How Coronavirus Is Impacting Lower Middle Market M&A Activity

Last week, Axial convened a virtual roundtable of members to review the impact of the coronavirus pandemic on lower middle…

Tags

“Digital marketing is the wave of the future for private equity,” says Melissa Frederick, Marketing Director at Clearview Capital. “This is the direction we’re going in.”

Today’s capital providers are using digital marketing in combination with traditional marketing to engage their audience and attract leads.

“We focus on brand building to raise our firm’s profile,” says Eric Starr, Partner at middle-market capital provider CapX Partners. “That can be both digital and traditional marketing — whether it’s a table at a conference, or giving away branded merchandise, or hosting a dinner, or sending out mass emails, or writing a blog post. We want people to know that if there’s a need consistent with what we do, that we are there. We want them to know it because we’re in their face all the time — in an informative and unobstructive way.”

A sample set of activities — both traditional and digital — a capital provider might engage in. (Note that you don’t have to do all these activities or everything simultaneously.)

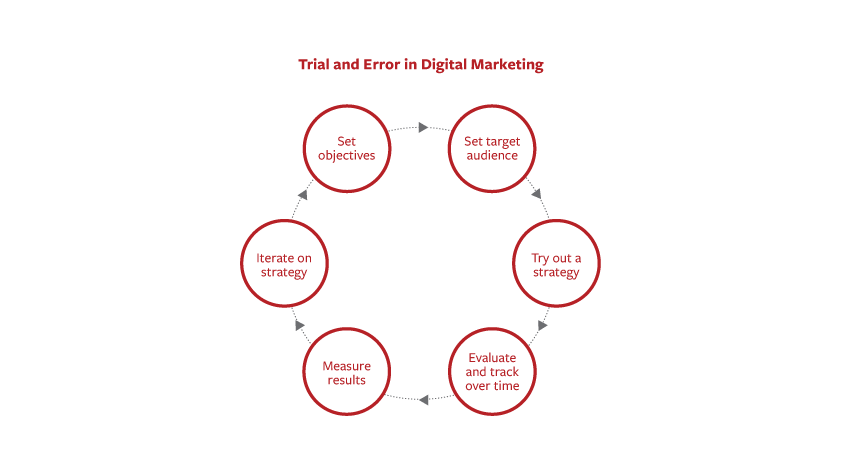

“It’s largely trial and error,” notes Lisa House, partner at marketing communications agency Williams and House, which works with clients in the financial services sector. “You don’t have to go full bore. Instead, be selective about what you decide to do, understand how to measure and evaluate progress, then move on.”

“A lot of times it’s easier to talk about tactics,” says House. “It’s easier to have a conversation about, well, I think I should do email or be on social media.”

But what’s more important is your objective. “Is it more calls in the door? Is it paving the way for you to be able to make a warm call to somebody? However you want to define that goal, then we look at what are the strategies to meet those objectives, and what tools do you use to do that?”

This question is fundamental to developing an effective digital marketing strategy. House says most people will answer “the people I work with.” But that’s too vague.

The more homework you can do to define your target audience, the easier it will be to determine what the best routes are to reach them.”

For example, for middle-market capital provider CapX Partners, “our main audience is people we provide capital to,” says partner Eric Starr. This includes PE-owned businesses. “We have an extensive network of PE groups and bankers to whom we reach out and engage.”

CapX also targets companies, but this is a secondary audience, given that there are millions of potential businesses to reach out to vs. a few thousand investment firms.

How you evaluate success again depends on your objective. “Each individual digital marketing tool has measurements you can look at specifically,” says House. For example, one firm’s goal may be “sheer reach” (in which case they might look at email opens or website traffic), while another is looking to get a specific message to a highly targeted audience (in which case they might focus on keyword rankings).

“Return on investment is important to us,” says Starr. But evaluating the efficacy of digital marketing isn’t as simple as sending out 100 emails and getting 2 deals closed. “That would be nice, but it’s not generally how it works.” That sort of straightforward measurement flies in the face of the whole notion of brand building. Digital marketing requires longer-term insights.

When measuring dealflow, Starr cautions, remember:

One of CapX Partners’ marketing goals is to improve their ranking for target keywords. “It’s a multistep process,” says Starr. “We incorporate these terms into different webpages and blog posts and other content that we put into the marketplace.”

Axial’s free Deal Sourcing ROI Calculator is an Excel template that helps you identify the highest-impact actions that lead to closed deals.