5 Strategies to Deliver Your Best Quarter

Today’s article is the second installment in our series on how to position your fund or advisory practice for a record-setting quarter. Part I is a downloadable goal setting excel template. Part II, walks through how you can optimize quarterly performance through five actionable tactics.

Last week, we covered what the best investors and intermediaries do differently to set themselves apart from the pack. The answer: they walk into every quarter with a detailed plan of attack.

Having robust and deliberate performance goals before you walk into the game gives you really valuable and actionable business insight. The more functional and targeted your goals, the easier it becomes to make the right decisions at scale. This applies regardless of whether you’re a fund manager targeting a certain IRR or an investment banker focused on growing advisory revenues.

But what do functional and targeted goals look like? This week, we’ll cover this topic.

Through our exposure to thousands of active business development professionals on the network, we’ve seen five consistent themes.

1. Define Specific Objectives

To optimize output, your goals should be as targeted, clear, and actionable as possible.

“Build a robust transaction pipeline” is a common objective. But how is your team planning to get there? If you were to hand your Q3 team goals to one of your associates, what is the first thing he would do?

On the flipside, consider a fund with the objective “increase the number of conversations with intermediaries specializing in middle-market industrial spinoffs”. This is a very actionable goal.

The first thing your associate would probably do is compile a list of investment banks in the sector. For every bank and broker with which he starts a conversation, your team moves one step closer to your desired portfolio of high-return investments.

2. Focus on Intermediate Actions

When you boil it down to the basics, every dealmaker is looking for the same thing. More deals. If you’re an advisor, this means more deal revenue. If you’re an investor, this means higher deal returns.

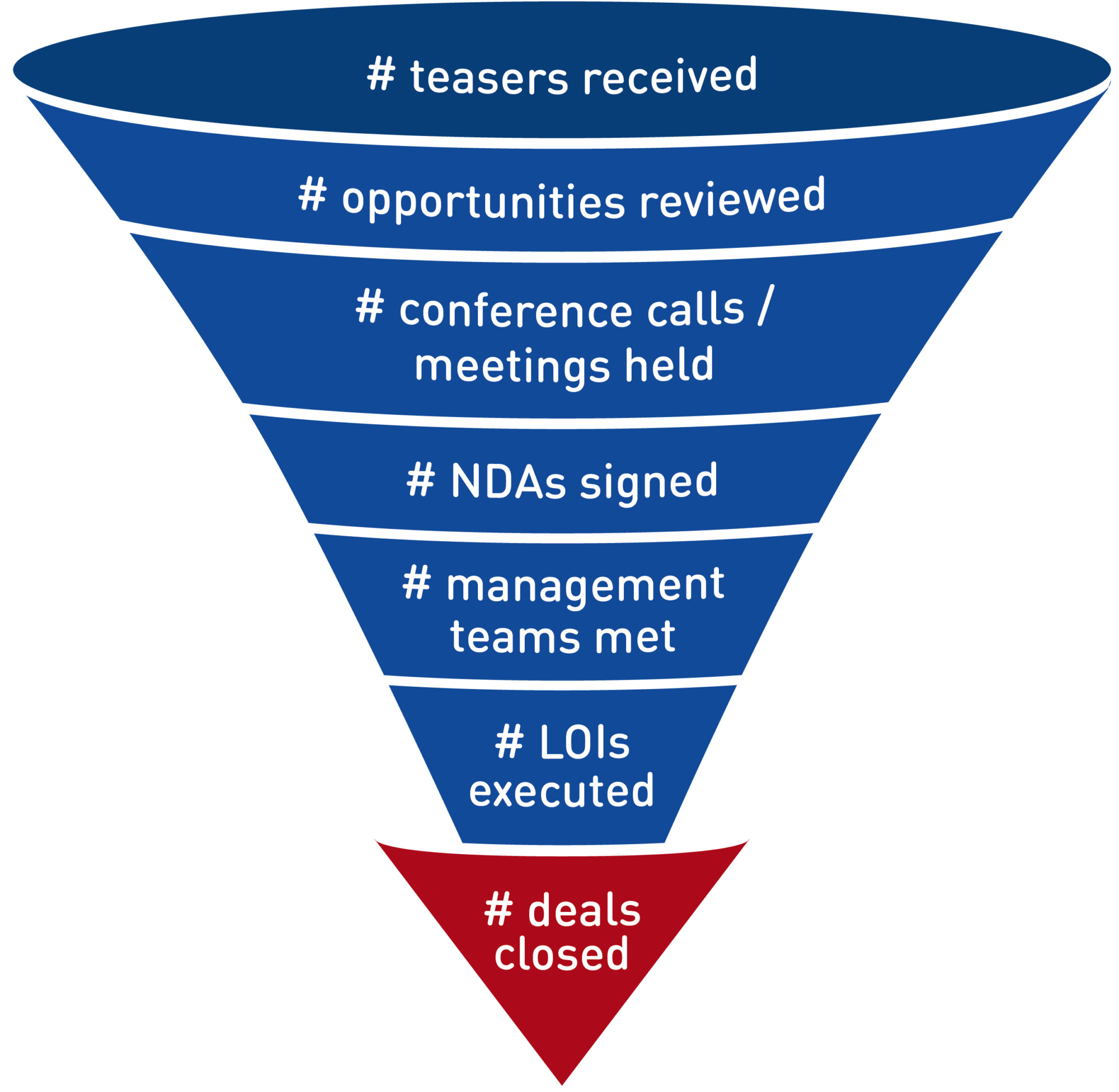

As a result, most funds have quarterly targets around the # of transactions completed, $ invested, % IRR, and $ cash returns. Similarly, most advisory practices have quarterly targets around the # of mandates won, # of deals closed, $ M&A revenue, $ financing revenue.

Why, however, do economists focused on GDP meticulously track leading indicators like unemployment filings, housing starts, and consumer confidence? Because leading economic indicators give them a sense of where the market is headed, allowing them to inform a fiscal and monetary gameplan that will perform soundly and successfully under those market conditions. Moreover these indicators give policymakers intermediate targets that, when healthy, contribute to the overall health of large-scale targets.

What are the leading indicators for advisory revenues or fund IRR?

- # new clients approached

- # pitches given

- # mandates won

- # NDAs executed

- # teasers / CIMs received

- # proprietary investment opportunities sourced

- # potential transactions analyzed

- # company owners contacted

- # LOIs executed

The best dealmakers don’t only set goals for the number of deals closed, internal rate of return, and advisory fees. They also set goals for everything important that gets them to these goals. Focus on setting targets around the activities your team needs to perform to reach the topline goal.

The second section of our business development template includes a list of metrics that every advisor and capital provider should have in their Q3 gameplan.

3. Set Measurable Outcomes

Many intermediaries would like to “improve relationships with strategic and financial buyers.” This is a goal, yes. But it’s not a measurable goal.

Case in point, if you end this quarter with 80 relationships and add 1 more in July, you would have technically met your target. But if you switch that goal up to read “increase number of relationships with strategic and financial buyers by 25%” suddenly you have something very different.

Choosing to set a quantified target for every single goal enables you not only to have clearly-defined goals, but to track your progress from quarter to quarter, month to month, or week to week.

The highest performing fund managers and advisory shops track their day-to-day performance metrics religiously. The moment they start falling short of their forecasted plan, they’re already devising a counter strategy (e.g., dedicate two days to sourcing, attend an adjacent industry conference, reach out to stale clients, etc.) to get back on track.

4. Optimize Sourcing Channels

This one is important. As we covered above, succeeding as a deal professional really comes down to having more high quality deals: more deal mandates for an advisor and higher deal returns for a capital provider.

However there are several ways to accomplish this. If you’re a private equity fund you could continue to cultivate legacy relationships with bankers, meet new bankers at industry events, use networking technology to meet fresh company owners, go through referrals, and so on.

Optimizing your quarter starts with knowing how much you rely on each of your deal-sourcing channels, and how they’re working out for you. List them, define them, and measure their efficacy at driving desired outcomes.

For example, let’s say you’re a Consumer investment banker and your objectives are # of deal mandates and $ advisory revenues. Currently 70% of your engagements come from legacy client relationships. What happens, however, when you hit a quarter in which none of your clients are acquisitive? Does it mean an automatic performance strike?

Knowing your channels, maintaining a certain degree of diversification, and optimizing them for scale is what allows the top dealmakers to succeed quarter after quarter.

The most productive partners and managing directors diversify across multiple channels: existing banker relationships, platform technologies, conferences, etc. See exhibit A. Those with their goals spread across channels (a) give themselves more opportunities to beat targets and (b) have a plan B, C, and D before it becomes necessary.

Exhibit A: Sample Channel Efficacy Tracking Template

5. Benchmark Relative to the Market

Finally, keep an eye on where your targets leave you, should you hit them.

What does it mean for you to achieve an IRR of 12% if every other fund in the space is hitting 16%? Does it ultimately help Goldman Sachs to increase meetings with new prospects by 10%, if Morgan Stanley increased them by 30%?

Hate it as we may, comparables are as important for deal professionals as they are for the investments we evaluate. As with anything in the markets, one weak year is perhaps insignificant but repeat subpar performance for a couple years is another definition for cyclical market underperformance.

Specifically to address this, the goal setting template combines your current results with an analysis of both sellside and buyside transaction activity growth on our network to help determine your recommended Q3 targets. Use these as a starting point.

As always, setting targets certainly doesn’t guarantee success. But figuring out (a) where you want to be, (b) how you want to get there, and (c) what numbers define decent, good, and great performance will, at the very least, provide your team with the tools they need to optimize this next quarter and, at the most, give them the tools necessary to deliver a record-setting quarter.