Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

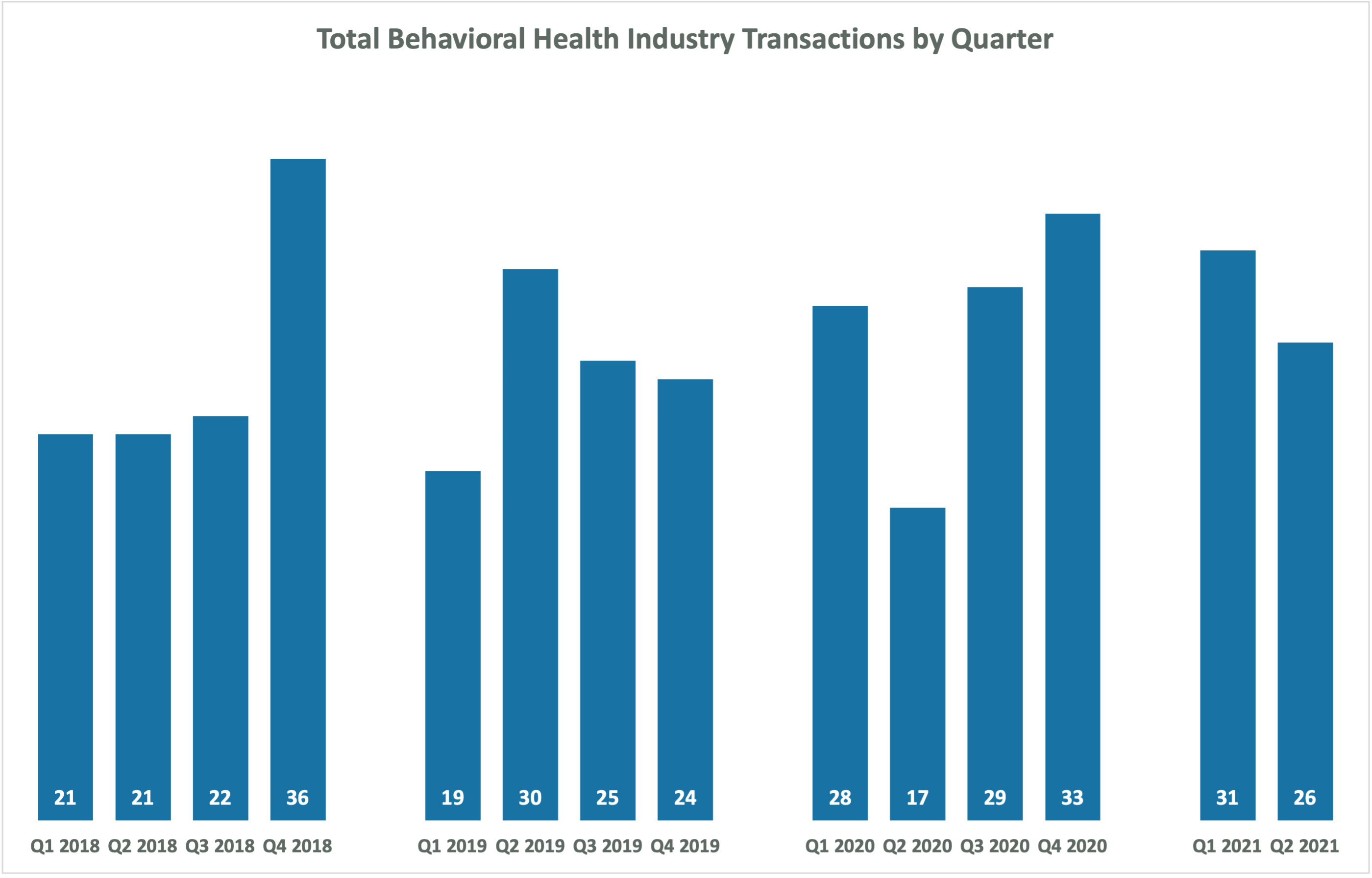

An active second quarter and a series of indicators that portend more deals to come have 2021 on track to be a record-setting year for merger and acquisition activity in the behavioral healthcare space. In the second quarter, 26 deals were announced, bringing the total to 57 for the year at its midpoint. That puts 2021 on pace to top the previous high watermark of 107 set in 2020.

“We expect transaction volume will likely accelerate over the second half of the year as sellers, burned out from the pandemic, are looking to get something closed in 2021 due to the anticipated increase in the capital gains tax rate,” said Mertz Taggart Managing Partner Kevin Taggart.

Note: Total industry transactions does not necessarily equal the sum of the sub-industries, as many transactions include more than one sub-industry.

The Biden-Harris administration has introduced a new tax bill that will have significant implications on transactions. The bill proposes moving the tax rate on long-term capital gains from 23.8% (including the 3.8% Medicare tax) to 43.4%, and if passed, would be expected to go into effect on Jan. 1, 2022. Under the current 23.8% rate structure, a $10 million transaction would result in $7.62 million of after-tax proceeds. To net the same $7.62 million after taxes under the new proposed rate, a deal would require $13.46M million in cash proceeds.

In the meantime, private equity groups have remained active in behavioral healthcare, accounting for 20 of the second quarter’s 26 transactions, including 18 completed by private equity-backed strategic firms. This includes four transactions by Chicago Pacific Founders’ Recovery Ways and two by Brightview, which is backed by Shore Capital.

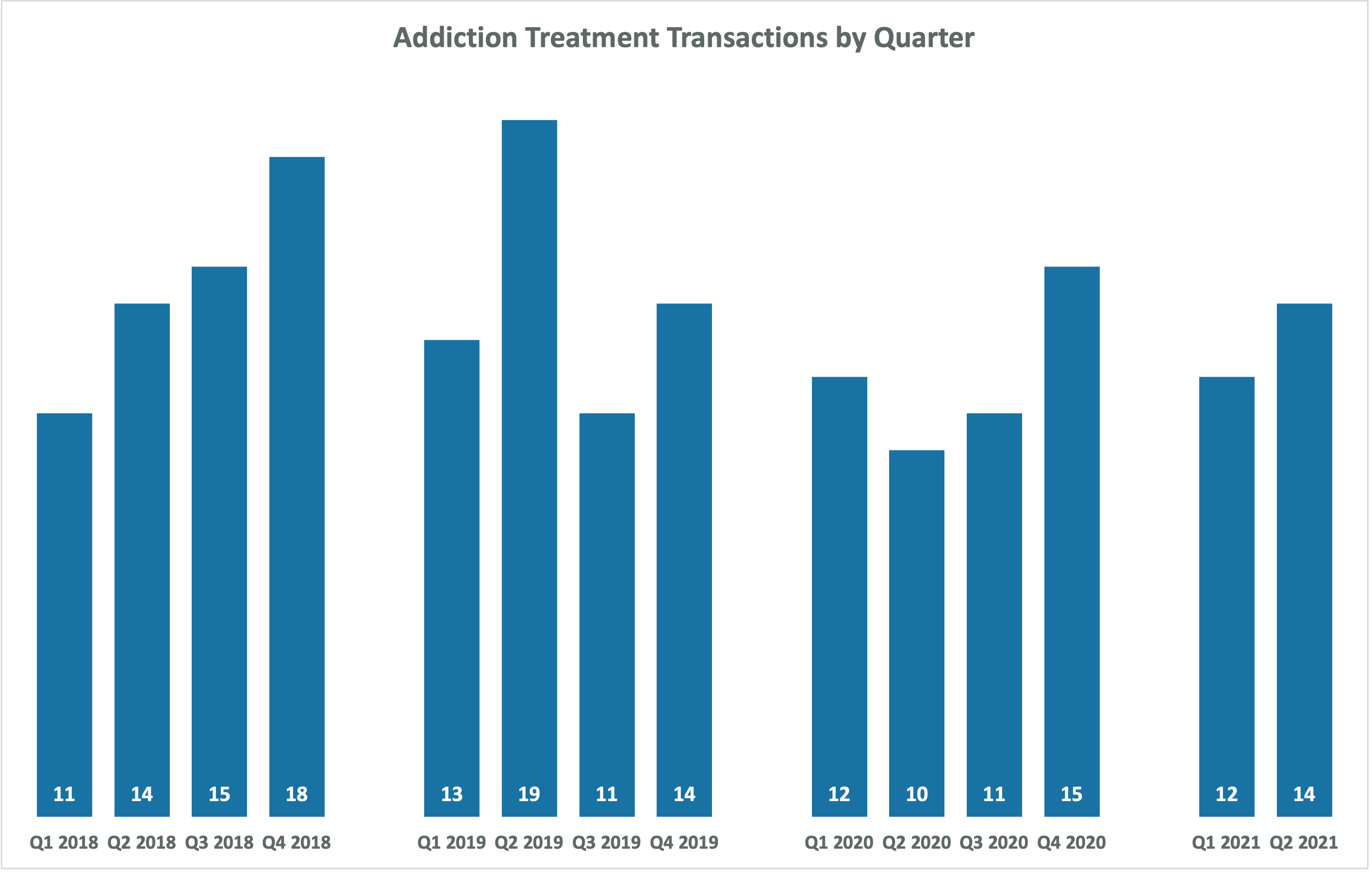

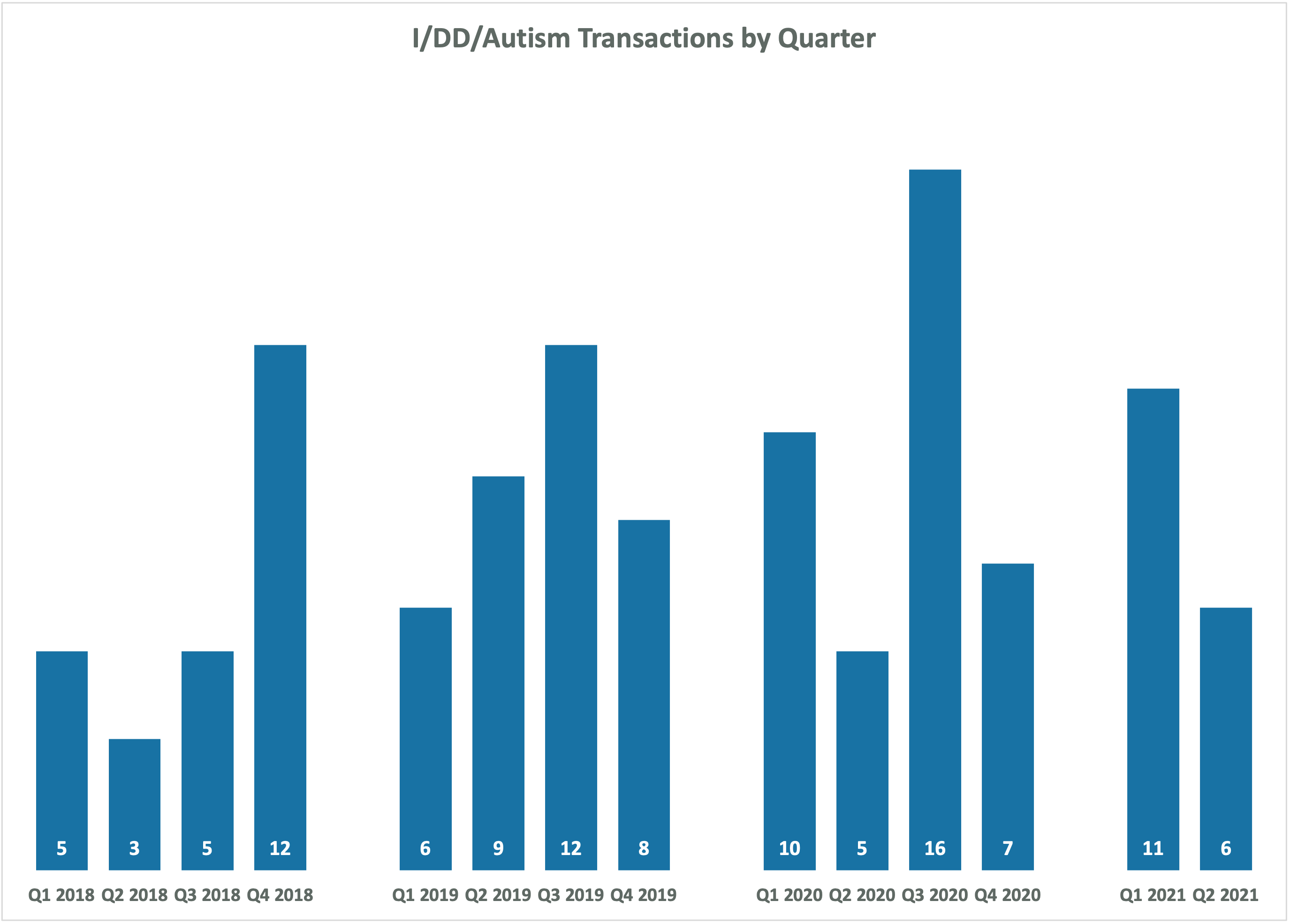

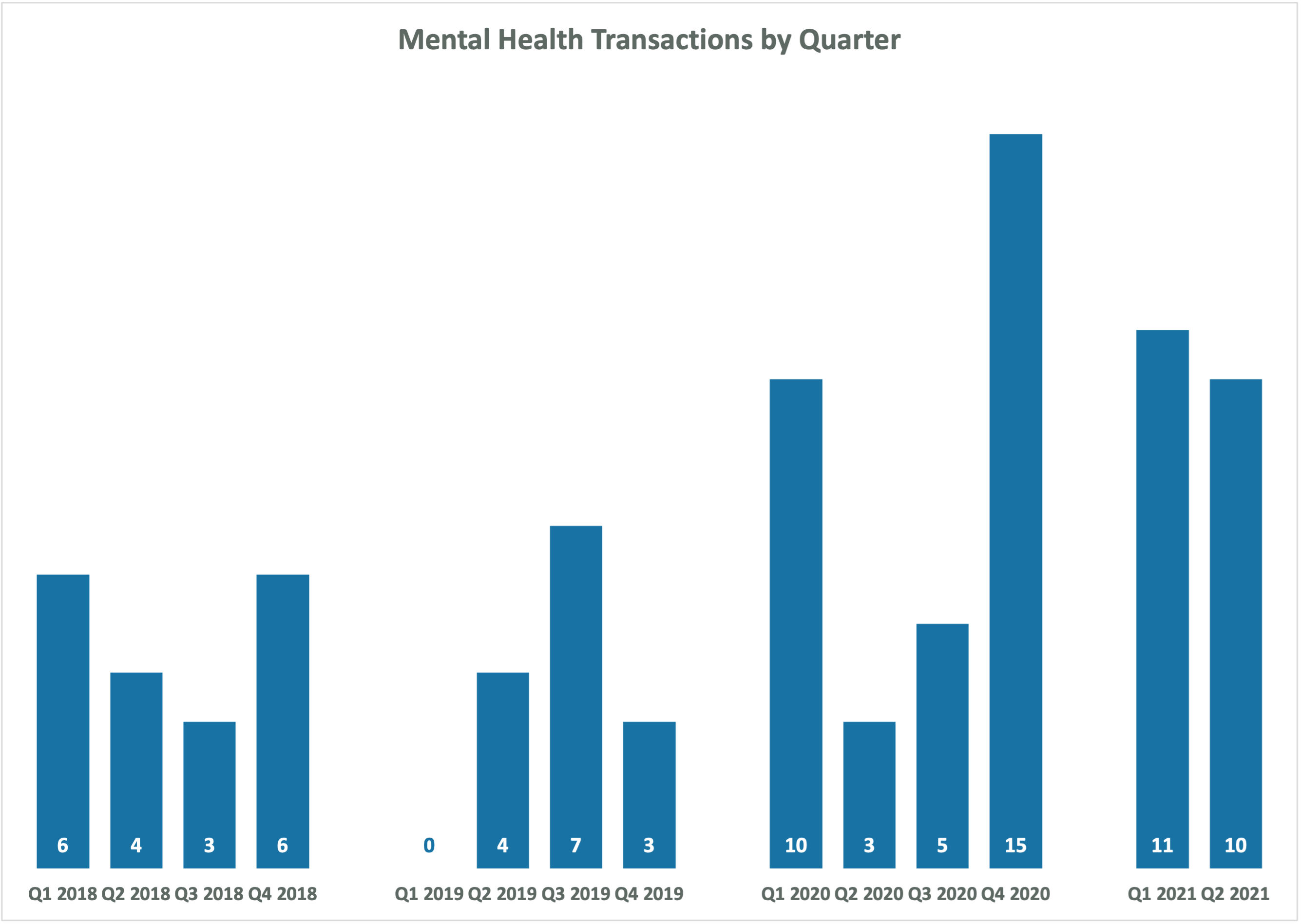

Deals involving addiction treatment and mental health provider organizations remained in line with activity in the first quarter of 2021. Mergers and acquisitions involving autism services and intellectual/development disabilities service providers, however, dipped from 11 deals completed in the first quarter of the year to just six in Q2.

“Many private equity groups that have a platform company have decided to go the de novo route rather than to acquire a small provider for what have been high multiples,” Taggart said. “They can do it more cost effectively and have a waiting list shortly after they open.”

Looking ahead to the remainder of 2021, Taggart said availability of M&A advisors—from attorneys and accountants to those in the clinical realm—could pose the biggest roadblock to deals getting done before the end of the year.

“Many won’t have the bandwidth to handle the volume for those that aren’t already progressing down the path,” Taggart said. “We’ve talked to a number of accounting firms, buyers and legal firms that are concerned they won’t be able to handle the demand for those that aren’t already engaged in the process.”

Demand for addiction treatment services continues to surge, as the latest CDC data shows more than 92,000 Americans died by overdose in the 12 months ending in November 2020, a record for a 12-month period and a 30% increase over a year prior.

M&A activity in the addiction treatment sector saw a slight uptick in the second quarter, with 14 deals announced, up from 12 in Q1.

The volume of deals for autism and I/DD services, which has ebbed and flowed on a quarterly basis since mid-2019, once again dipped in the second quarter of 2021. Just six deals in this space were completed in the quarter, down from 11 in Q1 of 2021.

Among the deals in the autism and I/DD space announced:

Deals for mental health service providers remained roughly in line with the first quarter of 2021, with 10 deals completed in Q2 compared to 11 in Q1. Demand for services in the sector is expected to remain high in the coming months as the nation starts to enter a post-pandemic phase.

Transactions involving mental healthcare organizations in the second quarter included:

Mertz Taggart is an industry-leading mergers and acquisitions firm specializing in home health, home care, hospice, and behavioral health.

This article was originally featured on Mertz Taggart’s Industry Insights publication.