Dead Deal Report: Unpacking 2023’s Broken LOIs

There are numerous factors that can lead to the breakdown of a deal, including financing challenges, discrepancies in EBITDA evaluations,…

The COVID-19 pandemic created a historic level of acquisition and investment opportunity across North America’s LMM. The story for Canadian firms and assets is no exception to the wider trend here, with potentially significant implications for the future of cross-border deal activity following record-setting activity driven by private equity firms in 2021. Positive tailwinds should carry the LMM deeper into unprecedented territory this year.

“Our view at the beginning of 2022 was that the buyer exuberance we saw across most industries in 2021 would continue based on planned infrastructure spending by federal governments both at home and abroad,” said Alan Chettiar, Partner, M&A Advisory with FirePower Capital. “On the downside, we were concerned with how inflationary pressure would dampen the proverbial party.”

Thus far, though, the impact of inflation has largely helped to keep purchase multiples in check after hitting all-time highs across most industries in 2021. As a result, dealmakers remain focused on fundamentals as they conduct due diligence.

“While buyers are spending more time on due diligence, treading more cautiously as valuations and seller expectations remain high, we still see a willingness for buyers to pay healthy multiples for good quality Canadian businesses,” said Karen Fisman, Director, Business Development with Origin Merchant Partners.

With record levels of capital to deploy, buyers on both sides of the border have tracked down top quality targets with increased frequency across Canada’s LMM in recent years.

Private equity funds of all sizes fell in love with Canada’s LMM long ago. As the Canadian Venture Capital & Private Equity Association reported at year-end, the preponderance of PE investment in Canada went to small and medium-sized businesses (SMEs) in 2021. Indeed, 84% of all deals with disclosed values tracked last year fell under C$25 million. And this link between PE investment and SMEs reaches the heart of the Canadian economy. As the CVCA reports, Statistics Canada has found that SMEs support more than 85% of all new jobs created across the country.

Overall, CVCA data reveals that C$4.8 billion was invested across 215 deals in Q4, raising the total for 2021 to some C$18 billion committed across 799 completed deals.

Axial’s deal activity data offers a credible proxy to CVCA’s findings, confirming the general trends shaping deal activity across Canada’s LMM coming into 2022. But before tucking into the numbers, a caveat: deal activity conducted and tracked via Axial does not seek to represent a comprehensive record of all LMM transactions. Rather, with thousands of active members using the platform, the dataset captures the drivers of dealmaking in this thriving corner of the private capital markets.

In addition to aggregate value and total volume, Axial’s tracking of buy- and sell-side mandates complete the portrait of investor appetite for assets across Canada’s LMM captured by CVCA. The number of new buy-side mandates on the Axial platform for Canada increased to 115 last year, a 46.7% jump over 2020. And already through late March, the number of new buy-side mandates has reached 57, putting it on pace for a record annual tally for 2022 by topping 225, should the performance posted in Q1 persist through the remainder of this year.

Since the start of 2017, Axial’s data on Canada reflects a LMM dominated on the buy-side by a bucket of independent sponsors, private investors, and search funds all seeking targets. These investors reflect an appetite for assets generating a median maximum in revenue of US$50 million and a median maximum in EBITDA of US$7 million. By contrast, PE firms, sitting on record levels of dry powder, have their sights set on richer targets. These funds specify that

they’re seeking annual sales at the median of US$100 million and EBITDA an order of magnitude lower at US$10 million.

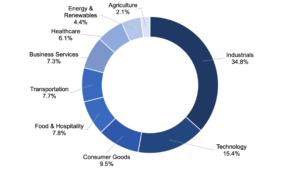

On the sell-side, the number of new mandates marketed on the Axial platform for Canada expanded to 203 in 2021, an increase of more than a third year-over-year. Through late March, the number of new sell-side mandates had already reached 53, a performance for the quarter that also has Canada’s LMM on pace to match at minimum the annual tally for 2021. Activity on this side of the negotiating table is largely mediated by business brokers (377 sell-side mandates since the start of 2017), advisory firms (294), and investment banks (150). However, corporates (20) and merchant banks (17) also play a vital role in this ecosystem. Although industrials represent just over a third of all sell-side mandates, Canada’s LMM reflects considerable dynamism across all verticals.

But the picture isn’t entirely rosy. It didn’t take long for Western sanctions against Russia to spur firms in Canada and elsewhere to reconsider their exposure to the country. On one hand, there’s simply the optics of continuing to operate in Russia following its brutal invasion of Ukraine. On the other hand, threats to the enterprise on the ground are very real and range from the challenges of securing new inputs to accessing business services during a war. These developments should bring assets to market that most buyers could not have anticipated entering the pipeline at the top of 2022.

To take a prominent early example of the war’s impact on this front, Kinross Gold announced plans to divest its Arctic Russian mine to Fortiana in early March. The Cypress-based firm remains under the control of Russian businessman Vladislav Sviblov. Kinross valued its Russian assets north of US$600 million through 2021. But that was before the war pushed the price of gold up by some 15% between late January and early March. At the same time, in the wake of Western sanctions, including Canada’s own, the value of Russian assets outside of commodities have cratered.

Meanwhile, both the agriculture and energy verticals garnered not inconsiderable attention from savvy investors looking to catch the upside from a Canadian market poised to rebound from the pandemic. The war in Ukraine and its impact on commodities has complicated an already complex picture, however—not least as key Canadian commodity prices remain elevated and will now stay that way far longer than many expected coming into this year.

Fortunately, Canada’s LMM has experienced a massive transformation of late. The result has been a steady increase in levels of sophistication from both buyers and sellers across the provinces. With a greater population of family offices, HNW investors, search funds, and independent sponsors than ever, North America’s LMM supports a significant proportion of add-on activity from American and Canadian PE funds that can also turn around to chase larger platform deals.

As cross-border dealmaking takes shape against a deteriorating macroeconomic backdrop complicated by an ongoing conflict between Russian and Ukraine—two of the world’s most significant players in the commodities space—this level of sophistication will now be required by investors hoping to win deals. Inflation pressures, supply chain challenges, and a pandemic entering its third year have not changed either. And buyers must now contend with total war in this already uncertain environment.

With investors settling into a less globalized market over the past five years, the SMEs of Canada’s LMM encountered more buy-side interest than ever. That already had Canada’s cross-border dealmaking prospect for 2022 and beyond poised to outperform coming into this year. The war between Russia and Ukraine has only made adopting a sector thesis or taking a thematic approach all the more paramount for successful deal making across Canada’s highly competitive LMM.