a weighted formula leveraging four key metrics:

The number of healthcare deals brought to market via Axial (sell-side).

The level of interest those deals generated from Axial’s buyside member base.

The number of specific healthcare-focused investment mandates created in the platform (buyside).

The number of healthcare deals that progressed through the deal funnel, achieving a signed NDA, shared CIM, received IOI, received LOI, executed LOI, or successfully consummated transactions (buyside & sell-side).