Fueling Up: Energy Deal Flow on the Rise

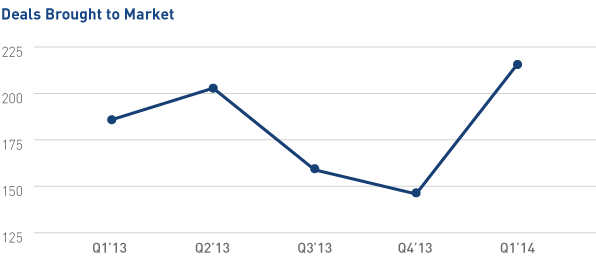

Although many investors are complaining about the current drought of investment opportunities, the Energy sector seems to be on the rebound. In Q1’14, 216 deals came to market on Axial in the Energy space, a 48% increase from the 146 deals in Q4’13.

Much of this increase in Q1’14 can be attributed to strength in some of the traditional oil & gas industries: Oil & Gas Equipment & Services (69 deals), Oil & Gas Exploration & Production (64 deals), and Oil & Gas Drilling (50 deals).

Given the focus on upstream and midstream businesses, it is unsurprising to learn that 27% of Energy opportunities originated in Texas in Q1’14. The Eagle Ford has seen the creation of thousands of new drilling sites in the last few years, and is ripe for institutional consolidation. Alabama had the second highest Energy deal flow, but represented only 8% of relevant opportunities. Louisiana and California followed closely behind, both representing 5% of the deals.

A Slow 2013

But, does Energy deal flow only look strong relative to the weak 2013? Most industry analysts agree that 2013 was a slower year in both deal volume and deal value for the Energy sector.

The lull was a result of the flurry of new acquisitions at the end of 2012. Since many firms were focused on developing their current assets/investments, they avoided any transactions. “Companies that have acquired large-acreage positions are now focused on optimizing production, streamlining operations and maximizing the return on assets of their holdings,” explained Deloitte’s John England.

After spending a year cultivating these businesses, however, many firms are ready to re-engage with the private capital markets.

Noncore Divestitures & Exits

At this year’s IHS CERAWeek Conference, many investors reported that the ongoing spike in deal flow could be attributed to growing number of divestitures. In his coverage of the conference, Mark Druskoff reported that speakers were noting that “oil and gas companies face ‘tremendous’ pressure to decapitalize,” and “companies are pursuing a ‘shrink to greatness’ strategy.”

Rob McCeney of PWC confirmed the divestiture hypothesis when he explained in a recent article that many oil & gas companies are seeking to “rationalize noncore investments” and focus on their core competencies.

Private equity firms are acting with similar motivations, as well. After investing in the natural gas boom of 2008, PE firms are reaching the limit of their holding period and are seeking viable exit strategies for their portfolio companies. Albeit a spectacular one, TXU’s bankruptcy is a fine example of portfolio company considerations.

There is some concern that, if too many firms look to sell assets in the coming year, the market will not be able to balance the supply and demand. Although Energy remains a very active sector, many investors are still uncertain about its future.

Sean Ward, a Partner at Blue Point Capital Partners, recently explained, “It is really a mixed bag right now. While there is a lot of activity, many people are very nervous about buying at the end of a run-up. The Energy space tends to be very cyclical and since there was a lot of activity roughly 24 months ago, investors are reticent to take a leading role right now.”

Ward’s comments parallel activity on the Axial network: deals coming to market have outpaced investor pursuits. If this investor trepidation remains, sellers may find a cool response, and be subject to the conditions of a buyers market.

Concern of Government Intervention

While divestitures help explain some of the uptick, concern over regulation has also encouraged some business owners to approach the selling table. Despite the recent growth in the energy sector, “more than half of energy CEOs are extremely concerned that excessive regulation could negatively impact growth,” found a recent survey. “Most don’t feel it’s helping improve production and/or services to deliver quality standards.”

CEOs are also very wary of tax increases. The report continued, “And energy executives are concerned about the impact the government may have in other ways too. More energy CEOs are extremely concerned that an increasing tax burden could slow down growth.” Tax dissatisfaction could be, if nothing more, a common talking point for energy CEOs and PE firms.

These concerns, combined with rising oil prices, may be encouraging many business owners to begin exit planning at the top of the cycle.