Small Business Exits: May closed deal data

Welcome to the May edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Finding the right acquirer for a business can be the most challenging task in M&A.

For advisors, the thing that has the highest impact on the success of a closed transaction is the strength of their buyer list. Building a top-notch buyer list can single-handedly help one investment bank win a deal over another.

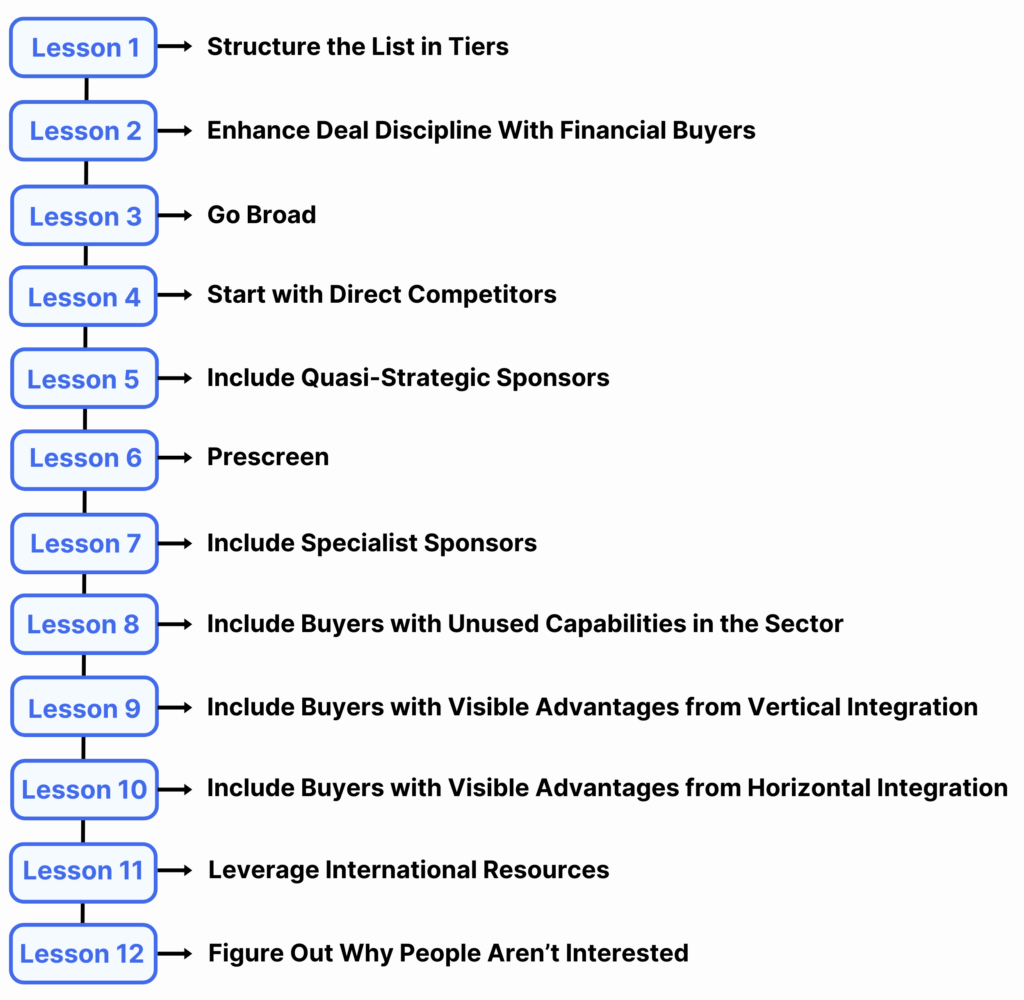

The 12 lessons outlined below provide tips and best practices for constructing an effective buyer list.

Set the list up in tiers arranged by buyer likelihood.

When building a buyer list, it is almost always a good idea to include financial sponsors and not just limit it to strategics. Why?

Bankers should go as broad as possible when putting together the buyer list. Here’s why.

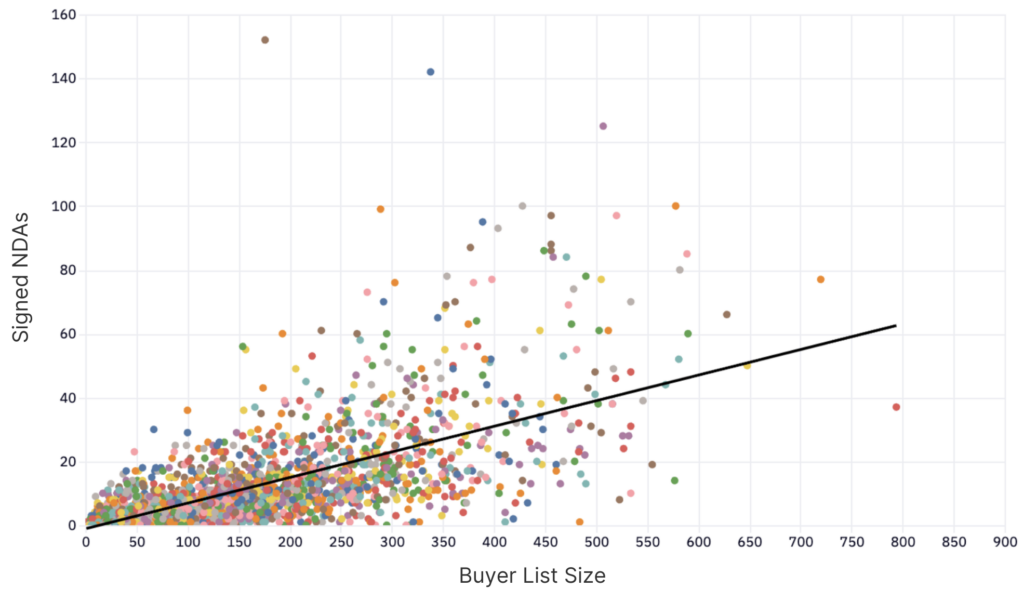

Buyer Lists and Signed NDAs

With the idea of going broad, we looked at the correlation between buyer list size and signed NDAs. Below is a snapshot of deals shared on the Axial platform in 2023.

When looking at the average buyer list size at certain benchmarks, we found that the larger the list, the more initial interest you’ll receive from buyers. For example, the average list with 100 names generated an average of 11 signed NDAs, and the average list with 400 names generated an average of 39.

Deal motives and synergies are the two most important things to consider when building a buyer list. The greater the need for an asset, the more a buyer will be willing to pay. The greater the synergies involved in a consolidation, the more they’ll be able to pay. Competitors are likely to rank near the top of the list on both the motives and synergies scales.

A quasi-strategic sponsor, or a “hybrid strategic,” is a financial buyer who owns a related business. This is the most valuable financial buyer to have on the buyer list. These buyers behave like strategics in the acquisition process, often have a high degree of interest, and can pay more.

Here are a few questions to ask in the prescreening stage.

Specialist firms allocate all their attention, time, and resources to one or a few sectors. This niche aptitude is almost always a benefit in a sell-side process. Even if a financial buyer has just one investment professional dedicated to a particular industry, at least one person has spent time learning the space, building industry relationships, and probably closing similar transactions.

There’s a lag between when a sponsor raises a fund and when it finds an appropriate investment opportunity in a particular industry. As a result, there are periods during which funds will have experts in a specific sector who aren’t using their expertise in the field.

A few benefits:

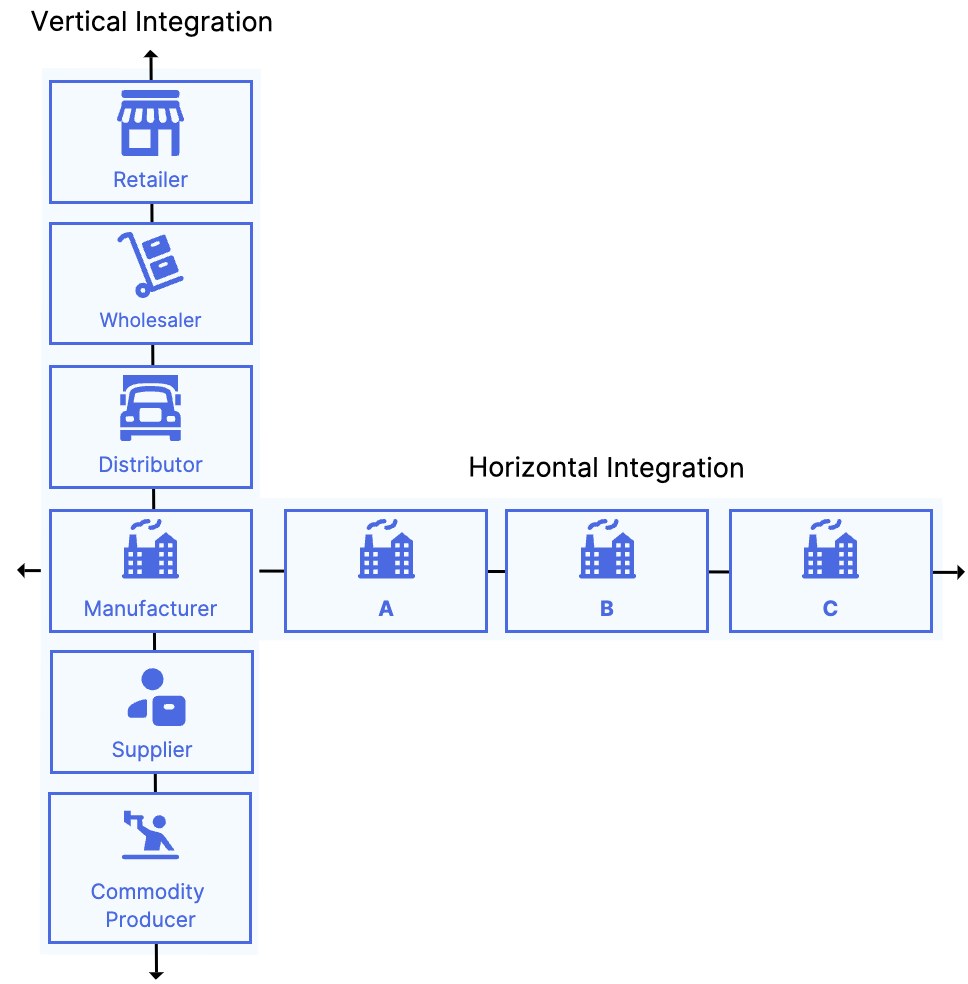

Vertical integration is an investment strategy where a company streamlines distribution by buying companies at various supply chain stages. Horizontal integration is where a company merges with or acquires companies in the same industry.

The best buyers are often industry participants with a strategic interest in integrating backward into the supply chain. If the asset represents an opportunity for either efficiency or financial benefit, an acquisition will be both more enticing and more justifiable for that buyer.

Buyers interested in horizontal integration can also add significant value to the process. An acquisition that allows a buyer to integrate horizontally (in the same industry) will often reduce costs, increase economies of scale, and improve market share.

The most agile funds and intermediaries find a way to form partnerships with international professionals. Working with these global partners helps introduce potential buyers and gain local market feedback on a buyer’s readiness for acquisition.

The fact of the matter is there will always be people who are not interested. The key is to find out why. If something about the company makes it unattractive to buyers, it’s important to know moving forward. Take the opportunity to connect with those declining the deal to understand the reasoning. Their feedback may uncover a flaw in the messaging and change the outcome of the process.

To read more on each lesson above, download the eBook below.

NOTE: This information does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.