The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Axial is excited to release our Q3 2025 Lower Middle Market Investment Banking League Tables.

To compile this list, we reviewed the deal-making activities of 400+ investment banks and advisory firms that met the qualifications to be considered for league tables last quarter.

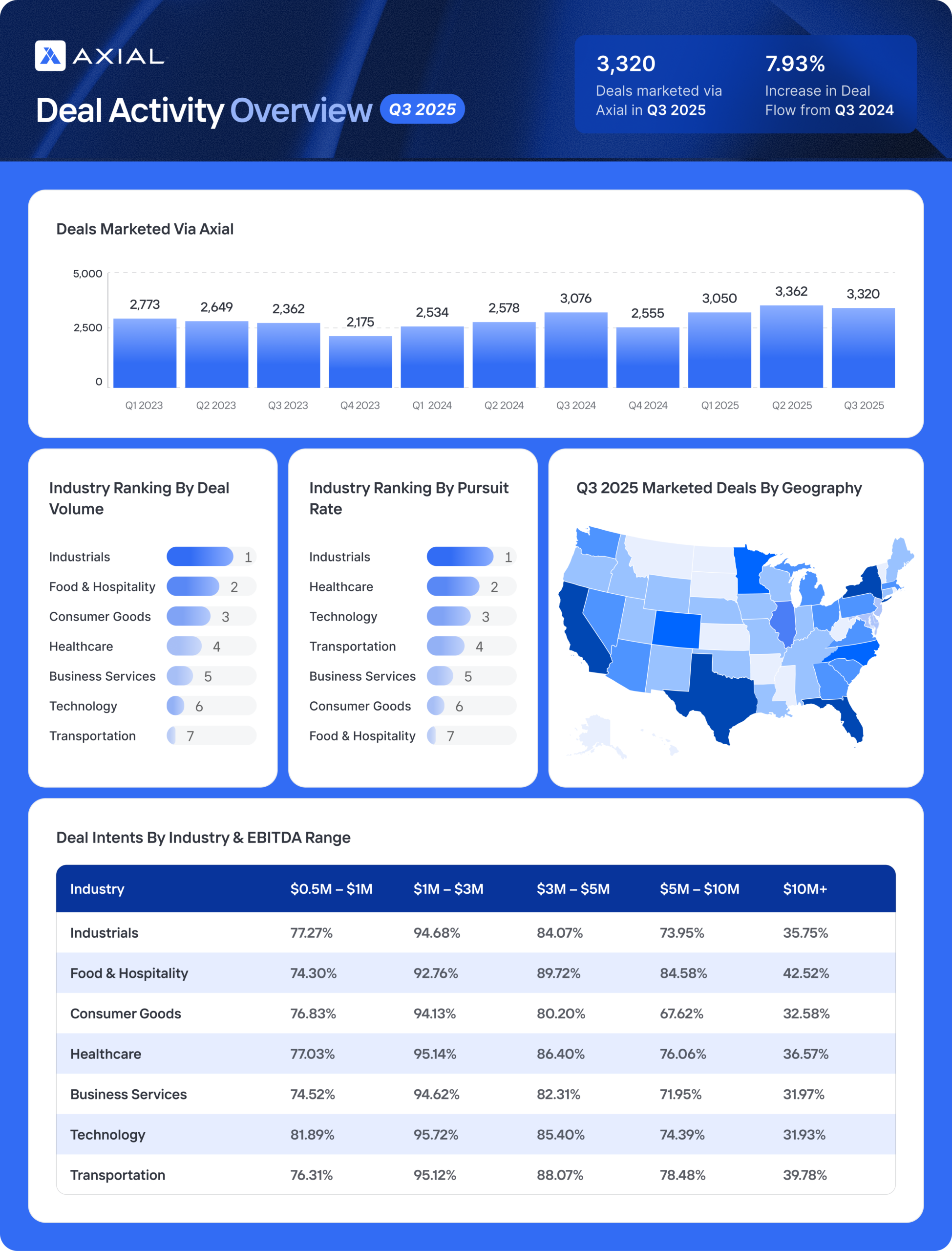

We saw 3,320 deals come to market in Q3, a 7.93% increase from the same time period last year and the second-highest quarterly total on record. See below for an overview of last quarter’s deal activity. If you’re interested in diving deeper, check out the latest issue of Axial’s The SMB M&A Pipeline, which surfaces a top-of-the-funnel breakdown of the deal activity, sorted by industry category.

Today’s 25 featured firms collectively marketed 140 deals via Axial last quarter. Those deals matched with 58,732 recommended buyers and received a total of 3,543 buyer pursuits, generating an average pursuit rate of 14.80% — a strong indicator of deal quality among these firms.

Deal Intent: A project created by a buyside member on Axial to signal the types of businesses they are actively looking to acquire or invest in, based on criteria like industry, size, and geography. Based on the specified range, deal intents can fall into multiple EBITDA buckets (e.g., $1M–$4M falls into both $1M–$3M and $3M–$5M).

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is primarily driven by four factors:

Congratulations to these investment banks and M&A advisory firms for their dealmaking achievements!

| Rank | Firm | Member Since | Most Common Industry | HQ |

|---|---|---|---|---|

| 1 | Peakstone Group | 2010 | Consumer Goods | Chicago, IL |

| 2 | Founder M&A | 2024 | Industrials | Burleson, TX |

| 3 | The Advisory | 2024 | Industrials | Beverly Hills, CA |

| 4 | Hill View Partners | 2022 | Industrials | Providence, RI |

| 5 | Madison Street Capital | 2011 | Industrials | Austin, TX |

| 6 | MidCap Advisors | 2009 | Business Services | New York, NY |

| 7 | Vercor | 2009 | Industrials | Atlanta, GA |

| 8 | Golden Circle Advisors | 2017 | Industrials | Suttons Bay, MI |

| 9 | Ardent Advisory Group | 2014 | Transportation | Scottsdale, AZ |

| 10 | Cornerstone Business Services, Inc. | 2009 | Industrials | Green Bay, WI |

| 11 | OffDeal | 2024 | Industrials | New York, NY |

| 12 | Protegrity Advisors | 2014 | Industrials | Ronkonkoma, NY |

| 13 | Sunfield Advisors | 2016 | Technology | Raleigh, NC |

| 14 | Tower Partners | 2016 | Industrials | Columbia, MD |

| 15 | Embarc Advisors | 2020 | Technology | West Hollywood, CA |

| 16 | ACT Capital Advisors | 2009 | Industrials | Mercer Island, WA |

| 17 | Cross Keys Capital | 2014 | Consumer Goods | Fort Lauderdale, FL |

| 18 | Jahani & Associates | 2019 | Technology | New York, NY |

| 19 | The Bloom Organization | 2023 | Healthcare | Miami, FL |

| 20 | SovDoc | 2025 | Healthcare | Los Angeles, CA |

| 23 | TREP Advisors | 2021 | Industrials | Sarasota, FL |

| 22 | FourBridges Capital Advisors | 2014 | Industrials | Chattanooga, TN |

| 23 | A Neumann Associates | 2009 | Industrials | Atlantic Highlands, NJ |

| 24 | IBG - International Business Group | 2010 | Industrials | Denver, CO |

| 25 | Premara Group | 2020 | Technology | Lehi, UT |

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Visit Peakstone Group’s Profile

“At Founder M&A, we are a dynamic advisory firm specializing in sell-side transactions across diverse industry sectors, with decades of transactional expertise that has enabled our seasoned team to orchestrate numerous deals in the lower-middle and middle markets successfully.

Our approach is grounded in a proven formula for success, carefully tailored to guide business owners and leaders through the complexities of the transaction journey. With a focus on facilitating deals for businesses with annual revenues ranging from $5 million to $250 million, Founder M&A ensures smooth transitions and optimal outcomes for all parties involved.”

“We are an investment bank representing business owners and operators navigating the process of selling their company. We primarily advise middle market “add-on” businesses during the sale process to one of the 4,500+ private equity companies that own “platforms”. We specialize in helping businesses in Skilled Trade, Consumer Services, and Medical Services connect directly with top private equity buyers, not just local brokers. Our team creates competitive bidding environments by leveraging deep relationships with leading private equity platforms to maximize your company’s value.”

“Hill View Partners, Founded in 2016 by Arthur Petropoulos and headquartered in Providence, Rhode Island, provides Mergers & Acquisitions and Capital Advisory services to privately held family, entrepreneur, and small investment group-owned companies generating $1 million to $10 million in EBITDA (or Pre-Tax Cash Flow)

We help companies sell/exit their business or a unit of their business and find/source capital, whether that be traditional bank financing or more creative sources for purposes of growth, acquisitions, partial monetization, or any other strategic reason.

Hill View Partners brings the tenure and wisdom of $1 Billion+ of transaction experience to support and work alongside businesses and owners. We understand and appreciate the complexities of our clients’ enterprises, and we unwaveringly espouse to our motto of doing good work for good people.”

Visit Hillview Partners’ Profile

“Madison Street Capital is an international investment banking firm dedicated to the highest standards of integrity and professionalism. We provide corporate financial advisory services, mergers and acquisitions expertise, valuation services, and financial opinions to publicly and privately held businesses through our offices in North America, Asia, and Africa.

Our professionals draw on specialized expertise to partner with middle-market firms across all industry verticals and niche markets, achieving optimal outcomes through a variety of transactions. Madison Street Capital’s professionals precisely analyze each client’s needs to determine the best match between buyers and sellers, arrange cost-effective financing, and produce capitalization structures that maximize each client’s potential. Madison Street Capital is a trusted partner and industry-leading provider of financial advisory services, M&A assistance, and business valuations.”

Visit Madison Street Capital’s Profile

“MidCap Advisors, a middle market investment bank headquartered in New York, specializes in mergers and acquisitions, corporate finance, capital raises, ownership transition planning, business valuations, and negotiation support services for companies generating $5 million to $250 million in revenues.

A business owner’s definition of success is multi-faceted. For some, it is selling a business for maximum value. For others, it is affecting a smooth transition of ownership to key employees or family members. And for others, the question has not been fully answered yet. That’s why our experienced and knowledgeable advisors created and adopted a 360-degree approach to help business owners identify and accomplish all of their goals. MidCap Advisors also represents corporations, private equity firms, and investors who are seeking to grow through acquisition.”

Visit MidCap Advisors’ Profile

“VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Our team manages the entire process – business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal.

VERCOR brings national and international resources to the job of selling a business in the mid-size market. VERCOR merger and acquisitions consultants provide worldwide resources usually available only to companies with revenues in excess of $100,000,000. VERCOR serves business owners who are interested in: selling all or part of their business, private equity recapitalization, and management buyouts.”

“Golden Circle Advisors is an investment bank with a unique and unwavering commitment to exclusively serving the lower middle market. With a strategic focus on this often underserved segment of the business landscape, GCA brings a tailored approach to meet the distinct needs of small and mid-sized enterprises. As a dedicated partner, the firm leverages its broad network of funding relationships and a comprehensive suite of financial solutions to empower businesses in the lower middle market. Through a blend of high-touch personalized service, utilization of cutting-edge technology data platforms, and thorough execution of tailored financial strategies, Golden Circle Advisors stands at the forefront of championing the optimal potential of all served.”

Visit Golden Circle Advisors’ Profile

“Ardent Advisory Group is a privately-held, independent investment bank that provides strategic advice and execution on mergers and acquisitions. Our team’s diverse background as advisors, industry executives, and investors provides a unique and broad understanding of the industry’s financial, regulatory, and competitive landscape. We have deep sector-specific relationships and experience, making Ardent Advisory Group a trusted advisor of choice. Ardent Advisory Group believes in 100% alignment with client success. Over the last few years, Ardent Advisory Group has grown into one of the West’s premier investment banking firms by providing its clients extensive transaction experience, in-depth industry knowledge, and access to key investor relationships.”

“Cornerstone Business Services is a boutique investment bank serving the lower middle market of mergers & acquisitions. We’re based in the Midwest but work throughout North America, and are a founding member of the Cornerstone International Alliance. We create value through acquisition searches, company sales, and valuations, focusing on businesses with annual revenue of $5 million to $150 million.

Cornerstone uses a team approach on each transaction along with our proprietary Assurance 360™ process, which typically generates multiple offers, has a high likelihood of closing, and maximizes value. We work really well with first-time sellers that value an advisor’s role and want to ensure the largest financial transaction of their life is done right.”

“OffDeal is the world’s first AI-powered investment bank helping businesses in the $1-10M EBITDA range exit at premium prices. Our expert bankers leverage proprietary AI technology to provide its clients an effective and streamlined M&A service.

OffDeal is backed by top technology investors including Y Combinator and Radical Ventures, and has raised over $17M in venture funding to date.”

“Protegrity Advisors is a leading M&A advisory firm focused on lower middle market transactions for companies with revenue ranging from $10 million to $100 million. With a management team averaging over 25 years of transactional experience, we have a proven track record of successfully closing deals with public and private companies and private equity firms across the U.S. and internationally.

Our reputation for representing highly sought-after clients attracts a wide range of buyers, and our extensive network, proprietary database, and dedicated research team position us to deliver exceptional results with speed and precision.”

Visit Protegrity Advisors’ Profile

“With a combined experience of 125 years, we are an influential Mergers and Acquisitions (M&A) advisory firm dedicated to helping our clients gain exposure to the right audiences. Through a combination of strategic sell-side and buy-side advisory, we possess the knowledge and experience to facilitate successful business transactions. We have extensive and successful experience working with businesses owned by both new and established entrepreneurs.

As entrepreneurs ourselves, it is inherent for us to offer guidance to fellow entrepreneurs in the field of M&A. The partners at Sunfield have a history of buying and selling companies, which is fundamental to our success as advisors.

We are committed to delivering an experience that is authentic, intelligent, and efficient.”

Visit Sunfield Advisors’ Profile

“Tower Partners is a leading Private Investment Bank and Advisory Firm providing premier service to the middle market. Our team of industry veterans has advised sell-side and buy-side engagements with over $15 billion in value for entrepreneurs, family-run businesses, and financial sponsors.

We are a national firm with a global reach, supporting clients throughout the United States with headquarters in Columbia, MD, and offices in Baltimore, MD, Denver, CO, and New York, NY.

Our entrepreneurial roots and years of experience have solidified our will to charge forward when others might quit. “

“Embarc has a unique model that bills hourly like a law firm with no success fee, aligning its incentives more closely with sellers. This approach enables us to deliver high-quality, high-touch services to a select number of deals rather than chasing multiple transactions simultaneously, ultimately resulting in a much lower overall cost when a deal is consummated.

The team is comprised of professionals with experience at leading firms such as Goldman Sachs, McKinsey, Credit Suisse, and PwC, as well as from private equity and corporate development roles—reflecting Embarc’s belief that buyside experience is essential for effectively advising on sell-side transactions.”

Visit Embarc Advisors’ Profile

“ACT Capital Advisors has been helping owners sell their businesses since 1986. Through hundreds of transactions, we’ve developed a strategic process that’s highly effective in closing deals. Unlike other M&A companies that hand you off to various specialists throughout the stages of a sale, you’ll work with one team at ACT, a group of hand-selected individuals familiar with your industry. They’ll be with you from start to finish, working toward your goals and looking out for your best interests.”

Visit ACT Capital Advisors’ Profile

“Cross Keys Capital has offices in Fort Lauderdale, Florida, and Chicago, Illinois. With a team of more than 20 professionals, we provide our clients with a full suite of investment banking advisory services, including sell-side and buy-side M&A, recapitalizations, restructurings, and capital raising. At the onset, we perform comprehensive diligence and analyses on our clients to identify key deal factors, including the quality of the management team, the stability and track record of the business, the strength and testing of the company’s financial profile, and its competitive positioning.”

Visit Cross Keys Capital’s Profile

“Jahani and Associates (J&A) is a privately held investment bank headquartered in New York City. J&A specializes in the intangible assets of the healthcare and technology verticals. The firm provides capital advisory, mergers and acquisitions (M&A) advisory, and management consulting services to clients all over the globe.”

Visit Jahani & Associates’ Profile

“A leading investment bank specializing in healthcare mergers and acquisitions. With closed transactions representing more than $10 billion in market capitalization, our leadership team of professionals has developed unmatched relationships with healthcare providers and industry professionals. We understand that healthcare, more than any other industry, requires a deep understanding of the strategic value of both buyer and seller.”

Visit The Bloom Organization’s Profile

“SovDoc is a growth and M&A advisory firm, focused specifically on private practices & healthcare companies. SovDoc takes a data-driven approach to M&A and growth advisory, helping entrepreneurs value their businesses, grow profitability, and prepare for future exits. SovDoc leverages deep financial expertise, industry insights, and a rigorous execution process. Whether you’re scaling your practice, preparing for a sale, or securing strategic capital, the SovDoc team ensures every step is optimized for maximum value.”

“TREP Advisors is an advisory firm focused on succession solutions for business owners. At TREP Advisors, we know you want to be an owner who understands the future options for your business. To do that, you need a succession plan that fulfills your desires and addresses all the issues of estate planning and taxes. The problem is that you are so busy running the company that you feel confused about how to address succession planning issues.

We believe every owner is truly unique and that your succession plan is the single most important business decision you will make to achieve the freedom you deserve. We understand the struggles and opportunities you face every day because we have walked in your shoes, which is why we have been able to help owners like yourself sustain control over their business while liquidating equity in their business for financial security.”

“FourBridges Capital is an investment banking firm that serves business owners across the Southeast. We act as the interface between our clients and the capital markets, helping them to identify potential investors or acquisition targets and successfully complete transactions. Our senior professionals draw on both expertise in investment banking and experience as C-level executives, having spent most of their careers serving the middle market.”

“A Neumann & Associates, LLC is a professional mergers & acquisitions advisory firm that has assisted business owners and buyers nationwide for over 20 years in the business valuation and sales process. ANA has a team of trusted professionals with a deep knowledge base in all aspects of the business transfer process. Our company has an A+ Better Business Bureau Rating for 20 years in a row, and has performed over 5,000 business valuations through multiple field offices along the East Coast.”

“IBG Business exists to bring clients the best of the best skills and knowledge that deliver maximum value when they are ready to sell or buy a business. The firm is defined by a distinctive character and shared values, and by a continuous commitment to deliver business owners the very best in M&A services.

Our hands-on M&A experience with privately held middle market businesses is broad and deep. IBG Business was founded by combining the expertise, resources, and best practices of industry leaders in the mergers and acquisitions (M&A) profession and owners of top M&A advisor firms from across the country. We bring owners the strengths of earned credibility and respect our founders brought into IBG at inception, and have worked diligently to maintain in each relationship.”

“Our mission is to help business owners maximize their outcome during a liquidity event. As operators with a combined 25+ years of experience running all sizes of businesses, we are uniquely positioned to help business owners with sales and financial operations early in the process all the way through to the closing of a transaction. We utilize technology and specialized services to implement the best solutions for our clients.

Our primary focus is on lower middle market transactions in the high-tech and e-commerce space. Our team of advisors has experience running the types of companies we represent. This means we understand the nuances of acquiring or selling a business. We have experience running large teams in Fortune 100 organizations and early-stage startups with less than 10 employees.”

Unlike traditional league table structures that have remained unchanged for years, where firms are assessed based on deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down-funnel effectiveness for their clients.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those that work with the most in-demand clients, balance breadth, selectivity, and accuracy in the buyers they engage, and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.