Who’s Buying in the Lower Middle Market in 2026? Key Buyer Trends From Axial Data

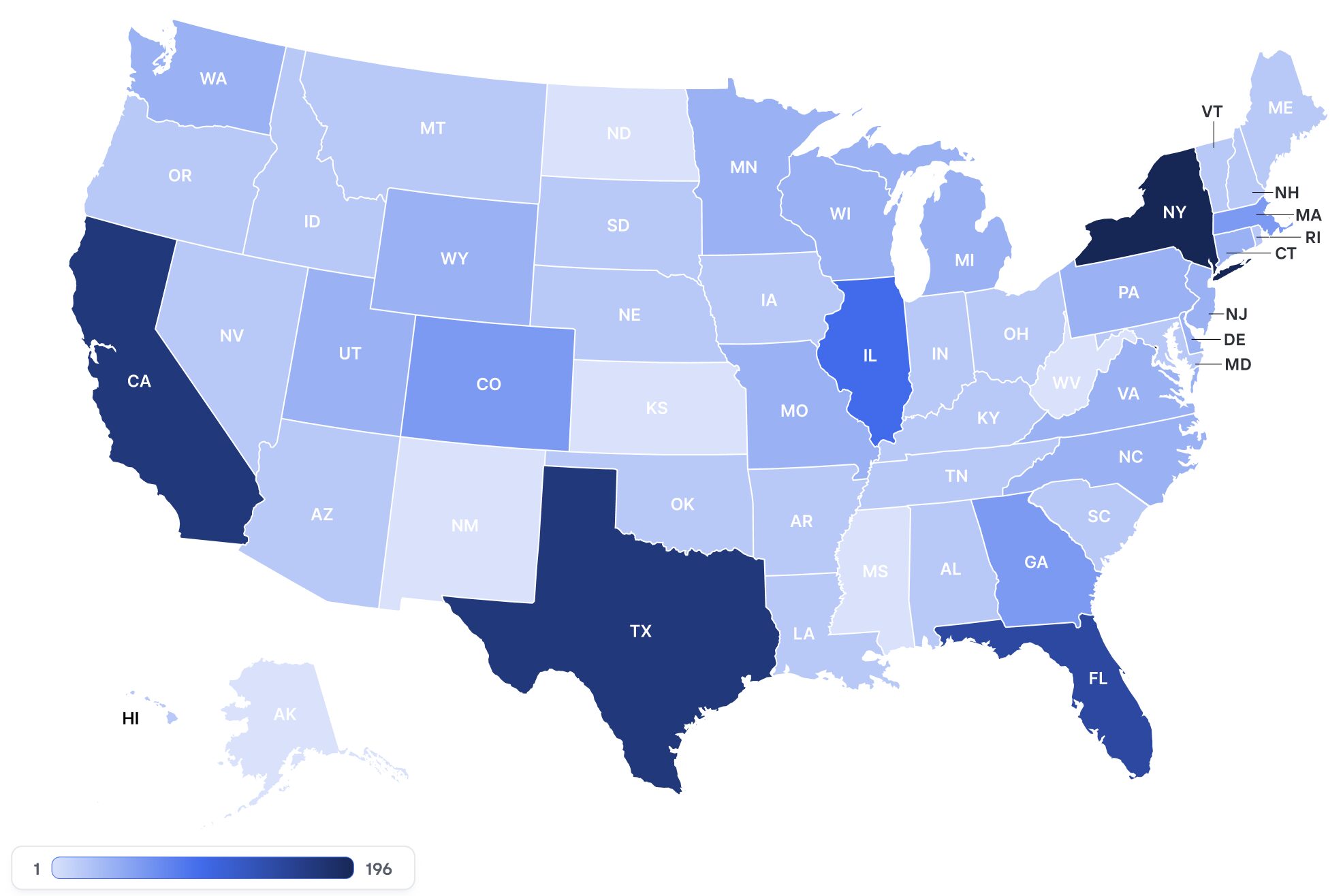

The lower middle market buyer universe is getting bigger, broader, and more competitive. In 2025, Axial saw an all-time high…

We are thrilled to release the 2025 list of the Top 20 Independent Sponsors on Axial!

This ranking highlights the most active and successful Independent Sponsors driving transactions in the lower middle market on the Axial platform.

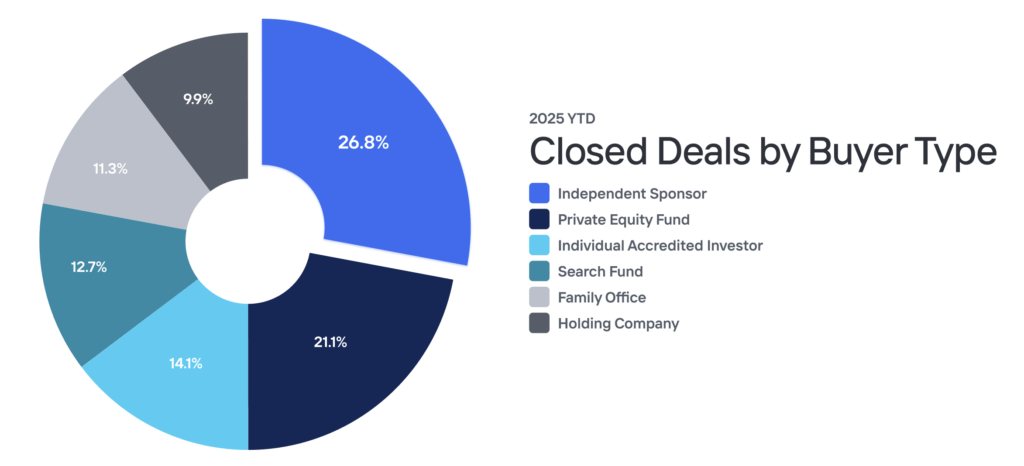

Independent Sponsors continue to cement their role as the most active buyer group on Axial in 2025. Year-to-date, they account for 26.8% of all closed deals on the platform, outpacing Private Equity Funds (21.1%) and every other buyer type.

Average Revenue: $12,207,135

Average EBITDA: $2,184,751

Average EBITDA Multiple: 4.74x

Axial’s Independent Sponsor ranking is assembled based on the deal-making activities of 1,098 Independent Sponsors actively sourcing transactions via the Axial platform, and is primarily driven by three factors:

Congratulations to the featured Independent Sponsors for their achievements!

| Rank | Firm Name | HQ |

|---|---|---|

| 1 | LP First Capital | Austin, TX |

| 2 | Broadwing Capital | Dallas, TX |

| 3 | Evolution Strategy | Austin, TX |

| 4 | Bochi Investments, LLC | Portland, OR |

| 5 | North Park Group, LLC | Chicago, IL |

| 6 | Hayden Creek Capital | San Francisco, CA |

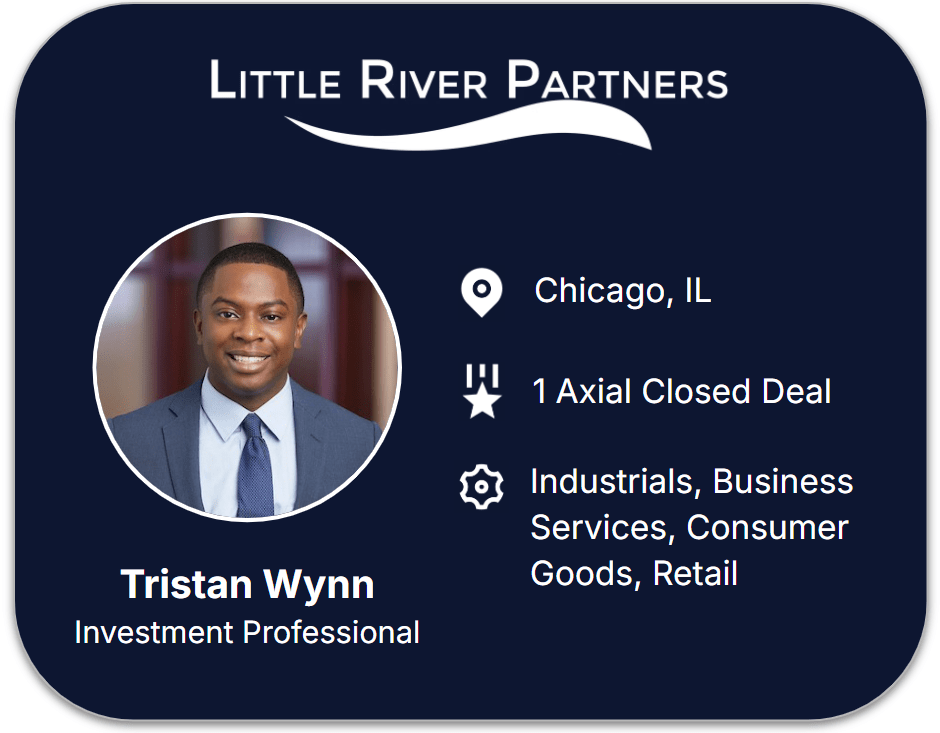

| 7 | Little River Partners | Chicago, IL |

| 8 | Falx Capital | Denver, CO |

| 9 | Burlington Street Partners | Toronto, ON |

| 10 | TX NM Holdco | Midland, TX |

| 11 | Chicago Capital Partners | Highland Park, IL |

| 12 | Parkstone Growth Partners | New York, NY |

| 13 | Cascata Capital | Dallas, TX |

| 14 | SIG Partners | Dallas, TX |

| 15 | Black Lake Capital | Evergreen, CO |

| 16 | Pillar49 Capital | Toronto, ON |

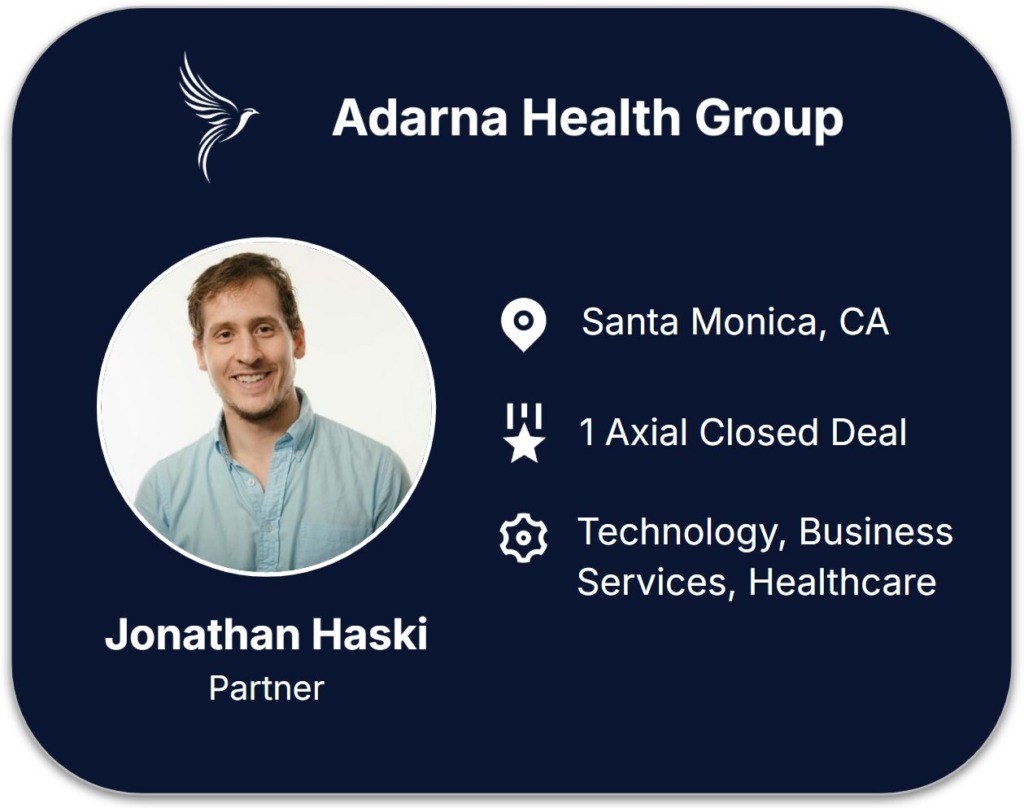

| 17 | Adarna Health Group | Santa Monica, CA |

| 18 | Thesis Capital Partners LLC | Houston, TX |

| 19 | Pearl Street Capital Partners | New York, NY |

| 20 | Amalgam Capital, LLC | Chapel Hill, NC |

–

“LP First Capital is a private investment firm focused on commercial, consumer, education, and healthcare services businesses. We seek to acquire leading, high-performing services businesses that are primed for organic and acquisitive growth. We utilize our strong operational backgrounds to help our management teams create a focused value creation plan and growth strategy. Our passion is partnering with founder-led and family-owned businesses to generate long-term value for all business stakeholders.”

Visit LP First Capital’s Profile

“Broadwing is a Dallas-based private equity firm that actively partners with management teams to build industrial, services, and niche manufacturing companies, while also investing in their people and communities. Its primary objective is to acquire and manage a portfolio of businesses, with deal-by-deal financing serving as its main source of capital.”

Visit Broadwing Capital’s Profile

“Evolution Strategy Partners is a differentiated, principled private equity firm with a unique approach to conducting business.

We consider our portfolio companies as true partners, not merely investments. Evolution values and respects the people with whom we work and believes its value-added involvement is only beginning at the time a transaction closes. We stay engaged and empower company leaders to accelerate the maximum potential of their businesses.

Evolution’s primary focus is on entrepreneur-owned businesses, but we remain flexible to explore other opportunities where our knowledge and interests are aligned. We typically target industrial and commercial service businesses with under $75 million in revenue and select only a handful of new platform opportunities to pursue each year.”

“Bochi Investments, LLC is a private investment firm based in Utah and Oregon since 2019, with the flexibility to invest between $500,000 and $20 million. The firm considers both growth equity investments and acquisitions, operating as a hybrid between a family office—investing its own capital—and an independent sponsor, forming SPVs and bringing in outside investors. Bochi actively seeks opportunities in lower middle market companies with $5–50 million in revenues, focusing on the consumer, industrial, and business services sectors, with a preference for businesses located in the Western U.S., including Texas.”

Visit Bochi Investment’s Profile

“North Park Group is a team of business leaders focused on acquiring and operating US-based manufacturing and distribution businesses under a long-term hold model. Our goal is to hold the companies that we acquire for 10+ years.. We are business operators who love to work in small to mid-size businesses. We grew up in manufacturing businesses and feel more comfortable on the shop floor than in the boardroom.”

Visit North Park Group’s Profile

“Hayden Creek Capital (“HCC”) is a principal investment firm that focuses on investment opportunities in lower-middle market private companies. Our Principals have deep expertise in making growth equity and buyout investments principally in the Consumer Food and Beverage, Business Services, and Distribution industries.

HCC is not a typical private equity firm—we are not a fund. We take a flexible and creative approach to capital structures, having an extensive network of debt capital and institutional and family office equity capital providers. Our investing philosophy is grounded in identifying opportunities that will produce above-market risk-adjusted returns for us and our capital partners.

HCC seeks to partner with engaged management teams that have solid visions for growth and proven track records. We actively work with those teams to identify and implement the key strategic and operational initiatives that will drive value. In select situations, HCC also provides strategic advisory services to business owners focused on increasing equity value.”

“Little River Partners is a private investment and consulting firm focused on acquiring founder or family-owned businesses. Little River Partners takes a disciplined approach to identifying, acquiring, managing, and ultimately exiting its operating businesses. We have specific investment criteria that guide our investment decision-making process.

Visit Little River Partners’ Profile

“Falx Capital is a private investment firm focused on Healthcare, B2B Services, and Niche Manufacturing in the lower middle market. We partner with existing management teams or bring in new management to build upon a business’s legacy and provide flexible capital solutions to its owners. By leveraging our professional experience and established industry network, we can provide differentiated insights and best practices to create long-term value for all stakeholders.”

“Burlington Street Partners (BSP) is a firm owned and operated by partners with decades of experience in analyzing, acquiring, and operating businesses. As a private investment partnership, we seek to acquire small to mid-sized companies and invest using primarily our own capital. We aim to be the partner of choice for the thoughtful business owner looking to sell by being flexible, structuring win-win outcomes, and following through on our word.”

“TX NM Holdco targets scalable lower middle market businesses. Our primary objective is to deliver robust returns with lower volatility. We strategically invest in high-potential businesses with proven track records, leveraging our experience to enhance their technological infrastructure and maximize growth potential. Our core mission revolves around fostering equity through financial success for all.”

“Chicago Capital Partners is a private equity firm that primarily makes control investments in lower middle-market companies with $2-10 million of EBITDA in the following industries: business services, consumer products, distribution, food and beverage, and niche manufacturing. Our fund structure and investment mindset promote building business partnerships and creating value over the long term.”

Visit Chicago Capital Partners’ Profile

“Parkstone Growth Partners is a private investment firm focused on lower middle-market investments across the healthcare, insurance, consumer, and retail industries.

Our mission is to serve as business-building partners by providing capital and resources to accelerate growth while enhancing long-term value. Our values drive us in everything that we do: Integrity, Partnership, Mutual Respect, Measurable Impact, and Family.”

“Cascata Capital, LLC (“Cascata”) is a Dallas-based alternative investment firm specializing in private equity platform investments in partnership with institutional investors and family offices. The firm targets $5–$75 million investments in control and select minority positions, with a focus on building products, infrastructure, energy services, healthcare, manufacturing, and other key sectors.

With over 50 years of combined experience, Cascata emphasizes defensible market positions, proven management teams, and strong growth opportunities, aiming for 20–25%+ IRR and 2–3x+ MOIC. Managing Partner Chris Cuzalina, who founded Cascata in 2003, brings extensive experience across private equity, hedge funds, and investment banking, and serves on multiple boards.”

Visit Cascata Capital’s Profile

“SIG is an investment firm that has acquired 18 companies in the last 4 years. What makes SIG special is our team of highly qualified Operators we bring into our firm and place as CEO or GM in the companies we acquire. This allows ownership to transition out successfully within 30-45 days. SIG brings 90% to 100% cash to close. SIG is a high-probability-to-close buyer. SIG is always committed to preserving the legacy, brand names, and existing employee pool of all of the companies we acquire. If you go to www.sigpartners.com/companies, you’ll see 18 companies still operating under the name they were founded under. ”

“Black Lake Capital is a Colorado-based private investment firm partnering with technology and innovation-enabled businesses generating $2-12M in annual cash flow. From 100% buyouts to equity recapitalizations with majority or substantial minority positions, Black Lake has the flexibility to meet the needs of growing businesses and has completed 15 transactions in its 11-year history.”

Visit Black Lake Capital’s Profile

“Pillar49 Capital provides liquidity, succession solutions, and growth capital to owners of small and medium-sized businesses, while preserving and building on the factors that made them great – culture and people.

We partner with North American businesses that have $1 million to $10 million or more of EBITDA / cash flow, with a long growth runway and attractive industry characteristics.

At Pillar49, we take a different approach than most investors by “rolling up our sleeves” as active managers, providing our partners with the operational and financial resources to support and drive long-term growth. With over 20 combined years of experience investing, advising, and helping build businesses, we will be a foundational “pillar” for the next stage of your growth through our active ownership.”

Visit Pillar49 Capital’s Profile

“Adarna Health Group is an operationally focused investor in Revenue Cycle Management that drives long-term sustainable growth. We preserve your legacy and empower your team with our unique technology background and RCM experience.”

Visit Adarna Health Group’s Profile

“Thesis Capital Partners, LLC is an independent sponsor that invests in family-owned companies in the United States. We partner with exceptional entrepreneurs to grow these businesses for the next generation in a hands-on way.”

Visit Thesis Capital Partners’ Profile

“Pearl Street Capital Partners (“PSCP”) invests in outstanding family-owned and privately held businesses that have a track record of success in their markets. PSCP has committed capital from two family offices and a mandate to invest in attractive opportunities in the lower middle market. PSCP partners with founders/owners and management teams to deliver value and preserve business continuity while bringing strategic resources and capabilities to help businesses grow. Our goal is to build stronger businesses that are well-positioned for long-term success. ”

“Amalgam Capital, LLC is a private investment firm focused on small to medium-sized acquisitions. We are a team of seasoned operators who plan to work closely with our portfolio companies to drive measurable value for all stakeholders.

We acquire and sustainably grow underrated businesses as independent sponsors.

Our multidisciplinary team of investors, entrepreneurs, and operators has created substantial value for others.”

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.