How Marmic Used Axial to Close Three Add-Ons in One Year — And Then Sold to KKR

Marmic Fire & Safety®, a leader in end-to-end fire and life safety services, has been protecting lives and properties since…

The lower middle market demonstrated its resilience in 2022, serving as the source for fresh consolidation opportunities that a growing number of investors have capitalized on despite sustained macro-level uncertainty. These plays have also provided business owners with liquidity and succession planning that ensures the enterprises they have built not only retain a competitive advantage in their markets, but also continue to function as cornerstones in the communities they serve.

The consolidation of mom-and-pop hardware stores is no exception to the rule of firms leveraging franchise businesses to enter new markets, access more customers, improve operational efficiencies, and realize cost savings from greater scale.

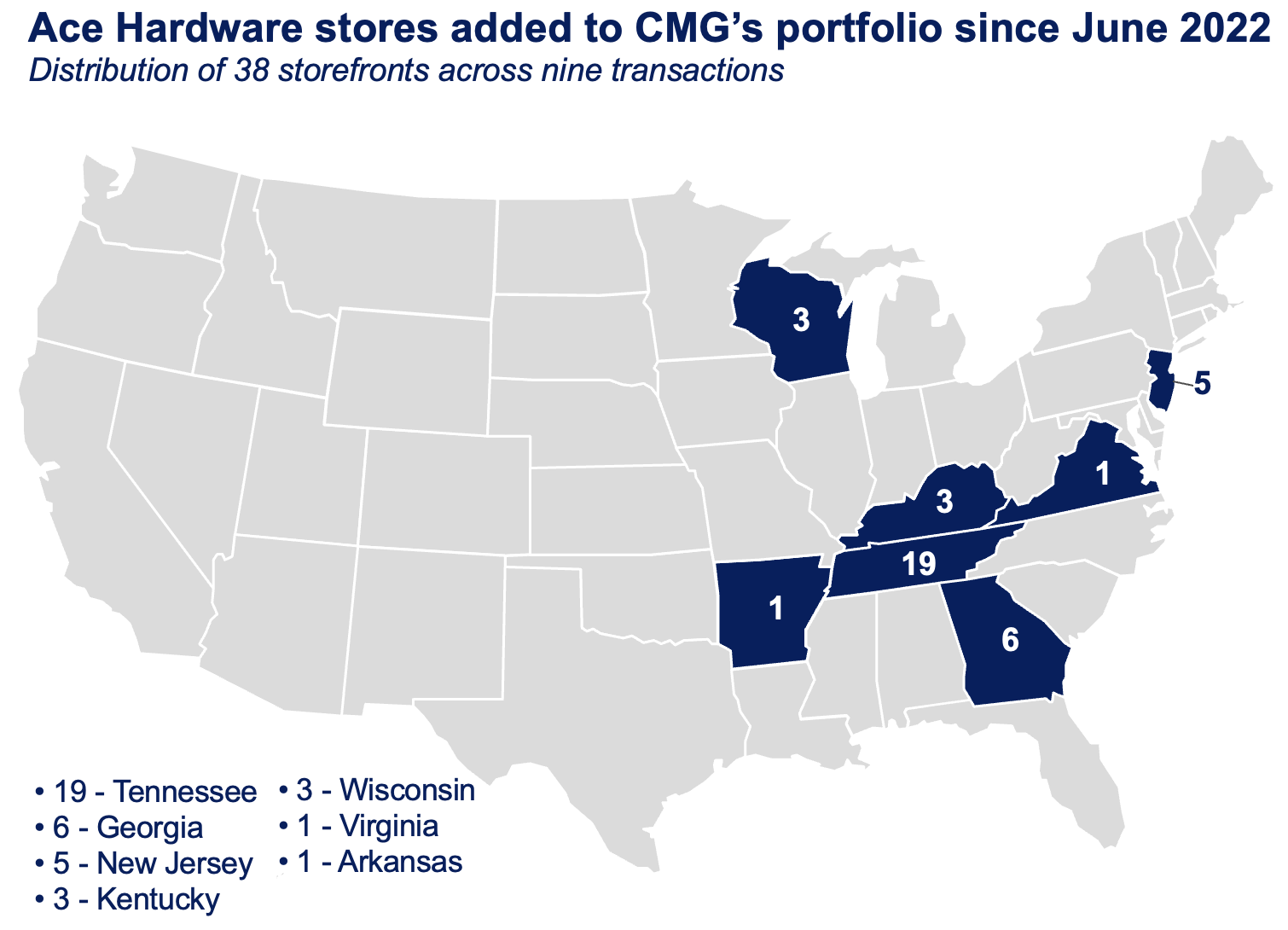

Texas-based investment group and Axial member CMG has followed this playbook, adding 38 storefronts to its franchise holdings across nine transactions executed since June alone. And those were just the Ace Hardware locations that they added to the portfolio. CMG sourced three Wisconsin stores and the Douglasville, Georgia Ace Hardware via Axial in 2022.

With the purchase of more than 20 Potter’s Ace Hardware locations across middle Tennessee and southern Kentucky in June, CMG kick-started its plan to combine up to 150 Ace Hardware locations in one group: Bolster Hardware.

“The hardware business has largely proven itself to be “Amazon proof” — even during the pandemic, when everyone was otherwise shopping from home,” CMG’s Ajay Amin, Principal Leadership of Ace Platform, M&A, Finance and Special Projects. “Pipes leak and circuits break at any moment, so homeowners want to get the right thing in hand as fast as they can.”

The demographics of hardware store owners supports CMG’s thesis, with an average age in the low-to-mid 60s across this corner of the lower middle market. For Potter’s Ace Hardware’s part, it has been family owned since 1946. And supporting strong succession planning is a cornerstone of CMG’s overall approach.

“The ownership is aging on the sell side in the hardware store space and, as in other industries, often without any real succession plan in place,” Amin has observed. “For those seeking to acquire an established, profitable legacy business on the buy side, much of the time it can just take some guidance on what is being seen in the wider valuations world and how prospective targets compare per geography.”

But many small business owners remain unaware of the comprehensive preparation required to achieve a successful sale and ensure a smooth transition out of day-to-day operations. That is part of the reason why Amin breaks down this side of due diligence and negotiations into a set of complementary roles to play while coaching owners through the sales process:

As Amin has pointed out, sellers must invest their time in becoming educated and clear-eyed about what they can expect from any transaction process. So, he encourages owners to take tangible steps prior to pursuing a sale by seeking out experienced professionals for sound guidance when it comes to realizing their vision for exiting successfully.

“The most important thing for a small business owner when considering a sale is educating themselves on valuations and the process of a sale and knowing what they want their exit to look like,” Amin said.

CMG’s background in retail dates back to 2001, including a significant footprint operatingKFC and Taco Bell franchises as well as Marriott, Hilton, IHG hotels. Late 2020 saw the group become Rent-A-Center’s largest franchisee after purchasing 99 stores from corporate. Al Bhakta, a principal and founding team member with CMG, describes the group’s approach as “pursuing ‘weatherproof’ tier-one, multi-unit brands.”

As a result, CMG has an established track of consolidating smaller franchisees and acquiring corporate units via divestiture. But even with the strongest track record in place, it is always possible for the sales process to hit a snag.

“There is a good amount of emotion with most sellers, as they (or their family) have worked hard to build their business,” Amin said. “But ultimately it is a business with a finite value. So, when deciding to buy or sell a business, both sides of the table have many things to consider. And things like pride of ownership, keeping current staff members employed and, perhaps most importantly, preserving family legacies — these can all play a significant factor in their own right.”

Because “a bonafide buyer is going to stick with a deal,” Amin’s advice for sellers is simple:

By contrast, the challenges for buyers have only grown more complex.

“Traditional approaches such as valuations-focused ‘dog and pony shows’ are less effective than ever,” Amin has found. “Rather, discussions focused on identifying potential buyers downstream are valuable. The key is recognizing that if you don’t make a strong play up front, future opportunities for success may fade away. And most small business owners want to know that there’s a plan in place for years to come.”

CMG operates some 300 restaurants, 90 retail units and 8 hotels located in more than 20 US states. It also has interests in sports franchises, real estate and other commercial investments.