How Coronavirus Is Impacting Lower Middle Market M&A Activity

Last week, Axial convened a virtual roundtable of members to review the impact of the coronavirus pandemic on lower middle…

Tags

Highlights from iCapital Network’s report on single-family offices:

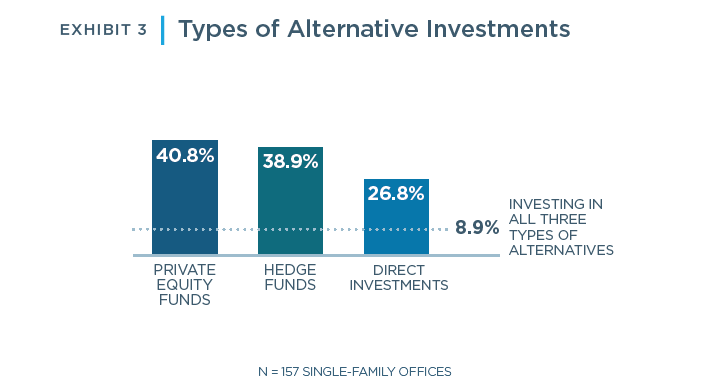

As alternative investments, which include private equity funds, hedge funds and direct deals, become a larger part of single-family offices’ portfolio, it is no secret that some of the world’s richest families are going big on direct investments.

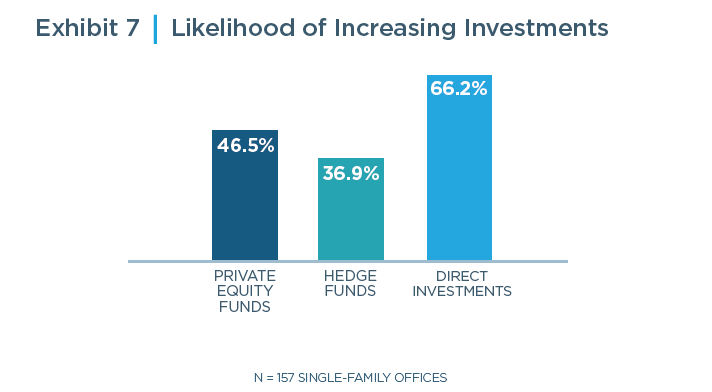

The report from iCapital Network shows that 66% of the 157 single-family offices surveyed plan to increase their direct investments. Around 25% of the surveyed family offices already invest directly in private companies, which may include co-investing alongside managers as well as ‘club’ deals with other family offices.

“This breadth of exposures more closely approximates institutional strategies than those typically implemented in the high-net-worth channel,” said the report.

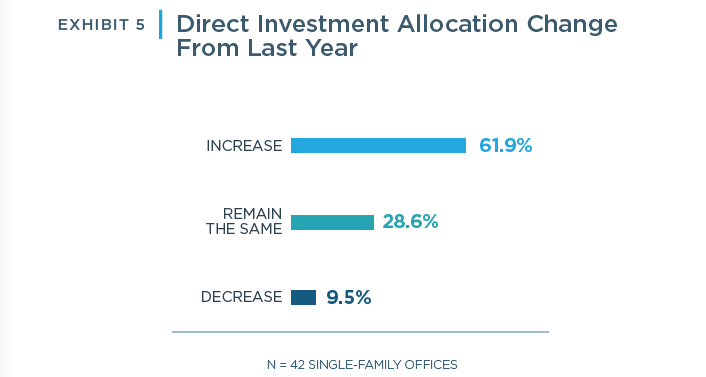

The survey result shows that close to 90% of single-family offices maintained or increased their private equity exposure either through funds or direct investments from last year. Out of the 42 single-family offices that have made direct investments in the past, 61.9% of them reported an rising allocation in direct investment allocation from last year, and 28.6% said the allocation remained the same.

Over the next three years, single-family offices are looking to increase exposure to alternative allocations across the board. Direct deals are especially appealing to them. Two-thirds of the single-family offices participated in the survey said that they would pursue more of these transactions going forward.

“One potential reason for the heightened interest in direct investments is the long history of entrepreneurialism within the family office community and the desire to preserve that legacy for future generations.,” the report said.

Most family wealth is created through entrepreneurial means. Over the years, many single-family offices have developed a particular expertise and presence in specific fields, such as real estate development or manufacturing. This allows them to exploit competitive advantage in areas that they understand well and that align with the family’s history and interests, according to the report.

Another reason for the shift towards direct deals, according to the report, is the desire to avoid the fees associated with gaining private equity exposure via third-party funds.

In the past, single-family offices were largely content building alternative allocations using third-party managers and renegotiate fees in cases of underperformance, according to the report. These organizations are now increasingly hiring portfolio managers directly and establishing their own in-house funds.

“Family offices are beginning to resemble asset managers in some respects as they seek to optimize their allocation mix and maximize returns, and will benefit from more robust systems to support these efforts,” the report said.

Although single-family offices represent a serious and substantial pool of capital for alternative asset managers, they act very differently from average high net worth individuals. “Recognizing single-family offices’ desire for greater control over their investments, at less cost, will be necessary to creating partnerships that are appealing to them,” the report said.

In addition to co-investment, separate accounts and other structures commonly used to capture institutional assets are also likely to become more common.

Click here to see the full report: Single-Family Offices and Alternative Investments