Exit Preparation: What Business Owners Need To Know

When we surveyed Axial’s Investment Banking membership on the topic of exit preparation, we asked a wide range of questions…

COVID-19 has been a clear catalyst for the food delivery industry. Widespread government-mandated restaurant closures and consumer quarantining has driven unprecedented demand for grocery and food delivery services. The accelerated adoption of online ordering and delivery by restaurants has given rise to new business models, catching the attention of investors looking to take part in this unprecedented growth.

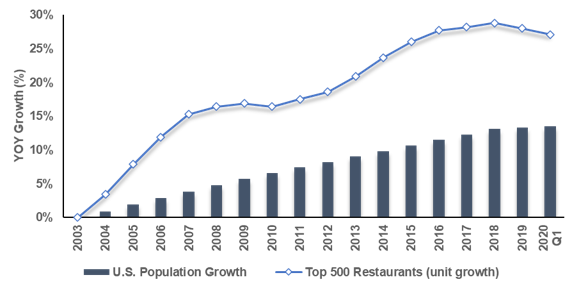

The restaurant industry has spent much of the past decade focused on expansion, with some of the biggest fast-food companies opening locations on what seems like every street corner. Growth among the top 500 dining chains has outpaced U.S. population growth since 2003, leading to a situation of oversupply. There are currently more seats in restaurants than diners nationwide.

Much of this early expansion was originally financed with cheap debt, as companies took advantage of near historic low interest rates. Restaurants started to feel the pain in 2019 as those rates began to change, along with shifting consumer tastes, delivery options, rising wages, and increased competition. Now, fast forward to 2020 where restaurant traffic nearly disappeared overnight (down between 40% and 80% across the industry), and you’re looking at a significant retraction in the growth that traditional dine-in restaurants have experienced over the last 10+ years.

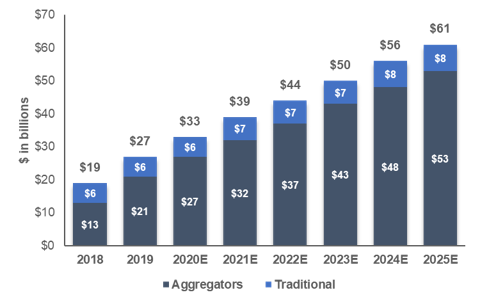

Consumers have grown accustomed to having meals brought to their workplace or home with a simple phone call or a few mobile swipes. Even before the outbreak, the online food-delivery market was on the rise, projected to reach $61 billion by 2025, growing at a CAGR of 14.6%. The online food-delivery market consists of two different delivery service models: restaurant-to-consumer delivery (traditional) and platform-to-consumer delivery (aggregators).

The traditional delivery segment includes the delivery of meals carried out directly by the restaurants. The order may be made via platforms (e.g. Delivery Hero, Just Eat) or directly through a restaurant website (e.g. Domino’s). Major brands including Chipotle, Panera, and Roti have added second lines to accommodate the influx of carryout orders.

The aggregator segment focuses on online delivery services that provide customers with meals from partner restaurants that do not necessarily have to offer food delivery themselves. In this case, the platform (e.g. Deliveroo) handles the delivery process. Online food-delivery platforms such as DoorDash, Caviar (now part of DoorDash), Uber Eats, Seamless, Postmates (now part of Uber Eats) and Grubhub (soon to be part of Just Eat) are expanding consumer choice and convenience.

Many online food-delivery companies see COVID-19 as an opportunity to gain market share. Uber CEO Dara Khosrowshahi has indicated he believes the company’s Eats segment will see a boost from social distancing as consumers increasingly dine in.

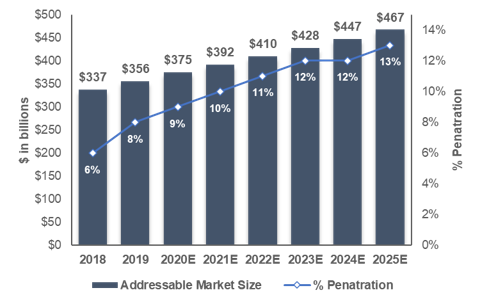

Although the restaurant delivery market is maturing, with only a small number of players dominating the largest markets, smaller cities and rural markets remain underserved. The addressable market share for food delivery in the U.S. alone is estimated to reach $467 billion by 2025. Despite overall industry growth, the battle for customers is getting more intense because fewer of today’s diners are loyal to just one service. Grubhub’s CEO has cited “promiscuous customers” as hindrance to his company’s growth. There is enough demand to go around, with a significant opportunity for investors with capital to deploy.

Many investors have traditionally avoided the restaurant industry as a whole. Historically, the traditional restaurant model had limited opportunities to scale their business with expansion driven by cash flows from operations. Over time, this model changed. VC investment activity in new-age restaurant trends, like ghost kitchen businesses (delivery-only meals food preparation facilities), has risen over the past five years, with deal values increasing at least 2.4x each year since 2016.

Although deal activity has slowed dramatically over the last few months, with most investors preferring to wait on the sidelines until a model has been proven, COVID-19 has facilitated targeted investments within the space since its onset. Furthermore, COVID-19 will continue to be a catalyst for online food-delivery, with emerging ghost kitchen startups providing an attractive business model as more restaurant sales move to off-premise dining.

COVID-19 has hit restaurants hard, specifically those that do not offer take-out, drive-thru, or delivery. The historical performance of the restaurant industry indicates a strong comeback is highly probable for those who adapt. Much like the rise of the food trucks following the 2008 recession, ghost kitchens will be at the forefront of the next major industry shift. Limits on in-store dining are putting new pressures on restaurants’ off-premise capabilities, accelerating an already growing focus on takeout and delivery. The largest companies with the most cash will be the ones that will come out the strongest. Small and midsized concepts will have the toughest time reemerging. Private-equity firms that aren’t spending their investment cash shoring up or supporting existing properties or portfolio companies may find an opportunity to consolidate an array of restaurant chains at a discount. Alternatively they could explore investing in or greenfield KaaS facilities to piggyback off the growth of the online food-delivery trend which is here to stay.

This post was a guest submission by Axial member Bob Dekker, Managing Director at Balmoral Advisors. Click here to access the firm’s comprehensive Q2 Restaurant Industry Spotlight Report.

Balmoral Advisors is an independent investment bank dedicated to providing mergers & acquisitions, corporate finance, and financial restructuring advisory services involving mid-sized transactions. The firm specializes in helping clients sell their businesses, find and complete acquisitions, and raise or refinance capital. Balmoral Advisors works with business owners, corporations and financial investors worldwide involving early stage growth companies, successful mature businesses, corporate divestitures, special situations, and distressed transactions.