Recap for ROI Part 2- A Reluctant Seller Considers Alternatives

Last week we talked about how to achieve return on investment through recapitalization. Part 2 of this series compares the…

A company’s capital structure is arguably one of its most important choices.

From a technical perspective, the capital structure is defined as the careful balance between equity and debt that a business uses to finance its assets, day-to-day operations, and future growth.

From a tactical perspective however, it influences everything from the firm’s risk profile, how easy it is to get funding, how expensive that funding is, the return its investors and lenders expect, and its degree of insulation from both microeconomic business decisions and macroeconomic downturns.

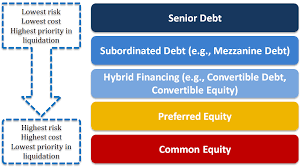

By design, the capital structure reflects all of the firm’s equity and debt obligations. It shows each type of obligation as a slice of the stack. This stack is ranked by increasing risk, increasing cost, and decreasing priority in a liquidation event (e.g., bankruptcy).

For large corporations, it typically consists of senior debt, subordinated debt, hybrid securities, preferred equity, and common equity. See exhibit A.

Exhibit A: Generic Sample Capital Structure

Senior Debt: A class of loans with priority on the repayment list if a company goes bankrupt. Holders of this form of financing have first dibs on a company’s assets. This means that in a liquidation event, lenders holding subordinated notes are not paid out until senior creditors are paid in full. Because of the minimal risk that accompanies this block of the capital structure, senior lenders loan money at lower rates (i.e., lower interest payments and less restrictive debt covenants) relative to more junior tiers.

Subordinated Debt: A class of loans that ranks below senior debt with regard to claims on assets. For this reason, this block of the capital structure is more risky than senior borrowings. However it also comes with commensurately higher returns, usually in the form of higher interest payments. For more, see our piece on drivers behind the rebounding popularity of subordinated debt.

Mezzanine Debt: A class of subordinated debt that blends equity and debt features. It therefore receives liquidation after senior capital and is generally used when traditional funding is insufficient or unavailable. Correspondingly, mezzanine firms lend at higher interest rates than traditional debt providers, and usually reserve the right to trade some of their debt for equity. Though mezzanine financing exhibits both equity- and debt-like characteristics, it’s usually classified as a category within subordinated debt. For more details, see our overview of mezzanine debt.

Hybrid Financing: A class of the capital structure in publicly-traded companies that also blends equity and debt features. By definition, hybrid securities are bought and sold through brokers on an exchange. Hybrid financing can come with fixed or floating returns, and can pay interest or dividends.

Convertible Debt: A class of hybrid financing. Convertible bonds are the most common type of hybrid financing, and usually take the form of a bonds that can be converted to equity. The conversion can only happen at certain points in the firm’s life, the equity amount is usually predetermined, and the act of converting is almost always up to the discretion of the debt holder.

Convertible Equity: A class of hybrid financing. Convertible equity usually takes the form of convertible preferred shares, which is preferred equity that can be converted to common equity. Like convertible debt, convertible preferred shares convert into common shares at a predetermined fixed rate, and the decision to convert is typically at the owner’s discretion. Importantly, the value of a firm’s convertible preferred shares is usually dependent on the market performance of its common shares.

Preferred Equity: A class of financing representing ownership interest in a company. As opposed to fixed income assets (e.g., debt), equity is a variable return asset. However, preferred equity has both debt and equity characteristics in the form of fixed dividends (debt) and future earnings potential (equity). Correspondingly, it gives the holder upside and downside exposure. Its claims on the company’s assets and profits come behind those of debt holders and ahead those of common stock holders. Generally, preferred equity obligates management to pay its holders a predetermined dividend before paying dividends to common shareholders. On the flipside, preferred equity typically comes without voting rights.

Common Equity: Also a class of financing representing ownership interest. Common equity is the junior-most block of the capital structure and therefore represents ownership in an business after all other obligations have been paid off. For this reason, it comes with the highest risk and the highest potential returns of any tier in the capital structure.

Any company’s capital structure serves several key purposes.

First and foremost, it’s effectively an overview of all the claims that different players have on the business. The debt owners hold these claims in the form of a lump sum of cash owed to them (i.e., the principal) and accompanying interest payments. The equity owners hold these claims in the form of access to a certain percentage of that firm’s future profit.

Secondly, it is heavily analyzed when determining how risky it is to invest in a business, and therefore, how expensive the financing should be. Specifically, capital providers look at the proportional weighting of different types of financing used to fund that company’s operations.

For example, a higher percentage of debt in the capital structure means increased fixed obligations. More fixed obligations result in less operating buffer and greater risk. And greater risk means higher financing costs to compensate lenders for that risk (e.g., 14% interest rate vs 11% interest rate).

Consequently, all else equal, getting additional funding for a business with a debt-heavy capital structure is more expensive than getting that same funding for a business with an equity-heavy capital structure.