Axial launched its first business broker league table earlier this year, recognizing the Top 25 brokerages delivering exceptional outcomes for business owners in the lower middle market. With today’s release of the 2025 Semi-Annual Business Broker League Table, Axial continues its effort to rigorously benchmark performance, highlight M&A excellence, and celebrate the firms driving results in the sub-$10M deal space.

This league table is separate from Axial’s Lower Middle Market Investment Banking League Table, which will remain focused on the $10M-$100M M&A market.

Axial’s business broker league table ranking methodology (detailed methodology available in the footnotes) is primarily driven by four factors:

- Deal attractiveness (measured by pursuits per deal and total recommended buyers)

- Buyside targeting effectiveness (measured by pursuit rate per deal)

- M&A process effectiveness (sell-side ability to advance buyers from initial pursuit to NDA to CIM)

- Deal competitiveness and final outcome (LOI and close rates)

Congratulations to these M&A brokerages for earning their ranking on the 2025 Semi-Annual Axial Business Broker league table.

Top 25 Business Brokers: 1H 2025

| Rank | Firm Name | HQ |

| 1 | Business Exits | Beverly Hills, CA |

| 2 | Sunbelt Business Brokers | Independence, OH |

| 3 | Transworld Business Advisors | West Palm Beach, FL |

| 4 | Murphy Business & Financial Corporation | Clearwater, FL |

| 5 | Website Closers | Tampa, FL |

| 6 | ProNova Partners | Santa Monica, CA |

| 7 | First Choice Business Brokers | Las Vegas, NV |

| 8 | Calder Capital | Grand Rapids, MI |

| 9 | Raincatcher | Denver, CO |

| 10 | HedgeStone Business Advisors | Syosset, NY |

| 11 | East Coast Business Brokers | Melville, NY |

| 12 | VR Business Brokers | Raleigh, NC |

| 13 | N3 Business Advisors | Mississauga, ON |

| 14 | Quiet Light Brokerage | Mooresville, NC |

| 15 | Business Modification Group | Horseshoe Beach, FL |

| 16 | Bristol Group | Boise, ID |

| 17 | IAG M&A Advisors | Addison, TX |

| 18 | Merge | New York, NY |

| 19 | BayState Business Brokers | Needham, MA |

| 20 | Latona's | Atlanta, GA |

| 21 | Corporate Investment Business Brokers | Ft. Myers, FL |

| 22 | Calhoun Companies | Edina, MN |

| 23 | Inbar Group Inc. | New York, NY |

| 24 | Website Properties | Seattle, WA |

| 25 | Synergy Business Brokers | New Rochelle, NY |

Insights From Top Business Brokers

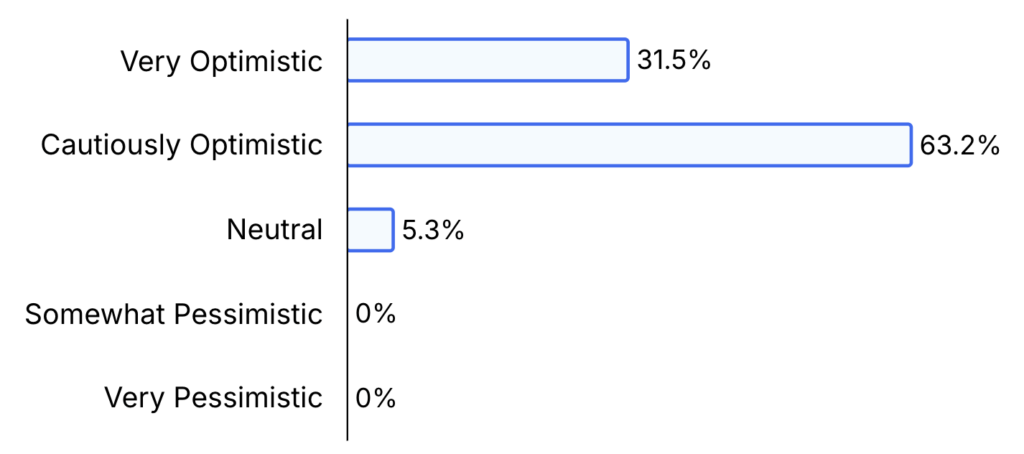

We asked the brokerage firms featured on this list to share insights on 2025 to date, as well as expectations for the second half of the year ahead. The results below reflect not only a positive upswing in deal activity so far this year, but also a cautiously to very optimistic outlook for the remainder of 2025.

2025 M&A Overview: Deal Flow and Deal Dynamics

How would you characterize your deal flow so far in 2025?

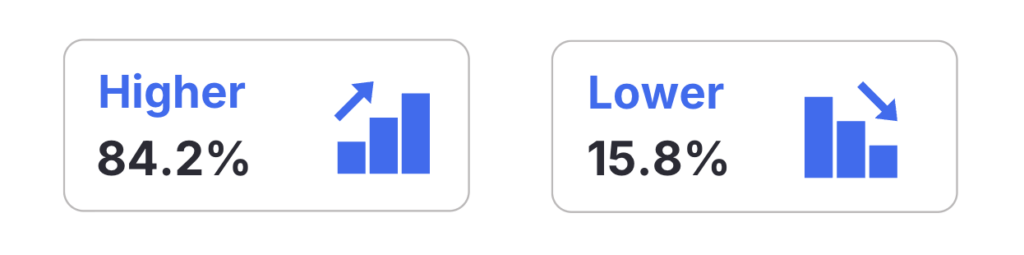

While 21% of honorees said their deal flow is flat or slightly down compared to last year, the majority — 79% — reported an increase in activity, and none indicated a “significant” decline.

All honorees have signed at least 11 sell-side mandates so far in 2025. A third have signed between 11–25, another third between 26–50, and the final third have closed more than 51 mandates. Notably, 22% of brokers have already signed more than 75 mandates in just the first half of the year.

This momentum, however, isn’t without friction. Convincing sellers that now is the right time to go to market remains a major challenge, particularly in such an uncertain environment. And as always, getting deals to the finish line continues to be an uphill battle.

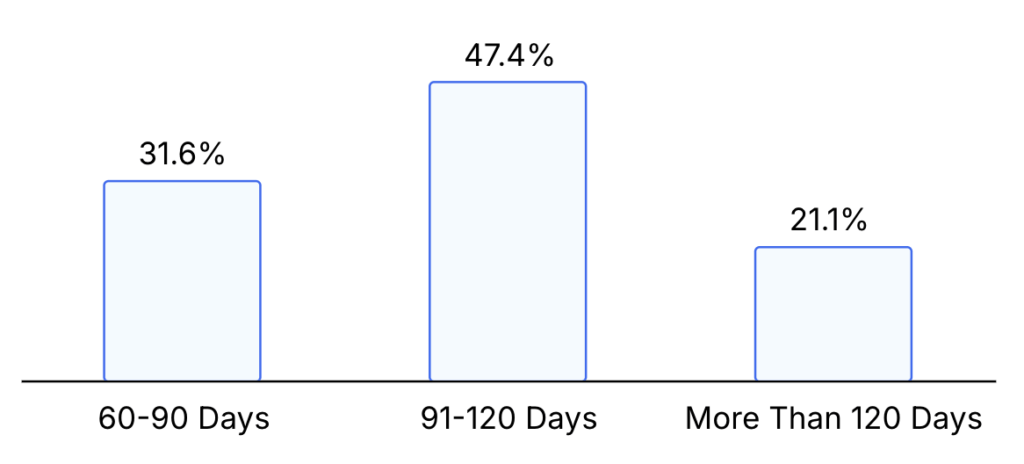

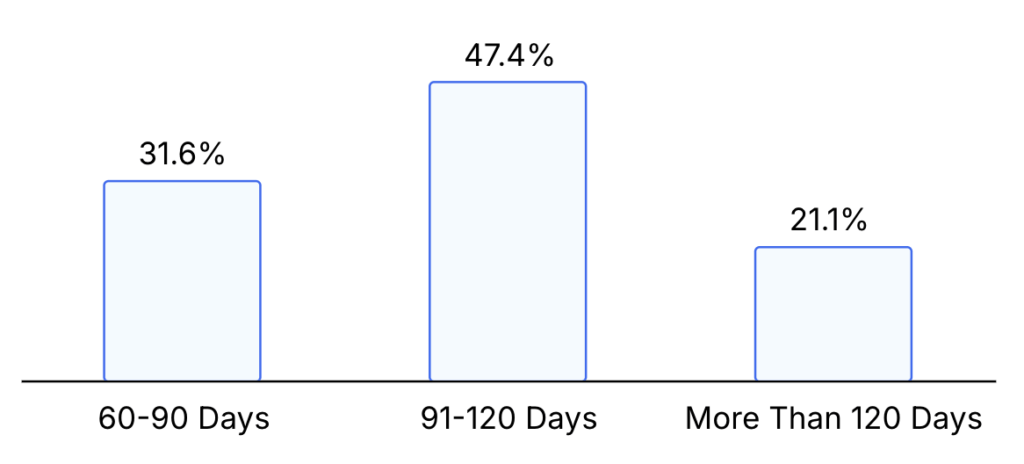

On average, how long is it currently taking to close a deal (LOI to close)?

Whether it’s managing mismatched valuation expectations, navigating tighter credit markets, or adapting to increasingly complex deal terms, today’s sell-side teams have plenty to juggle. Still, despite these challenges, 79% of our honorees and their firms are consistently closing most of their deals in under 120 days.

And when the deals do fall apart, it’s no longer because of inflation, supply chain issues, or labor shortages. Instead, brokers now point to interest rates, cost of capital, and continued geopolitical uncertainty as the top transaction killers in 2025.

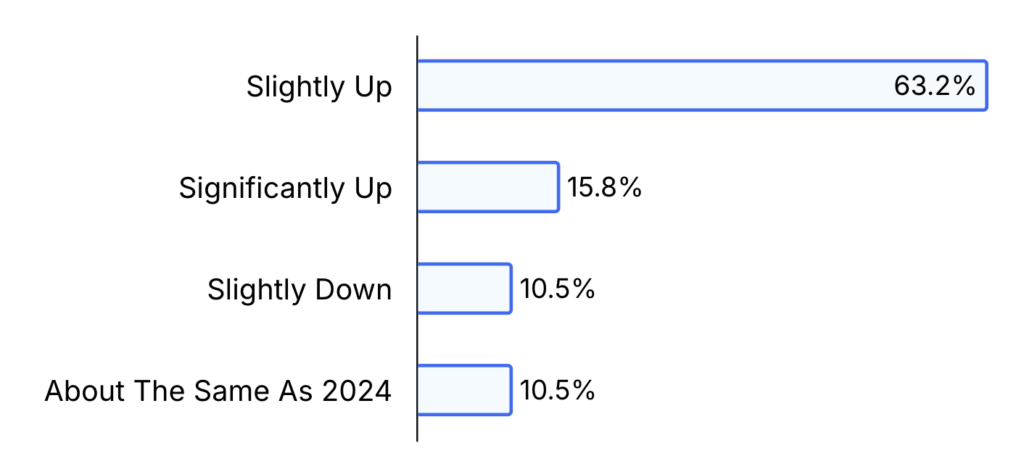

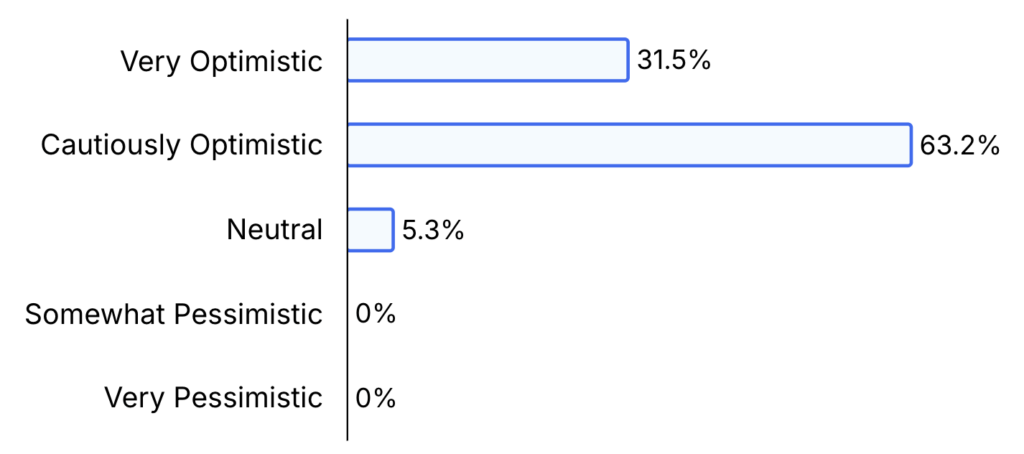

So what does this mean for the next six months? Well, according to Axial’s top brokers, the pros that they’re seeing outweigh the cons. None of Axial’s top brokers expressed pessimism about the second half of the year; while 5% are taking a neutral stance, 63% are cautiously optimistic, and 32% are highly confident that deal activity will remain strong through year-end.

What is your outlook for the second half of 2025?

| Axial Member | Insights |

| Jason Guerrettaz, Website Closers | We are seeing 10-20 offers per transaction. Our focus is on finding the right buyer and a debt/equity stack that has the highest assurance of closing without adjustments to the original offer. |

| Max Friar, Calder Capital | We are way up on closings so far in 2025. Not many are dying. There are various reasons for those that have died but primarily it's performance of the seller's business has faltered. |

| Jason Hullender, IAG M&A Advisors | [Our biggest challenge is] giving Sellers confidence that it is a good time to sell. |

| Bristol Group | [Our biggest challenge is] finding good, quality businesses with enduring profitability as well as owners/sellers that are motivated to sell and willing to be flexible on deal terms. I guess this really isn't any different for 2025. This is what I am always challenged with as a business broker every year. |

Anatomy of the Deal: Valuation, Structure & Diligence

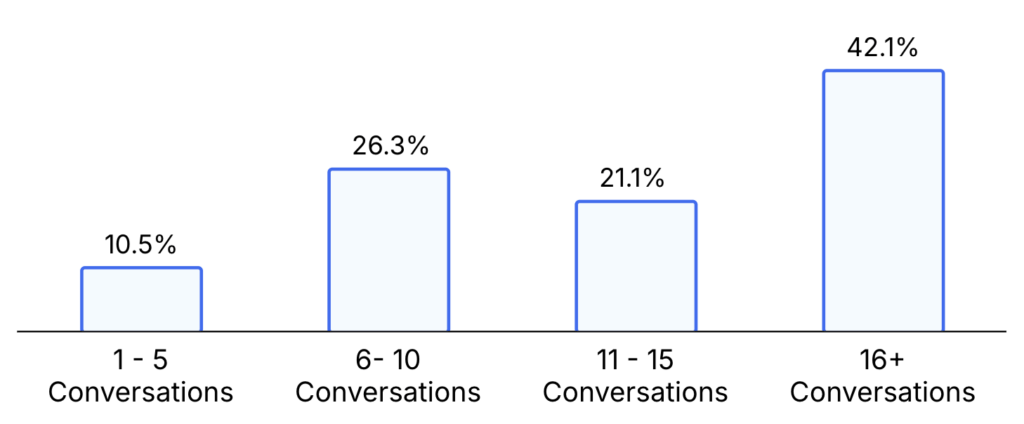

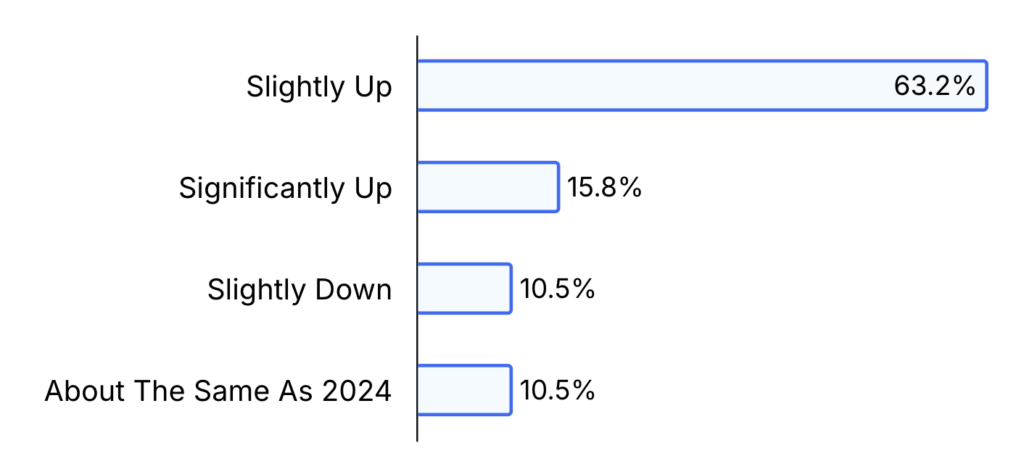

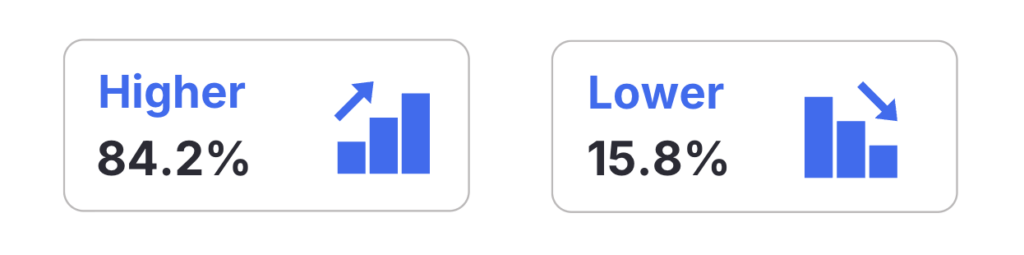

How does your 2025 closed deal volume compare to this time last year?

While deal volume is up and close rates are holding steady, brokers report that the anatomy of the average deal in 2025 is becoming more nuanced—and, in many cases, more challenging.

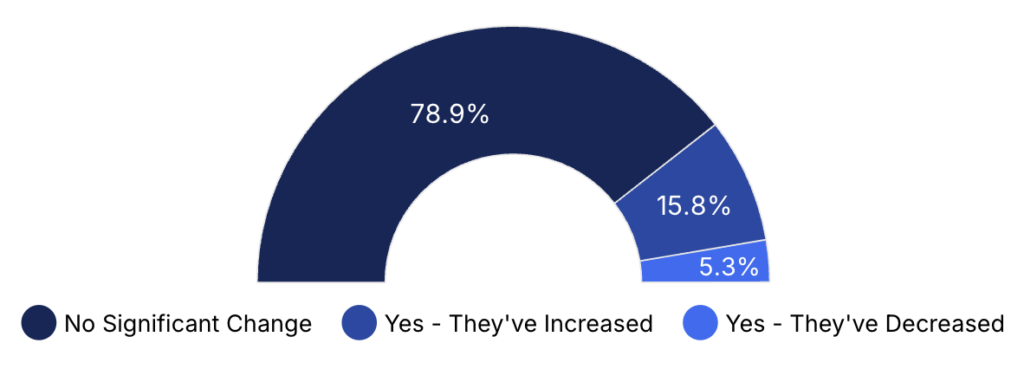

Have seller valuation expectations shifted in 2025?

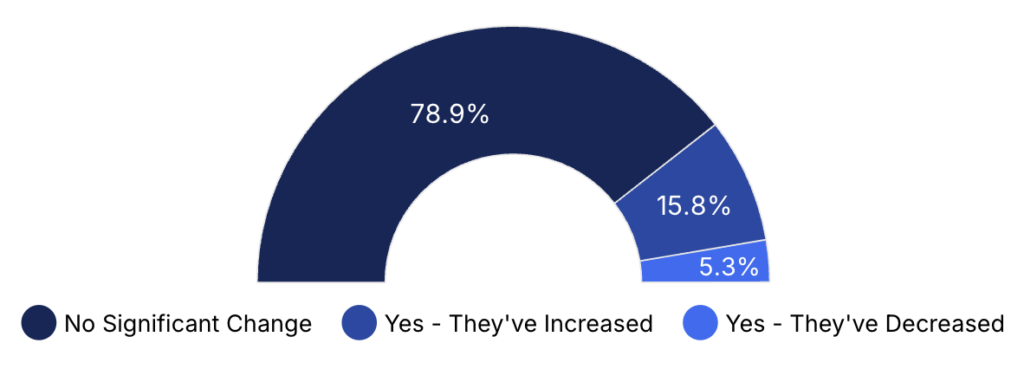

The vast majority (78.9%) of surveyed brokers said seller valuation expectations haven’t shifted meaningfully this year. But for those who have seen a change, the movement has predominantly been upward: 15.8% said expectations have increased, while only 5.3% noted a decrease. Multiple brokers pointed out that resetting unrealistic seller expectations remains a top friction point in today’s market — and in some cases, valuation misalignment was cited as the primary reason a deal died.

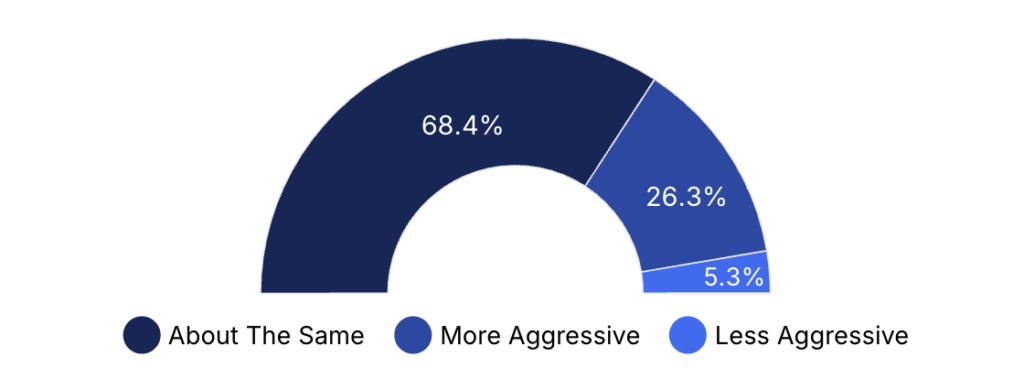

How would you characterize buyer behavior on valuations compared to last year?

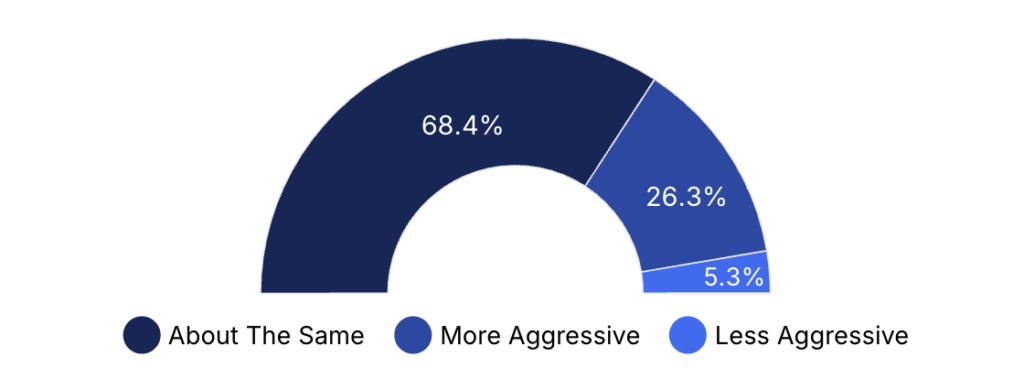

On the buyside, valuation behavior is largely holding steady, with 68.4% of brokers reporting no significant change. Still, over a quarter (26.3%) said buyers are behaving more aggressively on valuations compared to last year, while just 5.3% said they’re seeing buyers act more conservatively.

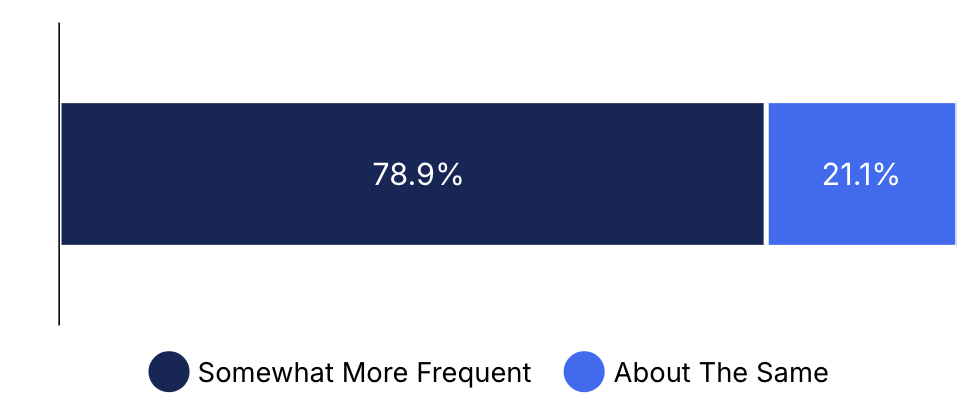

How often are buyers requesting seller financing or earnouts in your 2025 deals, compared to 2024?

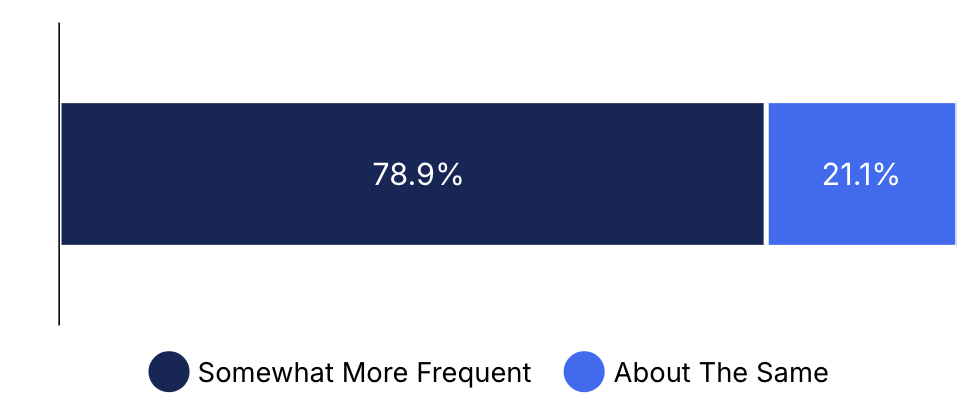

Deal structure is also continuing to evolve. In 2025, 78.9% of brokers said they’re seeing more frequent use of seller financing or earnouts than they did in 2024. The remaining 21.1% reported no meaningful change. Notably, no respondents said those structures are being used less frequently, suggesting a clear directional trend toward more creative structures as buyers seek to bridge valuation gaps and mitigate risk.

The New Diligence Playbook: Longer Timelines, Smarter Tools

Diligence timelines are also shifting. While 47.4% of brokers reported that diligence periods are about the same as last year, 42.1% said they’ve gotten longer, and only 10.5% said they’ve shortened. This extended scrutiny often uncovers red flags that complicate or kill deals — common issues include undisclosed liabilities, customer concentration, and regulatory risks. As buyers dig deeper, deals are increasingly contingent on a seller’s ability to withstand that scrutiny.

Technology is also playing a larger role in the mechanics of getting deals done. Thirty percent of brokers cited internal CRMs as a key driver in improving deal process efficiency, while another 30% said tools like ChatGPT and other AI platforms are becoming integral to their workflows. Deal rooms also received multiple mentions as helpful infrastructure—supporting smoother collaboration, cleaner diligence handoffs, and tighter control over sensitive information.

In a market where volume is strong but certainty remains elusive, valuation alignment, flexible structuring, technological leverage, and comprehensive diligence aren’t just best practices—they’re the critical levers for deal execution in 2025.

| Axial Member | Insights |

| Sarah Grossman, Baystate Business Brokers | Bidding wars are pushing buyers to make offers above their comfort range. Once they dig into the diligence information, they find things they don't like or want to use as an excuse to negotiate a lower price. |

| Hannah Nabhan, Calder Capital | [A common deal killer] Valuation expectations - higher interest rates cause downward pressure on buyers. Sellers anchor themselves to their best year (even if it was 2021) for peak valuations. |

| Donna Byers, Latona's | [A common challenge is] buyers asking for more seller financing and [a common deal killer is] buyers expecting more seller financing. |

| Jason Thomas, Raincatcher | Market pressure is separating the prepared from the reactive—those with a growth plan in place are the ones preserving valuation multiples. |

Buyer Behavior: Who, What, and How Are They Getting Deals Done?

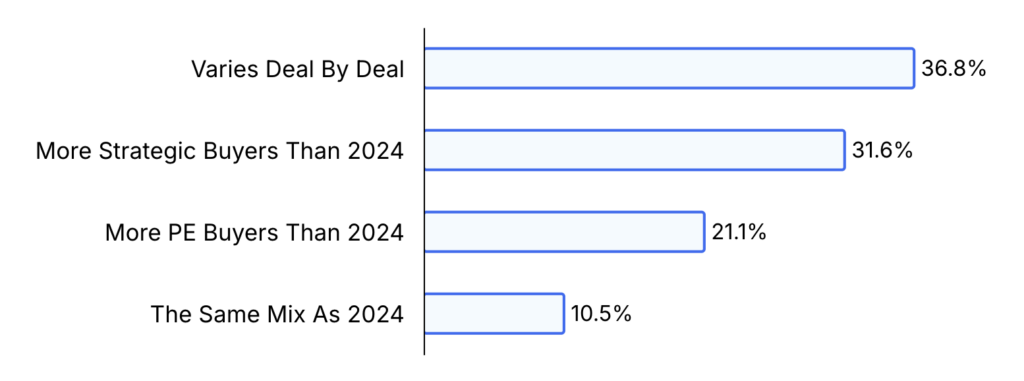

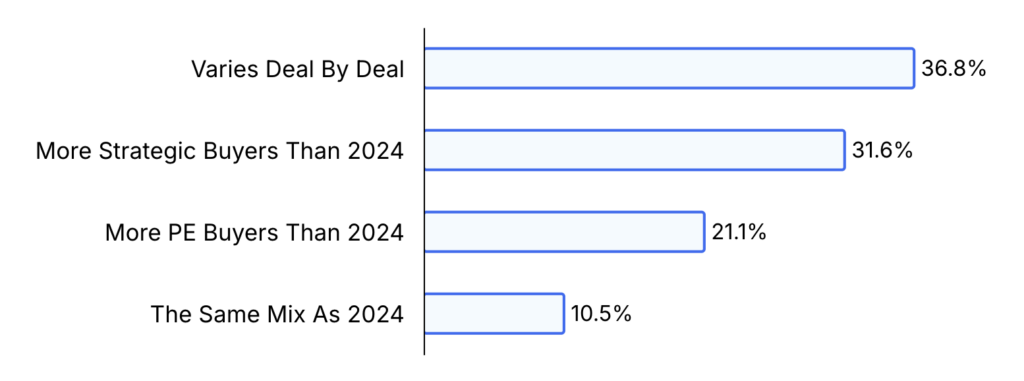

How has the mix of private equity vs. strategic buyers shifted in your 2025 deals compared to 2024?

Sizing Up the Seller: Expectations, Readiness & Reality

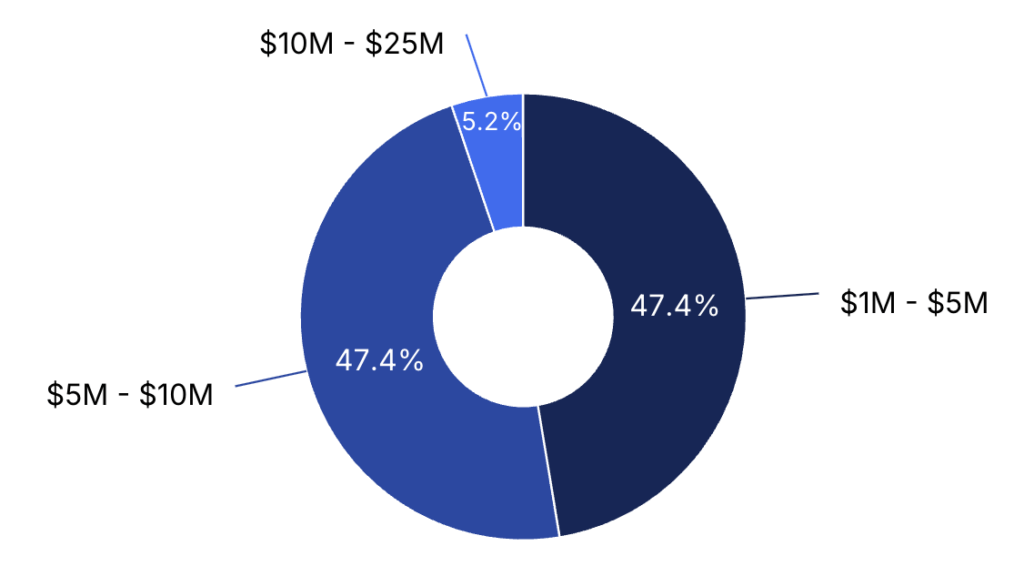

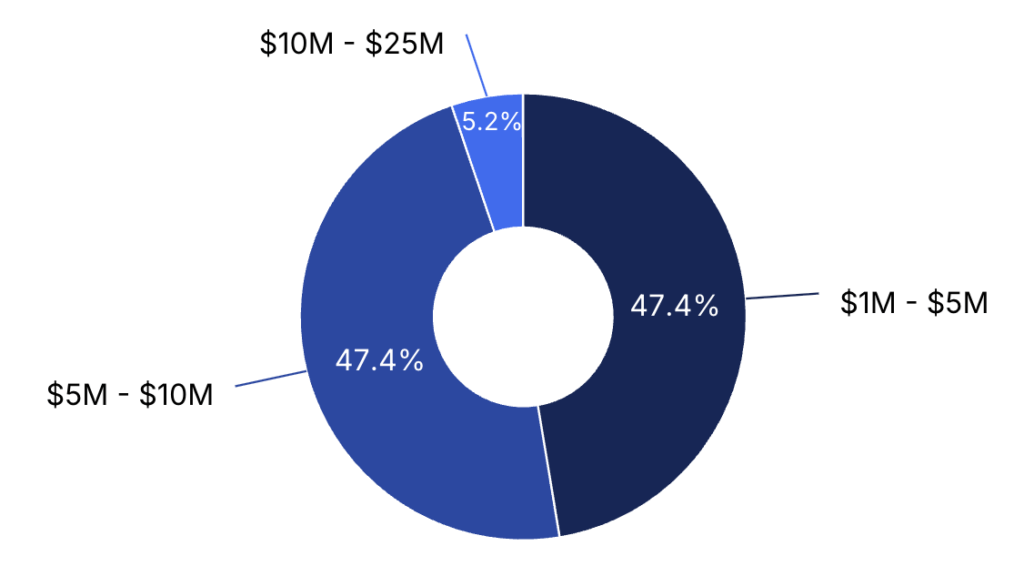

What is the average enterprise value range of businesses you are currently taking to market?

In 2025, most of the business brokers bringing to market fall within the lower middle market sweet spot. Nearly half of surveyed brokers said their current mandates involve companies valued between $1–5 million, while another almost-half are handling deals in the $5–10 million range. Only 5.3% reported working with companies above $10 million in enterprise value, making it clear that smaller deals continue to dominate for lower middle market brokers.

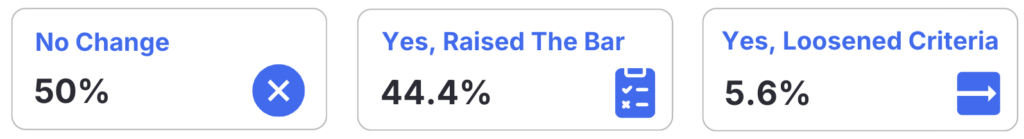

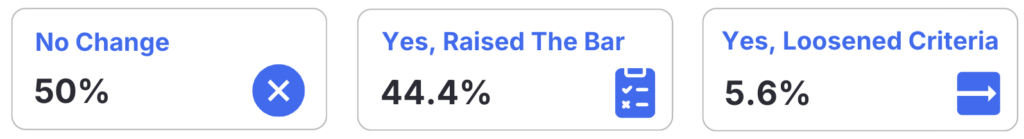

Have you changed your qualification criteria for new clients in 2025?

As buyer scrutiny intensifies, brokers are tightening their screening standards. Half of respondents said their client qualification criteria haven’t changed in 2025, but 44.4% reported raising the bar, while just 5.6% loosened requirements. This shift is likely driven by the increased rigor buyers are applying in diligence alongside brokers’ desire to work with clients who are better positioned to survive that gauntlet. In open-ended responses, several brokers cited poor qualification practices as a recurring misstep in the industry, including taking on listings without sufficient due diligence or failing to align sellers with realistic valuation expectations.

When it comes to seller preparedness, the picture is mixed. Most brokers say their clients are equally as prepared to exit as they were last year. A third believe that sellers are actually coming to market better prepared in 2025, while the remaining 11.1% say readiness has declined. Some of the improved readiness may be attributed to the fact that sellers have been sitting on the sidelines during recent market uncertainty, using the time to clean up financials, address operational gaps, and plan for a more successful exit.

In today’s environment, seller readiness and realistic expectations aren’t just helpful — they’re essential. Brokers know that buyers are asking more questions, digging deeper into diligence, and showing little patience for businesses that aren’t buttoned up and well-positioned to sell.

Final Thoughts

The first half of 2025 has revealed a resilient, adaptive, and cautiously confident lower middle market. Brokers are seeing more deals, more buyer engagement, and more creative structuring—all against a backdrop of continued uncertainty and complexity. While challenges around seller expectations, financing, and diligence persist, the consensus among Axial’s top brokers is clear: the fundamentals for a strong second half are in place. As long as sellers stay realistic, buyers stay committed, and deal teams stay nimble, the remainder of 2025 holds promising ground for successful transactions.

Business Broker League Table Methodology

A business broker, as defined by Axial, is a sell-side M&A advisor who works on a range of deal sizes, including sub-$10M valuation Main St. transactions, and whose distribution strategies extend beyond Axial and their direct networks.

This league table ranking is based on Axial platform data that reveals client quality, ability to manage a sell-side process, and down-funnel effectiveness. The firms at the top of the Axial Business Broker League Table are leaders across the following categories:

- Client Quality: Buyside demand for engagements represented by the business broker.

- Buyside Targeting: The ability to balance selectivity, accuracy, and breadth when identifying potential buyers.

- Process Effectiveness: The ability to generate positive outcomes for their client.

- Overall Deal Relevance: The number of buyside mandates (financial and strategic) that align with the business broker’s marketed engagements.

- Signed NDAs: The number of buyers that indicated interest in each business broker engagement, measured by the number of signed NDAs.

- Shared CIMs: The number of buyers that received confidential information post NDA, measured by the number of CIMs shared.

- LOIs Received: The number of LOIs received from Axial Buyers.

- Executed LOIs: The number of LOIs that were successfully executed either with an Axial buyer or that were marked under LOI on the Axial platform.

- Closed Deals: The number of deals closed with an Axial buyer or that were marked as closed on the Axial platform.

- Buyer Referrals: Feedback from buyers on how the business broker manages their processes.