How Coronavirus Is Impacting Lower Middle Market M&A Activity

Last week, Axial convened a virtual roundtable of members to review the impact of the coronavirus pandemic on lower middle…

Tags

Private equity is an easy target for politicians. Most feel they can win brownie points with the general public by criticizing fund managers and fostering an “us vs. them” mentality, and even some of the most anti-government candidates lazily slip into arguments about “paying their fair share.”

The most high profile PE issue revolves around the tax treatment of carried interest, which makes up the bulk of income earned by many partners for PE funds. Carried interest benefits from a provision in the tax code that treats profits distributed to “general partners” on behalf of “limited partners” as long-term capital gains rather than ordinary income.

The top marginal rate for ordinary income is 39.6% and long-term capital gains are taxed at 20%, effectively cutting in half the potential tax burden for fund managers. By comparison, a single filer declaring $40,000 in taxable income pays a top marginal rate of 25% – a fact that draws outrage from some in the political community.

Also up for debate are the fees assessed by private equity firms. Some loud voices – notably Warren Buffett – have long been critical of PE fee structures, but the issue took center stage last December after Blackstone Group LP and TPG Capital disclosed fees that investors and limited partners weren’t fully aware of.

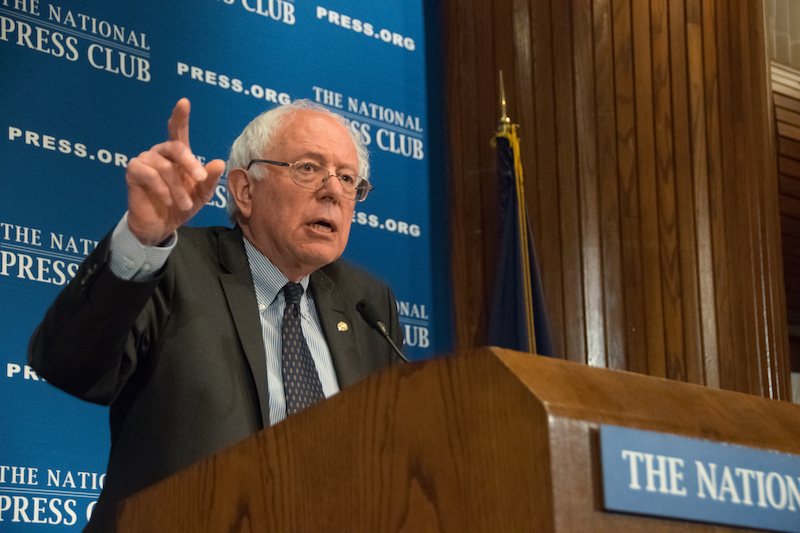

Sanders is easily the loudest antagonist of private equity firms, hedge funds, and Wall Street in general. This February, the Independent-turned-Democratic candidate sent a letter to the Obama Administration asking for the closure of “six of the most egregious loopholes in our tax code,” including the carried interest provision.

The self-described Democratic socialist is light on policy details, and spends most of his anti-corporate energy assailing large investment banks. However, it’s probably the safest form of conjecture to say Sen. Sanders would be in favor of more regulation, taxation, or just general public condemnation of private equity operations.

Hillary Clinton (D – New York)

Hillary Clinton (D – New York)

“It offends our values as a nation when an investment manager making $50 million can pay a lower tax rate on her earned income than a teacher making $50,000 on her earned income,” Hillary Clinton proclaimed back in 2007.

No candidate has been as specific, for as long, about the controversies surrounding private equity as Hillary Clinton. Clinton supports ending the carried interest “loophole” and wants to enforce stricter reporting and disclosure requirements, but argues that “private equity and venture capital play important roles in our economy.”

Of course, it wouldn’t be politics without a healthy dose of irony. The Clinton family has earned millions from private equity activity, ranging from Hillary’s $200,000+ speaking fees with KKR to Bill’s cushy job with Yucaipa Companies.

Martin O’Malley (D – Maryland)

O’Malley hasn’t staked out a crystal clear position on PE firms, but he seems to walk the modern Democratic party line on the issue of carried interest. In a March interview with Salon, the former Maryland governor answered “yes” when asked if he would “do away with the carried interest rule and other things” before pivoting to how he didn’t like stock buybacks.

Donald Trump (R – unelected)

Donald Trump (R – unelected)

The real estate mogul made waves in September when he attacked hedge fund managers for benefitting from the carried interest tax (something The New York Times unabashedly cheered on). Despite his business background, Trump is no champion of the free market, and he either misunderstands or intentionally misrepresents how fund managers operate.

“These are guys that shift paper around and they get lucky,” Trump told CBS’s Face the Nation, repeating that carried interest lets partners “get away with murder.”

On the surface, PE operatives should be concerned about Trump. However, Trump’s tax plan is far less populist than his rhetoric. The Americans for Tax Reform point out that Donald Trump wants to lower the top marginal rate to 25% (only 1.2% higher than those currently paying the carried interest rate, once Medicare taxes are included). Moreover, it’s likely Trump’s plan would actually exempt private equity firms from such an increase.

Rand Paul (R – Kentucky)

Rand Paul (R – Kentucky)

If any candidate is friendly to the bottom line for private equity actors, it’s the libertarian-ish junior senator from Kentucky. Paul was specifically asked about carried interest when he sat down with The Alpha Pages, responding that “I don’t believe we should be raising taxes for anyone” and that individual and corporate taxes should move “to a flat tax at a lower rate.”

Since then, Paul has released his own tax plan including a flat 14.5% rate for all business and personal income, including capital gains and dividends, rendering the carried interest provision moot. Paul is philosophically opposed to more regulation in private capital markets, stating on his website that he will “cut regulations and take power away from unelected bureaucrats.”

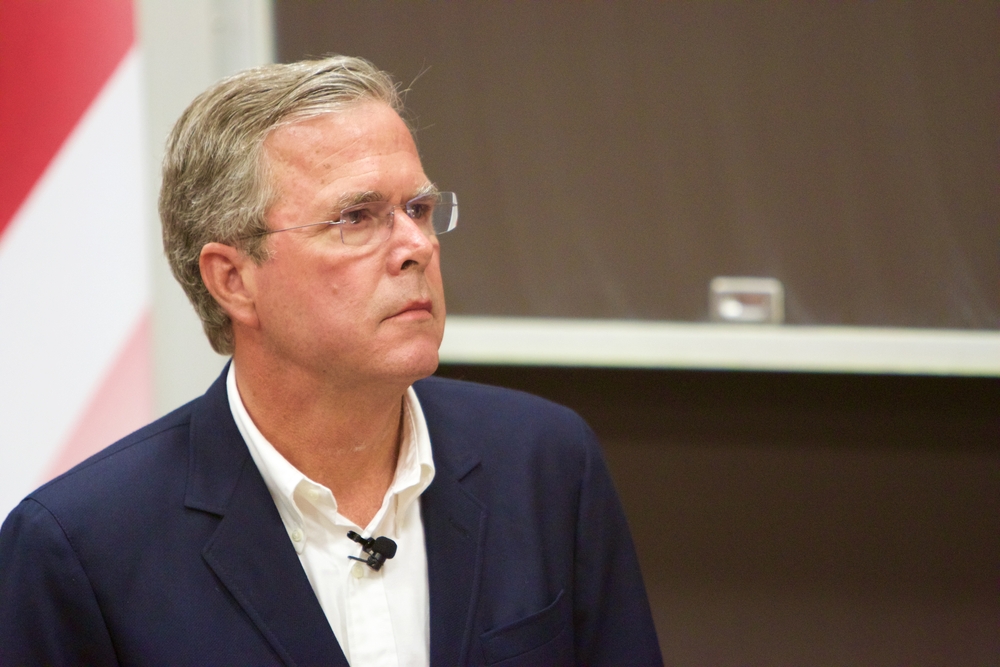

Jeb Bush (R – Florida)

Jeb Bush (R – Florida)

Bush, whose campaign is flush with private equity donors and who is listed as chairman and manager of offshore fund BH Global Aviation, has a surprisingly tough stance on PE. Bush wants to raise taxes on carried interest to the top marginal level. He even advocates eliminating interest payment deductions for businesses, making it more costly for PE firms (and everyone else, except banks, who are exempted) to borrow money.

Leveraged buyouts would obviously suffer in such an environment. Bush’s plan does call for corporate tax rates to drop to 20% and let’s companies deduct first-year capital investments, so it isn’t all scary news for the PE world.

Mike Huckabee (R – Arkansas)

Mike Huckabee (R – Arkansas)

Former Arkansas governor Mike Huckabee doesn’t wade into tax policy or capital market regulations very frequently. He has previously called Wall Street “a strip club” and lamented those who make their money investing rather than producing, but his tax policy would actually do away with all taxes on income, investments, savings, and earnings and replace them with a consumption tax.

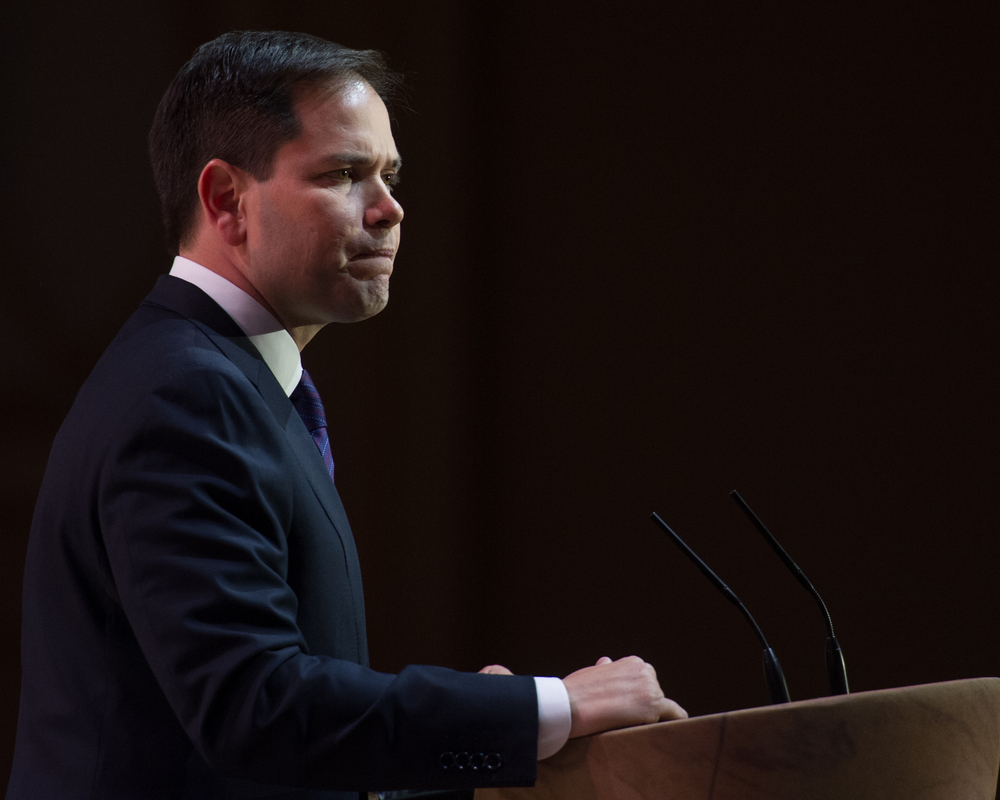

Marco Rubio (R – Florida)

Marco Rubio (R – Florida)

Fortune magazine interviewed Marco Rubio in 2014, briefly mentioning the carried interest for investment managers; Rubio didn’t stake out a position.

Rubio talks a free market game – and he’s assuredly less apt to regulate PE firms than Sanders or Clinton – but the only distinct proposal in his arsenal includes a call to eliminate the deduction for new debt.

Ted Cruz (R – Texas)

Ted Cruz (R – Texas)

The senator from Texas supports a flat tax, but it’s unknown at what rate. He otherwise has nothing to specific say about carried interest, disclosures on fees, or the practice of private equity takeovers or exits.

Ted Cruz seems to eat (political) red meat three times a day, however, so it’s likely he’ll adopt whatever the official GOP position is.

Ben Carson (R – unelected)

Ben Carson (R – unelected)

Ben Carson is not a capital markets expert or tax policy wonk (he’s a neurosurgeon, in case you somehow forgot), but his proposals include graduating towards a 10% – 15% flat tax rate, similar to the religious practice of tithing, because he “thinks God is a pretty fair guy.”

Carly Fiorina (R – unelected)

Carly Fiorina (R – unelected)

Fiorina, a former CEO and proud businesswoman, does not offer much by way of a tax policy and hasn’t addressed PE operations publicly. She may be the most difficult candidate to anticipate.

Chris Christie (R – New Jersey)

Chris Christie (R – New Jersey)

“My plan is to get rid of every deduction or loophole except for the home mortgage interest deduction or the charitable contribution deduction.” That excerpt comes from a CNBC interview with Chris Christie, who was asked about but never addressed carried interest.

John Kasich (R – Ohio)

John Kasich (R – Ohio)

John Kasich is, thus far, the only presidential candidate who openly championing the principle behind the carried interest provision. Disagreeing with Trump, the governor of Ohio opposed “changing the incentives for investment and risk-taking” associated with PE and hedge fund general partner income. In fact, Kasich wants to lower the long-term capital gains rate to just 15%, lower than any candidates except Rand Paul and Mike Huckabee.