Axial Research: 2011 Health Care M&A Activity Report

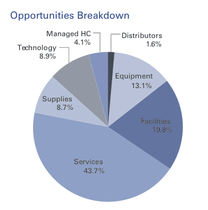

This month’s Axial network activity report takes a closer look at the 300 Opportunities brought to market specifically within the Health Care industry in the United States and Canada in 2011. Health Care accounted for 9% of overall network activity and experienced a 96% increase in deal flow in Q4.

There was a relative surplus of Opportunities in the Health Care Services subsector and, although they had a higher than average EBITDA margin, the average Pursuit rate and Pursuits per Opportunity indicated low demand for these types of companies.

In 2011, across the Axial network, over 1,500 Transaction Profiles executed more than 8,800 Pursuits and 1,285 Axial Members managed over 3,762 transactions on the Axial network.

Download the Axial Network 2011 Health Care M&A / Deal Activity Report today.

Health Care M&A activity insights include:

- Managed Health Care was the least active subsector, with only 10 Opportunities, yet it has included some of the most profitable companies, with an average EBITDA margin of 17.6%.

- Although there was a limited supply of Health Care Distributors Opportunities, the sector included the most profitable companies, both maintaining an average EBITDA margin of 20% and one of the highest pursuit rates across all sectors at 9%.

- Although the fewest number of companies, 13, originated in the East South Central region, they averaged 5.5 Pursuits per Opportunity, the second highest, behind only the Middle Atlantic, indicating a better than average quality of Health Care opportunities in this region.

- The West South Central significantly underperformed in average pursuit rate with only 3.2 Pursuits per Opportunity, despite a nearly 20.30% average EBITDA margin, while the Middle Atlantic significantly overperformed with 5.6 pursuits per opportunity even though it had less than half the Average EBITDA margin of the West South Central with 9.35%.