Distressed Investing: Why Bankruptcies are on the Decline

Although there were immense opportunities for distressed investors in the immediate aftermath of the financial crisis, the environment has become challenging to predict. With cheap money, questionable recovery, and few bankruptcies, the number of distressed companies is in a state of uncertainty.

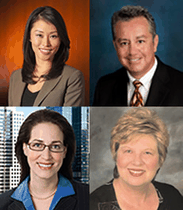

Carollynn Callari of Venable, Gail Bernstein of PNC Business Credit, and Member Suzanne Yoon of Versa Capital Management recently participated in our panel-style webinar to discuss the current state of the market. The webinar, moderated by George Blanco of Avant Advisory Group, covered all aspects of the distressed market, from sourcing techniques to best options for purchasing assets. Since each panelist touches distressed investing in a slightly different manner — legal, banking, and private equity — their combined insights create a holistic overview of the state of distressed investing.

Note: You can view the full webinar at the bottom of the page.

Insights include:

- Although there was a liquidity crunch in the immediate aftermath of the financial crisis, the lower interest rates have since flooded the market with very accessible capital.

- Because of the abundant liquidity, default rates and bankruptcy filings have dropped. Rather than seeking traditional Chapter 11 bankruptcies, business owners and lenders are seeking alternative, less expensive refinancing options.

- Although bankruptcies are down, the energy, healthcare, and military-related industries are expected to see an uptick in the next few years. Changing government regulations, funding, and military presence are expected to heavily impact these areas.

- It is expected that once the Fed begins increasing interest rates, there will be an uptick in bankruptcy filings.

- Because of the uncertain macro-environment, many distressed investors are seeking companies that are ailing due to poor management or fraud, rather than those impacted by larger macro-economic cycles.