How Family Offices Approach Direct Investing

The trend of direct investments by family offices continues to develop momentum. “Direct investing has become very popular with both single family and multi-family offices,” explained Richard Wilson, founder of the Family Offices Group. “Nearly every family I know has exposure to direct or co-investments.”

The decision to adopt hands-on investments is a reaction to family offices being dissatisfied with “getting burned in the public markets and trusting other people with large amounts of their money,” says Wilson.

To better understand how family offices are going about their direct investing strategies, Wilson surveyed his network and found some interesting qualities about the direct investments.

They Prefer Majority Investments…

When a family office makes a direct investment, it almost always prefers majority investments. As Wilson explained, “Some [family offices] would like a strong majority leader, but almost none are looking to make 50, 100, or 200 minority investments.”

Making minority investments in private companies is less beneficial for many single and multi-family offices. “If they wanted to take a bunch of minority investments, they might as well go into public markets, buy some shares, and have more liquidity and transparent reporting at the same time.”

By making majority investments instead, these families can offer more real strategic guidance to the business. “Since most family offices are founded around entrepreneurs, they understand the markets and industries. As such, most of these families see industry experience and knowledge as the source of their money,” explained Wilson. “They enjoy working in these types of businesses and it is natural to them to have confidence in making more money or preserving their family’s worth this way.”

Majority investments within their core industries allow family offices to use their experience to build the business and generate solid returns — a favorable combination for both the entrepreneur and the family office.

…between $500K – $5M

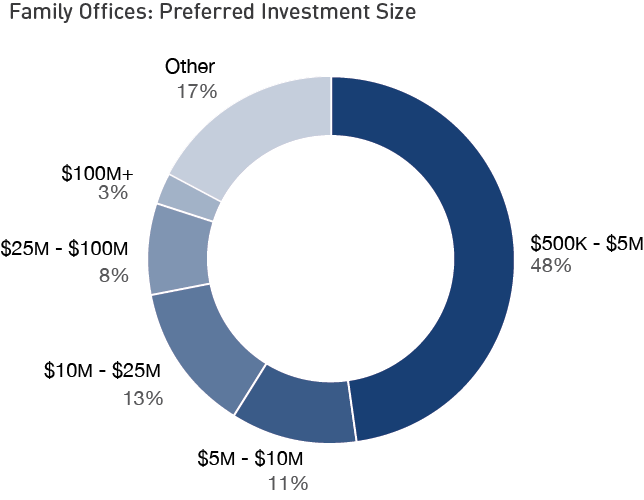

According to Wilson’s survey, “the largest volume of survey respondents are making $500K-$5M sized-investments.” While 48% of family offices were looking to make investments between $500K – $5M, only 11% were looking to make investments larger than $25M.

This preference  for smaller deals has less to do with strategy than budget. “Families with [funds of] $50M-$200M are more common than families with $1B+,” explained Wilson. Unsurprisingly, the size of the check generally corresponds with the size of the family office. After appropriate portfolio diversification, smaller families can only write smaller checks.

for smaller deals has less to do with strategy than budget. “Families with [funds of] $50M-$200M are more common than families with $1B+,” explained Wilson. Unsurprisingly, the size of the check generally corresponds with the size of the family office. After appropriate portfolio diversification, smaller families can only write smaller checks.

Wilson continued, “I know that our $1B+ clients almost always want to write checks at a $5M minimum and it is only those single family offices looking for concentrated positions in just a few industries or those larger $500M-$1B+ group who are looking to do the $20M-$100M size deals. While looking closer at the data it is the larger single family offices and those families who have built out fully formed private equity fund or private equity portfolio divisions which are conducting these larger deals.”

Their Biggest Challenge

Like any dealmaker, one of the biggest challenges confronting family offices is deal flow. “Many of these families don’t know how to find the relevant partners or dealflow,” explained Wilson. “They do not know who to trust, and they don’t have a lot of connections in the network.” Since family offices have traditionally maintained a discreet profile, it is difficult for intermediaries and business owners to contact them.

As a result, there is a new trend in which family offices are becoming more public. “They want to be known in the marketplace to the right parties because they want the deal flow. Not many have this mindset today but that is a very early trend I’m just now starting to see this year and I’m sure will continue,” said Wilson. “There are new family offices starting every day. As the industry grows, there will be family offices that are set up that recognize the benefits of being public.”

We are already seeing this increased publicity on the Axial network. Over the last three years, the number of family offices on the network has grown 205% percent. Additionally, these family offices are resolving their dealflow issues by becoming more active –the average family office pursued 20 opportunities in 2013, up from only 6 in 2011.