Top 10 Articles of 2019

Happy New Year! As we move into 2020, we’re recapping the most popular Middle Market Review articles from the past…

Co-investing is the process of pooling capital from multiple financial partners for one transaction. It’s a strategy that’s been employed for a long time by investment funds of all shapes and sizes.

With 46% of investors reporting that their co-investments outperform their private equity fund commitments by more than 5%, co-investment is as attractive as ever — but the structure and motivation for these deals is changing.

We talked with Benjamin Gerut, Founder at Kuzari Group, an active innovator and participant in lower middle market equity coinvesting, about how co-investing has evolved over time and what opportunities lay ahead.

“You used to see a lot of club deals where a lot of small groups came together to participate in one transaction. Usually that was because the transaction was too risky or too large for any one party to execute on alone,” says Gerut. In some instances, more than five parties might come together on one deal.

However, while club deals diffuse risk, they also diffuse reward. This is particularly true in the lower and middle market, where businesses have lower revenues and EBITDA. When a middle market company transacts, there’s less money for intermediaries and investors to gain. “With the size of deals in the lower and middle markets, it’s often not time- or cost-efficient to assemble a club of investors for a deal,” says Gerut.

There’s still a need among financial buyers for additional capital to get a deal across the finish line. “The reality is a lot of deals reach somewhere near completion but don’t ultimately close because the buyer simply can’t assemble the capital,” says Gerut. However, investors are increasingly realizing that sharing a deal between just two or three investors makes more economic sense.

This might mean a PE fund partnering with an LP, who invests his or her own capital alongside the fund, or an independent sponsor finding a co-investors to provide the last 30% of capital.

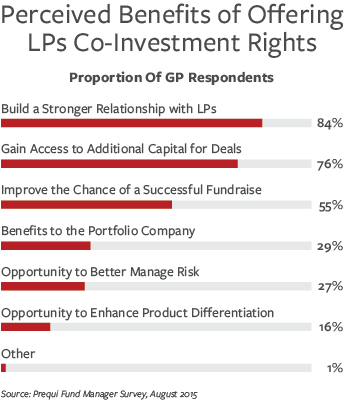

ValueWalk reports that 87% of fund managers currently offer or are considering offering co-investments to their limited partners. A survey of fund managers found the biggest perceived benefits of co-investments to be creating closer relationships with LPs, gaining access to additional capital for deals, and improving the chances of a successful fundraise.

For LPs, the biggest benefit of co-investments is performance, according to a survey from ValueWalk: “80% of limited partners have seen their co-investments outperforming private equity funds, with 46% seeing their co-investments outperform by a margin of over 5%.”

Co-investments are also attractive to LPs because they may exist outside the traditional 2 and 20 fee structure. “Almost half (49%) of GPs charge no management fee on co-investments, and 48% charge no carried interest,” reports ValueWalk.

Operators who aren’t associated with a fund often have access to great deals through their networks, but can struggle to find the right partner to get it over the finish line. “Sadly, it’s often the most qualified, highest skilled operators who get passed over because of capital access,” says Gerut. With an increasing number of fundless sponsors and search funds in the marketplace, investors like Kuzari Group LLC see more opportunities to invest minority equity in a co-investment structure.

By partnering with an investor, operators can access the capital they need to be competitive while maintaining control over the acquisition process. Co-investors are crucial in providing not only capital, but also strategic guidance from past experience to speed up due diligence and ensure a successful takeover.

Over the next few years, we’ll likely see co-investment opportunities become even more prevalent.

But deal-making is a very labor-intensive and relationship-driven business. “A lot of people are getting into co-investment under the guise that it’s embedded deal flow and it’s easy. It’s not easy,” says Brian Gallagher, Partner Twin Bridge Capital Partners in an interview with PrivCap Media. “It’s a relationship business, and you can screw up a relationship pretty quickly if you can’t get there in time, and move in lockstep with the sponsor.”