IPOs Aren’t Coming Back to the Middle Market

Ever since Facebook went public just over a year ago, analysts and industry experts have been eyeing the IPO markets with increasing scrutiny. Some believe the IPO market is in a lull, while others believe the path to recovery is well underway.

Tom Courtney, President and Managing Director of the Courtney Group, believes that the IPO market has actually undergone a more tectonic shift — one that has been occurring for decades, not months. We spoke with him earlier this week to get his insights on the IPO market, its shifts, and its future.

How would you describe the current IPO Market?

“The IPO market has changed in a fundamental way since 2000. The average IPO now has a market capitalization of $300 million. That means much larger and later stage companies are going public than before. People keep saying the IPO market will be great when it returns, but it is unlikely that it will ever return to the way it used to be. The days of small technology or health care companies having an IPO of $10 or $20 million are not happening anymore.”

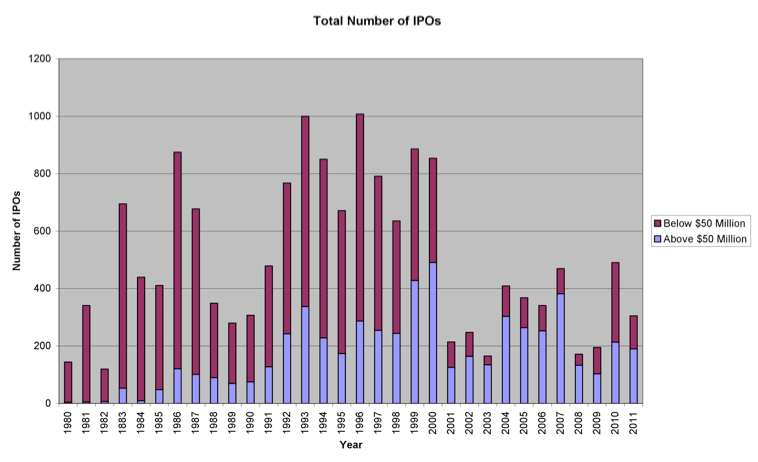

“There has been a huge drop in number of IPOs from 800 a year in the 1990s to about 200 to 400 a year since 2000. The average IPO has gotten much larger. In the 1980s, the average IPO was around $28 million; in the 2000s, it was $212 million; today the average is about $300 million. IPOs over $50 million in proceeds have remained at a level of about 200 year since 1992, but the number IPOs with under $50 million has declined from almost 1,000 in 1996 to about 50 to 100 per year since 2000.”

Source: The Courtney Group and Securities Data Corporation

Why has the IPO market changed so much?

“The primary reasons for the change in the IPO market are:”

1) The Growth of Mutual Funds: “Today most people own shares in companies through mutual funds, for instance in 401ks, or IRAs — not directly in the stocks of companies. As a result, mutual funds are now driving the IPO market. Mutual funds have limits on liquidity and market capitalization. Most mutual fund managers do not want to own more than 5% of a company (because they have to report it to the SEC) and want to be able to sell a position in 3-5 days without moving the price of the stock. Add to this the economics of the mutual fund business, that an equity mutual fund typically becomes a profitable business at around $200 million in assets under management (charging 1% a year for expenses) and you can calculate that a stock must have a market capitalization of about $300 million.“

2) Consolidation on Wall Street: “Stock brokerages have consolidated and gotten larger partly in response to buyers of stock shifting from individuals to institutions. IPO underwriters have realized that there are very few buyers for small deals and have focused on larger IPOs.”

3) The Decimalization of Trading on Listed Securities: “It used to be that Merrill Lynch and other firms would make a market on thousands of small companies. They would make money with both a commission and the spread (difference in bid and ask prices). With stocks trading in decimals not a quarter of a point spreads are smaller. Competition and technology has lowered commissions. As a result, most market makers have decreased the number of small companies they were willing to make market in and there is less aftermarket support for a smaller IPO.”

“To me, some of the regulatory changes had unintended negative consequences for capital formation and capital raising.”

What do these mean for middle-market deal professionals?

“I think many executives still have not come to terms with the changes in the IPO market. In reality, IPOs have been dissolving as an exit strategy since 2000. Because mutual fund buyers are favoring bigger, more mature companies, venture capital firms have shifted their focus to bigger and later stage companies with incubators and angels now playing a key role in startup financings.

“Companies valued at $300 million or more have had a steady chance for an IPO since 1992. Smaller companies though have had to turn to strategic buyers and private equity investors for an exit. For most of the last decade private equity buyers accounted for about 25% of middle market transactions.”

“However, private equity is not a destination — it is a stop along the way. No private equity firm will be the ultimate owner of a business since they need an exit to return capital to their investors. The end game is either a sale to a strategic or development of the business to a reasonably mature level for an IPO. That level for an IPO has increased dramatically.”