How to Prepare Your Business for Sale: What Makes Owners Exit-Ready in 2025

Each month, Axial surveys its member network on a topic related to lower middle market M&A, aiming to spotlight what’s…

Over the last 12 months, 10,009 deals have been brought to market via the Axial platform. With Thanksgiving this coming Thursday, we thought it would be fitting to take a deep dive into seven different deal categories associated with the holiday.

For each category, we’ve shared the following five data points:

Enjoy the report, and have a wonderful Thanksgiving!

AAA predicts 55.4 million people will drive 50 miles or farther from home for Thanksgiving. Staying with family is not always the first (or second) choice, so making travel reservations is a great way to avoid sleeping on that basement cot at Grandma’s.

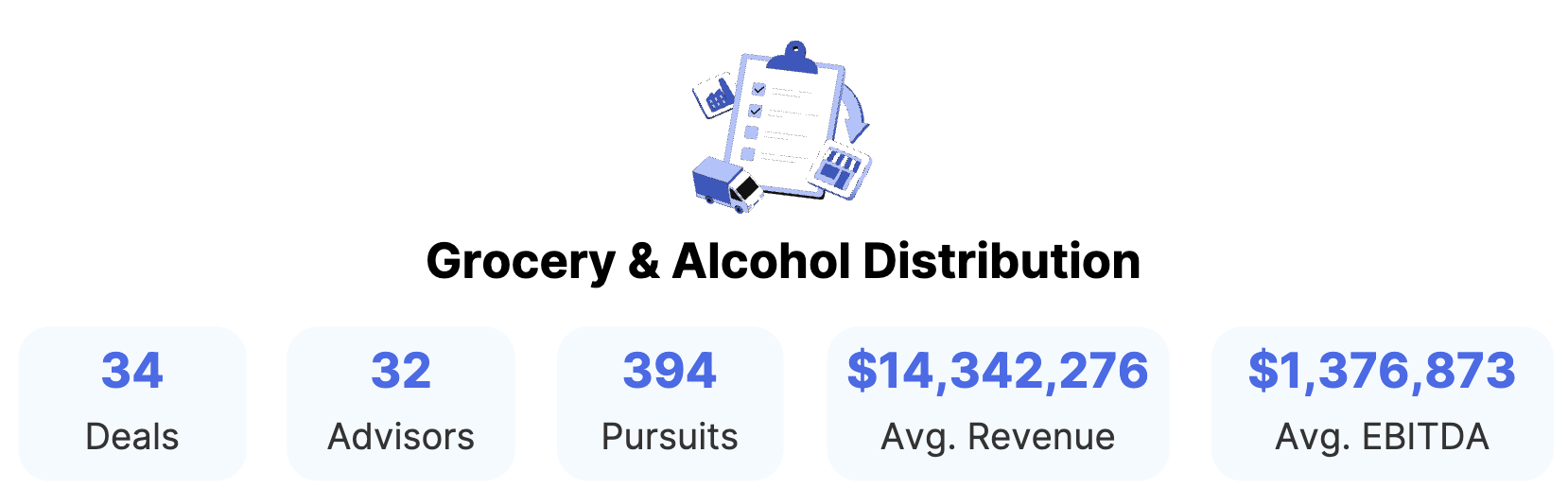

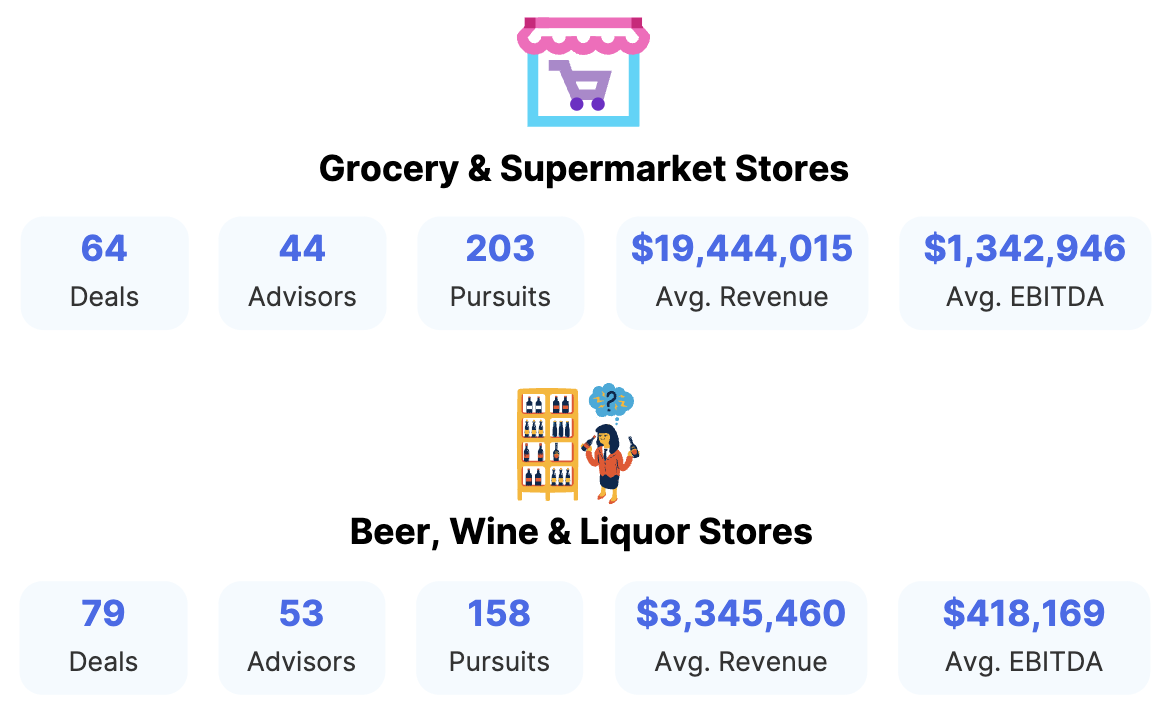

Long before the turkey goes in the oven and the first bottle of wine is opened, grocery and liquor stores gear up for the surge in shopping. Considering that, we looked at the M&A activity for Grocery & Alcohol Distribution deals this past year.

According to WalletHub, the average calories per person consumed on Thanksgiving falls in the 3,150-4,500 range, with the average number of alcoholic drinks consumed at 3.1 and 2.4 for men and women, respectively. That’s a lot of pre-holiday shopping!

Even though pies remain the star of most Thanksgiving dessert spreads, bringing an alternative sweet with a great M&A backstory could be the perfect addition to your celebration. If that’s the case, HIlliards Chocolates and this Masters in Small Business M&A podcast episode is just what you need!

Jonathan Kasen and Gordon Scott, former portfolio managers at Fidelity, share their journey of transitioning from financial careers to co-owners of Hilliards Chocolates, an artisan brand in New England, since 1924. The fourth-generation family-owned business appealed to them due to its resilience, strong brand following, and impressive family management team.

The episode discusses their acquisition of Hilliards and its sister company, Harbor Sweets, highlighting the success of maintaining family involvement in day-to-day operations, which has been a unique but effective approach to their partnership with Hilliards. Listen now.

There are more household fires on Thanksgiving than any other day, causing $26M in residential building property damage. Even with plenty of preventative measures, accidents can still happen, which is likely a contributing factor to the high number of pursuits per deal (10.98) on Fire Restoration Contractor deals.

Marmic Fire & Safety, a corporation headquartered in Missouri, specializes in fire suppression and safety services and has found success on Axial with three acquisitions in the past two years.

Once the tryptophan wears off, the realization that there are only 32 days until Christmas will be motivation enough to get back on track before the next set of celebrations starts. Luckily, these days, there are plenty of businesses to help keep you active.

With a few extra days off school, many parents will be looking for fun options to keep their children occupied and active. Hopefully, there are businesses like The Little Gym in your area. Check out this Q3 acquisition by Taurus Capital Partners.👇

Enjoy this set of LOI terms and deal data.

To assemble this eBook, we compiled the first 25 Winning LOIs and included summary breakdowns of key data points. To download, please enter your email below.