What Do 89% of CEOs Do Before Talking to You?

In a survey of 769 business professionals who run, advise, or invest in private businesses, we asked how digital tools are being used in the transactional space and the opportunities that they present.

In the changing deal environment, a few things are clear: The web is now the first part of the deal process, professionals are seeking digital information and connections, and the online world is heating up competition for the best deals.

Below are 3 important trends that emerged from the results:

You Must Be Online

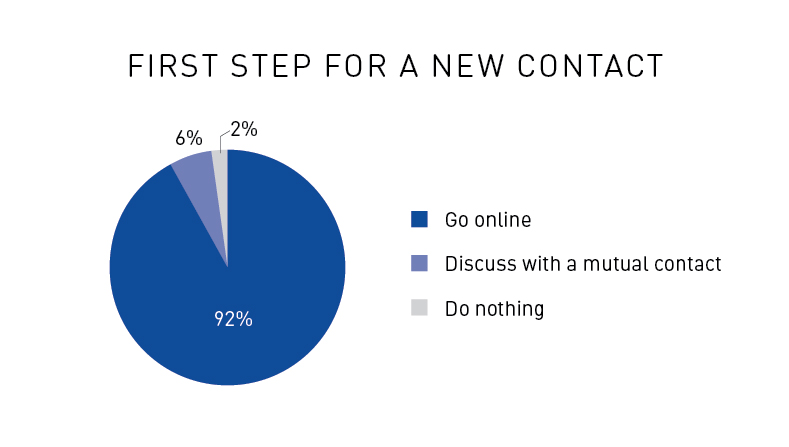

Unsurprisingly, the first step for deal professionals when being introduced to someone new is to go online. In fact, in a world where the handshake is often the final step, 92% of business professionals start relationships by going online – both looking up the person and looking up the firm.

As it turns out, only 6% of the respondents indicated they would first ask a mutual contact about a potential business partner.

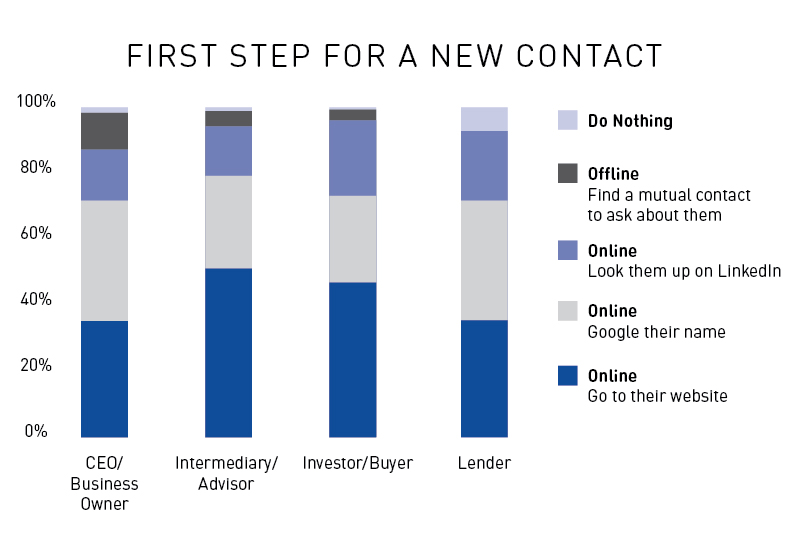

For CEOs, 89% go online for the first step. Googling a person’s name or going straight to a company’s website is the point of first touch when it comes to researching a potential financial or business partner (36% and 35% respectively). Sixteen percent of CEOs go to Linkedin first and only 11% find a mutual contact to ask about the person in question.

Deal professionals say they will go to a company’s website (48%), before they use Google to search a name (27%) or go to Linkedin (18%). Very few (4%) deal professionals turn to a mutual contact prior to first touch. Interestingly, professional networks like Linkedin are more popular with capital providers — lenders, investors and acquirers (23%), versus intermediaries — advisors and bankers (15%).

The prevalence of online communication and outreach helps confirm that deal professionals need to invest in both inbound and outbound online business development channels to best capture interest from all relevant counterparties.

Varied Use for Online Tools

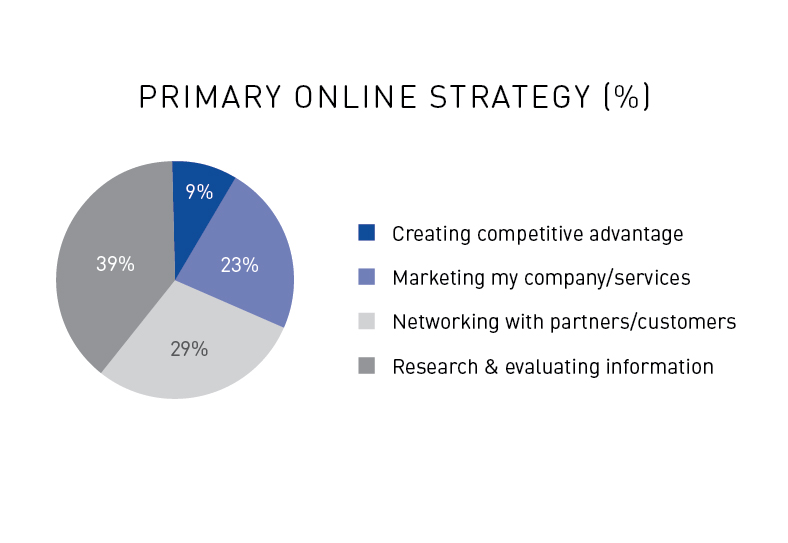

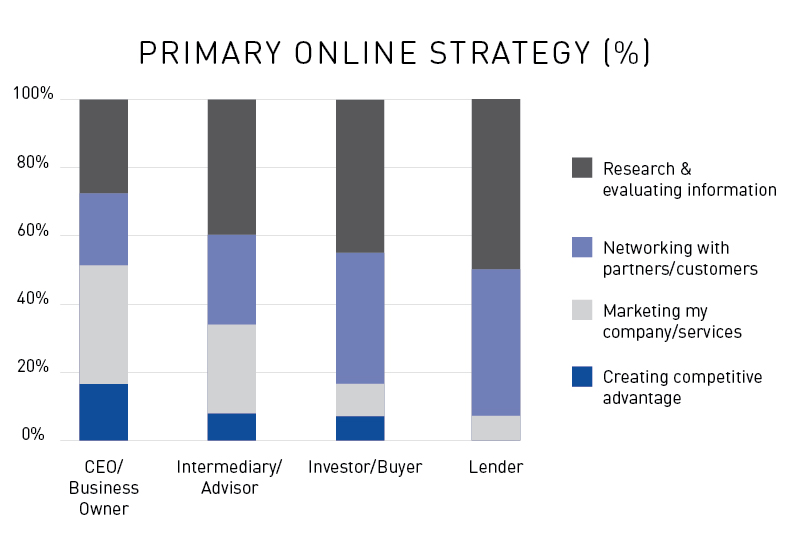

While the data confirms that an overwhelming number of deal professionals and CEOs engage with online tools and social media, the specific strategies vary. Across the board, respondents agree that online tools can best aid any part of their job that requires research and evaluating information. Thirty-nine percent of all respondents, 41% of deal professionals and 27% of CEOs say so. Within the deal professional category, it’s the capital providers who believe they can unlock networking advantages by using online and social tools (37% vs. 26% of intermediaries). Twenty-six percent of intermediaries also say marketing is the number one opportunity.

The results also point out a disconnect between CEOs and the transaction professionals that serve them in how they believe online tools and social media can power their networking goals. 32% of deal professionals say networking with partners and customers is the single biggest opportunity that online channels provide. Meanwhile, CEOs are more bullish on using online channels to market their company’s product and services (34%). Twenty-one percent agree that networking is the number one opportunity that technology and social media represent.

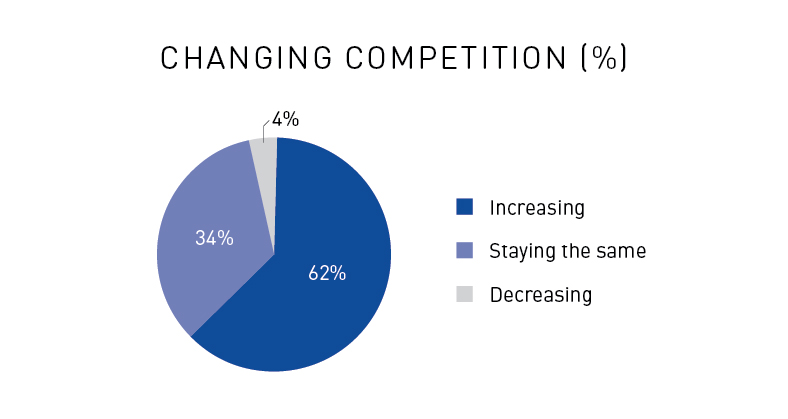

Competition is Increasing

The use of online strategies and tools has accelerated the competition within the private capital markets. No longer confined to specific geographies or personal networks, deal professionals and business owners can now reach counterparties all across the country. As a result, an overwhelming 62% of respondents indicated that competition was increasing for their respective businesses. Only 4% indicated it was decreasing.

As competition increases, it is critical to be discoverable online. The above research proves that deal professionals and business owners alike are utilizing online tools and strategies to help find the right partners. If you do not have a developed presence, your ability to compete in today’s private capital markets are slim to none.

A Note on Methodology

Respondents included Axial Concord attendees and subscribers to the Axial’s online publication, Forum. All respondents self-identified as either a business owner/CEO, investor/buyer, lender, intermediary/advisor or other type of deal professional. Results were collected between September 30 and October 5, 2014. Surveys were distributed in person and also via email.