Top 10 Articles of 2019

Happy New Year! As we move into 2020, we’re recapping the most popular Middle Market Review articles from the past…

As a fitness-focused culture continues to thrive in the U.S., health and wellness investments have seen particularly strong interest from private equity and strategic buyers. Meanwhile, deal volume continues to plateau, ensuring that competition among those buyers remains high.

We dug into recent trends in the space, and also asked a group of investors and advisors at a recent Dealmaker Breakfast Series event hosted by Tricap Partners & Co. and Crowell & Moring for their thoughts on the state of the industry.

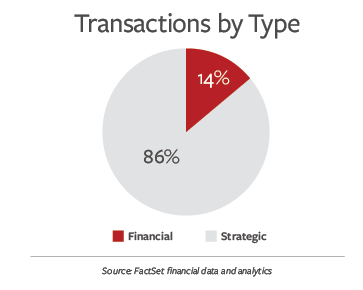

According to a recent report by SDR Ventures, only 14% of health and wellness deals in Q4 2016 were closed by financial buyers.

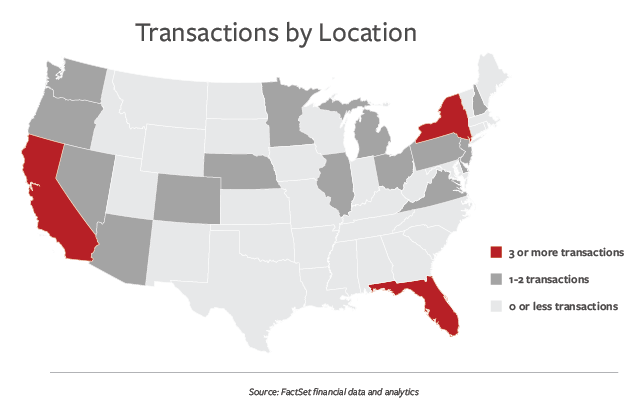

California, New York, and Florida saw the largest number of transactions.

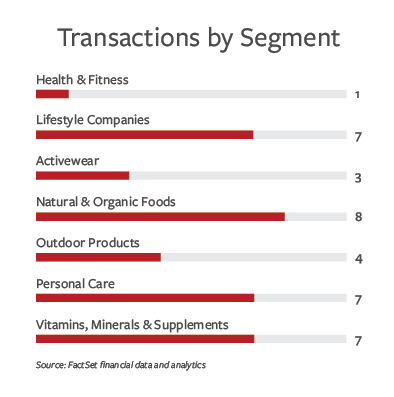

Lifestyle companies; personal care; and vitamins, minerals, and supplements closely followed with 7 transactions each.

“For the restaurants category, I expect continued deal flow related to growth equity capital for emerging brands focused on health and sustainability (these often go hand in hand),” says Kristina McDonough, Managing Director at Capital Growth Advisors, LLC. “We continue to see new ‘healthier’ brands across not just traditional fare like better burgers, pizza, juice, but increasingly across more international flavors like Indian, Mediterranean ,and other ethnic offerings. Most of the restaurant brands focused on health/wellness are young/emerging brands, fast growing, and in need of more than just capital.”

Sean Hayes, Vice President of Latin America at L Catteron, says that for that region in particular, “we expect the fitness subcategory to remain very active as consolidation continues and new entrants emerge in various geographies. We are also closely monitoring which subcategories may be subject to a skip step that changes the category landscape.”

In particular in Latin America, “it is really the sponsor-backed fitness players that are best positioned at the moment. In the non-fitness health and wellness categories, it is more of a 50/50 proposition. On the fitness side this is driven by the capital intensive nature of the business, whereas in other wellness subcategories that is not necessarily the case and therefore CPGs often get involved at an earlier stage.”

According to Capital Growth Advisors’ McDonough, “Other areas we see as growing in health and wellness include natural/organic cosmetics, customized/personalized nutrition, functional beverages, natural/organic supplements and essential oils, products related to the human bio-dome (pro and pre biotics), cannabis-based products for medical needs, and personal services offerings related to mindfulness and stress management.”