The SMB M&A Pipeline: Q1 2024

Welcome to the Q1 2024 issue of The SMB M&A Pipeline. This quarterly series surfaces a top-of-the-funnel breakdown of the…

Tags

We find ourselves at the starting line of yet another industrial revolution — “Industry 4.0.” It was only 70 years ago that the third industrial revolution took hold. These revolutions tend to accelerate the pace of creative destruction for industrial economy entrepreneurs, and for the capital partners with whom they build their businesses.

Artificial intelligence, M2M (machine-to-machine) communications, cloud computing — these are the central underlying technologies driving the advent of Industry 4.0.

In this report we profile 50 of the top industrials-focused private equity firms and M&A advisors transacting in the lower middle market via Axial today. As active members of Axial, we have insight and access to understand their focus areas, their efficacy, their reputation, and their track records.

Click here to see the full list

In this piece, we also present an analysis comparing anonymized industrial economy transactions from the last twelve months and the specific industrial segments most in demand on Axial during that same time period. This analysis is accompanied by practitioner commentary on trends in the broader industrials sector. We’d like to thank the following Axial members and industrial specialists:

Like this report? It’s the fourth in an ongoing series (click here for the Software Top 50, here for the Healthcare Top 50, and here for the Consumer Top 50). Email us at [email protected] if you have questions, ideas, or additions.

The industrials category has long been one of the most active M&A sectors in the lower middle market. Hard assets, relatively predictable cash flows, and large amounts of market share fragmentation are three of many reasons that private equity grew up in the 1970s and 1980s so disproportionately focused on industrial businesses.

Those hallmark attributes, however, quickly took a back seat to operational experience when crisis struck last year. “Covid-19 is uncharted territory for all of us. Dealing with crisis is not,” says Craig Korte, Director of Business Development at Industrial Opportunity Partners, a specialized, industrials-only focused private equity firm investing out of their third, $450M fund. “Having experienced operational talent who knew how to move quickly to cut costs and stabilize supply chains proved to be absolutely critical.”

Agility is what enabled so many businesses to weather last year’s storm. That same agility can now be harnessed to capitalize on some of the accelerated trends that were already in motion before the pandemic. Data from the last financial crisis shows that those who actively and decisively pursued M&A during the crisis outperformed competition over the long term.

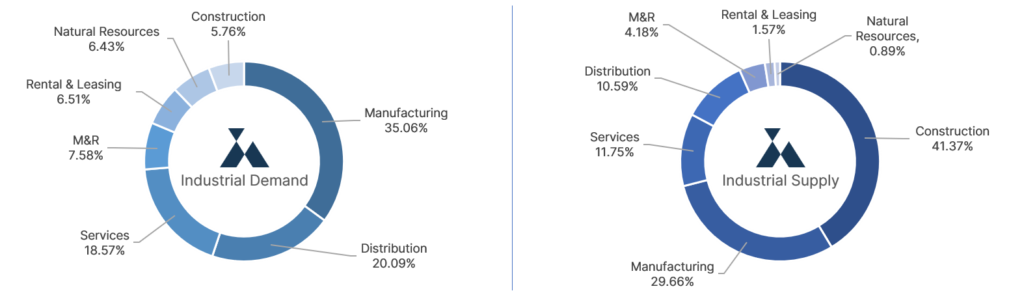

We reviewed the industrials-focused investment criteria of over 500 private equity investors and corporate acquirers on Axial and over 2,000 industrial related deals that have come to market in the last 12 months. The analysis yielded the following top seven lower middle market industrials segments on the buy and sell-side:

Investor Demand by Industrial Category

| Rank | Sector | Percent of Buyer Mandates |

|---|---|---|

| 1 | Manufacturing | 35.06% |

| 2 | Distribution | 20.09% |

| 3 | Services | 18.57% |

| 4 | Maintenance & Repair | 7.58% |

| 5 | Rental & Leasing | 6.51% |

| 6 | Natural Resources | 6.43% |

| 7 | Construction | 5.76% |

Deal Flow by Industrial Category

| Rank | Sector | Percent of Deal Flow |

|---|---|---|

| 1 | Construction | 41.37% |

| 2 | Manufacturing | 29.66% |

| 3 | Services | 11.75% |

| 4 | Distribution | 10.59% |

| 5 | Maintenance & Repair | 4.18% |

| 6 | Rental & Leasing | 1.57% |

| 7 | Natural Resources | 0.89% |

The effects of Covid-19 on industrial operations and a general trend towards automation have significantly impacted the performance of industrial businesses and their transactional needs. Private equity and strategic buyers targeting the space have followed suit, redefining their business development strategies to capitalize on these trends.

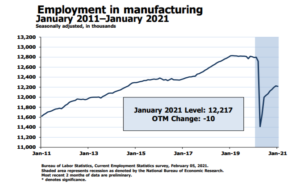

Unemployment was one of the first economic consequences of COVID-19. The bureau of labor statistics recorded 1.4M lost manufacturing jobs in March and April of 2020 alone.

Unemployment was one of the first economic consequences of COVID-19. The bureau of labor statistics recorded 1.4M lost manufacturing jobs in March and April of 2020 alone.

The decision to lay people off is never an easy one, especially in certain industrial sub-sectors that require skilled labor.

“I began my career as an hourly worker at Toyota,” says John Stewart, author of “Toyota Kaizen Continuum: A Practical Guide to Implementing Lean” and Founding Partner at MiddleGround Capital, a private equity firm investing in industrial and specialty distribution companies. “I know how it feels to be in that position. I also know the value of a trained workforce. I was worried that if we laid off skilled workers, other manufacturers would hire them.”

Companies who were able to overcome the catch-22 of retaining talent while reducing costs, proved to be those who were able to recover most quickly when the first wave of shutdowns ended. “We saw Covid’s impact on our businesses in the form of supply chain disruption as early as January. We announced to our work force that we weren’t going to lay anyone off. Our focus on managing working capital and not over-levering businesses put us in a position to be able to make that commitment.”

Workforce management also tends to directly correlate with a business’ ability to transact at competitive multiples, notes Dustin Hill, Director of Investment Banking at FINNEA Group, a leading boutique M&A and financial advisory firm. “Companies that shut their doors in April, but managed to get back up and running at 90-100% by mid-summer, were those who were able to retain their employee base and keep the shop floor full. Those assets with quick recoveries are in high demand right now and multiples are at pre-covid levels.”

Many businesses who were not able to easily retain talent during the crisis looked towards automation to make up the gap in production. The human constraint was removed from the equation, a tactic that is not likely to reverse itself once life goes back to normal. Are those jobs gone for good?

“Automation has always happened throughout history and humanity has still found a way to keep people busy,” says Hill. “we have to remember that unemployment was at an all-time low a little over a year ago, yet automation had never been more prevalent.”

While certainly fast tracked over the last twelve months, automation is poised to continue to materially change the way businesses operate for the foreseeable future.

In addition to solving for employment and labor limitations, automation has begun to play a growing role in digitizing key elements of industrial operations. Take the supply chain. Industry 4.0-oriented industrial businesses leaned hard into new-age technologies like Digital Supply Networks to get real-time activity updates at every point of the chain.

Steve Sandbo – board member at RST / Measurand, Applied Plastics, and Wytech Industries – and Principal at Vance Street Capital, an LA-based PE firm that has made over 100 acquisitions in it’s almost 15 year history, talks about how important it is to invest in digitizing industrial operations. “Connectivity of software to hardware has become an imperative part of running an efficient, technology-based solution. Customers want real time access to their data, and they want it all in one place. Having those operational insights at your fingertips has and will continue to allow management teams to make the best decisions in any scenario that arises.”

Another catalyst driving the adoption of automation specifically in the U.S., is the renewed push towards onshore manufacturing. “The pandemic is causing a lot of businesses to rethink offshore manufacturing,” says IOP’s Craig Korte. “Bringing manufacturing back to the United States will solve a lot of logistical issues. The only real way to do that and remain price competitive, however, is by investing heavily in automation.”

A recent McKinsey study estimated that digitization in the broader industrials space could increase revenues and margins by up to 4% – 7% in the short term. That translates to an increase in EBITDA of up to 9%. Those percentage points will have a major impact on underwriting calculus and M&A due diligence in the space.

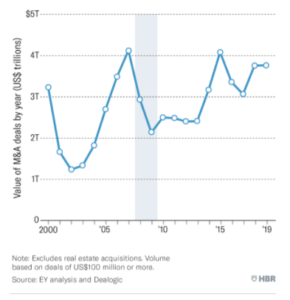

Industrial businesses have been incredibly active in M&A over the last decade, in large part to acquire new capabilities and to remain competitive with their more technology-forward peers.

Industrial businesses have been incredibly active in M&A over the last decade, in large part to acquire new capabilities and to remain competitive with their more technology-forward peers.

That M&A activity, which peaked in 2019, stood still in April at the onset of the pandemic. The transactional drought that ensued created a significant backlog of supply that only started to come back to market again at the end of Q3 2020. Investors and industrial economy business owners alike had to deal with the challenge of reconciling Covid performance with establishing fair valuations. A complex exercise, but not an impossible one.

“We’ve seen an influx of opportunities that have come to market due to Covid-19, and frankly, we’ve found some gems,” says MiddleGround CEO, John Stewart. “What 9 out of 10 investors would call distressed, we’d call a growth opportunity. Perspective is everything and it enabled us to get great deals done despite the circumstances.”

Deal volume has continued to be strong so far in the first quarter of 2021, and seems poised to only increase throughout the year. “We expect a very active year, especially the back half of 2021,” says Korte. “Some businesses impacted by the pandemic that need to transact will wait until the second half of the year when the direct effects from Covid no longer show up in their TTM figures.”

Industrial business owners are all too familiar with the need to adapt to change. Rapidly evolving digital trends already materializing well before the pandemic, kept business owners constantly on their toes. Either move fast, or lose customers to the competition.

Like so many other industries, the pandemic accelerated these trends. Owners who understand the operating environment, appreciate the implications of Industry 4.0, and make good decisions fast will survive and even thrive.

To conclude, we’re excited to present Axial’s 2021 Top 50 industrial Investors and M&A Advisors, whose work both advising and partnering with industrial business owners deserve recognition.