Top 10 Articles of 2019

Happy New Year! As we move into 2020, we’re recapping the most popular Middle Market Review articles from the past…

Deals come, and deals go.

Right now, M&A deal volume is at its lowest level since Q2 2015, with 549 deals closed in Q1 2017, according to business advisory firm BDO LLP. Still, BDO reports that investors remain bullish on the overall M&A market as well as valuations for sellers (which increased from 11.3x in Q4 2016 to 13.2 in Q1 2017).

While market trends can be hard to predict, there’s something much simpler that may have an even bigger impact on the deals coming across your desk: the season.

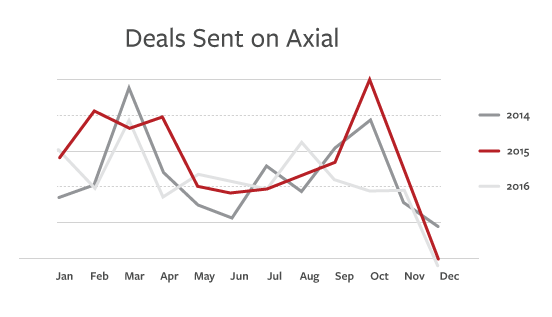

For many deal professionals, summer brings a more laissez-faire attitude — and lots of out of office messages. We decided to analyze Axial data from the past few years to see whether the “summer slump” held true for deal flow on the network.

Overall, we can see a definite dip leading up to and throughout the summer months every year (though 2016 did see a spike in August). Only December consistently sees fewer deals sent through the platform year-over-year.

Especially given the current market, chances are good that this year will see a similar decline. But fewer deals don’t have to translate to less productivity. For investors, this time of year can be an ideal time to ramp up business development efforts before a busy fall.

Here are a few ideas for making the most of the summer slowdown.

1. Ramp up your inbound marketing strategy: Inbound marketing is all about keeping your firm top-of-mind in a crowded landscape. Have you been meaning to revamp your website? Start an email newsletter? Publish articles on LinkedIn or Axial Forum? Be more active on social media? These activities are a great use of time on the days that you and your team are in the office this summer. All are relatively low-cost ways to increase visibility among bankers, business owners, and fellow investors.

2. Market your closed deals: Your closed transactions may be the secret weapon you’ve been waiting for. “There’s nothing that does a better job of telling the market — especially owners and operators — what you do and what you’re looking for than the deal you just closed,” says Brandon Labrum of FundLab. The summer is also a great time to reiterate your investment theses in person — especially over a drink or a round of golf.

3. Clean up your CRM: Dealmaking is not only about whom you know — it’s also about how you manage those contacts. Check out The Deal Professional’s Guide to CRMs to make sure you’re getting the most out of your software. If you’re not currently using a CRM, now is the time to start. If this process seems daunting to your existing team, summer is a great time to hire ambitious interns or MBA candidates who can help share the load.

4. Attend summer dealmaking and industry-specific events. Use the summer months to expand your network and nurture existing relationships at conferences and events. When possible, plan meetings with nearby bankers and/or investors to coincide with these trips. Here are a few events in July and August to put on your calendar:

July 13: ACG NY SummerBash 2017 (New York)

July 18: Axial Concord – Chicago (Chicago)

July 19-21: AM&AA Summer Conference (Chicago)

August 29: Axial Denver Summit (Denver)