The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

Consumers are a vital part of the US economy, and their influence on consumption of GDP growth is quantifiably large (roughly 67% in Q1). Consumer behavior is undoubtedly being impacted by COVID-19, prompting McKinsey to publish a piece on recent trends in the sector and speculating on M&A activity in the space in the years to come. The article draws on data from deals since the 2008 Global Financial Crisis to identify the specific acquisition types that have delivered the most shareholder value over time.

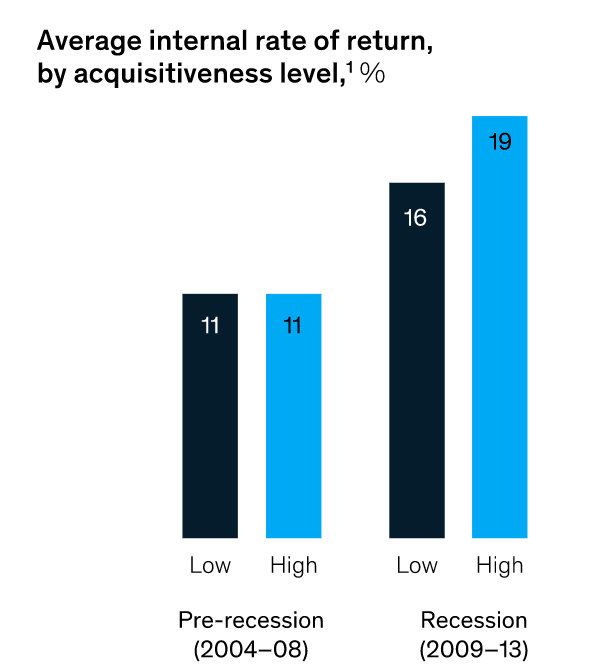

According to the data, acquisitive companies in the 2008-09 downturn outperformed their least acquisitive peers by nearly 6x, as measured in shareholder returns through 2017. The article also states that more active private equity firms were similarly advantaged over the same period.

This out-performance can be partially attributed to any acquirers with dry powder at the time having an opportunity to capitalize on temporarily depressed multiples. Whether that was through shrewd capital planning or good fortune, it’s empirically demonstrable that crises can create opportunity through attractive valuations.

Acquiring the Competition: The most successful consumer goods acquisitions from 2013 to 2018 were those focused on the absorption of “disruptive challengers.” The best performers in this category had a programmatic approach, acquiring multiple potential challengers each year. This allowed incumbents to snap up high-growth competitors, often augmenting their technological capabilities along the way.

Coronavirus is likely to cause these trends to repeat. Smaller up-and-comers are often disadvantaged by less fortified balance sheets and relationships with retailers who prioritize more reliable supply availability. Success here will hinge on the acquisition’s ability to quickly improve capabilities in e-commerce, data & analytics, digital marketing, or last-mile delivery. These characteristics are likely to be acquired at a discount in the immediate future, and the best deals are likely to deliver exceptional value when the economy returns to expansion.

Established Brands: Acquisitions of established brands delivered roughly half of the return delivered by challenger take-outs over the past decade. Larger scale operations can improve supply chain resilience, and could curry favor with retailers. Scale, in this case, refers not only to volume, but also to data and analytics capabilities, which could deliver value beyond the current crisis. Acquisitions of value brands could also help protect market share in the medium term.

Horizontal Expansion: The least successful deals of the past decade involved the horizontal expansion into adjacent businesses. These bolt-on acquisitions did not yield meaningful scale gains, nor did they strengthen core portfolios. As a result, total shareholder returns were close to zero. These strategies are likely to lose favor in a time of crisis, as most companies focus on core competencies. However, diversification could become available at attractive valuations, which could cause some acquirers to prioritize diversification over efficiency.

Uncertainty in debt markets and global demand create a challenging environment for the traditional PE sweet spots, but nearly $2T in liquidity across the industry is likely to facilitate activity through the COVID-19 crisis. There should be opportunities to acquire sought-after brands that previously carried prohibitive valuations. The shedding of non-core or under-performing businesses is also likely to attract PE attention. Distress and portfolio review can offer attractive entry points, and investors who keep the above post-crisis performance in mind can stand to opportunistically enhance returns.

The McKinsey article concludes that M&A activity grounded in sound financial health, with special focus on evolving competitive advantage and diligent market analysis could lead to exceptional outcomes. This seems like an obvious statement, but it is especially salient at a time when crisis will lead to rapid economic shifts, volatile market conditions, and the competitive elimination of those who fail to learn from history with an eye to the future.