Who’s Buying in the Lower Middle Market in 2026? Key Buyer Trends From Axial Data

The lower middle market buyer universe is getting bigger, broader, and more competitive. In 2025, Axial saw an all-time high…

Tags

The Federal Reserve’s recent 0.25% rate cut marks a meaningful shift in the cost of capital, lowering the federal funds rate to a target range of 3.75%–4.00%. This adjustment reflects the Fed’s response to easing inflation and a cooling economic outlook, conditions already beginning to influence credit markets and deal financing structures.

To better understand the implications, we surveyed Axial members to understand how lower borrowing costs may shape valuations, competitive dynamics, and seller timing in the lower middle market as we head into 2026.

Thank you to the Axial members who participated in this survey and shared valuable perspectives. The following members are quoted in this article.

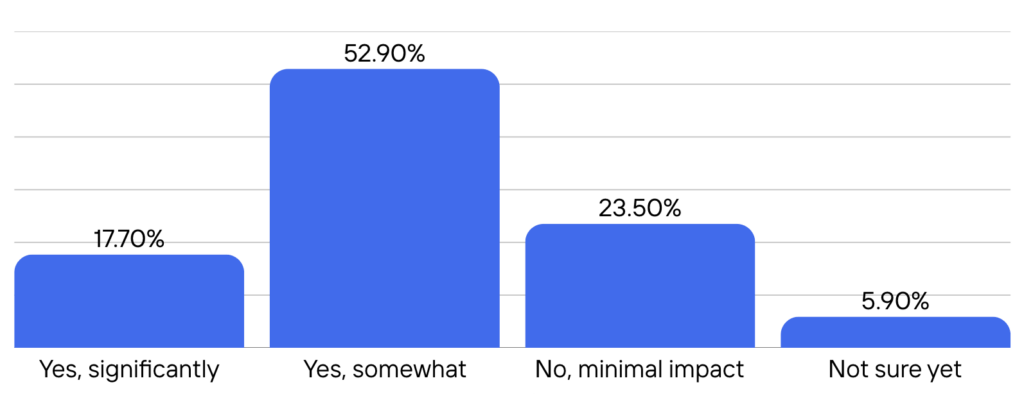

Survey responses indicate that most Axial members expect lower rates to have a noticeable impact on LMM deal activity, but the magnitude and timing vary. Roughly 70% of respondents believe the Fed’s recent and expected cuts will influence deal activity—17.7% expecting a significant impact and 52.9% expecting a somewhat meaningful effect.

When asked about timing, nearly half (47.1%) expect the effects of lower rates to appear in early 2026, with an additional 29.4% pointing to mid-to-late 2026, suggesting a broadly anticipated uplift beginning next year. Although the impact on overall deal flow is expected to be gradual, several members noted signs of early movement. Cody Clemens shared that his team has “started seeing more general excitement for next year.” He added that it’s difficult to pinpoint whether this shift is driven primarily by rate cuts or simply by “a less shaky end to the year,” but the overall mood among market participants has improved.

Others described a more cautious but still evolving environment. Warren Rose noted that it is “too soon to determine what long-term impact the rate cuts will have” and stressed that “anticipated future cuts will be necessary to develop a solid trend.” Even so, he has observed an immediate rise in interest around “large-scale acquisitions” and sector-specific activity, particularly in healthcare, technology, energy, and consumer goods. Together, these early observations suggest that while most dealmakers expect the broader effects of lower rates to build gradually, some momentum is already forming.

Survey responses suggest that Private Equity Funds stand to benefit the most from the recent rate cuts, with 47.1% of members selecting them as the buyer type that will benefit the most. This aligns with Investopedia’s observation that PE benefits greatly from lower interest rates, as cheaper debt directly improves the economics of leveraged transactions.

Nearly 30% of respondents pointed to Individual Investors and Search Funds, indicating that cheaper debt may help level the playing field for smaller buyers who have been disproportionately constrained by high financing costs.

Regarding transaction type, 41.2% of respondents selected platform acquisitions as the biggest beneficiaries of lower rates. This aligns with the fact that platform deals typically require larger initial financing, making them more sensitive to reductions in borrowing costs. Add-on acquisitions and recapitalizations followed at 29.4% each, suggesting that lower rates may also accelerate buy-and-build strategies and create more attractive opportunities for owners seeking partial liquidity.

Notably, no respondents selected minority investments, indicating that the impact of rate cuts is most meaningful in transaction types where leverage plays a central role.

When asked how seller valuation expectations might shift as rates fall, respondents anticipate only modest movement. A majority (58.8%) believe valuations to increase slightly, while the remaining 41.2% believe expectations will stay about the same. Notably, no respondents anticipate a significant increase or any decrease in expectations. This suggests that while lower rates may give sellers the confidence to hold firm on price, dealmakers do not foresee dramatic valuation inflation in the near term.

When asked whether rate cuts would help close the valuation gap between buyers and sellers, most respondents expressed hesitation. A majority (58.8%) said it is too early to tell, reflecting uncertainty around how quickly, or meaningfully, lower borrowing costs will filter into pricing alignment. Nearly 30% do not expect rate cuts to close the gap, suggesting that structural factors beyond interest rates may still be driving valuation mismatches. Only 11.8% believe lower rates will directly narrow the divide. Overall, respondents are cautiously optimistic but unconvinced that rate reductions alone will resolve the disconnect that has persisted in the market.

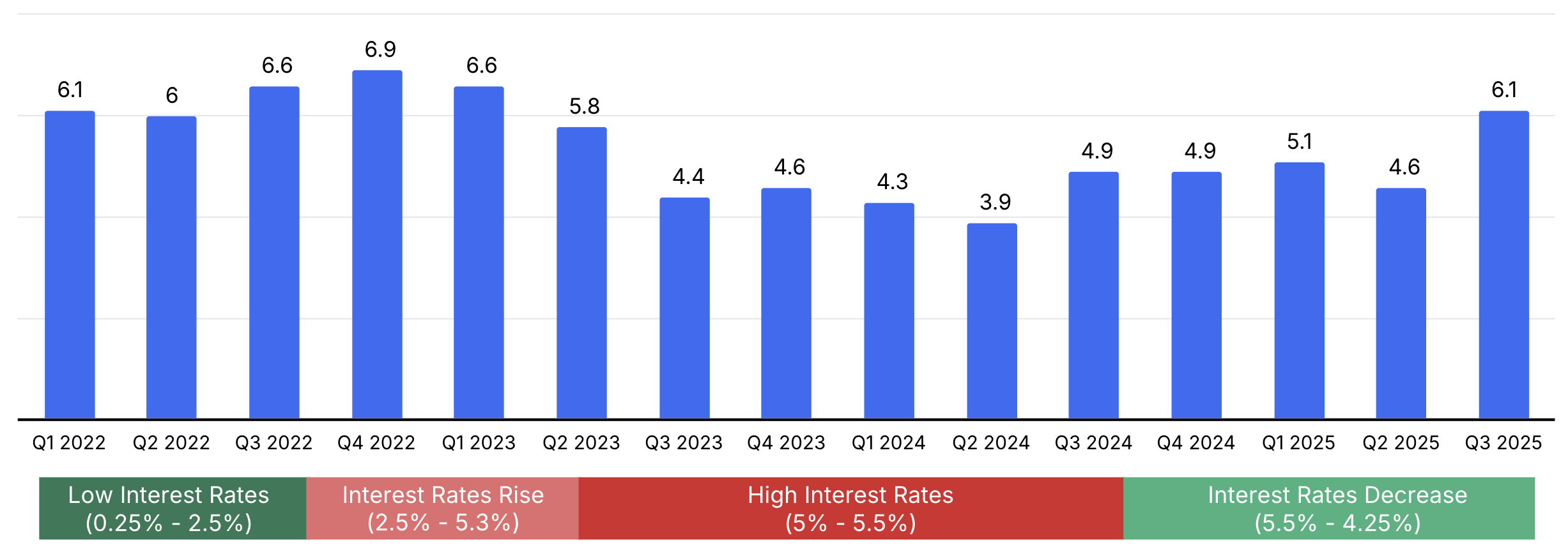

This recent Axial article highlighted the historical link between interest rates and LMM valuations. As illustrated in the chart below, the Axial platform data shows that multiples generally rise when borrowing costs fall and compress when rates increase.

Together with the survey results, the data points to a steady but modest outlook. As the Fed began easing in late 2024, valuation multiples began to rise, improved financing conditions gave buyers more flexibility, and lower yields elsewhere pushed more investors toward private deals. By Q3 2025, Axial platform multiples averaged 6.1x. While respondents expect only slight increases in seller expectations and remain unsure whether rate cuts will narrow the valuation gap, the broader trend suggests that easing rates are helping stabilize and gradually lift LMM pricing.

We asked Axial members to weigh in on the biggest opportunities and challenges that lower interest rates could create in the lower middle market. Their responses reflect a mix of optimism and caution: many see cheaper debt unlocking flexibility for buyers, renewed competition for quality assets, and stronger valuations for sellers, while others highlight the risk of overheated bidding, rising leverage, or inflationary pressures that could prompt the Fed to reverse course. The following perspectives illustrate how dealmakers are thinking about both sides of the rate-cut environment.

| Member + Firm | Quote |

| Michael Vann, The Vann Group, LLC | It creates some flexibility for buyers in meeting price requirements, particularly in the EtA space, which relies on SBA 7a loans. |

| Bill McDonald, McDonald Dalton Capital Partners | Lower rates may bring more buyers into the market, which could, in turn, convince some "on the fence" sellers to take action. |

| Warren Rose, Groce, Rose & Moore, LLC | The greatest opportunity that lower rates create for dealmakers is the ability to leverage reasonable and more accessible debt to enhance returns and increase deal flow. This creates a more favorable environment for both buyers and sellers by fueling deal activity that may have stalled due to higher rates. |

| Bradley Smith, Vertess Healthcare | Buyers being more aggressive. |

| Bill Schloth, ASA Ventures Group | I think it gives sellers more flexibility because strategic and financial acquirers will pursue deals, and both will likely submit competitive offers. |

| John K. Hudson, Jr., Confluence Healthcare Partners | It may create more competition for lower-rate financings, but I am not sure that translates into valuation increases like you would typically see in the larger-cap market. |

| Todd Cummiskey, Vercor | Ability for buyers to generate greater ROI and slightly higher valuations for sellers. |

| Mack Browder, Mack Browder & Associates | Lower rates will make financing easier and slightly increase valuations. |

| Cody Clemens, ASA Ventures Group | Lower rates cause IRRs on investments to lift without any change in company prospects. It creates momentum for both the buy and sell-side. Buy-side investors who have stuck to buying the highest quality companies have additional upside relative to PE groups who have overextended the last few years and are now putting portcos into continuation funds. |

| Member + Firm | Quote |

| Daniel Mizrah, Propeler Capital | As a buyer, a lot more competition to close deals |

| Cody Clemens ASA Ventures Group | The biggest risk to lower rates is inflation returning to the economy in a meaningful way. If we see a rise in inflation due in part to rate cuts, it could force the Fed to pivot to maintain price stability, perpetuating a “higher-for-longer” policy stance. |

| Bill McDonald, McDonald Dalton Capital Partners | I don't see any meaningful risks at these rate levels. Rates would have to move much lower to create negative incentives. |

| Michael Vann, The Vann Group, LLC | If inflation starts to increase, you could see more uncertainty enter the market as the Fed may pause rate cuts, and further impact company performance. |

| John K. Hudson Jr., Confluence Healthcare Partners | Buyers begin to put too much leverage on acquisitions. |

| Warren Rose, Groce, Rose & Moore, LLC | The biggest risk lower interest rates could bring to M&A is significant overvaluation of acquisition targets due to increased competition and cheap debt. |

| Bill Schloth, ASA Ventures Group | Sometimes, financial buyers can overleverage deals, but you have to look at their experience here and use your best judgment. |

When asked how the current interest rate environment has changed their definition of a “good deal,” the majority of respondents said that it hasn’t meaningfully shifted their criteria. Warren Rose noted that it hasn’t, emphasizing that a strong M&A deal “will always be a transaction that creates sustainable value by aligning with strategic objectives, being financially sound, and successfully integrating two companies with compatible cultures.”

Similarly, Bill Schloth reinforced that core fundamentals remain paramount, saying, “Not much. You need strong fundamentals in a business for it to be sellable in any market.” These perspectives highlight a consistent theme: while interest rates influence deal structures and valuations, the underlying definition of deal quality in LMM M&A remains steady.

The latest Axial member survey points to a measured but encouraging path forward. Rate cuts are beginning to restore confidence, improve financing conditions, and lift valuations, though respondents expect progress to be steady rather than swift. As 2026 approaches, dealmakers continue to anchor their decisions in fundamentals while navigating a gradually more supportive market backdrop.