The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

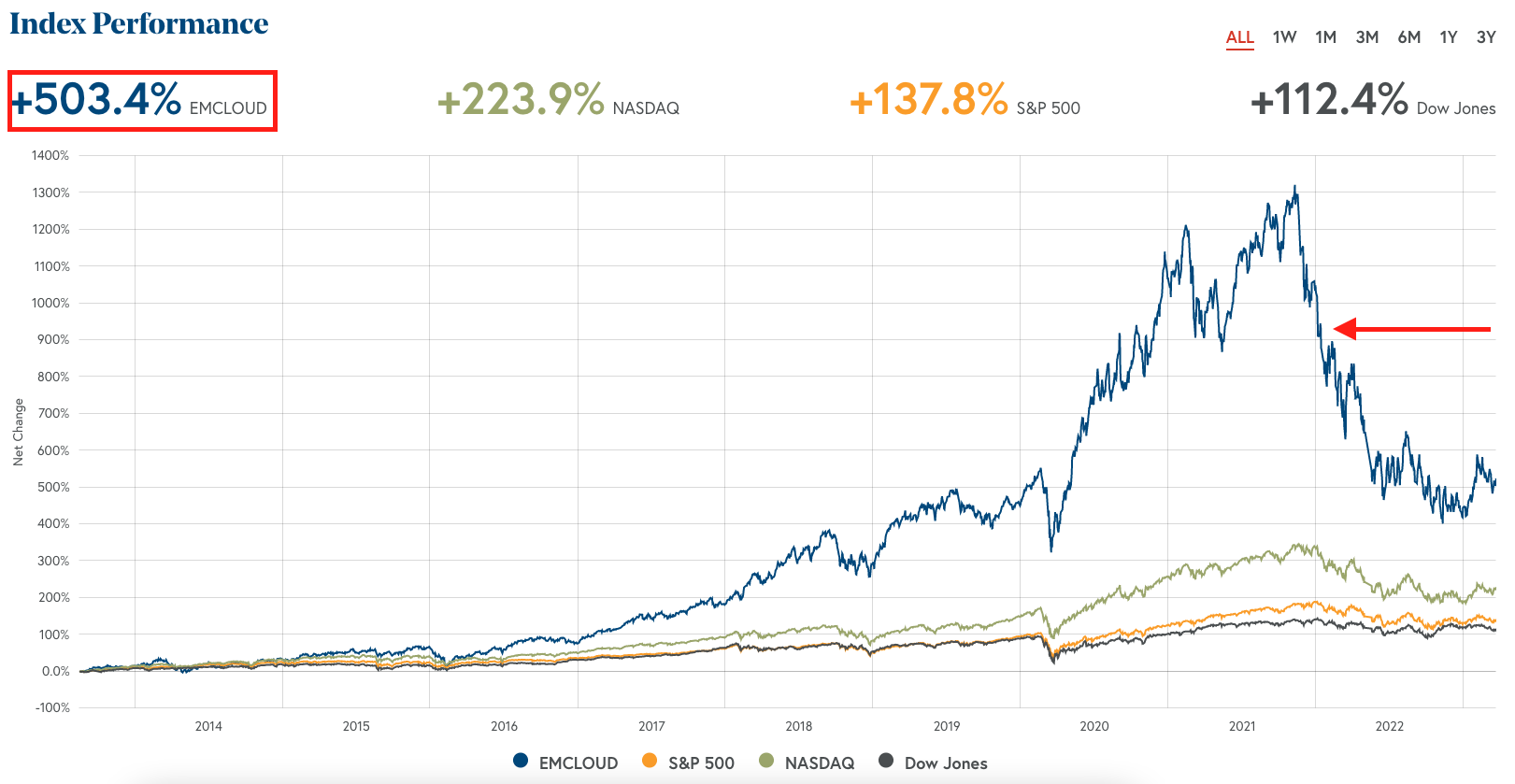

Look at “Cloud Software’s” incredible 10-year run. The category enjoyed incredible growth in overall size, market capitalization, and equity performance. Then the music stopped…

Major changes in interest rate policy and other macroeconomic factors are forcing software operators and SaaS investors to question how much of cloud software’s success and value creation is simply a zero interest rate policy (ZIRP) phenomenon.

This is Part 2 of Axial’s 2023 software M&A outlook in partnership with its Top 50 members in the software space.

The first part of our survey findings were published on March 23rd, and surfaced the current challenges and opportunities in a changing software market. In this second part, we explore the perspectives of the top 50 software members on leading and lagging sub-sectors, deal activity, and acquirer performance in 2023. Survey questions included:

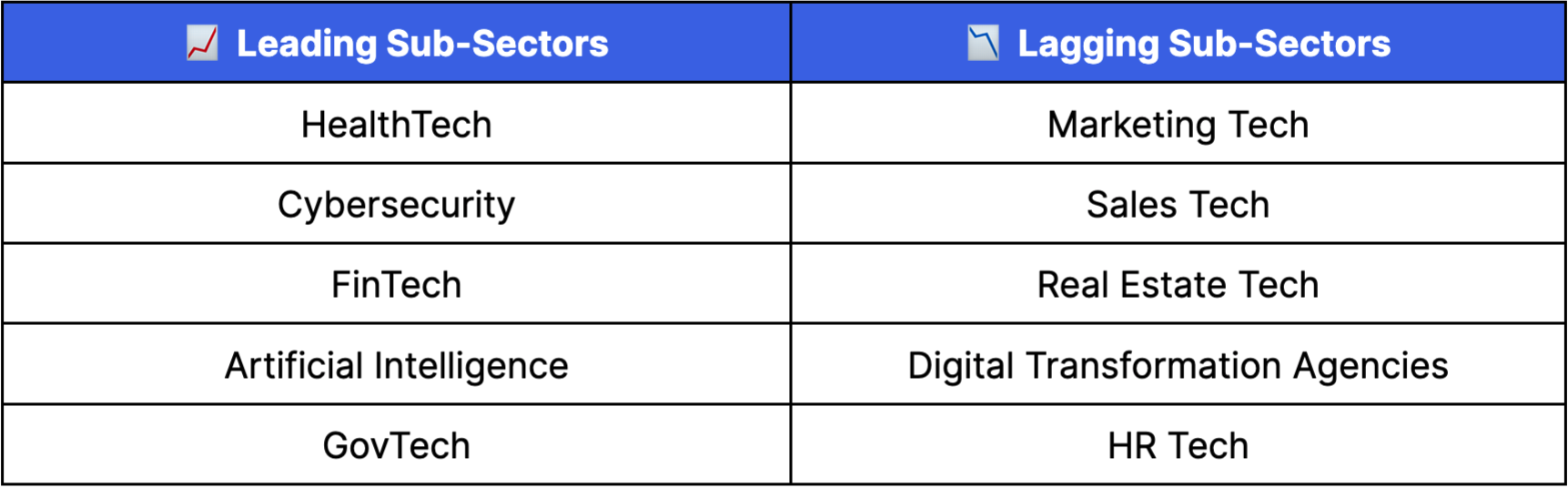

Leading Sub-Sectors: A Tale of Recession Resistance and Financial Stability

Cybersecurity, HealthTech, FinTech, Artificial Intelligence, and GovTech are the most appealing sub-sectors for M&A interest in 2023. According to Scott Mitchell of Investment Bank SDR Ventures, the most performant sub-sectors fall into two categories: “horizontal software that supports core business operations, the common operating environment or spend reduction, and vertical software in industries that are less prone to cyclical end-markets.” All 5 of the sub-sectors highlighted above share these traits.

HealthTech, FinTech, and GovTech are performing particularly well as they are less prone to cyclical end-markets. Michael Bolotin of TechStart says that “businesses in attractive sectors (e.g. cybersecurity, gov-tech, health-tech, fintech) that are relatively resilient to the macro environment, and have a clear path to profitability” will continue to be in high demand.

According to Muhammad Azfar of Auctus Capital Partners, HealthTech and Cybersecurity should remain strong “due to the essential nature of their services.” Stan Gowisnock of Focus Investment Bank, who is particularly bullish on Cybersecurity, called the sub-sector “a proven software solution” that is “better positioned to weather continued volatility in the market.”

The explosive interest in Artificial Intelligence is continuing to make its way into lower middle market M&A, and remains a leading sub-sector due to its mission critical nature. Stemming from Scott’s point above, AI applications are an example of software that is used to support core business operations and process sensitive information, where downtime can have significant implications. Stan Gowisnock of Focus Investment Bank, mentions that “AI tools that can be used with existing platforms is the area that presents the most opportunity for deal flow.”

Lagging Sub-Sectors: A Tale of Cyclicality and Capital Dependency

Marketing Tech, Sales Tech, Real Estate Tech, Digital Transformation Agencies, and HR Tech were the least appealing sub-sectors for M&A interest based on survey responses. Their discretionary and cyclical nature are the primary traits that sway away their demand from software acquirers.

Marketing Tech, Sales Tech, and Digital Transformation Agencies are having a particularly challenging time given their discretionary nature. Scott Mitchell of SDR Ventures characterizes them as “products that support what might be considered discretionary spending.” Scott adds that “digital transformation is being viewed by some companies as ‘discretionary’ as they buckle up for tighter budgets this year. This is causing some softness in new opportunities for suppliers of software products and services.”

Sharing Scott’s sentiment, Ryan Khan of Atlasview Equity mentions that “a lot of cyclical companies are out of favor given the macro environment.” He also adds that “any sub-sector that is considered discretionary is facing the tough challenge of meeting the end customers’ budget,” and “any business in need of high investment of capital is facing a tough economic battle.”

Survey responses indicate that a robust buyer’s market is in store for 2023. One of the factors driving buyer strength is the diminishing access to capital for software companies. Martin Magida of Berkery Noyes feels that “as more companies find their capital raising options limited, buyers will be presented with attractive opportunities earlier than they may have a year ago.”

Many acquirers are strategically sitting on the sidelines, or are participating selectively due to the lowering quality of software assets. Ambarish Gupta of PE firm, Basis Vectors, mentions that “buyers are waiting for the market to bottom out,” and for valuations to depress further. Ryan Khan of PE firm Atlasview Equity foresees software acquirers “being pickier for platform deals.”

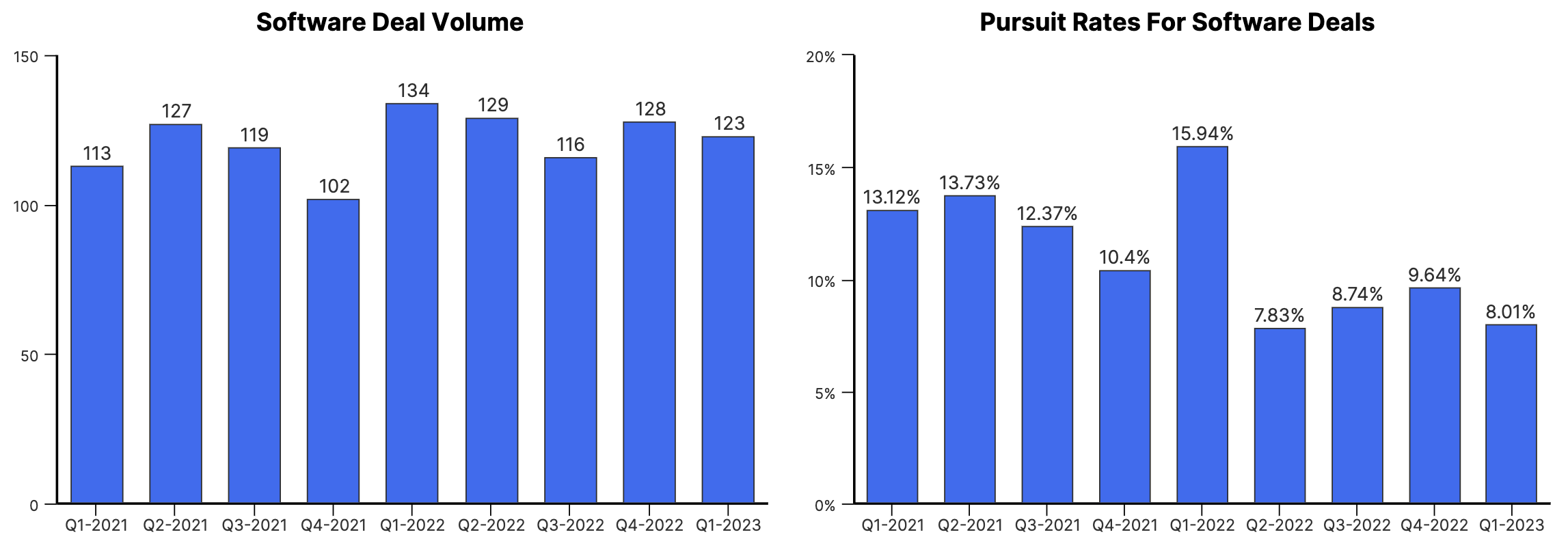

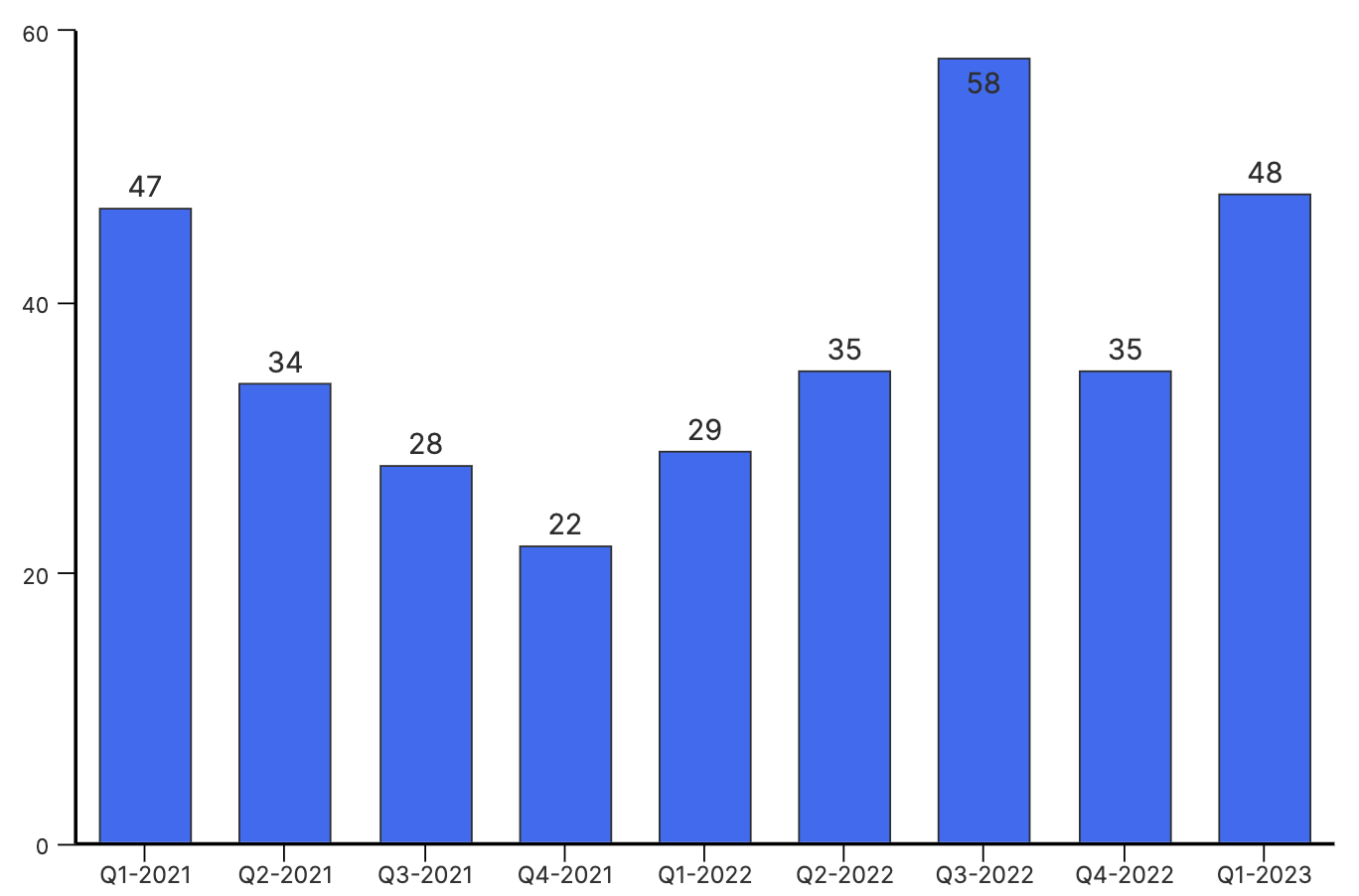

Source: Axial Platform Data

Source: Axial Platform DataAxial’s deal activity within the software space affirms this trend of buyer selectivity. The rate at which acquirers voiced interest in deals, which we characterize as their “pursuit rate,” decreased by 40-50% in the final three quarters of last year, and has continued in Q1 ‘23.

As a result, acquirers that choose to transact in today’s market are facing less competition. Stan Gowisnock of Focus Investment Bank alludes to this and comments, “The robust seller’s M&A market we saw from late 2020 through early 2022 will likely not be seen again for some time. Within the Technology sector, [active] buyers will likely have more leverage in future processes as the total pool of buyers shrinks.”

Acquirers with a deep bench of capital sources or strong balance sheets are predicted to be the most active in 2023 based on survey responses. According to Martin Magida of Berkery Noyes, those with “a good balance sheet or supporting sponsors are in the catbird’s seat.”

With large reserves of undeployed dry powder, private equity firms are in an ideal position to transact in today’s shifting market. Michael Bolotin of TechStrat, feels that private equity firms, in particular, “can take advantage of capital reserves and depressed valuations, despite having to finance deals with more equity than usual.”

In a market where retaining customers and growing organically is harder than ever, private equity firms are taking advantage of inorganic growth opportunities for portfolio value creation. Matt Tortora of BMI Mergers & Acquisitions expects 2023 “to be a year highlighted by a lot of add-on acquisitions in the private equity space.” Ryan Khan of Atlasview Equity also believes that the current market condition “presents a good environment to opportunistically pursue a buy-and-build strategy.” Ryan adds that software acquirers may be “willing to risk more by pricing in operating synergies for add-on deals”.

John Norton of ACT Capital Advisors foresees that “well capitalized strategic buyers can find good deals that will help them to grow.” Increasing market share, accessing new markets, and diversifying products continue to remain the core objectives, but strategics may also increasingly rely on acquisitions to source new talent. Acqui-hires of unsuccessful startups will allow acquirers to gain access to expertise and skill sets that might otherwise be harder to obtain economically via traditional hiring practices. “Startups that never took off might be purchased by large tech companies to up-level talent,” says Matt Althauser of Polychrome.

Takeaways For Software Operators

Despite the recent slow down, not all acquirers are sitting on the sidelines and waiting for valuations to depress further. In fact, many strategic acquirers and private equity backed portfolio companies are looking for recession-proof businesses with desirable IP or talent. “Defensive and recession-proof businesses are in favor, while a lot of cyclical companies are out of favor given the macro environment,” says Ryan Khan of Atlasview Equity. The companies that operate in sub-sectors that are prone to cyclical end-markets will experience challenges as customers buckle up for tighter budgets this year. They will likely be forced to wait before going to market for a sale, or accept the reality that they can find an acquirer, just at a depressed valuation.

The resulting scarcity in the market can naturally help sellers of businesses that are more resilient to the macro environment. Matt Tortora at BMI Mergers & Acquisitions remarks, “because some companies are waiting out the storm before going to market there is some scarcity in the market which naturally helps would be sellers.”

In either case, the responsible operators interested in exploring a sale should have a sound understanding of the relevant buyer universe.

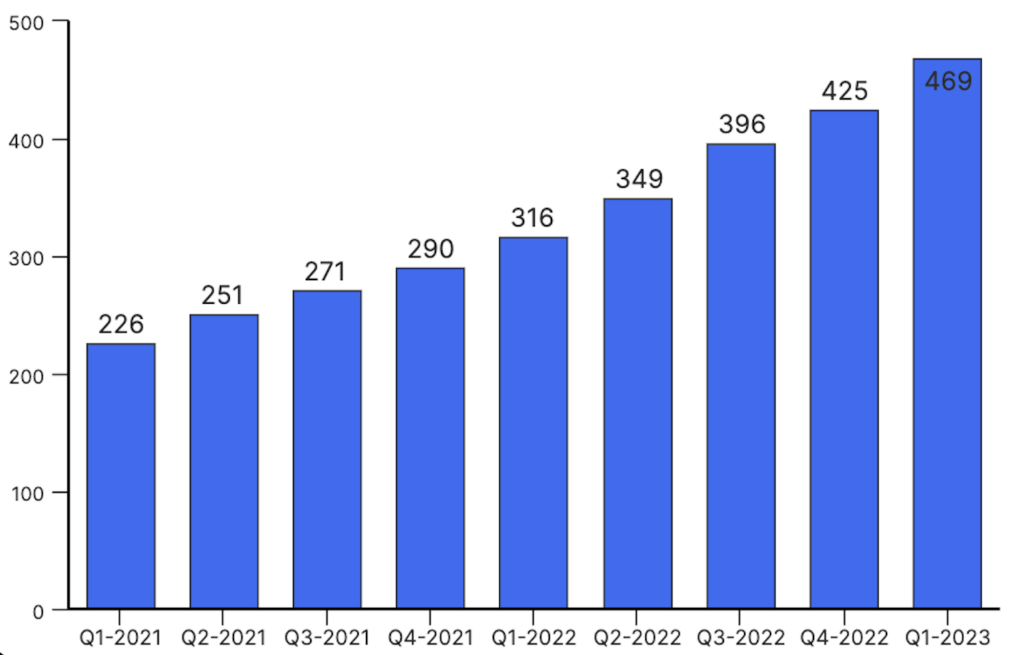

Axial’s universe of active acquirers sourcing software opportunities has doubled since 2021. Through our curated recommendations, many operators have been able to pinpoint the right capital partner for their businesses. If you’re interested in learning more about how business owners are cultivating these relationships on Axial, click here.

Takeaways For Acquirers

As we approach a robust buyer’s market in 2023, acquirers with strong balance sheets or supporting sponsors will continue to have more leverage. Given that many of their counterparts are sitting on the sidelines and waiting for the market to bottom out, acquirers who are actively participating in today’s market will benefit from lower competition. Strategics acquirers, in particular, are in an ideal position to make acquisitions that can allow them to economically obtain desirable IP or talent.

Private equity firms, on the other hand, have the ability to opportunistically source add-on acquisitions for portfolio value creation. Acquirers with portfolio companies in ‘lagging’ sub-sectors can benefit by finding deals with lower valuations. Meanwhile, acquirers with portfolio companies in ‘leading’ sub-sectors can benefit from being a part of the small subset of companies that can command a high valuation.

In the current environment, augmenting deal flow is the key to success for active acquirers. Acquirers need to see more deals in order to ultimately identify those that are good opportunities at good price points.

Software acquirers’ increased focus on business development and differentiated deal sourcing channels is apparent in Axial platform data. While some acquirers may be more selective in today’s environment, we’ve continued to witness steady growth in new acquirers who are sourcing software investments. If you’re interested in learning more about how investors are sourcing deals on Axial, click here.

Axial’s Top 50 software list was generated based on a weighted formula leveraging private transaction data from the Axial platform.

Metrics in the formula include: