Dead Deal Report: Unpacking 2023’s Broken LOIs

There are numerous factors that can lead to the breakdown of a deal, including financing challenges, discrepancies in EBITDA evaluations,…

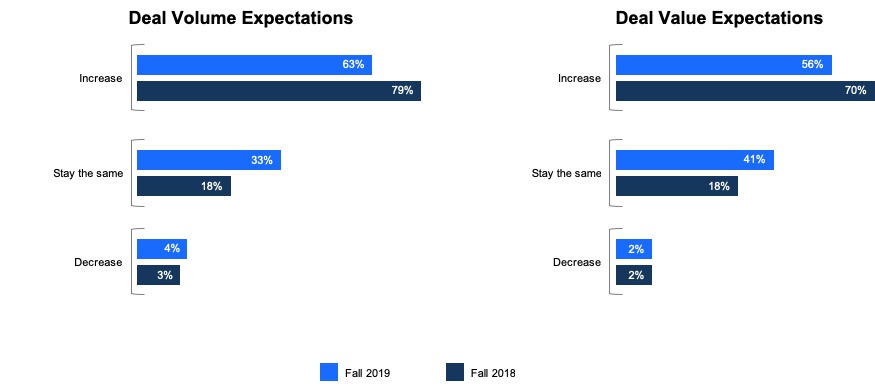

While a lot of fuss has been made lately about a coming bear market, dealmakers don’t seem so sure. According to Deloitte’s 2020 M&A Trends survey, only four percent of respondents anticipate a decline in deal numbers in 2020, and even fewer (two percent) think deal size will decrease. (Deloitte’s survey took into account opinions from 1,000 executives and private equity investors.) There are still record levels of dry powder at U.S. private equity firms, and U.S. corporations held a total of $1.55 trillion in cash at the end of 2019, only a slightly lower number than the end of last year and much of which they plan to use for mergers and acquisitions.

While few are truly pessimistic, however, it’s also true that expectations are slightly less rosy than at this time last year. Notes the report, “more muted enthusiasm seems natural at this stage in the M&A cycle, following seven years of heady growth and record-setting activity.” Fewer respondents to this year’s survey expect deal volume to increase (63 percent vs. 79 percent). Likewise for deal value — 56 percent expect it to increase in 2020, vs. 76 percent of respondents to the 2019 survey.

Of course, even the most optimistic investors and acquirers are thinking about the potential fallout should a downturn occur. For private equity investors, the most common dealmaking strategy in the case of a downturn is finding undervalued assets (44 percent), while for corporates, the goal is to maintain competitive positioning (48 percent).

What else does the new decade hold? Here are three trends that stood out from the survey:

“Almost every geography is less popular this year among survey respondents as a place to potentially pursue M&A,” notes the report. Interest in deals in China fell to 14 percent of respondents, from 28 percent last year. However, interest in UK deals remained steady at 24 percent, and there was only a small decline in interest in Canadian deals.

Overall, respondents seem split on the best way to respond to the uncertainties abroad. Thirty-percent of executives and investors say they’re shifting their focus to domestic deals as a result, while a nearly equal number (29 percent) are instead trying to leverage “market distress caused by trade tensions” to their advantage. Perhaps most telling is the fact that 40 percent of respondents aren’t making any changes to their M&A strategy as a result.

The 2017 changes to the U.S. tax law in particular may have caused some firms and companies to narrow their focus to domestic deals, notes David Hoffman, partner in M&A Services at Deloitte Tax LLP, in the report. “The changes… have cut multiple motivators for global deal making. Companies previously sought to deploy excess overseas cash on foreign deals. They also sought to increase or shift profits to tax-friendly non-US jurisdictions. Now, between more flexibility to efficiently use global cash piles, combined with rapidly changing and less generous non-US tax regimes, you’ve got a recipe for more domestically oriented M&A strategies.”

While both corporate and private equity survey respondents overwhelmingly prefer investments in their own industries, if they’re going to make an exception, it’s likely to be for technology plays. Sixteen percent of executives note that they are interested in technology acquisitions, followed by 10 percent who are interested in renewable energy and 9 percent interested in utilities, insurance, and investment management, respectively.

Twelve percent of corporate executives also identified their driving M&A strategy as “seeking deals that will help us acquire new (to us) technology.” This was the leading answer, followed by doing deals to add to the product portfolio (9 percent).

“Everyone is trying to add technologies—smart technologies that in many cases are very new to the world—and incorporate them to show growth and demonstrate an ability to innovate. M&A presents a clear path to do this, and using your deal-making to acquire technology is a trend that’s likely to continue or even strengthen as companies see how powerful new technologies, such as artificial intelligence, can help their businesses,” says Susan Dettmar, principal of M&A Services at Deloitte Consulting, LLP, in the report.

In a different but related vein, the report also notes that executives and private equity investors alike are increasingly using digital tools to help streamline the M&A process itself — including helping to provide insight on their acquisition model (53 percent), minimizing risks during due diligence (51 percent), helping to plan for integration (40 percent), and speeding up time to close (35 percent).

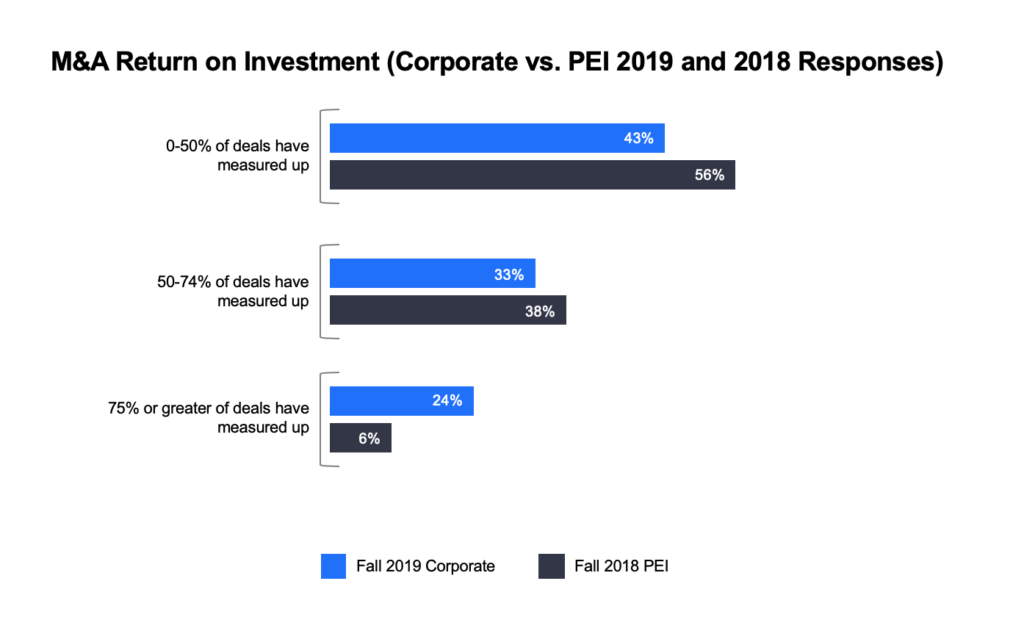

Around half of survey respondents (46 percent) say that fewer than 50 percent of their deals over the past two years have met their value expectations. This is a slight increase from last year’s survey, where 40 percent of respondents noted the same sentiment.

Private equity investors seem more likely to be disappointed than executives on the corporate side, according to the data in the graph below.

Investors and acquirers cite both external and internal factors as explanations for the lower-than-anticipated deal value. External reasons included economic forces (32 percent), market or sector forces (30 percent), and changing regulatory and legislative environment (27 percent) topped the charts, while common internal factors included lower than expected sales (30 percent), not achieving revenue synergies (28 percent), gaps in execution/integration (28 percent), and talent issues at the target company (28 percent).