An In-Depth Guide to Selling a Manufacturing Business (+ Info on Navigating New Tariffs)

In-depth guide to selling your manufacturing business—from valuation and exit prep to negotiation. Plus, how new tariffs may impact your company’s valuation.

The Private Equiteer has today’s great Private Equity post titled “An Introduction To Working Capital” (paywall). From this post, you can navigate to the entire series of posts the Private Equiteer has written on the topic. Working capital issues are crucial to understand, both as an investor and as a business owner/operator.

In the series, the Private Equiteer talks about the importance of understanding working capital from three key perspectives:

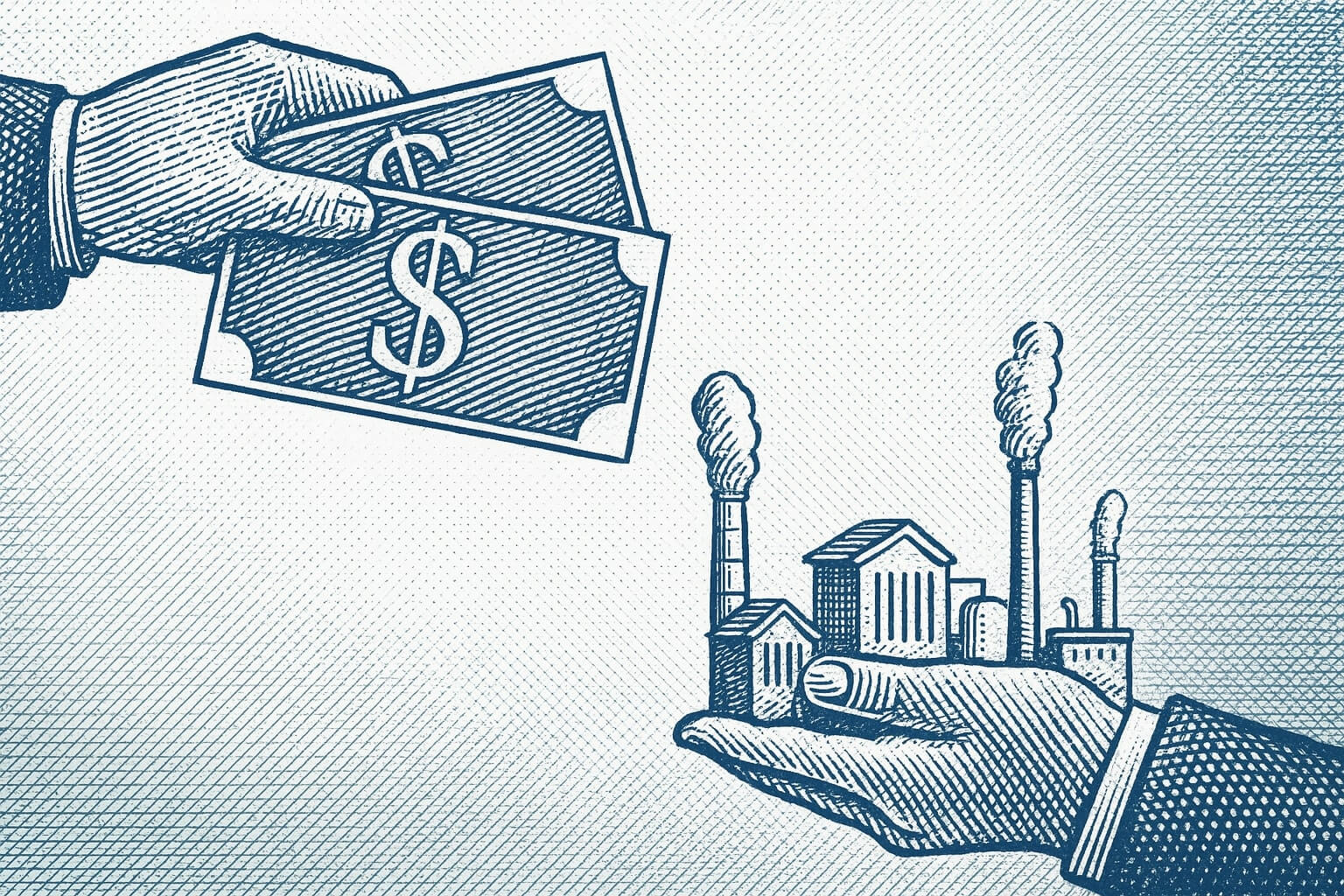

There are two primary ways to define working capital, one which includes cash on your company balance sheet, and the other which excludes that cash. When evaluating a business during an investment or sale process, working capital tends to be analyzed without including the cash figure.

The simplest way to think about working capital is as follows:

If a company has customers that pay on average 3 months but has vendors that they have to pay every month, then the working capital requirements for the company expand as the company grows (not a good thing typically). Now, if the company’s customers pay up front and receive their services in the future, then the company has much lower working capital requirements, because the company’s customers are “funding the business” as it grows.

A great example of this is Amazon.com and their working capital model, which as of 12/31/2009, was generating a significant advantage for them. As you can see, Amazon has $988M in receivables that are owed to them, and they have $5.6 billion in payables, which is money they owe to their suppliers and vendors. This means that Amazon is selling its products to their customers way before they have to pay their suppliers. This is often referred to as a “negative working capital” scenario.