Week in Review: 2014, Dry Powder, and Lieberman

Happy New Year from a very snowy New York. Overall, analysts seem positive about M&A in 2013. While there were many legal challenges and changes, merger activity ended on a high note. Thanks to increased confidence, favorable lending environments, and a rising IPO market, 2014 begins on a strong footing.

Despite the increased activity, private equity firms have accumulated $1.074 trillion in dry powder — more than they had in 2008. Is most of the capital still sitting on the sidelines, or is fundraising outpacing activity?

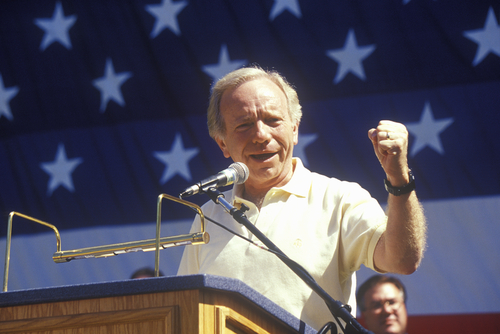

In other news, Joe Lieberman joins Victory Park Capital, Stryker acquired Patient Safety Technologies, and Neogen acquires Chem-Tech.

Opinions:

- US business mergers at highest levels since 2001

- Megabuyouts: Don’t call it a comeback

- Markets buoyant, merger activity picks up

- Private equity enjoys a record year

- 2013 closes with record amount of dry powder

- The Volcker Rule explained…in only 27 pages

- How to be the CFO of a PE-owned firm

- Joe Lieberman joins Victory Park Capital

Transactions:

- Stryker acquires Patient Safety Technologies for $120 million

- Peak Rock Capital acquires Natural American Foods

- Maxim Partners forms Bobcat Disposal Companies

- Neogen acquires Chem-Tech

- Monsoon Commerce acquires CompassIM Warehouse Management System

Thanks to spirit of america for the photo.