How to Value a Technology Company: A Guide for Business Owners

Valuing your technology company is a good way to see if your business is exit-ready. By knowing your company’s value,…

Tags

For business owners, timing a sale is one of the most critical — and most difficult — decisions. Wait too long, and you risk missing a window. Move too early, and you might leave value on the table.

The Federal Reserve’s recent decision to cut rates — and its signaling of more cuts ahead — just changed that timing game.

When the Fed cuts rates, it ripples through the system — lowering the cost of capital across the board.

A one-point shift in interest rates can add millions to the annual financing costs of a mid-market deal. That ripple directly affects what buyers can pay — and what owners ultimately receive at the closing table.

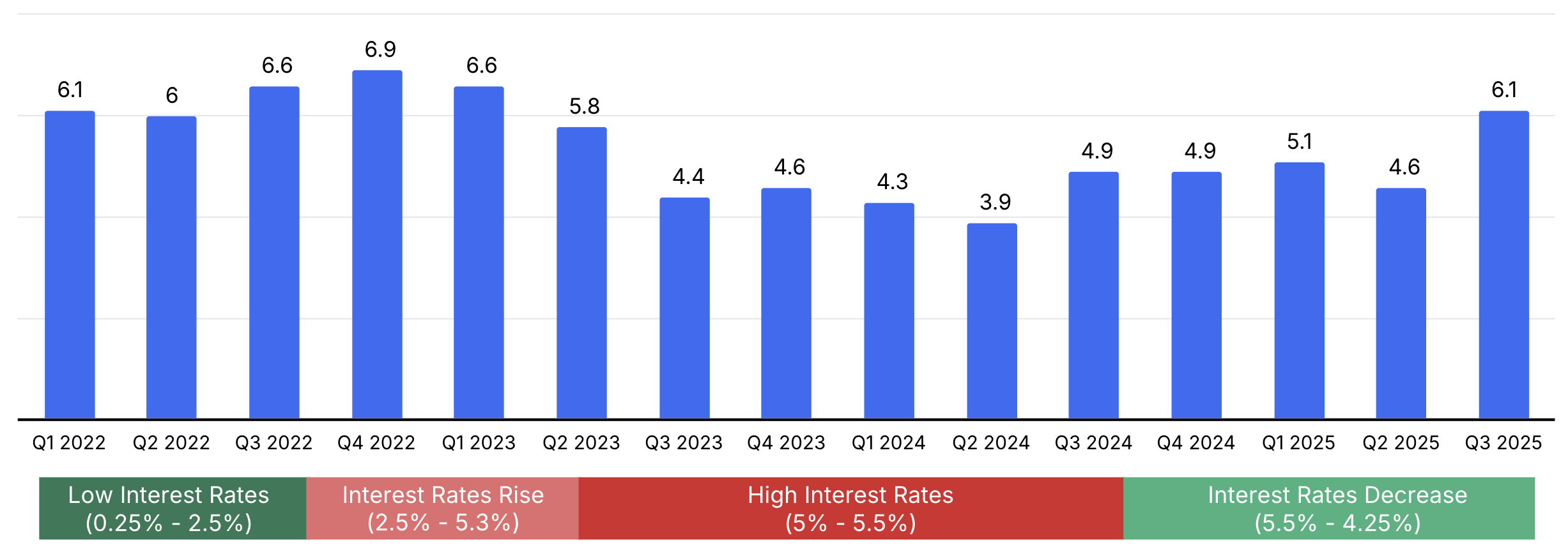

The chart above illustrates the same dynamic for larger businesses with $1M–$5M EBITDA. In 2022, when rates were still low, buyers could stretch to pay 6–7× earnings because cheap debt meant deals penciled out even at higher entry prices. As rates climbed through 2023, financing costs ballooned, forcing buyers to cut leverage and driving multiples down sharply — bottoming out around 4×. Starting in late 2024, as the Fed began easing policy, valuations recovered. Cheaper debt gave buyers more room to pay, and lower yields on safe assets nudged more investors toward private deals, lifting multiples back above 6× by mid-2025.

| Close Date: Q3 2022 | Close Date: Q2 2025 | ||

| Healthcare Recruiting and Staffing Business | Medical Sales Recruitment and Staffing Firm | ||

| Revenue | $8,500,000 | Revenue | $9,400,000 |

| EBITDA | $1,424,000 | EBITDA | $1,400,000 |

| Purchase Price | $12,000,000 | Purchase Price | $5,625,000 |

| EBITDA Multiple | 8.4x | EBITDA Multiple | 4.0x |

This case study highlights just how dramatic the impact of interest rates can be on deal outcomes. In Q3 2022, with borrowing costs still near historic lows, a healthcare staffing business with $1.4M in EBITDA sold for over $12M — an 8.4× multiple. Fast forward to Q2 2025: a nearly identical business with slightly higher revenue and the same EBITDA sold for less than half that amount, at a 4.0× multiple.

The businesses were comparable, but the financing environment was not. With debt far more expensive in 2025, buyers could not justify the same leverage or valuation. For business owners, the takeaway is clear: the same company can command vastly different outcomes depending not just on its performance, but on the broader interest rate backdrop.

When debt is expensive, buyers pull back and valuations soften. When debt becomes cheaper, lenders open up, and buyers underwrite more aggressive purchase prices.

Private equity firms, independent sponsors, and strategic acquirers all benefit from this environment. Even SBA buyers — who lean heavily on prime-rate lending — feel the effect immediately. Every quarter-point cut by the Fed lowers its cost of capital, giving them more room to stretch.

It’s not unusual to see a 25–75 basis point drop in rates translate into half a turn of EBITDA multiple expansion. For an owner, that can mean the difference between a “solid” exit and a “life-changing” one.

Private equity firms are sitting on record levels of dry powder. Strategic buyers — especially public companies — are under pressure to deliver growth amid slowing organic expansion.

For the past two years, many of those buyers waited out high borrowing costs. A Fed pivot is the green light they’ve been looking for. As capital loosens, buyers move quickly to put it to work.

On the other side, many owners delayed their own decisions in 2023–2024. That supply will hit the market in 2026 and 2027. Owners who prepare now will be positioned ahead of the crowd — and in M&A, being early often means stronger leverage and cleaner processes.

Every M&A cycle has “valuation floors” — the baseline multiples that businesses of a given size and profile tend to command. High-rate environments push those floors down.

Rate cuts lift them. For a $1–5M EBITDA business, where multiples had drifted into the mid-4x to mid-5x range, signs are pointing back toward the high 5s and 6s. Strong businesses with recurring revenue, diversified customers, or growth tailwinds are positioned even better.

But these floors don’t stay elevated forever. Once supply floods in, buyers have more choices. Timing your exit to land in this financing-friendly, demand-heavy moment is what captures the premium.

These shifts aren’t just theory — we’ve seen them play out before:

The pattern is clear: rate cuts + buyer demand + limited supply = strong valuations. Waiting until the window is obvious usually means competing with everyone else.

Hiring an advisor in Q4 2025 sets up an ideal timeline:

This timeline aligns with the Fed’s projected easing cycle and a buyer universe eager to re-engage. Just as importantly, it gives your advisor time to run a disciplined process — positioning your company to attract multiple bidders, not just one or two.

Not every owner will find “right now” to be the best timing:

Rate cuts create a powerful tailwind, but they don’t replace the need for strong fundamentals and readiness.

The instinct for many owners is to wait — for valuations to rise a little more, for the market to feel “hot.” But by the time it’s obvious, the crowd is already rushing in.

The best outcomes come to those who anticipate, not those who react. Acting early doesn’t just maximize financial leverage; it also builds emotional confidence. Owners who start preparing now won’t just have better negotiating leverage; they’ll also have peace of mind that they didn’t leave timing to chance.

Selling a business is never just about macro conditions. The fundamentals of your company matter most. But when the external environment tilts in your favor, it creates a tailwind worth riding.

The window is opening. Owners who prepare now — hiring an advisor in Q4 2025, preparing through early 2026, and going to market in the back half of the year — will be positioned to step through it before the crowd.