3 Ways Your Proprietary Database is Costing You Time, Money, and Deals

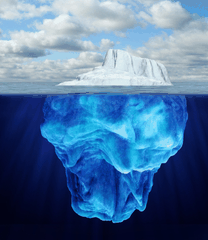

An important component of modern business is data. Data grows exponentially and becomes difficult and expensive to manage. Fortunately the advent of “the cloud” has mitigated this problem for companies that used to rely on expensive proprietary, physical databases (sometimes even spilling into those boxy gray metal rusted file cabinets) and accompanying software to manage relationships and transactions. A progeny of the cloud, the Online Network makes data and relationship management easy and efficient, nearly automatic, in that it self-updates as members edit their profile and take certain actions. In a sense it is a living ecosystem, unlike the old and too often stagnant database.

Of course there are positive aspects of maintaining a proprietary database, the crown jewel of many investment funds. Proprietary databases beget proprietary deal flow, so the story goes. But leaks still remain. Online networks alleviate the following three costs of maintaining a database to source deals:

Data Maintenance

It can cost up to $40,000 to keep a large proprietary database on your own computer network or servers and to process it with your own software, according to former Sun Microsystems engineer Jignesh Shah (see his former colleague, fellow Sun, and now Oracle engineer, Allan Packer’s blog post, “Are Proprietary Databases Doomed?”). Cloud computing has solved the former problem by allowing CRM (Customer Relationship Management) providers like Salesforce.com to render personal software almost obsolete. There is a high opportunity cost of manually updating and combing tomes of data when you could be spending time doing more productive things like meeting with potential partners for a deal or researching an opportunity that has come across your desk unsolicited.

Even if you have an intern or someone else in charge of the database, it is an inefficient and almost antiquated method of keeping information up to date. Whoever is working on the database can most likely add more value to your organization doing something else; it is simply not a valuable use of time to manually update a database whose maintenance online networks perform automatically, down to filtering out insignificant contacts and quantifying interactions.

Stale Information

Inaccurate data causes a discrepancy between what you thought an advisor or a counterparty was doing at some point in the past and what they are doing now. M&A is a fluid, constantly evolving industry in which it pays (literally) to keep a finger on the pulse of the market. Working off old information puts you at a disadvantage. Stale information is irrelevant, and trusting it can lead to missed opportunities.

People change jobs, numbers, email addresses, assignments, and will probably not think to inform you of such changes if the extent of your relationship is a quarterly blast email. If you are connected with someone on a network that maintains profiles and documents activity, your information will automatically be up to date and you will always be in front of the right people.

Information asymmetry is a difficult problem to solve in financial markets, and George Akerlof, Michael Spence, and Joseph E. Stiglitz won the Nobel prize for Economics in 2001 for their work on the phenomenon through exploring economic inefficencies arising from differing, imperfect information levels between buyers and sellers of goods and services in the marketplace. As technology’s virtue is making business easier, being on a network revolving around robust information is a modern step to solving a prominent financial market problem.

Unilateral Communication

A potential problem with maintaining a proprietary database and popping up every now and then to survey the M&A landscape is that, hypothetically, you could miss out on opportunities that arise in the interim. You also have no idea if you’re even in someone else’s database. The onus is completely on you when you remain inaccessible relative to competitors who have joined a network. Then you fall behind, and trying to catch up in the form of blast emails under the guise of familiarity can result in a quick dismissal, deletion, and negative connotation.

Quite the opposite, you are always present and in sight when maintaining a profile on an M&A network. The only burden is updating your information and clearly articulating your goals, but this pales in comparison to the time and energy spent taking care of a database.

It is easier than ever to stay in front of opportunities today and to outsource data management to the cloud by joining a network. Technology can make life and work a lot simpler and more productive. Take advantage of it.