The Winning LOI [Vol. 3, Issue 8, No. 35]

Welcome to the 35th issue of The Winning LOI, the Axial newsletter that anonymously reveals small business M&A valuation data…

This is Issue #12 of The Winning LOI, the Axial newsletter that anonymously reveals small business M&A valuation data and certain key deal terms associated with winning LOIs.

Sign up to receive the Winning LOI newsletter here.

Sponsorship inquiries: [email protected]

In this issue, we dive into the M&A valuation data and key M&A deal terms for a food & beverage distribution company generating $2M – $2.25M in EBITDA at the time it went to market. The deal was confidentially marketed in Q2 of 2022 via Axial, spent 17 days in market, and closed 250 days after the winning LOI was executed.

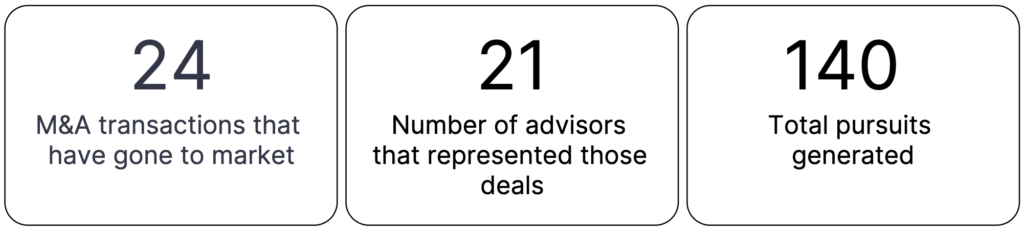

We took a deeper look at the deal activity for the grocery and related food distribution industry on Axial over the last 12 months. Here are the basics:

See below for Winning LOI #12’s anonymized data ⬇️

| The Deal | |

|---|---|

| Deal Type | Change of Control |

| Revenue Range (2021) | $6.5M - $7M |

| EBITDA Range (2021) | $2M - $2.25M |

| EBITDA Margin Range | 30% - 35% |

| Key Industries | Food & Beverage |

| In-Market Date | Q2 2022 |

| Axial Deal Data | |

|---|---|

| Recommendations* | 112 |

| Recipients* | 112 |

| # of Pursuits* | 11 |

| Deal Pursuit Rate* | 9.82% |

| Winning LOI Pursuit to LOI Executed | 17 Days |

| Winning LOI Executed to Deal Closed | 250 Days |

| The LOI | |

|---|---|

| Total Enterprise Value (TEV) Range | $10.5M - $11M |

| EBITDA Multiple Range (2021) | 5.25x - 5.5x |

| Exclusivity | 120 Days |

| Structure | |

| ➡️ Cash | 75% of TEV |

| ➡️ Rollover Equity | 18% of TEV |

| ➡️ Earnout | 7% of TEV |

| ➡️ Seller Financing | ❌ |

| Axial Sell-Side Member Data | |

|---|---|

| Member Type | Business Broker |

| Total Deals Marketed on Axial | 1,323 |

| Average Annual Deals Marketed | 132 |

| Average Revenue of Deals | $13,735,892 |

| Average EBITDA of Deals | $1,653,637 |

| Axial Buyside Member Data | |

|---|---|

| Member Type | Corporation |

| Number of Acquisitions | 1 |

| Buyside Pursuit Rate* | 5.71% |

| Buyer Responsiveness Rate* | 95.24% |

*Buyside Recommendation: Axial sell-side members receive a matching set of buyside members for every deal they manage via Axial. A buyside recommendation refers to a specific buyside Axial member who matches a particular deal.

*Recipient: A recipient is a buyside member who has been granted access by an Axial sell-side member to review a particular deal.

*Pursuit: Axial buyside members express initial interest in a deal by clicking “Pursue”, after which they can access and sign the NDA.

*Deal Pursuit Rate: The deal “Pursuit Rate” is defined as the number of times a particular deal is pursued by unique buyside members (i.e. the buyer shows explicit interest in exploring the deal) divided by the total number of buy-side firms invited to evaluate the deal

*Buyside Pursuit Rate: The buyside “Pursuit Rate” is defined as the number of deals pursued by a particular buyer throughout an entire Axial membership term, divided by the total number of deals sourced during the same timeframe.

*Buyside Responsiveness Rate: The buyside “Responsiveness Rate” is defined as the rate at which a member responds to teaser shares within 5 days. The calculation initiates when a member has a minimum of 10 teasers and is calculated based on the member’s last 100 teasers received.

Disclosures: All data presented in The Winning LOI is anonymized to respect and protect the confidentiality of Axial members and their transactions. Data is provided to Axial by Axial members in accordance with the Axial Member Terms of Service. Axial has endeavored to present data accurately, but Axial does not and cannot fully verify the accuracy of the presented information. Information contained in The Winning LOI is for informational purposes only, and does not represent investment advice or recommendations of any kind.