The Changing World of Working Capital Loans

In May 2013, Google invested $100 million in super-hot peer-to-peer (“P2P”) lending company, Lending Club, because of its potential to become a major player in the small business finance space. Less than a year later, Lending Club released to major fanfare its small business loan product.

Lending Club is not the only company raising money. OnDeck Capital, which is solely focused on small business finance, has raised over $300 million in a combination of debt and equity since May 2012. Prosper, too, has raised almost $190 million since 2006. There are a number of companies that have raised much smaller amounts to develop small business finance products in the last few years. What has generated all this interest? Below are 3 factors that I believe are behind the interest:

The Success of Lending Club & Prosper

Lending Club & Prosper pioneered the model of making short-term (5 years or less) loans to individual consumers. They proved that firms could gather enough information online to assess a potential borrower’s risk, and give them a firm interest rate quote instantaneously after completing an application. (Verifying the information on which the quote was based can take a few days.) In other words, Lending Club showed the way for making the process of shopping around for a loan easy for borrowers. Because potential borrowers know the rates upfront, Lending Club and Prosper don’t have to spend lots of time on processing / verifying information for applicants not interested in going through with a loan. The cost of onboarding borrowers is very low for these firms compared to traditional banks. While the process of onboarding small business borrowers is a bit more complicated, Lending Club and Prosper proved that transaction costs could be greatly reduced for lenders and the process could be less time consuming for borrowers.

Banks Not Meeting the Needs of Small Business Borrowers

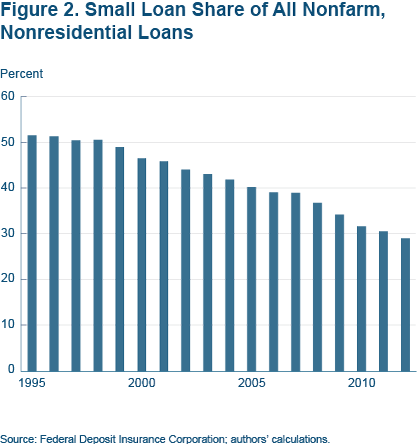

Banks have been reducing their borrowing to small business borrowers, providing an opportunity for non-bank lenders to fill the gap. This would be an easy one to blame on the financial crash of 2008. However, banks have been reducing their loan portfolio allocations to small business for a long-time. The chart below, which comes from a great report by Cleveland Federal reserve on the topic, show that banks have been reducing their lending to small business borrowers since 1995.

Greater Confidence in Firm’s Ability to Predict Risk with Purely Online Models

Non-traditional borrowers now appear to have enough data and solid models for assessing risk. While OnDeck may have become a large name in the last couple years, the company has in fact been operating since 2007. There are a handful of other companies that have been making such short-term loans to small businesses for some time, like Funding Circle (which has lent hundreds of millions to UK small businesses) and IOU Central. The track record of these companies in underwriting loans is making investors more willing to jump into the business of providing them capital.

Key Players & Factors

Here are some of the emerging players in the small business lending space:

- Lending Club: The largest player in the “P2P” consumer lending space now offers loans from 1 to 5 years for amounts up to $150,000. Details

- OnDeck: In the small business lending space for over 7 years, some businesses can borrow up to $250,000 for two years. However, $40,000 for a six to 12 month term is far more common. Details

- Funding Circle: While new to the US, the company has established a great reputation in the UK. They tend to lend to larger and more financially secure small businesses.

- CAN Capital: Owned by one of the largest companies in the merchant cash advance space (credit card receivable financing), CAN Capital is well positioned to be a major player.

- Biz2Credit: Provides borrowers with the ability to get quotes from multiple lenders at once.

- Prosper: Peer-to-peer lending marketplace, allowing people to invest in each other in a financially and socially beneficial way.

Things To Consider:

- Factor Rate and Interest Rate Are Not The Same – Let’s say that your company borrows $100,000 with a factor rate of 1.3. This means that you will be required to pay back $130,000 over the life of the loan. However, the actual amount can be much higher, even double the factor rate. This is true for several reasons, including the length of the loan being less than a year and amortization of the loan from daily payments.

- Simple Interest and Computed Interest – Lets say your company borrows $100,000 for a year at an interest rate of 20%. However, some companies require that you pay the interest based on the entire term of the loan, regardless of when the loan is paid back. This is called computed interest. Interest calculated based on when the loan is paid back is called simple interest.

- It’s A Business Loan, But You’re Personally Going To Be On The Hook – Most of these companies require that a company owner personally guarantees the payment of the loan.

Bottom Line

For good businesses, there are now several options for quickly getting a loan of $150,000 to $250,000 with a 6 month to 5 year term. But borrower beware, this money carries a very high interest rate and there are many unpleasant terms to taking the money. Those companies not in an emergency funding situation should try to see if they can get SBA CAP Lines loan.