How Coronavirus Is Impacting Lower Middle Market M&A Activity

Last week, Axial convened a virtual roundtable of members to review the impact of the coronavirus pandemic on lower middle…

Tags

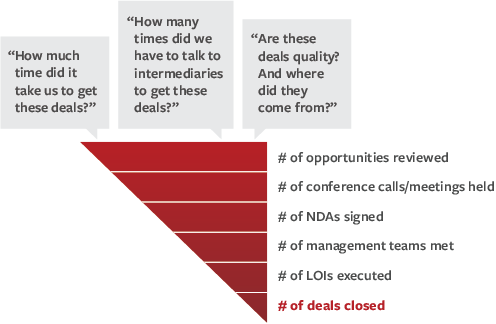

When it comes to tracking deal metrics, many private equity firms invest the majority of their time and energy into the bottom of the funnel. It’s natural to think about done deals. But the top of the funnel is where it all starts — you can never do a great deal if you don’t see it, to begin with.

We spoke with Gretchen Perkins of Huron Capital Partners, Rachel Hannon of Summit Park, Linda Cutler of Empire Valuation Consultants, and Istvan Nadas of IGH Holdings (a subsidiary of Dunes Point Capital) to find out which top-of-the-funnel metrics help them assess the health of their business development efforts. Here are three metrics they measure:

We’ve all heard the phrase “time is money,” but do private equity firms really behave like this is true?

As painful as it may be, it’s important to identify the more time-consuming activities among employees at the firm since payroll is the major fixed expense of any deal sourcing and business development operation. Doing so gives you a true understanding of your fully loaded deal sourcing costs and often leads your team to identify inefficiencies in your sourcing process and make common-sense changes.

“Too many investors don’t really think about how much money is spent on deal sourcing, all in, and what the quantifiable results are from those efforts,” says Charles Muhlbauer, a business development consultant with Axial. “Best-in-class business development teams analyze and optimize for cost-efficiency when it comes to deal sourcing.”

Tracking these metrics can help dealmakers develop strategies to use their time more efficiently. For example, after analyzing the amount of time the firm was spending on educating deal sources on their offerings, Linda Cutler, Director of Marketing at Empire Valuation Consultants decided to create a new set of marketing assets. “I realized that people just don’t know what we can offer. So we decided to illustrate it,” says Cutler. “We created a speedy way to give people a very clear picture as to where we fit [in the marketplace].”

Especially in the middle market, “the universe of intermediaries is huge and it’s always turning over, and it is important to allocate time efficiently,” says Istvan Nadas, Senior Analyst at IGH Holdings (a subsidiary of Dunes Point Capital). Business development teams segment intermediary communication into different categorizations depending on their needs. Among the most effective categorizations are industry, type, and location:

Regular communication is often the key to being top of mind for great deals, but you also want to respect the investment bank’s time and process. Be sure that your message is tailored and personal — and remember that while you’re tracking touch points like a salesperson would, you’re also building a relationship.

“Quality trumps volume every time when it comes to deal flow,” says Nadas. As such, it’s important to have a firm-wide definition of the term “quality” and to be sure that deals meet that standard.

To access quality, “We look at whether [the company] is a platform or add-on fit, control or non-control, meets the minimum EBITDA requirements, how it performed in the last downturn, and if it has a steady track record for growth,” says Perkins. Once the firm has confirmed its viability, it moves forward in the process.

Tracking sources for deals that meet the firm’s specific quality thresholds and definitions allow investors to make much more informed decisions about business development activities in the months and years to come. “[We track] deal sources with whom we have invested the most time (management visits, valuations, primary research, etc.), and the outcome of the participation in those processes,” says Hannon.

Those who track these metrics regularly work more efficiently as a firm and close more deals.