The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

Small and medium businesses make up a disproportionate size of the total number of businesses operating in the US today. For every one business doing more than $10M in annual revenue, there are seven businesses doing between $500k and $10M.

Unfortunately, 7x the volume does not automatically translate to 7x the attention from the M&A community. Mainstream private equity buyers have historically spent their time upmarket, where larger businesses offer the potential for larger returns. However, ballooning valuations over the last 18 months have accelerated the SMB acquisition trend, as more and more buyers head downmarket in search of value.

Throughout this evolution of the SMB M&A market, the Business Broker community has steadfastly stood side-by-side with SMB business owners, offering expert advice and advisory services when it comes to selling their life’s work.

In this article, we feature 10 Axial members and business brokerage firms who have excelled at representing SMB owners on the Axial platform.

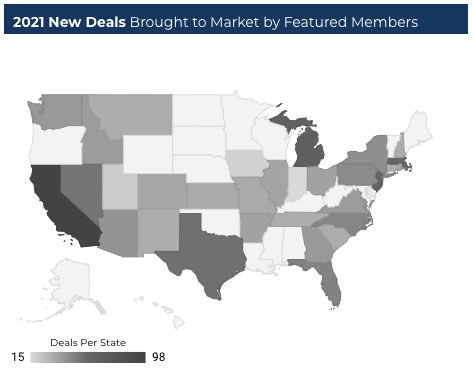

Featured Firms – 2021 Activity Data

It’s important to note that while the core competency of these business brokerage firms is SMB engagements, they also have significant experience working on larger transactions.

Without further ado, here are 10 business brokerage firms operating in the SMB M&A market today that you should know:

Bristol Group

The Bristol Group is a trusted Business Brokerage and Merger & Acquisition firm. The Bristol Group team’s business brokers represent the interest of their clients as exclusive agents and guide them through the complex process of selling or buying a business. The firm’s mergers and acquisitions advisory serves all fifty states. Bristol Group has more than 30 years of experience structuring transactions for business owners, individual buyers, private equity groups, and corporate acquirers.

View Bristol Group’s Profile on Axial

First Choice Business Brokers

First Choice Business Brokers provides a nationwide network of Business Sales Professionals to help guide business owners through the buying or selling process. Since being established in 1994, First Choice Business Brokers has grown to become one of the largest organizations in the U.S. specializing in business sales. First Choice has listed and managed the sale of over $7.5B in businesses for sale. Buyers and sellers alike can enjoy the ease and expertise of a national network of professional business brokers.

View First Choice Business Brokers’ Profile on Axial

IAG M&A Advisors

IAG M&A Advisors is a business intermediary consulting firm, facilitating the buying and selling of businesses. With over 100 years of combined experience, the management team has been a leader in the industry and has helped the owners of privately-held companies “cash in” on all their hard work and get the best payoff possible. Services include consulting services, securing accredited third party business valuations and pro forma portrayals of future business performance, seller-buyer matching, providing funding resources for buy/sell transactions, and tax planning and deal structure analysis.

View IAG M&A Advisors’ Profile on Axial

Calder Capital

Calder Capital is a full-service mergers and acquisitions firm specializing in advisory services for businesses located in the Midwest across a number of industries. The firm’s mission is to provide the highest level of professional service to help their clients achieve their desired results. Each service Calder Capital provides carries its own complexities but the goal at Calder Capital is to bring simplicity to the process. They accomplish this through their systematic process and through their team’s experiences and unique skills. The result: a better outcome for everyone concerned no matter what service offering.

View Calder Capital’s Profile on Axial

Select Business Sales

Select Business Sales represents businesses with annual revenues from $1M to $20M. The firm has successfully completed nearly 100 transactions since inception. Select Business Sales sells businesses using a quantitative model which allows them to sell any type of business regardless of industry. The team at Select Business Sales firmly believes that a focused effort on a select, smaller group of listings results in less time in market and fast broker response.

View Select Business Sales’ Profile on Axial

NuVescor

Typically serving clients with revenues from $5M to $500M, NuVescor is a premier mergers and acquisitions (M&A) advisory firm. Located in the Midwest, NuVescor services middle-market companies across the United States and internationally. NuVescor expertly provides advisory services to both sellers and buyers of businesses across a broad range of industries. Although a business broker typically facilitates small business sales, NuVescor provides a team approach at the highest level for those who want expert guidance regarding how to sell or buy a business.

View NuVescor’s Profile on Axial

BizEx

BizEx is a Los Angeles Business Broker providing M&A quality services for small business owners. The firm leverages its technology and expertise to simplify and expedite the buying and selling of businesses. In the buy sell business transaction, matching the right Buyer with the right Business is how BizEx defines success. Hand picking Business Brokers / M&A Advisors with operational business experience in a wide variety of industries provides them with structured support and a methodology for business sales transactions.

Baystate Business Brokers

Baystate Business Brokers is a brokerage firm specializing in selling businesses for owners. In addition, the firm sells the related real estate and offers business valuation services. What sets Baystate apart is that they combine the services of business brokers and merger and acquisition intermediaries to smaller businesses. These services are business valuations prepared by accredited appraisers, professionally prepared reports about the business for buyers, and targeted searches to find industry, private equity, and other business buyers for the businesses they represent. In addition, Baystate’s advertising reaches buyers all over the world who may be interested in buying their clients. Baystate does all of this while maintaining the confidentiality of their client.

View Baystate Business Brokers’ Profile on Axial

Business Brokers Plus

Business Brokers Plus connects business buyers and sellers. The main focus of Business Brokers Plus is to service the $2M – $50M market segment focusing on Healthcare, Software and Technology, Manufacturing & Distribution, and Services industries. Originally founded as NJ Brokers Plus, the mission of this company is to serve “main street” NJ & NY business owners and assist them in the sale of their businesses. As the company and team grew, there was also increasing demand to offer similar services to middle market companies. Business Brokers Plus was created to concentrate on the middle market space.

View Business Brokers Plus’ Profile on Axial

LINK Business

LINK is a global Merger & Acquisition and Business Brokerage firm with offices in the United States, New Zealand, Australia and the Philippines. The LINK Enterprise division specializes in high-net commercial business transactions in the Lower Middle Market. The firm’s highly-qualified Enterprise professionals include former business owners and leaders, bankers, financial investors and advisors. LINK offers the following services: business transactions (seller representation, buyer representation), business valuation, exit planning, and consultation to improve business valuation (planning & execution).

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 1,800 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email matt.oconnor@axial.net to learn more.