Don’t Leave Money on the Table: Improving Returns

In the private equity world, it’s all about the deal. When a major deal is closed, it is rightly celebrated by the team that worked hard to make it happen, as it should be. But after the champagne corks are popped and accolades traded, it’s time for the real work to begin, and this is where trouble often starts.

A myriad of issues in the newly acquired firm suddenly crop up, including operational issues. The PE executives who did the deal are on to other opportunities, and these operational problems get passed from one person to another in the portfolio company’s management team – a classic case of “hot potato.” And this unproductive cycle continues as the clock keeps ticking toward the eventual sale of the company in three to five years, when the PE firm hopes to receive a solid return on its investment.

In our work with PE firms and their portfolio companies, we have seen this scenario play out time and again. By failing to fully attend to the operational improvement aspects of the deal, PE firms are unintentionally undermining the value of their acquisitions. All too many PE firms focus on quick, short-term EBITDA gains and stable market share growth to help define success, but many are ultimately disappointed by the value at exit, knowing that it could have been greater had they been able to tackle all the opportunities for improvement.

Lacking a “Quality of Operations” Report?

The seeds of this scenario are sown during the early stages of the deal. Most PE firms perform due diligence upfront to identify possible areas of risk as well as potential areas for adding value. All too often, this due diligence falls short of the level of depth and detail needed to truly maximize the potential value of the acquired firm.

Typically, PE firms’ due diligence lacks what we call a “Quality of Operations Report.” This is an extremely in-depth look at the operational health of the target firm spanning supply chain, operational efficiency, and the health of the product development portfolio. The Quality of Operations Report is a vital complement to the traditional Quality of Earnings report focused on the company’s financial health, and should be included as a fundamental element of every deal.

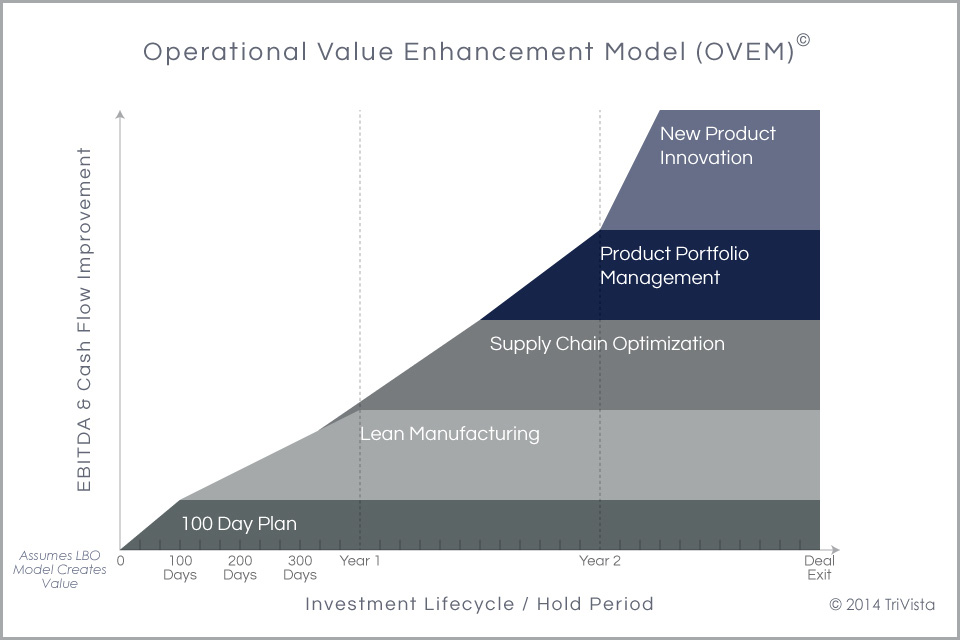

The Quality of Operations Report, which identifies both risks and opportunities in an acquisition target’s operations, should serve as major input to the 100-day plan a PE firm creates as a post-close game plan to ensure essential actions that need to happen immediately are identified and, importantly, assigned responsibility. After the 100-day plan has been implemented, a PE firm and its portfolio company management team should turn their attention to actions that can significantly improve operational performance over the next few years.

By following this blueprint for operational excellence, PE firms can dramatically improve the value of an acquisition, resulting in a significantly higher payday at exit.

OPERATIONAL EXCELLENCE BLUE PRINT – 3 STEPS TO CREATE VALUE

This blueprint includes “three pillars” of operational excellence that should be executed in a phased approach after the 100-day plan is completed.

Phase 1: Lean Manufacturing

The first phase, done six to nine months after the deal closes, is the cleanup phase, in which the company implements operational best practices and improvement initiatives—including Lean and Six Sigma—within the “four walls” of the organization to reduce waste, inefficiency, and costs.

Phase 2: Supply Chain Optimization

Shortly after the cleanup phase has begun, the company should begin focusing on optimizing its supply chain, both upstream to suppliers and downstream to customers—through such initiatives as strategic sourcing, logistics network optimization, and sales and operations planning.

The preceding phases are designed to address the company’s bottom line and cash flows. Done correctly, they will not only boost margins, but also enhance the organization’s overall capacity to quickly and efficiently fulfill demand.

Phase 3: New Product Development

Once the “house is in order,” it’s time to target the top line and capitalize on the company’s streamlined operations. Thus, the third phase – strengthening the new product development pipeline by focusing on improving the company’s ability to quickly, efficiently, and profitably bring a greater number of desirable new products to market. Efforts in this phase concentrate on boosting the effectiveness of the overall product development process (by, for example, adding or enhancing stage gates), strengthening the product portfolio pipeline, and incorporating customer input (voice of customer) to achieve greater product relevance and marketplace acceptance. Once phase one and two have been implemented, the company should be in a good position to drive new product sales through their more efficient plants and supply chain. In many cases, significant revenue growth can be achieved without the need to add roofline, resources, or excess inventory.

FINAL THOUGHTS

So after popping the champagne cork, it’s crucial for the PE firm to remain focused on the basics:

- Pre-Acquisition:

- Quality of Operations Report

- 100-Day Plan

- Post-Acquisition:

- Lean Manufacturing

- Supply Chain Optimization

- New Product Development

By attacking a portfolio company’s operations in this three-pronged approach (post-acquisition), a PE firm not only can significantly enhance the company’s profitability, but more importantly, boost the company’s future value by demonstrating a more robust product pipeline and process for getting those new products to market. That combination is the key to ensuring money isn’t left on the table, and the highest purchase price multiple for the company is obtained when buyers come calling.