The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

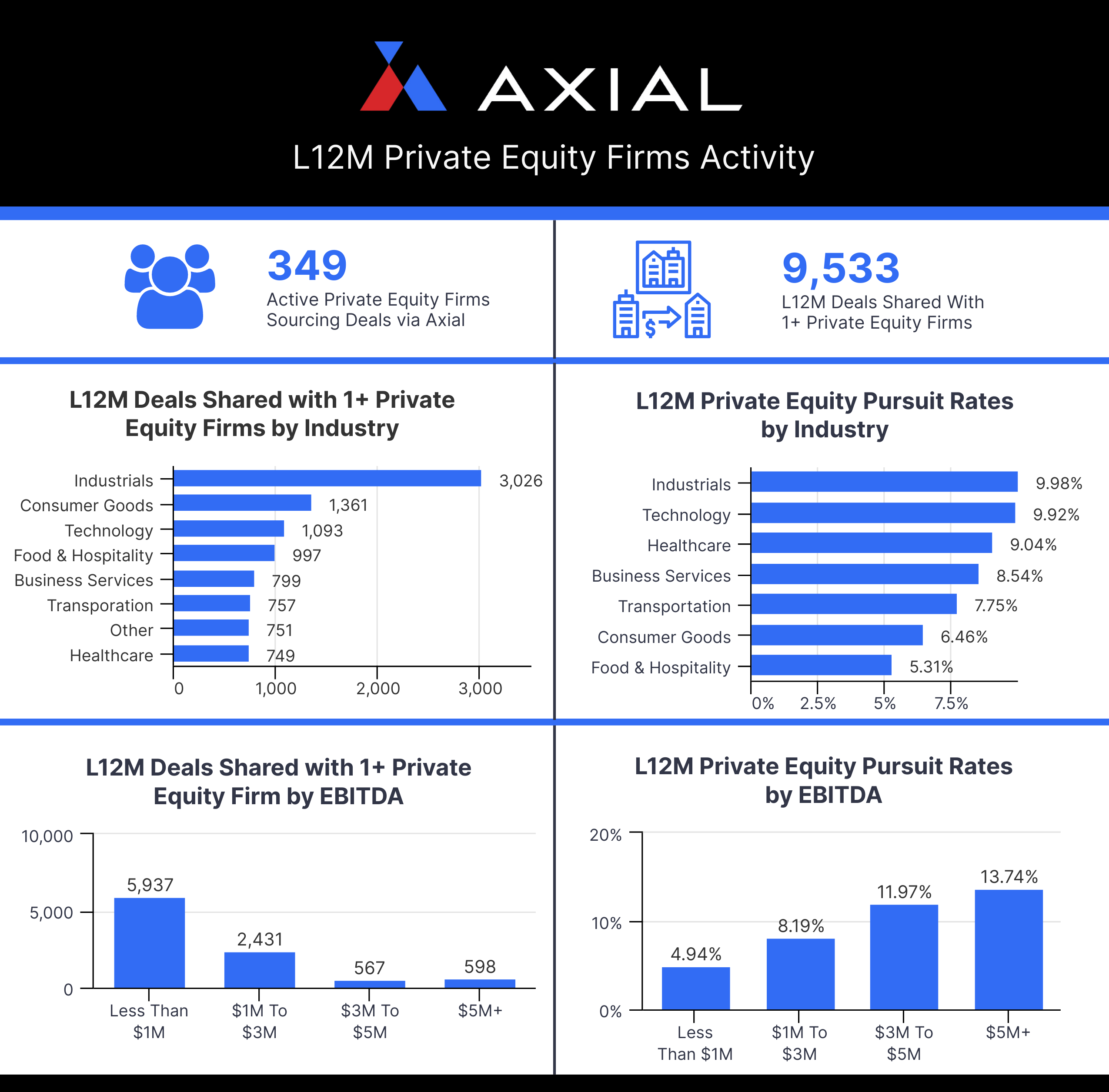

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

In recent years, the prominence of non-traditional investment firms in the lower middle market has seen a spike. However, despite increasing numbers of independent sponsors, family offices, search funds, and other less conventional buyers, private equity funds remain the most prominent type of financial buyer in the market.

And don’t be deceived; their numbers continue to grow as well.

Today we are featuring the 25 Most Active Private Equity Firms on the Axial platform. This is the third installment of our buyside ranking series. Select the images below to review the lists for Independent Sponsors and Family Offices from 2023.

Axial’s Private Equity Firm ranking is assembled based on the deal-making activities of 349 Private Equity Firms and is driven by three factors:

Congratulations to the featured Private Equity Firms for their achievements.

Want to receive articles like this directly to your inbox? Enter your email below to subscribe to Middle Market Review.

| Rank | Firm | HQ |

|---|---|---|

| 1 | Baymark Partners  |

TX |

| 2 | Pfingsten Partners |

IL |

| 3 | JLL Partners  |

NY |

| 4 | KLH Capital Partners |

FL |

| 5 | Shoreview Industries |

MN |

| 6 | Source Capital |

GA |

| 7 | CPS Capital |

CAN |

| 8 | LFM Capital |

TN |

| 9 | Envest Capital Partners |

VA |

| 10 | Hidden Harbor Capital Partners |

FL |

| 11 | Argonaut Private Equity |

OK |

| 12 | Gauge Capital |

TX |

| 13 | CIVC Partners |

IL |

| 14 | Fulcrum Equity Partners | GA |

| 15 | Gen Cap America | TN |

| 16 | Gemini Investors | MA |

| 17 | Mangrove Equity Partners |

FL |

| 18 | The Courtney Group |

CA |

| 19 | Hammond Kennedy Whitney & Company | IN |

| 20 | Alvarez & Marsal Capital Partners |

CT |

| 21 | Industrial Opportunity Partners | IL |

| 22 | Harbour Group |

MO |

| 23 | Alaris Equity Partners |

CAN |

| 24 | VSS Capital Partners | NY |

| 25 | Blue Point Capital Partners | OH |

![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial ![]() – 1 closed deal on Axial

– 1 closed deal on Axial

![]()

“Baymark Partners is a Dallas-based private equity firm investing in growing middle market IT, healthcare, business and distribution services, as well as lite manufacturing providing owners with liquidity and companies with resources to accelerate their growth.

The professionals at Baymark Partners possess over 100 years of successful experience in acquiring, investing and operating growth companies. Their experience ranges from early stage, high growth to fully developed market leaders. This experience, combined with its active Advisory Board, gives Baymark the ability to implement strategic and operational discipline required to transition middle market companies to a more mature and valuable market position.”

Industries: Technology, Manufacturing, Business Services, Distribution, Healthcare

![]()

“Pfingsten is an operationally-driven private equity firm focused on long-term value creation. From our headquarters in Chicago with support from representative offices in India and China, we help businesses in ways few private equity firms can, applying our unique operational and global resources to offer real solutions to our companies, unlocking value and propelling growth. We invest a minimum of 50% equity into the capital structure of each portfolio company, providing the flexibility to create value through operational improvements, professional management practices, global capabilities and profitable business growth, versus financial engineering. Our operating professionals, who comprise more than half our team, work in partnership with company management, and our global capability opens doors in markets around the globe..”

Industries: Manufacturing, Industrials, Business Services, Materials, Distribution, Technology

“JLL Partners is a leading private equity firm with a 34-year track record of transforming businesses through its operational and financial expertise. JLL Partners is dedicated to partnering with companies that it can fundamentally help build into market leaders through a combination of strategic mergers and acquisitions, market repositioning, and product and service line expansion. The JLL team is comprised of investment professionals and operating partners with extensive experience in portfolio company management, transaction structuring, capital markets, and business development. The firm has deep expertise in the healthcare, industrials, and business services sectors, and targets transformational opportunities with secular growth trends that enable long-term value creation for limited partners, management teams, and all other stakeholders. Since its founding in 1988, JLL Partners has committed over $5 billion across eight funds in more than 50 platform investments and 180 add-ons. For more information, please visit www.jllpartners.com.”

Industries: Financial Services, Technology, Business Services, Healthcare, Industrials

“Founded in 2005, KLH Capital is a private equity firm serving family- and founder-owned, lower middle-market companies. We make minority and majority equity investments in businesses to provide ownership opportunities for key managers and allow owners to harvest the value in their businesses. Our commitment goes beyond financial support as we believe in establishing a collaborative team of peers, all of whom have a hand in the company’s progress. When we combine management’s industry and operational expertise with our own, the company’s full potential is unlocked and value is created.

KLH Capital is currently investing out of KLH Capital Fund IV with $200 million of committed capital from institutional investors. For more on our investment criteria, please visit our website: www.klhcapital.com.”

Industries: Manufacturing, Materials, Business Services, Energy & Utilities, Industrials, Distribution, Technology, Consumer Goods, Telecom, Healthcare

“Founded in 2002, ShoreView is a Minneapolis-based private equity firm that has raised over $1.3 billion of committed capital across four funds. ShoreView partners with family or entrepreneurial-owned companies across many sectors, including engineered products, distribution, industrial services, business services, healthcare, and niche consumer products. Shoreview structures a variety of acquisition, recapitalization and build-up transactions, typically in businesses with revenues ranging between $20 million and $300 million.

We know how to operate in situations that are not “packaged” for sale. We are able to complete due diligence with limited information. We are experienced with unique situations that arise with family and entrepreneur owned businesses. We Structure Compelling Economics for Buy-Side Deal Sources. We clarify relationships through written fee agreements. We do retained engagements and/or blanket.”

Industries: Manufacturing, Industrials, Business Services, Distribution, Healthcare, Materials

![]()

“Source Capital, LLC is a private equity firm founded in 2002 which makes both control equity investments and mezzanine debt investments in mature, lower middle-market U.S. companies across a range of industries.

Source Capital’s investment strategy targets both healthy growing companies with greater than $2.0 million in EBITDA seeking a growth-oriented partner and distressed businesses that are over leveraged and/or operate in out-of-favor sectors.

Source Capital has offices in Atlanta and San Francisco.”

Industries: Consumer Goods, Manufacturing, Materials, Industrials, Business Services, Healthcare

Visit Source Capital’s Profile

“CPS Capital is a committed-capital fund built to target companies with annual revenues from $5-$40 million and annual cash flows from $2-$8 million. Our team brings strong and diverse experience from a variety of industries and functions. We will work with business owners to ensure the right deal for both themselves as well as their employees and customers.

We bring significant managerial capability and capital to provide business owners with an attractive option compared to traditional financial or strategic buyers. CPS will take an active role in the acquired business and is focused on business continuity and long-term value creation.

Flexibility for the business owner is paramount for CPS. We can provide owners with significant flexibility based on the owners’ objectives. From an operational perspective, CPS can allow owners the option to transition more quickly out of the business or to maintain an on-going role depending on preferences. From a financial perspective, CPS can be flexible with deal structure to meet unique tax or estate planning needs and/or allow for the owner to maintain equity in the business. Unlike strategic acquirers, we are not looking to fundamentally reshape the business or personnel. We are seeking to grow the business organically.”

Industries: Technology, Financial Services, Business Services, Industrials, Energy & Utilities, Healthcare

“Headquartered in Nashville, TN, LFM Capital invests in niche manufacturing and industrial services companies by providing financial capital and strategic resources. We work with existing management teams to develop world-class operations and targeted growth, driving long-term value for management, employees, and our investors.”

Industries: Manufacturing, Industrials, Materials, Business Services

“Founded in 2000, Envest is a private equity firm based in Virginia Beach, VA. We are dedicated to partnering with privately held and founder-owned businesses. The Envest principals have prior experience in general management of both large and small businesses which we believe has been fundamental to our success. Envest strives to provide flexible capital solutions to meet the needs of entrepreneurs while providing strategic direction and board governance to its portfolio companies. Envest has achieved top decile performance amongst its private equity peer group.

Envest focuses on privately-held businesses in basic industries and non-revolutionary technologies. We have experience investing in financial services, franchising, manufacturing, healthcare services, travel and entertainment, and software/IT. Envest is focused on long-term value creation, without any holding period or defined mandate for our investments. We seek to partner with proven management teams with a clear vision of growth. We have the flexibility to make control and non-control investments in companies with sustainable and demonstrated annual free cash flow of $500,000 to $6,500,000.”

Industries: Manufacturing, Financial Services, Industrials, Materials, Technology, Energy & Utilities

“Hidden Harbor Capital Partners is a private equity firm with an operations soul and intense passion for building great companies. Hidden Harbor brings large-scale, private equity experience and resources to the lower middle market with a focus on value-oriented, operationally intense situations. Our principals are investor operators who have both extensive transaction and operating experience to truly understand your business. As one team, we partner and work hand-in-hand with our portfolio companies to drive business successes.

We love corporate carve-outs (3 out of our 6 portfolio companies were corporate carve-outs), family owned and founder owned businesses.”

Industries: Manufacturing, Industrials, Materials, Business Services, Distribution, Energy & Utilities

“Founded in 2002, Argonaut Private Equity is a Tulsa, Oklahoma based private equity firm with over $1.5 billion of capital deployed by the firm’s principals. The firm is currently investing out of Argonaut Private Equity Fund IV, a $400 million fund that deploys Argonaut’s strategy of making control-oriented buyout investments in companies in the industrial, manufacturing and energy services and products sectors.

Argonaut looks to partner with management teams to improve operations, implement best practices and generate shareholder value. Argonaut has an over 15-year history of creating value through strategic acquisitions and operational improvements at industrial, manufacturing and energy services and products companies. Argonaut achieves this through a collaborative approach with management and a low-levered capital structure that provides portfolio companies with the necessary financial flexibility to grow in a disciplined manner. ”

Industries: Manufacturing, Industrials, Materials, Energy & Utilities, Business Services, Distribution

“Gauge Capital is a private equity firm that makes shared control and majority investments in growth-oriented service business. We tend to focus on the business service, healthcare service, consumer service, and food service sectors. Our platform investments typically have north of $5 million of EBITDA and are based in the US or Canada.”

Industries: Business Services, Healthcare, Technology, Financial Services, Consumer Services, Distribution

“CIVC Partners is a Chicago-based private equity firm investing in high growth middle market companies in business services sectors. Since 1989, the team has invested over $1.9 billion and currently invests from CIVC Partners Fund VII. More information on CIVC Partners and its portfolio companies can be found at www.civc.com.”

Industries: Business Services

“Fulcrum Equity Partners is an Atlanta-based growth equity firm focused on providing expansion capital to rapidly growing companies. We have been successfully investing in high growth businesses since 2000. The senior team all has significant operating experience in companies of the size and type in which we invest that had successful exits. We have been involved in over 400 transactions and know how to position businesses to be attractive acquisition candidates. Additionally, our investor base includes 100 current and former CEOs. In short, we look to investment in businesses where we can bring more to the table than just the capital.”

Industries: Healthcare, Technology, Distribution, Financial Services, Industrials

“Gen Cap America (GCA) is a private equity firm headquartered in Nashville, Tennessee that specializes in leveraged buyouts of privately held lower-middle market businesses.

Our investment criteria is Revenue: $5M – $100M, EBITDA: $1.5M – $10M, and Geography: United States & Canada.

Typical transaction types for Gen Cap include Family Succession, Management Buyout, Divisional Spin-off, Recapitalizations

Most transactions are management buyouts or buyouts of one or multiple retiring owners. GCA target investments typically have a long history of successful operations and cash flow, and quality managers who wish to be part of the buying group and become co-owners.”

Industries: Consumer Goods, Manufacturing, Materials, Business Services, Distribution, Technology, Financial Services, Industrials, Energy & Utilities, Healthcare, Telecom, Media

“Founded in 1993, Gemini Investors is a Massachusetts-based private equity firm that provides capital and strategic resources to lower middle market companies. Since its inception, we have invested approximately $600 million in more than 100 companies throughout the U.S., typically investing $3 – $8 million per transaction in either control or minority positions.

Gemini offers a flexible investment approach. We provide a wide range of financing structures, which include subordinated debt with warrants, preferred stock, and common equity. We have extensive experience leading transactions, as well as co-investing with other private equity firms and independent sponsors. Currently investing Gemini Investors V, L.P., we seek established businesses and experienced management teams that have a solid operating history and significant growth potential.

Target portfolio company has revenues of $5 to $50 million and EBITDA of at least $1 million. We have a diversified approach to investing, and a proven track record in consumer products and services, healthcare services, manufacturing, distribution, for-profit education, restaurants, waste and recycling, retail, hardware and software technologies, and business services.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Business Services, Materials, Distribution, Financial Services, Healthcare, Consumer Services, Media, Energy & Utilities, Telecom, Life Sciences

“Mangrove Equity Partners’ founding principals enjoy a national reputation as uncommonly effective, fair, flexible and honorable partners to company owners and managers. We have the captive financial resources (including bridge capabilities) and deal experience to efficiently close transactions. We also have substantial operating experience and a collaborative approach to building value at the companies with whom we partner. Mangrove’s three person internal operating team affords our fund the ability to help owner/operators maximize the value of their retained ownership, and allows Mangrove to invest in opportune situations, including those that are complex. Please visit www.mangroveequity.com to view our story.”

Industries: Manufacturing, Industrials, Business Services, Consumer Goods, Consumer Services, Energy & Utilities, Materials

“The Courtney Group, Incorporated is a private investment firm with a focus on business services, chemical, consumer, distribution, financial services, healthcare, manufacturing, and technology. We have invested in 25 companies since 1999. We are different from some other buyers in that (1) we are flexible about the size of our investment — from $1 million to $200 million in equity, and (2) that we can own a business for 20 years or more.

We seek control and non-control equity investments in businesses with EBITDA of $2 million to $50 million. We often acquire businesses from founders seeking to diversify, retire or find a partner to help them reach the next level of success. Our goal is to be trusted partners for great businesses.

We seek to invest in businesses with attractive growth prospects and high quality management teams. Company executives often invest with us and participate in a stock option plan, giving them meaningful ownership in the businesses they manage. The Courtney Group has a strong record of helping its investments reach new levels of success with financing, strategic advice, a strong network of contacts, helping recruit top talent, M&A deal flow and opportunity creation.”

Industries: Consumer Goods, Materials, Industrials, Technology, Distribution, Business Services, Manufacturing, Healthcare, Media, Real Estate, Retail, Consumer Services, Life Sciences, Financial Services, Telecom

Visit The Courtney Group’s Profile

“Hammond Kennedy Whitney & Company is evolving with clarity and purpose, while honoring the vision of the firm’s founders and our 100 plus year history. We focus on specific sectors in which we can utilize our skills and perspective, leveraging technology as part of a data-driven methodology to power our “Four Pillar” structure. HKW has developed processes that support our strategy to find, create, and sustain value in our companies while trusting and appreciating that our approach is what sets us apart..”

Industries: Technology, Business Services, Manufacturing, Consumer Goods, Healthcare, Materials, Distribution, Financial Services, Life Sciences, Retail, Industrials, Consumer Services, Telecom, Real Estate

“Alvarez & Marsal Capital (“AMC”) is a multi-strategy private equity investment firm with over $3 billion in assets under management across four funds and three investment strategies. Our firm is led by a highly experienced investment team, which is augmented by our strategic association with Alvarez & Marsal (“A&M”), one of the largest operationally focused advisory firms in the world. AMC combines a focus on middle-market private equity investing, with deep operational expertise, industry knowledge, and global corporate relationships of A&M, making us an attractive partner to management teams and business owners.

A&M Capital Partners (“AMCP”), with assets under management of $1.8 billion, is AMC’s flagship investment strategy focused on middle-market control transactions in North America. Since inception of this strategy we have invested in over 48 companies across 13 platforms.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Distribution, Healthcare, Consumer Services

“Industrial Opportunity Partners, LLC (“IOP”), based in Evanston, IL, is a private equity investment firm. With $910 million of committed capital since its inception, IOP is focused on acquiring and managing middle-market manufacturing and value-added distribution businesses. Utilizing its operations-focused approach and dedicated Board of Operating Principals, IOP has a track record of stabilizing, growing and enhancing the value of its acquired businesses having invested in over 20 platform companies.”

Industries: Manufacturing, Industrials, Distribution

“At Harbour Group, we concentrate on one thing: Building Businesses.

Throughout its 44 year tenure, Harbour Group has acquired and grown over 200 businesses with a focus on manufacturers of highly engineered or branded products and value-added distributors.

Harbour Group is a privately-owned operating company based in St. Louis, MO, with additional offices in Shanghai, China and Bangalore, India. Two-thirds of our professionals are operating executives with extensive experience in all aspects of manufacturing, distribution, and specialty business services, including global sourcing, management information systems, lean and quality principles, and environmental compliance. Since our founding in 1976, Harbour Group has acquired 211 companies in 47 industries.”

Industries: Manufacturing, Consumer Goods, Industrials, Distribution, Materials, Technology

“Founded in 2004, Alaris Equity Partners is a private equity firm based in Calgary, Alberta. The firm targets traditional majority recap/control sale mandates and structures the investments in a non-control manner via perpetual preferred equity. Throughout the company’s 17 year history, the preferred MBO solution has proven to create full liquidity events for the exiting majority shareholders while simultaneously providing an attractive option for high quality management teams to increase their post transaction common equity ownership to 100% where they can control the business moving forward and benefit from more of the upside. The firms capital base is evergreen and the balance sheet is positioned to provide access of up to $200 million of capital on an ongoing basis. Alaris has approximately 85% of its investments in US-based companies.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Retail, Business Services, Distribution, Healthcare, Consumer Services, Media, Telecom

“VSS is a leading private equity investment firm that invests in the healthcare, business services and education industries.

The firm has more than 30 years of experiewnce and over $4B in aggregate capital commitments across 8 funds. VSS has made investments in 96 portfolio companies, and has completed more than 400 add-on acquisitions.

VSS invests in businesses that are well-positioned for sustainable growth. The firm offers flexible capital solutions, from debt to equity, for a wide-range of corporate and shareholder uses. VSS also assists company management teams, boards, and financial sponsors in effective strategic initiatives.”

Industries: Healthcare, Business Services, Financial Services, Technology, Industrials

“Blue Point Capital Partners is a private equity firm managing over $1.5 billion in committed capital. With offices in Cleveland, Charlotte, Seattle and Shanghai, Blue Point’s geographical footprint allows it to establish relationships with local and regional entrepreneurs and advisors, while providing the resources of a global organization. The Blue Point partner group has a 21-year track record of partnering with lower middle-market businesses to build processes and capabilities to achieve dramatic growth, specializing in ownership recapitalizations, corporate divestitures and buyouts, and is typically the first institutional financial partner. Blue Point focuses on opportunities where it can leverage its collective experience, extensive network of operating resources and unique toolkit, which includes Asian capabilities, data & digital strategies and focused add-on acquisition efforts. Blue Point typically invests in businesses in the industrial, consumer, business services and distribution sectors that generate between $20 million and $300 million in revenue.”

Industries: Manufacturing, Consumer Goods, Distribution, Industrials, Business Services, Healthcare, Materials, Consumer Services, Energy & Utilities, Retail

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,500 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.